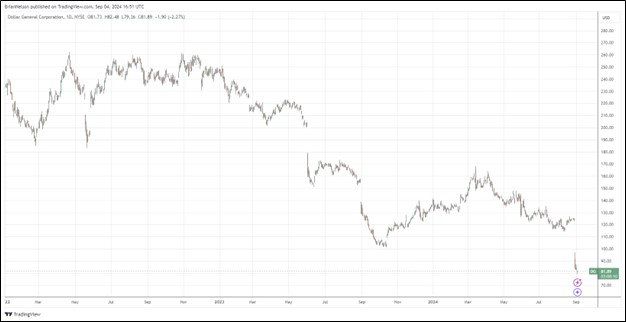

Image: Dollar General’s shares have been under considerable pressure the past couple years.

By Brian Nelson, CFA

Dollar General (DG) recently reported second-quarter results that left a lot to be desired. Revenue of $10.2 billion missed estimates by $170 million, while GAAP earnings per share came in at $1.70, missing the consensus forecast by $0.09. Same-store sales increased 0.5%, while operating profit fell 20.6% and diluted earnings per share dropped more than 20%. Management was disappointed with the performance:

We made important progress on our Back to Basics plan in the second quarter, However, despite advancing several of our operational goals and driving positive traffic growth, we are not satisfied with our financial results, including top line results below our expectations for the quarter. While we believe the softer sales trends are partially attributable to a core customer who feels financially constrained, we know the importance of controlling what we can control. With the evolving retail and consumer landscape in mind, we are taking decisive action to further enhance our value and convenience offering, as well as the in-store experience for our associates and customers.

Dollar General cut its outlook for fiscal 2024. Net sales growth is now expected in the range of 4.7%-5.3% compared to its previous expectation of 6%-6.7%. Same store sales growth is now anticipated in the range of 1%-1.6%, compared to previous expectations of 2%-2.7%. Diluted earnings per share are now targeted in the range of $5.50-$6.20, compared to prior expectations of $6.80-$7.55. Shares of Dollar General plummeted on the news, and we see no reason to jump into the name, particularly given the competitive market environment, with Walmart (WMT) likely gaining share.

—–

NOW READ: What to Do During This Market Selloff

Tickerized for DG, DLTR, OLLI, BJ, BIG

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.