Image shown: General Motors may very well be on its way to $50+ per share.

We continue to like General Motors, and we think Tesla is getting back on the right track with its financials. Auto parts suppliers have faced their fair share of pressure in recent months as the potential for a slowdown in global light vehicle production rises and input cost inflation also makes its presence felt.

By Kris Rosemann and Brian Nelson, CFA

On February 6, General Motors (GM) reported fourth-quarter 2018 earnings, and they were quite good. We continue to believe shares of GM are ultra-cheap, as we wrote in: “We Think General Motors Is Poised for New Highs.” The automaker is included as an idea in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. We value shares at $54 each, suggesting the potential for 35% upside based on its closing price February 6. We continue to believe GM’s electric-vehicle line-up will be a hit, and with Cadillac leading the charge in that area, we think the risk is actually to the upside. Here’s a quick synopsis of how GM ended the year:

In 2018, GM reported strong full-year earnings per share-diluted-adjusted. Results were driven by strong pricing, surging crossover sales, successful execution of the company’s full-size truck launch, growth of GM Financial earnings and disciplined cost control. Fullyear automotive adjusted free cash fow of $3.8 billion includes the impact of $600 million in pre-funding payments to certain non-U.S. pensions. Fourth quarter results were led by strong performance in GM North America, driven by a rich vehicle mix and strong pricing for GM’s all-new full-size pickup trucks: the Chevrolet Silverado and GMC Sierra.

Tesla (TSLA) is what they call a battleground stock, and it seems like there is a tug-of-war every few weeks or so between the bulls and the bears. The company reported fourth-quarter results January 30, and we liked them, all things considered, of course. You won’t see us adding Tesla to any newsletter portfolio, but free cash flow generation of $910 million in the fourth quarter, and most of that cash flow being added to the balance sheet to end the quarter with $3.7 billion at year-end is actually pretty good. We get the sense that a focus on free cash flow and balance-sheet health has become a priority, and we have to say that we like it. Nice job Tesla. Here are some highlights with respect to its outlook for 2019:

Model 3 production volumes in Fremont should gradually continue to grow throughout 2019 and reach a sustained rate of 7,000 units per week by the end of the year. We are planning to continue to produce Model 3 vehicles at maximum production rates throughout 2019. Inclusive of Gigafactory Shanghai, where we are initially aiming for 3,000 Model 3 vehicles per week, our goal is to be able to produce 10,000 vehicles per week on a sustained basis. Barring unexpected challenges with Gigafactory Shanghai, we are targeting annualized Model 3 output in excess of 500,000 units sometime between Q4 of 2019 and Q2 of 2020.

We continue to target a 25% Model 3 non-GAAP gross margin at some point in 2019. While there are many moving parts that will ultimately determine gross margin, we believe that significant cost reductions combined with better fixed-cost absorption and careful management of mix should enable us to get to this profit level. We expect that gross margin for Model S and Model X should remain relatively stable compared to 2018.

In total, we are expecting to deliver 360,000 to 400,000 vehicles in 2019, representing a growth of approximately 45% to 65% compared to 2018. In this range, we are expecting to have positive GAAP net income and to generate positive free cash flow (operating cash flow less capex) in every quarter beyond Q1 2019. We believe these results will be substantially driven by our restructuring action and the ongoing financial discipline with which we are managing the business.

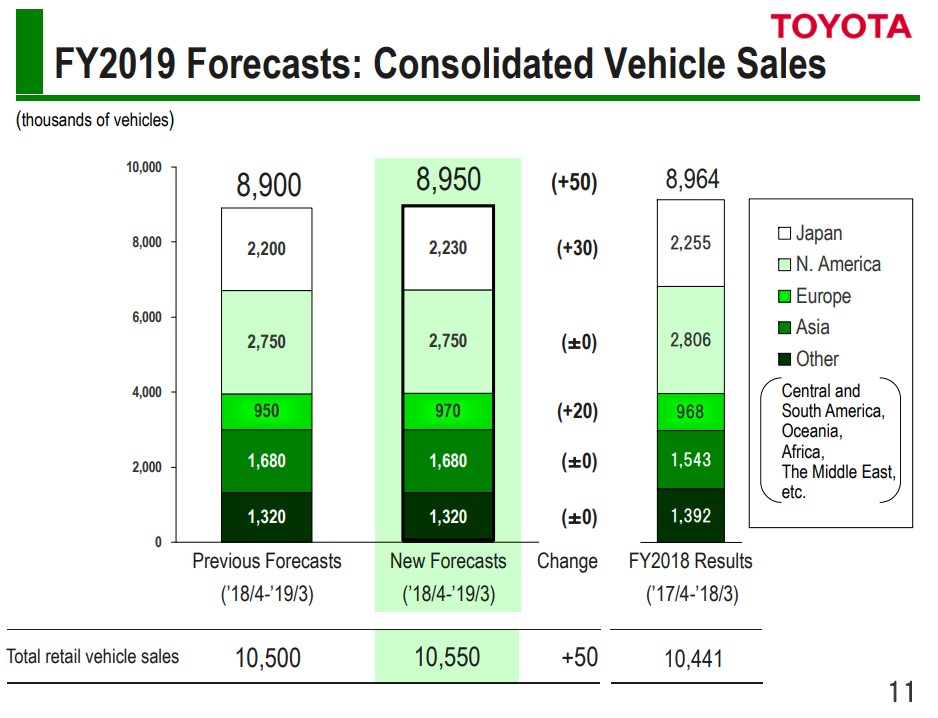

General Motors, of course, is our favorite automaker when it comes to an investment consideration. Tesla is one of the best innovators, but we’re also keeping an eye on Toyota (TM). We talk about the innovative Toyota Production System in our book Value Trap, and it’s hard for us not to like Toyota, the company. At the moment, however, we only have room for one automaker in the simulated newsletter portfolios, and that slot goes to GM due to its outsize price-to-estimated fair value discount. Still, there’s some exciting things happening at Toyota lately. Consolidated vehicle sales advanced nearly 2% through the first nine months of fiscal 2019, and net revenue and operating income also improved. Its outlook for the remainder of fiscal 2019 is solid, too.

Image source: FY2019 Third Quarter Financial Results

Although the major global automakers are holding up fairly well, the auto parts suppliers space has found itself under a notable amount of pressure of late as a result of a number of factors beyond the control of the management teams within. Not only are trade tensions impacting demand in key markets and pressuring margin performance via rising input costs, but the potential for a material slowdown in global light vehicle production appears to be rising, and that may weigh more on the supply chain than the automakers themselves. The inherent cyclicality of the auto-parts supplier chain and the pressure of having to negotiate with only a few major customers is partly why we tend to steer clear of the autoparts arena

Said another way, the automakers have considerable bargaining power over suppliers in negotiating terms on some of the most largely-commoditized parts, all the while suppliers have considerable operating leverage and remain extremely competitive, which we think prevents outsize economic returns over the long haul. In general, we don’t like the structure of the group. A number of auto parts suppliers found themselves struggling in the back half of 2018, and some were forced to cut guidance or lower expectations, both for the calendar year 2018 and beyond.

For example, Autoliv (ALV) extended the time horizon over which it expects to achieve its former 2020 financial targets. The targets remain unchanged at $10+ billion in sales and a ~13% adjusted operating margin, but management no longer expects to hit these goals in 2020. Autoliv still expects improvement towards its 2020 targets in the near term, but a slowdown in global light vehicle sales and production is anticipated in 2019. The first half of the year is likely to be challenging, with some improvement expected in the second half.

Delphi (DLPH) has been impacted by weakness in the Chinese (FXI, MCHI) auto market, and it expects to continue witnessing the impact of share loss by its local OEM customers in a weak market environment in the country. A slowdown in passenger car diesel engines, particularly in Europe (VGK), is also weighing on expectations. Local OEMs in China have faced significant reductions as their larger competitors are able to more effectively compete in a softer demand environment, and Goodyear Tire (GT) is another company that has seen its performance in China impacted by a weakening of its consumer base.

Superior Industries (SUP) may have faced as much selling pressure of any of its peers in recent months. The aluminum wheel manufacturer has been dealing with reduced shipments across Europe as a result of worldwide harmonized light vehicle test procedure emission standards and delayed spending from OEM customers in the United Kingdom (EWU). Rising energy costs have impacted its production base, particularly in Mexico (EWW), and higher launch costs have impacted margins in its European and North American operations. The company continues to battle tariff headwinds as a large consumer of aluminum. Though such costs are typically passed through to customers, higher prices have an impact on the demand curve.

Alternative parts supplier LKQ Corp (LKQ) also provided insight into the adverse cost environment the auto parts space is facing. The company noted that headwinds related to freight, vehicle, and fuel costs are impacting distribution costs, and wage and benefit inflation are also impacting its cost structure. These pressures are not expected to abate in the near term, making cost management all the more important for the company and its peers. We don’t have any plans to add an auto parts supplier to our newsletter portfolios at this time, and we maintain our very positive view on the investment merits of General Motors.

Auto Manufacturers: F, GM, HMC, HOG, TM, TSLA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann and Brian Nelson do not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.