By Brian Nelson, CFA

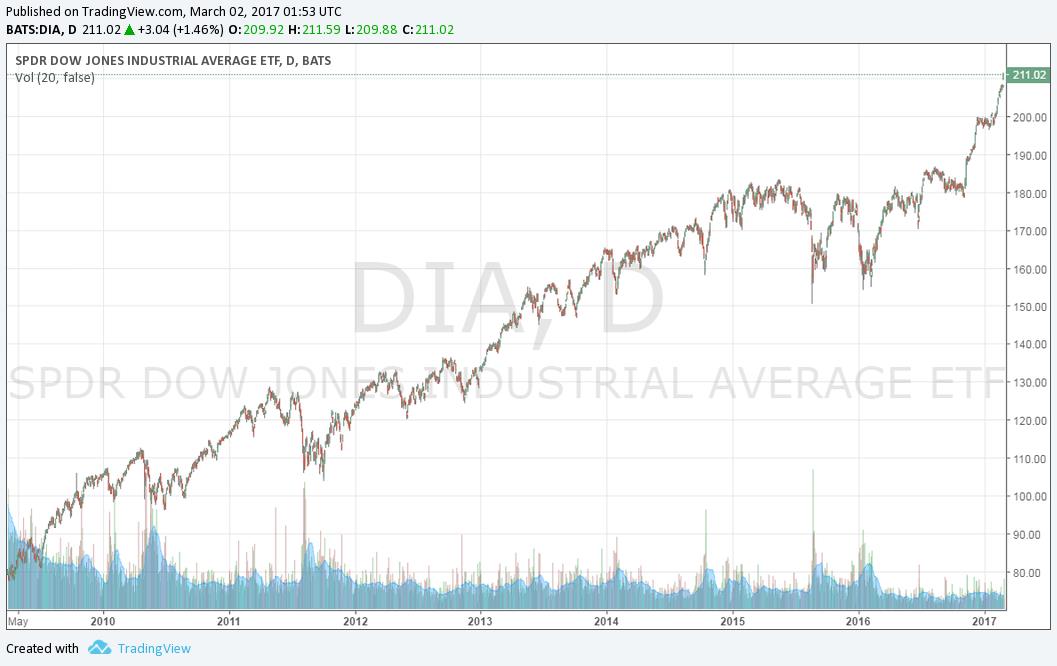

To say that the broader equity market is “extended” is an understatement.

After testing the 20,000 mark on the Dow Jones Industrial Average (DIA), stocks have now plowed through 21,000 in such a fashion that can only be compared to the euphoric trading activity of 1999 when the index surged to 11,000 from 10,000 over roughly the same time frame. Who remembers the days of the dot-com bubble? The market is clearly off its rocker, but the market isn’t always on its rocker. Stock prices under and overshoot intrinsic value all of the time. It’s a part of the markets, as much as oxygen is necessary for human life. The markets overshot to the downside during the March 2009 panic bottom, which sent stock prices to generational lows, and some 8 years later, we’re now on the other side of the trade. The fear of the Financial Crisis has now been replaced by the greed of the “Trump trade.” Does anybody even remember the Financial Crisis anymore?

Understanding the markets and how stocks don’t track intrinsic value precisely is why the momentum aspect of the Valuentum methodology is so valuable. That’s why we don’t always remove stocks when they reach our DCF-derived fair value estimate, and even sometimes, we may let stocks “run” into the high end of their fair value range. Sure – our methodology may seem obvious with the average S&P 500 stock trading at ~18 times expected earnings, but we’ve been preaching this approach for years. It has kept us reaping the rewards of this market. Fair or not, logical or not, we accept that a frothy market can always get frothier, and while we haven’t been fully invested at all times during this bull run, we’ve participated in a large way. Traditional value investors may have sold their holdings a few years ago, peculiarly bringing me to perhaps the most famed value investor of all time, who is not selling.

Don’t get me wrong — I love Warren Buffett. His teachings are fantastic, wonderful – and I will never forget his October 2008 Op-Ed in the New York Times (NYT), “Buy American. I Am.” He is a brilliant man, and whether he is brilliant because his actions are self-fulfilling as a result of large follower base that duplicate his actions without question, it really doesn’t matter. His accomplishments are many, and he is to be applauded–and he is and he is often. I remember when he poo-pooed the dot-com bubble and he was right, but did he do so because he didn’t own any technology stocks? It’s always up for debate. Today, as he has many a time before, he’s essentially telling investors to go all-in…again:

“American business – and consequently a basket of stocks – is virtually certain to be worth far more in the years ahead…Ever-present naysayers may prosper by marketing their gloomy forecasts. But heaven help them if they act on the nonsense they peddle…Investors who avoid high and unnecessary costs and simply sit for an extended period with a collection of large, conservatively-financed American businesses will almost certainly do well (Source: Berkshire Hathaway Letter to Shareholders, 2017).”

I don’t think there’s anything wrong with what the Oracle of Omaha says in the above block quote, but he is stretching a bit. Much like his words about the dot-com bubble where he cared little of a crash in those stocks, Berkshire Hathaway (BRK.A, BRK.B), with its hands in just about every American business (now even airlines!), stands to benefit greatly if investors take Mr. Buffett’s advice. Of course he is talking his book, and playing on the “feel-good” nature of nationalism – need we remind you of the campaign slogan of the sitting President of the United States, Make American Great Again? Appealing to nationalism simply works. It always has, and it always will, particularly when it comes to dynamics that are impacted by behavior, especially those like the stock market–which is driven by the buying and selling behavior of investors. What is it that I’m trying to say?

Well, first, I think Mr. Buffett is right–that America is great, and that over the long haul, investors “will almost certainly do well.” When you really think about it though, Uncle Warren isn’t saying much. Are his words just campaign rhetoric, but the stock-market equivalent? Essentially, yes. In my opinion, his optimism is just that—optimism; nothing more, nothing less. But if appealing to “near-certainties” and nationalism inspires young and old investors alike to throw their money into the stock market across a “collection of large, conservatively-financed businesses” at any price, well then Mr. Buffett’s words will serve to continue to drive the stock market higher, benefiting himself and many others. Can you imagine if he didn’t say stocks were good? What does one expect from one of the most influential investors of our day? Mr. Buffett is definitely talking his book – and yes, that’s okay. You simply won’t find many CEOs that aren’t optimistic about the future of their companies, and for Mr. Buffett, the stock market is his “company.”

Yet, you don’t have to get much further into Berkshire Hathaway’s 2017 Letter to Shareholders to get to the nugget of wisdom he may truly be trying to convey: “What is smart at one price is stupid at another (page 7)” – and that’s where we are today. As Americans, we love America. We love the American story. Many of us have lived, breathed, and studied history. But now it’s time to talk about the stock market – and price matters. The forward 12-month P/E for the S&P 500 (SPY) is 17.9, nearly 18 times, according to FactSet, based on a forward 12-month EPS estimate of $133.73. This is nosebleed levels. Mr. Buffett – this is the average S&P company; this isn’t a grouping of the most overvalued, but the average. Consumer staples entities are trading at 20.5 times, consumer discretionary 19.3 times, industrials 18.5 times, and this is the forward earnings multiple, not the trailing one (and in the midst of contractionary monetary policy and rising rates!). Say it ain’t so, Mr. Buffett. Have you, too, now thrown prudence and caution out the window?

What do I think? First, and maybe this is the Oracle of Omaha’s true intentions of his writings: do not panic. Nothing ever good comes from panicking. Trump’s economic stimuli and tax breaks may help bolster earnings in step-change fashion next year or the year after, but the magnitude of such impacts is far from guaranteed. It seems that the crux of our predictions for 2017 is essentially coming to fruition, “5 Shocking Stock Market Predictions for 2017 (December 2016),” emphasis on #1 – The Stock Market Bubble (Will) Continue(s) to Inflate. The markets are quite bubbly, but the Dividend Growth Newsletter portfolio is in great shape, and we continue to exceed the annualized goals that we’ve set forth in this publication. Of course I would like Warren Buffett to talk more sense into the market, but as I’ve said time and time again, 2017 may very well be the “Year of Evangeline Adams.”* It certainly looks that way. Don’t fall for the campaign rhetoric though!

*”(Just like astrologist) Evangeline Adams said in 1929, 2017 may be the year that ‘stocks climb to heaven.'”

Nelson’s Shocking Predictions for 2017:

/5_Shocking_Stock_Market_Predictions_for_2017

Warren Buffett’s New York Times Op-Ed:

http://www.nytimes.com/2008/10/17/opinion/17buffett.html

Buffett’s 2017 Letter to Berkshire Hathaway Shareholders:

http://www.berkshirehathaway.com/letters/2016ltr.pdf

Tickerized for Dow components.