Image: Walgreens Boots Alliance’s shares have been pummeled during 2022. Image Source: TradingView

By Brian Nelson, CFA

When Walgreens Boots Alliance (WBA)–forward estimated dividend yield of ~5.3%– reported first-quarter fiscal 2023 results January 5, operating performance wasn’t pretty. Sales from continuing operations dropped 1.5% in the quarter, while adjusted earnings per share fell 30.8% to $1.16 per share due to weakness at AllianceRX Walgreens from difficult comps related to COVID-19 vaccines.

Its predecessor company, Walgreen Co., used to be a clean “story.” Then, the firm bought Alliance Boots several years ago, and shares have languished for the better part of a decade now, after completing that transaction. Dealmaking, a dwindling stake in AmerisourceBergen (ABC) and liabilities related to the opioid crisis have only complicated Walgreens Boots Alliance’s investment prospects, not the least of which is the corresponding analytics.

During 2022, Walgreens Boots Alliance was one of the worst performers in the Dow Jones Industrial Average (DIA), but given its free cash flow generating potential, an optimist may say that has only driven its dividend yield higher for income-seeking investors. Walgreens Boots Alliance’s 10-K for fiscal 2022 was filed a few months ago for the period ending in August. For those that are new to the goings-on at the firm, here is a brief refresher:

Walgreens Boots Alliance is the largest retail pharmacy, health and daily living destination across the United States and Europe with sales of $132.7 billion in fiscal 2022. Walgreens Boots Alliance has a presence in 9 countries and employs more than 325,000 people. In addition, Walgreens Boots Alliance is one of the world’s largest purchasers of prescription drugs and many other health and well-being products. The company’s size, scale and expertise will help it expand the supply of, and address the rising cost of, prescription drugs in the U.S. and worldwide.

The company provides customers with convenient, omni-channel access through its portfolio of retail and business brands which includes Walgreens, Boots and Duane Reade as well as increasingly global health and beauty product brands, such as No7, NICE!, Soap & Glory, Finest Nutrition, Liz Earle, Botanics, Sleek MakeUP and YourGoodSkin. The company’s global brands portfolio is enhanced by its in-house product research and development capabilities…

…Additionally, the Company has a portfolio of healthcare-focused investments located in several countries, including in the U.S. and China. Strategic partnerships with some of the world’s leading companies enable the Company to extend its healthcare solutions and convenience offerings to the communities it serves. The Company is well positioned to expand customer offerings in existing markets and become a health and well-being partner of choice in emerging markets.

Walgreens Boots Alliance has a lot of moving parts these days. It acquired a majority stake in Shields, a specialty pharmacy integrator for hospitals, in October 2021 and will acquire the rest of the firm in the second quarter of fiscal 2023. It bought a majority interest in VillageMD, a provider of primary care services, which itself purchased Summit Health. Walgreens Boots Alliance also has a ~17% stake in AmerisourceBergen, having offloaded millions of shares of the entity in recent months. Walgreens Boots Alliance also completed the purchase of CareCentrix, a player in post-acute and home care management, on August 31, 2022.

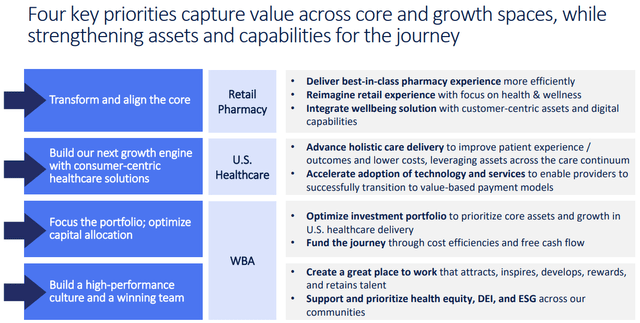

Image Source: Walgreens Boots Alliance

Walgreens Boots Alliance operates across three segments, of which it recently renamed: U.S. Retail Pharmacy ($109.1 billion in sales during fiscal 2022), International ($21.8 billion), and U.S. Healthcare ($1.8 billion). Roughly 74% of its U.S. Retail Pharmacy operations comes from its pharmacy operations (prescription drugs and the like) while the balance comes from retail (health and wellness, personal care and general merchandise, among other things). Its International business is primarily Boots branded stores in the U.K., while its U.S. Healthcare operations consist of VillageMD and Shields.

Walgreens Boots Alliance outlined the following outlook for fiscal 2023 in its October 2022 press release (items in bold and images added to block quote from fourth-quarter fiscal 2022 press release)):

“Expecting fiscal year 2023 adjusted EPS of $4.45 to $4.65 [fiscal 2022 adjusted EPS was $5.04] as strong core business growth is more than offset by lapping fiscal year 2022 COVID-19 execution, and currency headwinds [“Healthy core business growth of 8 to 10 percent in constant currency is expected to be more than offset by adverse currency movements of approximately 2 percent and by a headwind of 15 to 17 percent from lower COVID-19 vaccination volumes”}

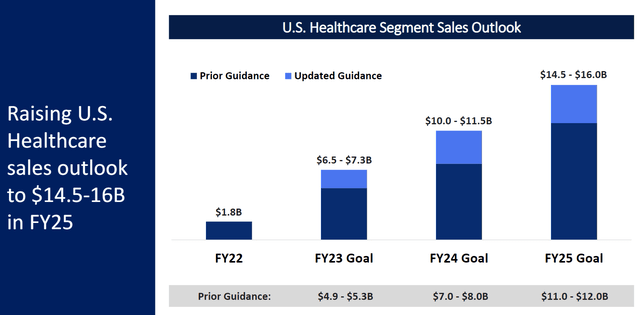

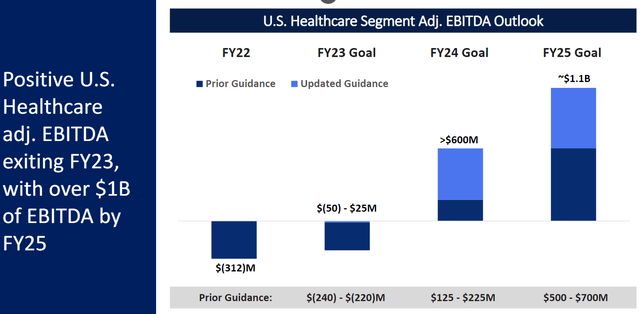

Raising U.S. Healthcare fiscal 2025 sales target to $11 billion to $12 billion, with the segment expected to achieve positive adjusted EBITDA by fiscal year 2024 [Note: On November 7, this guidance was revised upward to $14.5-$16 billion in U.S. Healthcare fiscal 2025 sales with an adjusted EBITDA target in the division in the range of -$50 million to $25 million for fiscal 2023, following VillageMD’s deal for Summit Health.]

Image Source: Walgreens Boots Alliance

Image Source: Walgreens Boots Alliance

Increased visibility to the company’s long-term growth algorithm, building to low-teens adjusted EPS growth in fiscal year 2025 and beyond”

With all the moving parts at this high-yield dividend payer, we think it is most constructive to look at Walgreens Boots Alliance’s cash-based sources of intrinsic value to get down to brass tacks. During fiscal 2022 (ending in August 2022), net cash from continuing operations came in at ~$3.9 billion, while it hauled in ~$2.2 billion in free cash flow, the latter declining ~$2 billion on a year-over-year basis due in part to weakness in AllianceRx Walgreens and higher capital spending (see image that follows). At the end of August 2022, cash and cash equivalents as well as marketable securities stood at ~$2.5 billion against short- and long-term debt of $11.7 billion. 2022 free cash flow still covered cash dividends paid of ~$1.66 billion over the same period, however.

Categories Member Articles