Image Source: Walmart

By Brian Nelson, CFA

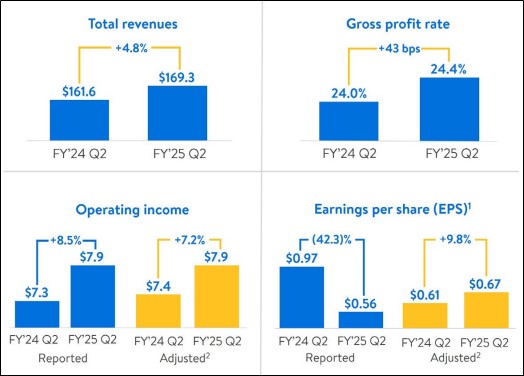

On August 15, Walmart (WMT) reported better than expected second quarter results with both revenue and non-GAAP earnings per share coming in higher than the consensus forecast. Consolidated revenue advanced 4.8% in the quarter led by Walmart U.S. comp sales up 4.2% and Sam’s Club comp sales up 5.2%, both measures excluding fuel. The company’s consolidated gross margin expanded 43 basis points thanks to strength in Walmart U.S. and Walmart International.

Walmart’s adjusted operating income increased 7.2% in the quarter “due to higher gross margins and growth in membership income.” Global ecommerce and global advertising advanced 21% and 26%, respectively, in the period. Adjusted earnings per share increased 9.8%, to $0.67 per share, from the second quarter of 2023 on a year-over-year basis. Management was upbeat in the press release:

Our team delivered another strong quarter. They work hard every day to help our customers and members save time and money. Each part of our business is growing – store and club sales are up, eCommerce is compounding as we layer on pickup and even faster growth in delivery as our speed improves. Our newer businesses like marketplace, advertising, and membership, are also contributing, diversifying our profits and reinforcing the resilience of our business model.

Looking to Walmart’s outlook, the company issued guidance for third quarter sales to grow 3.25%-4.25% and operating income to grow 3%-4.5% in constant currency. For fiscal 2025, Walmart raised its outlook with net sales now expected to advance 3.75%-4.75% (was 3%-4%) and adjusted operating income now targeted to increase 6.5%-8% in constant currency (was 4%-6%).

Walmart’s adjusted earnings per share for fiscal 2025 is now targeted in the range of $2.35-$2.43 (was $2.23-$2.37). The company ended the quarter with total debt of $47 billion and cash and cash equivalents of $8.8 billion. Walmart hauled in $5.9 billion in free cash flow during the first six months of the year, well in excess of the $3.3 billion it paid in dividends over the same time period. We liked Walmart’s second quarter report, its raised outlook for fiscal 2025, and the company’s very healthy dividend. Shares yield 1.2% at the time of this writing.

—–

NOW READ: What to Do During This Market Selloff

Tickerized for WMT, TGT, XRT, DIA, XLP, VDC, FSTA, RTH, IEDI, PJFV, AHOY, VIRS, NXTI, KXI

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.