Image Shown: Magellan Midstream is focusing heavily on growing its fee-based operations, with an eye towards expanding its refined products pipeline segment. Image Source: Magellan Midstream Partners L.P. – August 2019 IR Presentation

If you may wish to add the High Yield Dividend Newsletter to your membership, please click here.

By Callum Turcan

On October 31, Magellan Midstream Partners L.P. (MMP) — 6.6% yield — reported third quarter 2019 earnings. Its quarterly GAAP operating income climbed 8% year-over-year due to a combination of top-line growth (GAAP revenues up 3% year-over-year) and lower operating expenses (GAAP operating expenses down 3% year-over-year). Cost reductions were largely a function of reduced cost of products sales, meaning Magellan Midstream’s marketing division had a decent quarter given the year-over-year growth in products sales revenue. Additionally, Magellan Midstream benefited from a modest reduction in other operating expenses, which was counterbalanced by rising G&A expenses on a year-over-year basis.

Quarterly Overview

Going forward, we like the relatively flat operating expense profile of Magellan Midstream (after removing its more volatile marketing activities, buying/selling third-party volumes, from this picture), especially as the oil and gas infrastructure company continues to grow its core asset base. When removing changes in cost of product sales, Magellan Midstream’s operating expenses were up just a fraction of a percent year-over-year last quarter. When removing products sales revenue growth from Magellan Midstream’s third quarter performance, its top-line still grew nicely (transportation and terminals revenues were up 4% year-over-year).

Magellan Midstream’s refined products operations saw both higher transportation revenues per barrel shipped and greater shipped volumes in the third quarter on a year-over-year basis, leading to an 12% increase in that segment’s operating profit (dubbed operating margin by Magellan Midstream). Rising stored volumes at its marine storage operations helped increase Magellan Midstream’s operating margin from that segment on a year-over-year basis. We appreciate that management has been placing a greater focus on growing Magellan Midstream’s operations in these areas over the past several years.

Pivoting to Magellan Midstream’s crude oil operations, while shipped volumes grew materially in the third quarter allowing for year-over-year increases in the segment’s operating margin, we caution that Magellan Midstream’s transportation revenues per barrel of crude oil shipped moved meaningfully lower year-over-year. That was partially due to the contract renewals that came into force during the fourth quarter of 2018 locking in significantly lower committed rates along Magellan Midstream’s Longhorn Pipeline (a product of rising long-haul pipeline competition in West Texas, and a slowdown in North American drilling and completion activity).

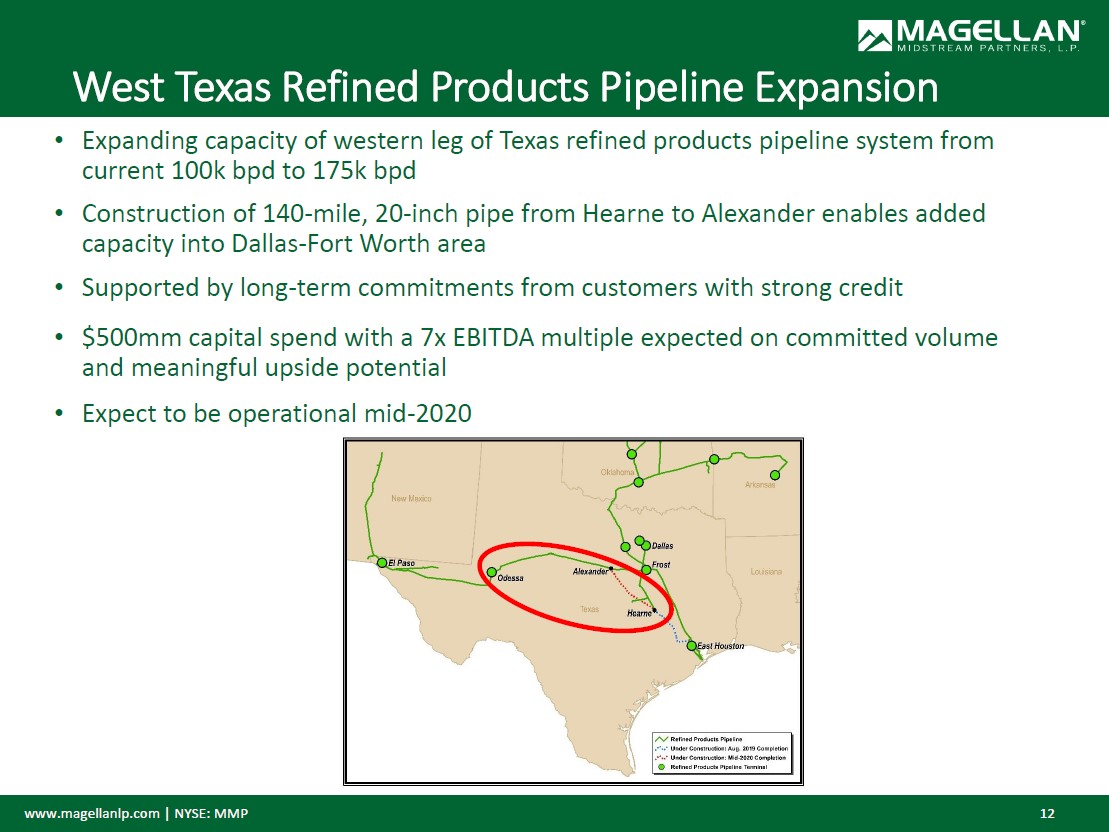

In the past, Magellan Midstream has contemplated selling off a large stake in the Longhorn Pipeline as the company is placing a great emphasis on growing its refined products and marine terminal operations. The graphic down below highlights one of Magellan Midstream’s refined products pipeline system expansions set to come online next year.

Image Shown: Magellan Midstream seeks to expand its refined products operations due to stable nature of the cash flow profiles pipeline systems catering towards the space often have. Image Source: Magellan Midstream – August 2019 IR Presentation

Concluding Thoughts

We continue to like Magellan Midstream as a holding in our High Yield Dividend Newsletter portfolio. The company’s investment grade credit ratings (BBB+/Baa1 as of August 2019) and preference to fund its growth trajectory with debt instead of equity (equity issuances have been very muted since 2010) allows for steady sustainable increases in the company’s per unit distribution. Magellan Midstream retains access to capital markets at attractive rates and will likely take advantage of the subdued interest rate environment by refinancing portions of its existing debt load at lower rates when able. Magellan Midstream’s quarterly distribution per unit has grown by almost three-fold since the start of 2010, and there’s room for additional payout increases over the coming years.

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Related: AMLP, AMZA

If you may wish to add the High Yield Dividend Newsletter to your membership, please click here.

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares or units in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.