With uncertainty surrounding the patent of blockbuster drug Humira, AbbVie is looking to deliver another success story from its pipeline. Is it headed for a patent cliff? Let’s take a look.

By Alexander J. Poulos and Kris Rosemann

A successful operator in the pharmaceutical industry (XLV) is often characterized by having high margins, allowing for copious amounts of free cash flow generation, which can be returned to shareholders via dividends. In today’s yield-starved market environment, major pharma, and the above-average yields of some players within, remains in demand, but investors must be cognizant of the unique risks that face the industry. One key risk remains the loss of patent protection on drugs and treatments that leads to the aforementioned attractive margins. Once a patent is lost, shares are often punished on the news of a loss of a meaningful patent.

Such a development can lure investors into a “value trap.” As pharma and biotech (IBB) companies approach the patent cliff, it is common for investors to sell on the news that a patent has been lost, pushing the stock price lower. Over-starved investors searching for attractive yields at a discount may be enticed to swoop in and scoop up shares at the lower price-to-earnings ratio that might result from such an event. However, evaluating the patents of a pharma company prior to investing is a must, from our point of view, and initiating a position in a firm approaching a patent cliff is a major no-no.

This concept should not be too foreign for Valuentum members, as it is related to the momentum aspect of our methodology. Just as we evaluate the most opportune time to initiate a position in a company based on the momentum in its share price, the most opportune time to enter a position in a pharma firm may be as it is beginning to turn the corner with respect to its patent cliff, not as it is approaching the patent cliff. Let’s take a look at some of the challenges facing AbbVie (ABBV) to further illustrate the point.

Humira

Overdependence on a single product can be a recipe for disaster, especially in the pharma arena where patents eventually expire and generic competition enters the market, providing meaningful top-line pressure and a potential value trap as described above. As a blockbuster drug, in AbbVie’s case Humira, is under patent and in its growth phase, the sales growth potential and operating leverage are extremely appealing, but as the patent expires, a tremendous challenge exists in replacing revenue lost to new generic entrants.

Humira, a treatment for a wide range of inflammatory diseases, currently accounts for over 60% of all of AbbVie’s sales, and management has masterfully marketed and expanded the disease states Humira can be used to treat. Label expansion aided in the rapid growth and success of the product, and Humira remains one of the top-selling branded pharmaceutical products in the world. However, 2017 may be the last full year of protected sales for Humira, “The Dreaded Patent Cliff…,” and management’s greatest challenge now revolves around developing a host of competing products to lap the expected sales erosion when Humira inevitably faces a biosimilar challenge.

IP Estate

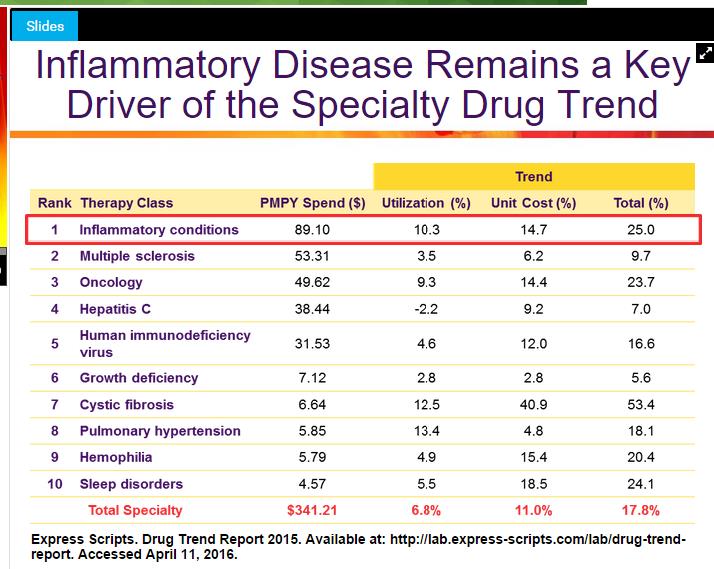

Image Source: Express Scripts

The unit cost for specialty pharmacy continues to grow well above the rate of inflation, thus putting enormous strain on national healthcare budgets. In fairness, the field continues to deliver a host of new treatments especially in the area of oncology, but we see the rapid acceptance of biosimilars as an excellent way to bring cost rationalization into the arena. As seen in the above image, drugs used to treat infalmmatory diseases saw the largest spending increase in 2015 thanks to a combination of advancing costs and utilization rates. Such a development makes Humira, inflammatory disease market leader in terms of share, a likely target for price-cutting biosimilars.

Adalimumab, the chemical name for Humira composition of matter patent, expired in December of 2016; a composition of matter patent covers the compound thus preventing competition. AbbVie also has a non-composition of matter patent which is expected to remain valid through 2022; non-composition of matter patents often attract a patent challenge from the generic drug companies as they jockey to gain the ability to first bring to market an authorized generic for the product. The management team at AbbVie remains steadfast that they will rigorously enforce its IP estate, a view we share. Where we differ is in the ultimate success of the effort, as a biosimilar for Humira is likely to be brought to market well before 2022, in our opinion, but more specific timing of such an entrant is difficult to forecast.

What we do know is the European patent for Humira will expire in 2018, and October 2018 looks to be the month a biosimilar will enter the European market. The management team at AbbVie remains confident they will be able to stem the decline, though no such guarantee can be made. For context, the recent entrance of a biosimilar of Amgen’s (AMGN) Neupogen is a prime example of market share loss that can be expected once an effective biosimilar enters the market. Neupogen worldwide sales eroded 25% on a year-over-year basis in the first nine months of 2016 after biosimilars were first launched in September of 2015.

We’re not convinced AbbVie will be able to retain the bulk of its market share and price once a biosimilar enters the market. To compound matters further, in what we view as a tone-deaf move in this ultra-sensitive pricing environment, AbbVie announced a price hike of 8.4% on Humira. Though we acklowledge the negotiations with the PBM’s will ultimately negate much if not all of the price hike, such a price increase only attracts attention to the lack of competition surrounding the drug.

Leonard Schleifer, the outspoken CEO of Regeneron Pharmaceuticals (REGN), and his firm are posing a significant threat to the long-term viability of the Humira franchise. In addition to it taking a stance against routine, unwarranted drug price hikes, Regeneron has a competing product dubbed Sarilumab that is awaiting marketing approval from the FDA. Regeneron and its partner Sanofi (SNY) funded a head to head comparison study pitting Sarilumab against Humira, and the data showed Sarilumab posted superior results in the study, ample ammunition that will be used to carve out a niche for Sarilumab in the marketplace. We would not be at all surprised if Regeneron/Sanofi aggressively price Sarilumab in a similar manner to what we’ve seen in the hepatitis C market, which have helped lead to a lowering of net treatment cost per patient.

Regeneron and Sanofi received a complete response letter from the FDA stating deficiencies in the factory that would be used to produce the product, delaying the commercial release of the treatment. However, Regeneron expects to resubmit the license application in the first quarter of 2017 and anticipates a two-month review cycle, putting an action date from the FDA in the second quarter of 2017.

Sarilumab is not the only competitive threat to AbbVie’s Humira; additional products have gained marketing approval with Cosentyx and Taltz the most recent examples. As the number of competitors increases, the PBM’s will utilize the increase in competition to drive down price through formulary exclusions. We believe it is unrealistic to expect Humira to not only maintain its market share but also implement price increases to expand revenues at a double-digit clip through 2022. AbbVie will need to develop new products to make up for the loss of revenue from Humira beginning in 2018 with European sales.

Imbruvica

Imbruvica is a Bruton’s tyrosine kinase inhibitor that is used to treat a range of diseases most notably varying forms of Leukemia. AbbVie purchased a 50% stake in the molecule when it acquired Pharmacyclics for $21 billion in 2015. Imbruvica remains the key compound, as AbbVie views Imbruvica as a clinical backbone to power its oncology pipeline. The product is partnered with Johnson and Johnson (JNJ) with peak expected sales north of $7 billion targeted for AbbVie’s stake–it controls 100% of the US sales and receives royalties from international sales. Thus far, the product seems well on track, generating more than $1.8 billion in sales for AbbVie in 2016.

Part of Imbruvica’s ability to hit AbbVie peak sales figure will come from label expansion. The product remains well on track with recent approval for Marginal Zone Lymphoma among other indications. Our outlook for Imbruvica remains favorable for now with the most notable challenger coming from AstraZeneca’s (AZN) recently acquired compound Acalabrutinib. AstraZeneca is angling for an early approval for Acalabrutinib in patients who are resistant to treatment with Imbruvica via an expected submission at some point in 2017. From the initial data reads, Acalabrutinib does hold particular promise as the molecule is better tolerated by the patients it has been studied on. At this time, Acalabrutinib seems to pose the greatest challenge to Imbruvica yet most of the indications will not be filed until 2020, giving AbbVie ample time to establish Imbruvica as the gold standard of care.

The all-important IP estate for Imbruvica is secure with the US patent in force through 2027, while the international patent does not expire until 2029. We feel based on Imbruvica’s impressive lead backed with a solid, long-dated patent that the treatment will become a core franchise for AbbVie once the Humira patent expires. The product will not make up for the entire revenue decline–Humira sales topped $16 billion in 2016–yet it should form the basis of a stable, high-value oncology franchise with lengthy patent protection.

Infectious Disease

AbbVie’s quest to carve out a chunk of the lucrative hepatitis C market continues to underwhelm. Management initially had high hopes for the unit; those dreams have been thoroughly dashed by Gilead Sciences (GILD) and to a lesser extent Merck (MRK). AbbVie’s initial foray into price competition via an exclusive deal with Express Scripts (ESRX) has done little to grow market share, with industry juggernaut Gilead still controlling over 85% of the overall US market for hepatitis C. The overarching challenge in the hep C market is that the eligible pool of candidates continues to decline as patients are cured after a short course of therapy.

In our view, the hep C market remains in terminal decline with little that can be done to increase the overall size of the market, and we’re looking at the market through a similar lens of a product that has lost patent protection except with a more drawn out revenue decline. To compound matters, the exclusive formulary deal with Express Scripts has lapsed with Gilead’s lead product Harvoni now gaining coverage.

The decline can be seen in AbbVie’s revenue with Viekira Pak totaling just over $1.5 billion in sales for 2016, a decrease of more than 6% from last year’s total, underscoring the declining patient dynamics in the hep C market. We do not hold in high regards the sales potential of newer, shorter course therapies and feel AbbVie would be better suited focusing on inflammatory disease and oncology as the two largest drivers of revenue and profits going forward.

Role of the Dividend

Due to the uncertain nature of the IP estate protecting Humira and declining hep C market, the main draw of shares of AbbVie at this point is its 4.2% dividend yield. We like the company’s dividend potential–its Dividend Cushion ratio currently sits just above parity (1)–based on the free cash flow generating potential of its portfolio, but the uncertainty surrounding the driver of 60% of its total revenue adds material risk to the safety of the payout. Should AbbVie fail to protect its blockbuster drug from material sales erosion prior to generating replacement revenue from its pipeline or via label expansions, free cash flow will ultimately falter, limiting the true upside potential of the dividend. Shares are currently changing hands within our fair value range, and we’re not interested in taking on the risk of a potential patent cliff to gain exposure to a fairly valued equity.