Image Source: Home Depot Inc – Third Quarter of Fiscal 2020 IR Earnings Infographic

By Callum Turcan

Executive Summary: Home Depot and Lowe’s Companies have experienced incredibly strong comparable store sales growth during the initial phases of the ongoing coronavirus (‘COVID-19’) pandemic. Past digital investments enabled both companies to better meet surging demand during these turbulent times, and demand growth is coming from both professional (i.e. contractors, home builders) and non-professional (i.e. more affluent households in the suburbs) consumers. The biggest thing holding both companies back is their large net debt loads and sizable operating lease liabilities, in our view, though please note that their cash flow profiles are stellar. It appears the North American home improvement and construction business is holding up quite well, all things considered, highlighting the industry’s resilience.

Home Depot

On November 17, Home Depot Inc (HD) reported third quarter earnings for fiscal 2020 (period ended November 1, 2020) that saw both its GAAP revenues and GAAP operating income bounce higher by ~23% year-over-year. Economies of scale were key to expanding Home Depot’s operating margins given its meaningful fixed costs. On a GAAP diluted basis, Home Depot’s EPS was up almost 26% year-over-year last fiscal quarter.

Comparable store sales were up about 24% last fiscal quarter versus year-ago levels, with comparable store sales in the US up almost 25% year-over-year. It appears a sizable chunk of the money US households saved from reduced spending on restaurants, vacations, and commuting has been allocated to the home improvement space. The pandemic prompted many households, particularly more affluent households in the suburbs, to pursue do-it-yourself (‘DIY’) projects while stuck at home.

As part of Home Depot’s strategy to adapt to the COVID-19 pandemic, the company increased the compensation for its hourly associates (weekly bonuses, additional paid-time off, improved health care and other benefits) and management has now decided to make several of those compensation/benefit increases permanent. While this decision will significantly increase its cost structure, Home Depot likely expects that such a move will better allow the firm to retain talent and that its stronger operational performance will favorably impact its financial performance over the long haul. This decision is expected to cost Home Depot an additional ~$1 billion on an annualized basis (for reference, Home Depot’s annualized SG&A expenses stood at ~$24-$25 billion during the first nine months of fiscal 2020).

Reduced worker turnover and a larger base of knowledgeable employees could support Home Depot’s customer service experience and ultimately lead to greater sales. In the fiscal third quarter, Home Depot’s customer transactions rose by 13% year-over-year and the average ticket size grew by 10% year-over-year, which resulted in its sales per square foot jumping 23% higher year-over-year. Please note that Home Depot’s professional business is quite large (this business includes customers in the contractor and home building industries) and having the required talent to quickly meet the needs of its professional customers could prove to be crucial. Home Depot refers to this part of its operations as its ‘Pro’ business.

Rising digital sales have also been key. Home Depot has significantly improved its e-commerce operations over the past few years, which includes home delivery, in-store/curbside pickup, and in some instances (particularly for professional customers), work-site delivery options. During Home Depot’s latest earnings call, management had this to say (emphasis added):

“Our interconnected retail strategy and underlying technology infrastructure have continued to support record level web traffic on a consistent basis for over six months. Sales leveraging our digital platforms increased approximately 80% versus the third quarter last year and approximately 60% of online orders were fulfilled through a store. We continue to invest in our digital assets, introducing new capabilities and different way to engage with The Home Depot.

Over the past several months, we have refreshed the digital experience in key categories and are extremely pleased with the customer response. In decorative lighting, for example, we enhanced the category experience to offer improved visual imaging and more lifestyle photos of our on-trend lighting assortment. As a result of these changes and increased marketing effort to better highlight our offering, we have seen significantly higher customer engagement with the category online which helped to drive sales growth above the company average in the quarter.

We also found new ways to leverage our online platform to better showcase our assortment for events. For our Halloween event, we increased our digital offering and enhanced our presentation, which resonated with our customers, resulting in the strongest customer response we’ve had to these events.” — Craig Menear, CEO of Home Depot

Beyond improving its fulfillment operations regarding its e-commerce business, Home Depot is actively improving its digital marketing and overall presentation strategy. Leading up to the Halloween holiday, Home Depot sold 12-foot skeleton offerings that helped drive up interest from non-professional customers. These types of marketing programs can be quite effective. Management noted that “each of [Home Depot’s] merchandising departments posted double-digit comps, led by our lumber and décor and storage departments” during the firm’s latest earnings call, indicating strength is widespread.

On November 16, Home Depot announced it would acquire HD Supply Holdings Inc (HDS), a national distributor of maintenance, repair and operations (‘MRO’) products, through an all-cash deal worth $8.0 billion by enterprise value (including HD Supply’s net cash position). Home Depot is paying $56.00 in cash per share of HDS. Management expects this deal will be accretive to Home Depot’s fiscal 2021 earnings, and the acquisition will be funded by cash on hand and by Home Depot tapping debt markets.

According to the WSJ, Home Depot sold off this business back in 2007, making this deal a reunion of sorts. HD Supply Holdings recently sold off its ‘Construction & Industrial’ segment for $2.7 billion in net cash, leaving just its MRO business that Home Depot likely finds quite appealing given the firm’s desire to further bulk up its professional business (and move deeper into adjacent businesses). We see this deal as favorably impacting Home Depot’s business model, though we caution that its balance sheet needs to be closely monitored going forward. Home Depot already has some MRO customers, though as a highly fragmented space, management sees room for significant upside here, and its growth strategy will be greatly assisted by scale and a much larger geographical footprint.

Home Depot had $14.7 billion in cash and cash equivalents on hand as of November 1. Stacked up against $2.5 billion in short-term debt and $32.8 billion in long-term debt, Home Depot’s net debt position before taking the HD Supply deal into account was already quite large. However, the company’s cash flow profile remains impressive. During the first nine months of fiscal 2020, Home Depot generated $15.9 billion in free cash flow which fully covered $4.8 billion in dividend payments and $0.8 billion in share repurchases made during this period. We view Home Depot’s pro forma net debt load as manageable. However, please be aware Home Depot also has significant operating lease liabilities which totaled ~$5.7 billion as of November 1 (including both current and non-current operating lease liabilities).

Our fair value estimate for Home Depot sits at $265 per share, indicating shares of HD are fairly valued as of this writing (shares of Home Depot are currently trading near ~$271 per share). The top end of our fair value estimate range sits at $318 per share, though for Home Depot to justify such a valuation, the firm would need to showcase that its recent sales gains are long lasting and have legs. Improving its relationship with non-professional customers and expanding its MRO business will be key here. On a final note, shares of HD yield ~2.2% as of this writing, and we give Home Depot an “EXCELLENT” Dividend Safety rating due to its impressive cash flow profile.

Lowe’s

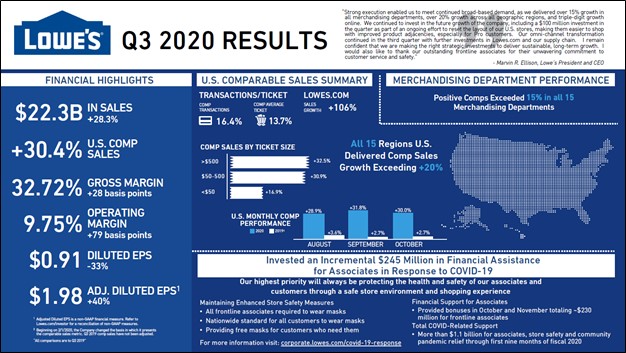

Home Depot’s smaller peer, Lowe’s Companies Inc (LOW), reported third quarter earnings for fiscal 2020 (period ended October 30, 2020) on November 18 that saw its GAAP revenues grow by 28% year-over-year and its GAAP operating income jumped higher by 40% year-over-year. Lowe’s experienced meaningful operating margin expansion due to economies of scale and considering its sizable fixed costs. The company’s comparable store sales were up just over 30% year-over-year last fiscal quarter (comparable store sales at its US home improvement business slightly outperformed company-wide results).

Image Source: Lowe’s Companies Inc – Third Quarter of Fiscal 2020 IR Earnings Infographic

For reference, please note that Lowe’s experienced a large ‘loss on extinguishment of debt’ expense (a non-cash item) last fiscal quarter. On a non-GAAP adjusted basis, Lowe’s reported $1.98 in diluted EPS (which removes the loss on debt extinguishment expense and certain Canadian restructuring charges) in the fiscal third quarter, up over 40% year-over-year. Lowe’s benefited from the same dynamics that supported Home Depot, though please note that Home Depot’s professional business is significantly larger than Lowe’s. Put another way, Lowe’s is more dependent on the DIY customer.

In the fiscal third quarter, the company’s digital business reported 106% year-over-year sales growth (particularly sales through Lowes.com). During the company’s latest earnings call, management had this to say regarding the firm’s digital strategy in response to an analyst’s question (emphasis added, lightly edited):

“Obviously we don’t have perfect visibility to the future and we had no idea, as no one did, that we’d be dealing with a global pandemic in the year 2020. But when I think about how far we’ve progressed in two years, when you look at the digital platform and our online business, the last two quarters growing 135% last quarter, 106% in the third quarter, we’re at levels that we could not have even imagined just 12 to 16 months ago.

Merchandising initiatives, supply chain, I think the key for us is that we’re not really concerned about the short term. We know this is a great brand. We have a strong balance sheet, and we’re trying to make the right investments in the future. When I look around at the accomplishments of the team, I’m exceptionally proud because we’re a little bit ahead of schedule… and we think that we’re going to start to lean into taking market share. At the December 9 investor update, we’re going to be a lot more specific about where we are in this transformation and how we see the out years and where we believe that we can really start to pick up additional market share.” — Marvin Ellison, CEO of Lowe’s

Though it appears management is waiting until Lowe’s hosts its big investor update next month to provide more details on the company’s digital/e-commerce strategy, Lowe’s is clearly indicating it plans to keep making major investments in this space.

As of October 30, Lowe’s had $10.1 billion in cash, cash equivalents, and short-term investments on hand plus $0.2 billion in long-term investments (which historically have been made up of US Treasuries, corporate debt securities and agency securities). Stacked up against $0.6 billion in short-term debt and $21.2 billion in long-term debt at the end of this period, the firm’s net debt position is sizable but manageable given its solid cash flow profile. However, please note Lowe’s also has significant operating lease liabilities to be aware of (as of October 30, Lowe’s had ~$4.4 billion in current and non-current operating lease liabilities combined on the books).

Lowe’s generated $10.3 billion in free cash flow during the first three quarters of fiscal 2020 and spent $1.3 billion covering its dividend obligations and $1.5 billion buying back its stock. In our view, the firm retains the financial capacity to invest heavily in its e-commerce/digital business and related fulfillment operations while being able to keep meeting its dividend obligations going forward. Given its relatively strong financial position, Lowe’s should be able to keep refinancing its debt at attractive rates over the coming fiscal years.

During the fiscal third quarter, Lowe’s was able to grow its ‘Pro’ business by over 20% (appears to be on a year-over-year basis) according to recent management commentary. Lowe’s still has a long way to go to close the gap between its Pro business and Home Depot’s Pro business. Management noted that Lowe’s is actively changing the layout of the products in its stores to help boost Pro sales. Here is an excerpt from the company’s latest earnings call (emphasis added, lightly edited):

“…[W]e are resetting the footprint of the store so it’s a more intuitive shopping experience for our customers, especially for the Pro. For example, the re-flow of our rough plumbing and electrical aisles are two key areas for the Pro that needed to reflect how the Pro shops. We are now placing all of the relevant products adjacent to each other, such as pipe cement next to pipe and the necessary fittings next to their respective pipe category. We are also eliminating merchandising bays without plan-o-grams – we call these junk bays, thus opening up space for higher velocity, higher demand items in categories that will better reflect the local market.

We are on track to have the reset complete for over 90% of our stores by fiscal year end, and as part of this store reset, there will be two other noticeable changes. First, we are adding a Pro flex area, similar to what we did earlier this year in our seasonal areas, making it easier for the Pro to grab and go. Second, we are moving the cleaning category to the main or the first aisle of our stores. This is just another example of ways we are working to improve the productivity in this highly visible area of the store.” — Bill Boltz, Executive Vice President of Lowe’s, Merchandising

Our fair value estimate for Lowe’s sits at $162 per share, and the low end of our fair value estimate range sits at $126 per share. Shares of LOW have been pressured recently due to growing concerns over operating expense pressures and whether its recent sales gains have legs. The company’s shares are currently trading in the bottom end of our fair value estimate range (currently trading near $150 per share), though we expect management will come out swinging during the firm’s upcoming investor conference (in terms of operational highlights and long-term goals). We give Lowe’s an “EXCELLENT” Dividend Safety rating and shares of LOW yield ~1.6% as of this writing.

Concluding Thoughts

The home improvement space, particularly in the US and Canada, has proven to be incredibly resilient during the COVID-19 pandemic. Home Depot and Lowe’s are both burdened by meaningful net debt loads and operating lease liabilities, though their stellar cash flow profiles and numerous competitive advantages support their long-term outlook. Investors are currently wondering whether home improvement spending would start to shift meaningful lower in the event global health authorities bring the pandemic under control and how recent changes in the cost structure at Home Depot and Lowe’s would impact their future cash flows.

We are keeping an eye on the space, and please note both shares of HD and LOW are up materially year-to-date as of this writing. On a final note here, US home construction activity has held up well so far during the pandemic, which supports the outlook for both Home Depot and Lowe’s. Should federal infrastructure spending increase in the US as part of a fiscal stimulus package to offset headwinds created by the COVID-19 pandemic, that would further support both company’s outlooks.

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, DNKN, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM

Also tickerized for LL, HDS, LESL, POOL, NEOV, XHB, ITB, W, FND, MAS, AFI, BECN

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Walt Disney Company (DIS) and Dollar General Corporation (DG) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.