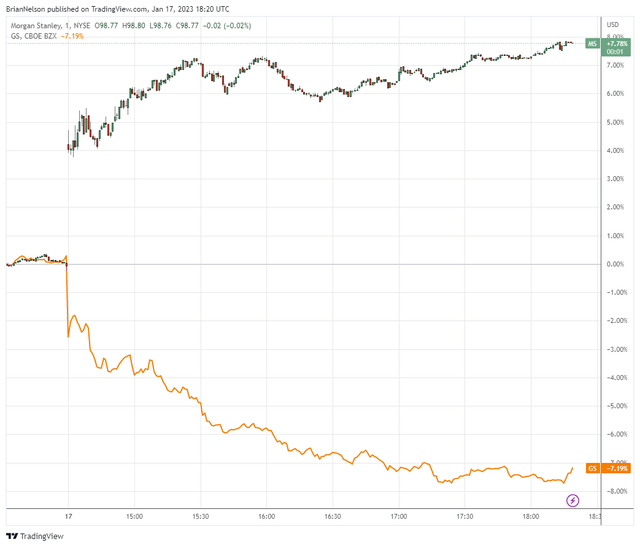

Image: Morgan Stanley’s Wealth Management division has provided the company with stability, while Goldman Sachs continues to feel weakness across several of its business segments. Image Source: TradingView

By Brian Nelson, CFA

Banking entities have kicked off fourth-quarter 2022 earnings season. The quarterly results across those that have reported have been mixed thus far, among the largest entities, but perhaps the dichotomy among players was no more pronounced than the market’s reaction to Goldman Sachs’ (GS) and Morgan Stanley’s (MS) respective fourth-quarter 2022 results.

Goldman Sachs’ shares fell to the lower end of our fair value estimate range, while Morgan Stanley’s shares surged toward our fair value estimate. We think Morgan Stanley’s shares could run to the high end of our fair value estimate range, or $118 each, in part on the basis of technical momentum, but we’re not making any changes to our banking fair value estimates following the results at this time.

Goldman’s Worst Miss in Decades as Strategy Experiences Hiccups

Goldman Sachs recorded its worst earnings miss in more than a decade when it reported fourth-quarter results, with quarterly earnings coming in at $3.32 per share, missing the consensus estimate by $2.65 per share. Revenue collapsed more than 16% during the quarter, and Goldman Sachs’ annualized return on tangible equity (ROTE) was a measly 4.8% for the fourth quarter of 2022. Without a doubt, the fourth quarter was a very rough one for Goldman given the 11% ROTE measure for all of the year. It destroyed value in the period.

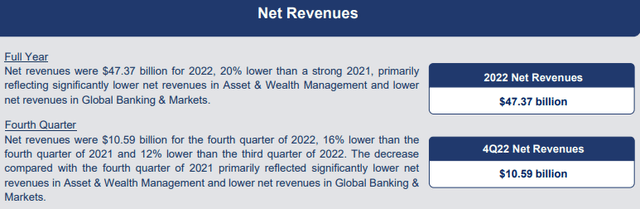

Goldman Sachs has been cutting jobs across its consumer business division, too, and the firm continues to struggle across its Asset & Wealth Management and Global Banking & Markets divisions. The latter is understandable given deteriorated market conditions, but we think Goldman is encountering execution issues as well, given what has been described as a “bull market for advice” these days. Net revenues in Goldman Sachs’ Asset & Wealth Management division, for example, were 27% lower during the fourth quarter, and that speaks of market share losses, in our view.

Image: Goldman continues to face pressure across its various businesses. Image Source: Goldman Sachs

Bank of America and Morgan Stanley Benefiting from Lucrative Wealth Management Divisions

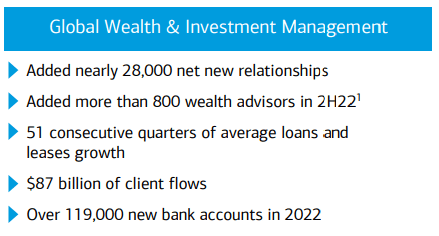

When Bank of America (BAC) reported its fourth-quarter results January 15, the company noted that its Global Wealth & Investment Management division added nearly 28,000 net new relationships and 800+ wealth advisors in the second half of the year as it gathered $87 billion in client flows. Bank of America delivered relatively flat, but resilient, performance in its Global Wealth & Investment Management division in the fourth quarter, despite client balances falling 12%, to $3.4 trillion, on a year-over-year basis. The revenue performance is in stark contrast to Goldman’s weakness across its own Asset & Wealth Management division.

Image: Bank of America Merill Lynch continues to manage its Global Wealth & Investment Management operations well. Image Source: Bank of America

Morgan Stanley’s shares popped following its fourth-quarter 2022 report, released the same day as Goldman’s. Morgan Stanley’s revenue beat expectations during the period, while non-GAAP earnings per share was about in-line with the consensus forecast. Morgan Stanley’s purchase of Eaton Vance has been helpful in the current market environment, and for all of 2022, the company’s Wealth Management division pulled in $310 billion in net new assets. Morgan Stanley has been buying back stock, and it continues to pay a very healthy dividend, with shares now yielding ~3.4%.

Concluding Thoughts

We like the Financials Select Sector SPDR (XLF) in the Best Ideas Newsletter portfolio for broad-based exposure to banking and financial entities. The Great Financial Crisis taught us that there may be little need to bet on one or two specific banks, given the opacity of their books and the leverage inherent to their respective business models. Sector-based exposure could make a lot of sense in a portfolio context and for diversification purposes, however, and Morgan Stanley’s shares are looking pretty good to start 2023, too.

We continue to monitor the sector closely.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Be Careful With Celebrity Endorsement of Investment Products >>

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.