Image source: Gilead second quarter earnings presentation

Filgotinib posted stellar data in a recent phase 3 trial for the treatment of Rheumatoid Arthritis. In light of the data, we feel Galapagos and, by extension of their commercial partnership, Gilead Sciences possess a best in class molecule in immunology.

By Alexander J. Poulos

Key Takeaways

Galapagos, which is ~15%-owned by Gilead Sciences, released stellar data of its lead compound Filgotinib.

Filgotinib again demonstrated a lack of clotting, which has torpedoed other competing promising molecules.

In our opinion, Filgotinib is well on its way to a best in class profile which augurs well for Galapagos and its commercial partner Gilead Sciences.

Though we continue to be cautious about any pharmaceutical/biotech idea, we still like Gilead’s potential. The company is navigating through a very difficult HCV unwind, but its pipeline remains promising.

We value shares of Gilead at $96 each. The company is included in both the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio.

FINCH2 Trial Results Are Here!

We have been anxiously waiting for Galapagos (GLPG) to announce the results of the clinical data from the FINCH2 phase 3 pivotal trial for the treatment of Rheumatoid Arthritis (RA) as the RA market remains one of the largest end-markets of Immunology and is expected to reach ~$29 billion by 2025. We’re waiting no more. The company released phase 3 results September 11, and they were impressive. The top-selling product in the world, AbbVie’s (ABBV) Humira belongs to the immunology class, but a significant portion of the patient pool is not adequately treated through the usage of Humira alone. For a new entrant to gain market share, the new treatment will need to demonstrate superior clinical data along with a benign side effect profile. Galapagos has this potential.

Enter the JAK Inhibitor Class

One of the most promising new classes of treatment in Immunology is the JAK class as the once-a-day oral dosage formulation has proven as efficacious as Humira while negating the need for injections, which can be a significant impediment for widespread patient adoption. Previously-marketed products in the class have encountered problematic side-effect profiles, which prevent widespread adoption even with superior clinical data versus industry standard Humira.

For example, Pfizer’s (PFE) Xeljanz, an anti-JAK, has had an uneven patient adoption thus far due in large part to its side effect profile; prolonged Xeljanz usage may lead to a higher propensity of infections, especially for the patient population that is considered immunocompromised (Diabetics, HIV and weak immune systems). Thankfully for the Pfizer’s shareholders, Xeljanz has grown into a blockbuster product–2017 sales came in at more than $1.3 billion–despite what Pfizer CEO Ian Reed publicly pointed to as a concerted effort to prevent patient access to the product:

Probably one of the largest changes, which I think would be overall positive for the industry is the Secretary’s intention to remove the safe harbor for discounts so as to eliminate rebates. At the moment in time, about 40% of the pharmaceutical prices are subsidies to the rest of the health care system. We realized some 58% of our list price. The rest goes to subsidize profitability of PBMs; insurance companies; and frankly, premiums for those that are healthy. This is not a sustainable position. And so removal of the rebates, I believe, will be very beneficial to patients and our industry, especially those companies that are — who are at launching — those companies who are launching new products over the next 5 years or so would remove the rebates, will remove the sort of what we call the rebate trap, whereby access is denied to innovative products because of a strong position of another product with its rebates. An example would be Xeljanz slow penetration but steady into the — into its market given the situation of rebates of bigger competitors.

Quote Source: Pfizer Q2 2018 Earnings Conference Call

The story for Eli Lilly’s (LLY) Olumiant is not as positive as the drug that once hoped to attain “breakthrough product” status was shot down by the US FDA as a result of its problematic side effect profile. The FDA granted marketing approval for the 2mg dose but denied the more efficacious 4mg dose due to the potential for patients to develop blood clots, which will severely hinder the uptake of the product. The 4mg dosage form is approved in the EU, but Eli Lilly’s US sales force will have its hands full trying to carve out a niche for this product.

Filgotinib Data

The FINCH2 trial data reveal indicated Filgotinib response levels are on par with the other molecules in the class, including Upadacitinib, AbbVie’s next-gen replacement for Humira. Upadacitinib recently posted data that led many to conclude the molecule has best in class potential, but there have been some reports of blood clots in the patient pool treated with Upadacitinib. In our opinion, the Olumiant 4mg rejection by the FDA has set an important precedent towards its willingness to approve the products with this troublesome side effect profile, which suggests the best in class molecule will need to demonstrate an absence of blood clots, most notably deep-vein Thrombosis (DVT).

The FINCH2 trial again demonstrated Filgotinib’s ability to provide efficacious treatment while avoiding DVTs. The following quote neatly sums up the entire spectrum of side effects witnessed in the trial:

Filgotinib was generally well-tolerated in the FINCH 2 trial, with no new safety signals compared to those reported in previous trials of Filgotinib. Treatment-emergent adverse events and serious adverse events were mostly mild or moderate in severity. Serious adverse events occurred in 3.4, 5.2 and 4.1 percent of the patients in the placebo, 100mg and 200mg groups, respectively. The proportion of patients who discontinued study drug due to treatment-emergent adverse events was also similar across groups. Two cases of uncomplicated herpes zoster were reported in each Filgotinib group. Two major adverse cardiovascular events (MACE) were identified, one subarachnoid hemorrhage in the placebo group and one myocardial ischemia in the Filgotinib 100 mg group. There was one case of non-serious retinal vein occlusion in the Filgotinib 200 mg group and no reports of deep venous thrombosis (DVT) or pulmonary embolism (PE). There were no deaths, malignancies, gastrointestinal perforations, or opportunistic infections, including active tuberculosis.

Quote Source: Galapagos Press Release

The lack of opportunistic infections gives the product a leg up compared to Xeljanz, while the absence of DVTs is a clinical advantage the sales force can exploit to gain market share against AbbVie’s Upadacitinib.

Implications for Gilead Sciences

The news is key for simulated Dividend Growth Newsletter portfolio idea and simulated Best Ideas Newsletter portfolio idea Gilead Sciences (GILD).

Filgotinib’s stellar showing validates Gilead Sciences’ decision to invest in the development of the product. Galapagos initially struck a deal with AbbVie to develop Filgotinib, but AbbVie decided to terminate its agreement to develop its own internal candidate Upadacitinib in 2015, which led Galapagos to shop the promising molecule to find a partner willing to fund and ultimately market an approved product. Flush with cash from the stellar ramp from its HCV treatment suite, Gilead emerged from the pack of potential suitors as the optimal choice as the combination of deep pockets and relatively intimate corporate culture helmed the closest to the environment fostered at Galapagos.

Under the terms of the initial deal announced in December 2015, Gilead acquired a 15% equity stake in Galapagos for $425 million in addition to a licensing fee of $300 million. Galapagos can receive additional payments up to $1.35 billion in tiered milestones (based on how well Filgotinib progresses through clinical trials), tiered royalties starting at 20% of sales, and a profit split in co-promotion territories, which will allow Galapagos to develop its own internal sales force. The deal was amended in December 2017 with Galapagos opting to take on 35% of the co-promotion efforts in select co-promoted countries in Europe as it builds out its commercial infrastructure.

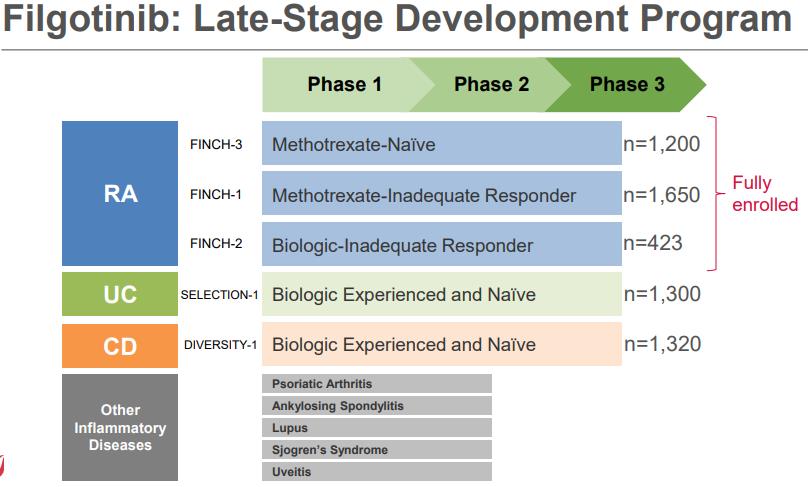

We view Filgotinib as a critical molecule for Gilead Sciences to broaden its product suite away from the rapidly declining HCV market. With Filgotinib under its control, Gilead is well on its way to establishing itself in the lucrative field of Inflammatory Disease with what may very well be a best in class molecule. Additional trials are ongoing with Filgotinib already posting stellar data in inflammatory bowel diseases (Ulcerative Colitis and Crohn’s Disease).

Filgotinib, when combined with recently acquired CAR-T treatment Yescarta, provides Gilead with two best in class products in Inflammatory Disease (Filgotinib) and Oncology (Yescarta) to be paired with its dominant HIV franchise. Thanks in large part to the success of its HIV and HCV franchises, Gilead has outgrown its small biotech roots into a dominant player in the industry with a far different profile, and we are anxiously awaiting the announcement of the company’s next CEO. Gilead is now firmly in “Big Biotech” territory, which requires a different set of skills to lead the company, but the much-maligned outgoing executive team is leaving its successors in good shape with a net cash balance on the books (when including long-term marketable securities) and a few promising molecules.

Wrapping Things Up

We’re growing more and more excited about the long-term potential of Gilead, and we like the steps it continues to take to build its pipeline to replace lost HCV revenue. We value shares in the mid-$90s at the moment, but we reiterate our view that the equity will remain quite volatile and that the range of fair value estimate outcomes is rather large for the company. Please be sure to read our downside case analysis on Gilead to assess key risks: “What Are the Downside Risks of Gilead Sciences? (July 13, 2018).”

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Heathcare and biotech contributor Alexander J. Poulos is long Gilead Sciences. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.