We continue to be big fans of the transformation currently underway at Gilead Sciences. That said, however, we were initially surprised by CEO John Milligan’s decision to step down.

By Alexander J. Poulos

Key Takeaways

CEO John Milligan announced he is stepping down thus closing the book on the original management team that grew Gilead from a tiny upstart into a biotech behemoth.

Sales of the HCV franchise appear to be stabilizing leading credence to 2018 is a “trough year” for Gilead.

HIV sales continue to ramp thanks to strong uptake of Biktarvy.

We are anxiously awaiting the data read from Filgotinib at year end.

Executive Departures

We were initially caught off-guard by CEO John Milligan’s decision to relinquish his role as CEO of Gilead Sciences (GILD) as the company looks to move past its historical roots as a leader in infectious disease. The departure of Milligan closes the book on a stellar chapter in the life cycle of Gilead as the triumvirate of Milligan, former CEO John Martin, and Norbert Bischofberger, the Chief Science officer are in various stages of departing the company they have helped bring to prominence. Bischofberger began at Gilead in 1990 as he helped lead the tiny upstart into the dominant force in infectious disease beginning with HIV and later the pivot to HCV.

We find the timing of the departures rather interesting as Bischofberger fled to become CEO of a tiny start-up Kronos Bio with an impressive list of backers including his long-time boss at Gilead John Martin and Arie Belldegrun the founder of Kite Pharma, the company acquired by Gilead to gain Yescarta. Kronos is actively-seeking to develop new targets to treat cancer—we find the up-start nature of Kronos more-than-likely appeals to the entrepreneurial spirit of Bischofberger—a pivot back to the early stages of Gilead before it grew into a behemoth. We suspect the departure of Bischofberger for a more entrepreneurial setup more-than-likely deeply influenced Milligan to leave—we would not be at all surprised if he winds up in a similar venture.

It has become painfully obvious the original executive team at Gilead did not possess the necessary skill set to operate a sprawling enterprise—Gilead is more akin to a big pharma powerhouse than the nimble start-up of yesteryear. While we have great respect for the accomplishments of the two John’s and Norbert the last few years, they have been less than kind for the shareholders of Gilead. We do believe they have left the company in fantastic shape spearheaded by Yescarta for CAR-T therapy, Filgotinib for inflammatory disease and a potential treatment for NASH. However, as is the norm when climbing to the upper echelon of corporate leadership, when the business flounders the board will act by pushing for a new perspective to jump-start the business. We believe the next leader will need to possess extensive experience in big pharma to help usher in the next chapter for Gilead.

Earnings

Sales for the first six months of 2018 tallied $10.54 billion, a steep decline of 21% as the HCV franchise continues to post sharply-decelerating sales momentum. Total earnings for the company came in at $3.39 per share as the loss of revenue in HCV continues to hamper overall profitability. Gilead remains in the midst of its “earnings trough” with early signs of stabilization as evidenced in our breakdown of the individual franchise components. Management reiterated its guidance of overall sales in the $20-$21 billion dollar range during 2018 with gross margins remaining in the 85-87% range.

HIV Franchise

The HIV franchise continues to post stellar growth aided by the growth of Biktarvy as the treatment is poised to overtake Genvoya as the number one prescribed regiment for newly-diagnosed patients based on current growth trajectories. Sales for the HIV franchise totaled $3.7 billion for the second quarter of 2018, a sharp increase of 13% over the comparable period in 2017 aided by the growth of Biktarvy.

We feel Biktarvy is poised to dominate in newly-prescribed patients as its chief rival has come to market with a doublet therapy with many key opinion leaders voicing their concern over the possibility of resistance developing over long-term use. The triplet formulation of Biktarvy eliminates most of this risk which in our view will allow Biktarvy to dominate going forward.

From our vantage point, the HIV franchise is in remarkable shape with Biktarvy serving as a critical refresh of the product line-up, which should ensure continued domination in HIV well into next decade, in our view. Gilead posted some impressive market share numbers with an estimated 748,000 patients receiving anti-retroviral therapy. Of those under current care, approximately 594,000 or 79% receive a Gilead product—Gilead remains the undisputed leader in HIV, but additional new therapies are necessary to grow top-line sales going forward.

HCV Franchise

Obscured by the announcement of CEO Milligan stepping down, the troublesome HCV franchise is showing signs of stabilization with sales totaling $1 billion, a decline of 4% versus Q1 2018. While we are loath to applaud a decline in sales, we feel the stabilization in HCV will mercifully reset investors’ attention away from the HCV franchise towards the burgeoning near-term pipeline, which in our view, holds great appeal. We have often found the optimal entry into big-cap pharma/biotech is in the midst of an earnings trough as any sign of new growth often found by a new innovative product will spark the share price.

Yescarta

The onboarding of new treatment centers continues with an additional 61 cancer centers authorized to provide treatment in the US. Yescarta is an innovative treatment that requires a good deal of infrastructure to be built out first before the realization of the full commercial potential. We believe the critical number to watch the next few quarters are the total number of new centers brought into the fold rather than the total sales number ($68 million) as authorized centers in our view are a better predictor of future revenue growth.

Pipeline

The balance of 2018 contains a number of interesting data readouts highlighted by the phase 3 data readout of Filgotinib (FINCH-2 trial) for the treatment of Rheumatoid Arthritis. Filgotinib is a Jak-1 inhibitor that is currently in late-stage testing for a wide range of inflammatory diseases. The inflammatory disease category is the most lucrative, yet fiercely competitive landscape with the top-selling product Humira the treatment of choice. Thus far, the Jak-1 class remains plagued with the potential to cause blood clots, which may hamper the overall effectiveness of the class even though thus far the entire class has shown to be more efficacious than Humira.

If Filgotinib is successful in phase 3 coupled with a clean side-effect profile (i.e., minimal risk to cause blood clots), the proverbial grand slam as it would instantaneously vault Gilead into the forefront of inflammatory disease, an area where Gilead currently does not have a presence. The data is scheduled to be released in the third quarter of 2018—we will update when the data is released with our analysis.

The second noteworthy data point is the two-year survival data from the ZUMA-1 trials of Yescarta. Thus far, the results posted by Yescarta are superior regarding partial and complete response to treatment with the best long-term survival prospects. We feel the two-year data may move the needle further in favor of Yescarta despite the less than favorable side effect profile.

Concluding Thoughts

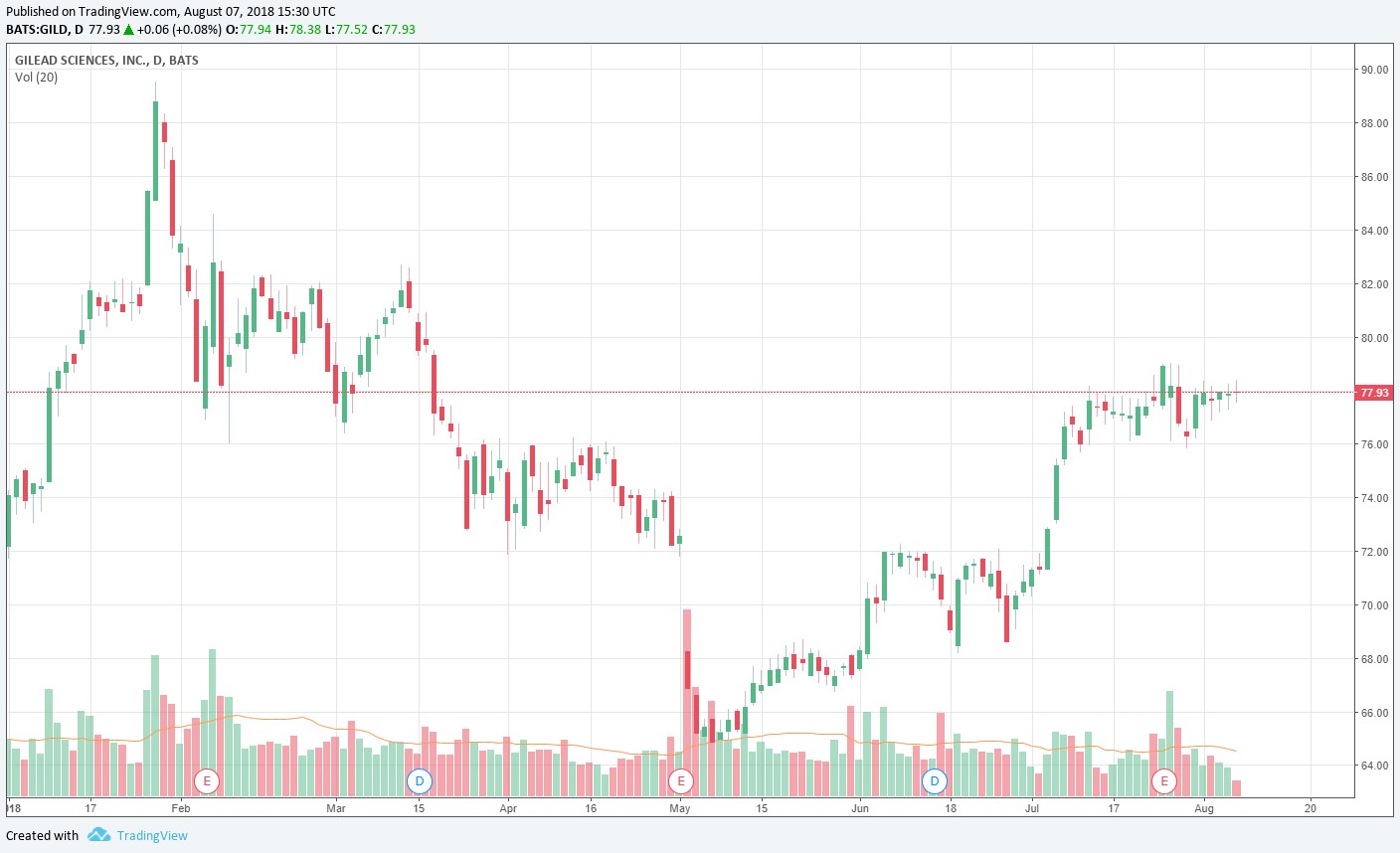

We continue to view Gilead Sciences as a worthwhile investment idea as the company is poised to power forth from the current earnings trough with what appears to be a very innovative suite of new products to augment the strength of its HIV franchise. We are anxiously watching a few key announcements over the balance of the year beginning with the new CEO and the results of Filgotinib to gain a better handle on the potential of the company going forward. Our fair value estimate remains unchanged at $96 per share with excellent dividend health metrics. We expect a dividend increase announcement in the fourth quarter with the departure of Milligan and a potential new CEO announcement to have little impact on a hike. The stock is not without considerable risk, however, “What Are the Downside Risks of Gilead Sciences?”

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Heathcare and biotech contributor Alexander J. Poulos is long Gilead Sciences. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.