Image Shown: Shares of Credit Suisse Group AG have performed poorly in recent years as a revolving door of leaders combined with several major scandals have led to billions in losses and prompted Swiss regulators to launch investigations into the bank. The company has a plan in place to turn things around, though it will take years for these efforts to be fully reflected in its financial performance. Credit Suisse recently issued out lackluster guidance for 2022 that weakened investor confidence in its turnaround story. We think Credit Suisse is a good case study in poor corporate governance.

By Callum Turcan

A key part of the investment decision-making process involves evaluating a company’s leadership team, the process of which we covered in detail in our recent article Governance: The G in ESG Investing that can be viewed here. Pairing environmental, social, and governance (‘ESG’) analysis (subscribe to our ESG Newsletter here) with traditional enterprise free cash flow analysis, and the Valuentum process more generally, may help investors further understand possible downside risks.

At Valuentum, we combine both qualitative and quantitative aspects of investment analysis in a holistic firm-foundation, stock-selection fashion. Our data-driven discounted cash-flow process and comparable multiple analysis overlay help to identify underpriced stocks while our technical and momentum indicators assess the timeliness of an investment idea, but we can’t ignore many of the “hidden” and sometimes asymmetric qualitative risks either, many of which come to light in our ESG work.

At the core, ESG investing standards focus on locating and eliminating certain risks from investment portfolios. ESG analysis has always been an important area for investors to consider, of course, but the category has been further refined the past decade and is gaining more and more traction in recent years, with tremendous opportunities for asset under management (‘AUM’) growth across various ESG strategies.

Credit Suisse’s Weakened Risk Management

In but the latest example of poor corporate stewardship, Credit Suisse Group AG (CS) attempted and largely failed to deal with myriad governance issues in the wake of several scandals. The bank is perhaps best known for its investment banking operations, but it also provides various other financial services around the world from private banking and wealth management services to advisory and planning operations.

Last year, the Swiss bank took a total hit of CHF$4.8 billion (equivalent to roughly USD$5.2 billion at exchange rates as of this writing) from the demise of a customer, the hedge fund Archegos Capital Management in March 2021. Archegos Capital Management had borrowed heavily from Credit Suisse and others to fund its trading activity, and unfortunately, the hedge fund defaulted on a margin call and became insolvent.

Credit Suisse published an extensive report on the scandal–which was based on an independent external investigation–more than 80 interviews with current and former Credit Suisse employees, and a treasure trove of documents and data. In addition to the Archegos blunder, the bank was also hit with losses from the blowup of the supply chain financing company Greensill in 2021, and these scandals prompted the Swiss Financial Market Supervisory Authority (‘FINMA’) to launch investigations into the governance practices at Credit Suisse.

When Credit Suisse reported its fourth quarter 2021 earnings update in February 2022, the Swiss bank stated that it would not publish its report into its Supply Chain Finance Funds (‘SCFF’) operations. An independent external investigation into the matter helped create the report. In the view of Credit Suisse, publishing its SCFF report would further damage its reputation and standing in the banking community.

Turnover at the Top

Pivoting here, the former CEO of Credit Suisse, Tidjane Thiam, resigned in February 2020 in the wake of a different scandal involving Mr. Thiam allegedly being involved in spying activities that concerned senior Credit Suisse employees. Reportedly, there was a power struggle going on at the bank, and while Thiam denied the allegations, the allegations were somewhat concerning.

Urs Rohner (who reportedly was in the power struggle with Thiam) remained chairman of Credit Suisse at the time, though clearly Rohner (who served as chairman of Credit Suisse for a decade before retiring in 2021) failed to identify the risks stemming from the bank’s involvement with Archegos and Greensill. In 2020, Thomas Gottstein, a multi-decade veteran of the Swiss bank, became CEO of Credit Suisse. As of February 2022, Gottstein is still CEO of Credit Suisse.

In April 2021, Credit Suisse brought Antonio Horta-Osorio in as chairman to try and clean up the company. Horta-Osorio previously worked as CEO of Lloyds Banking Group PLC (LYG) and accordingly to financial media reports, was well-respected within the banking industry and broader financial sector. However, in January 2022, Horta-Osorio stepped down as chairman due to him allegedly violating U.K. and Swiss rules regarding containing the spread of the coronavirus (‘COVID-19’) pandemic.

Axel Lehmann has now taken over the chairman role at Credit Suisse. Lehmann joined Credit Suisse’s board in late 2021 and is the chair of its risk committee, having previously worked at UBS Group AG (UBS). Clearly, the frequent changes at the top of Credit Suisse were a warning sign that governance risks were mounting.

Credit Suisse’s Financials

—

On February 10, Credit Suisse reported a lackluster fourth quarter 2021 earnings update.

The company’s net revenues (on a basis that is comparable to US GAAP accounting standards) fell by 12% year-over-year last quarter for a few reasons. Credit Suisse cited “a reduced risk appetite across the Group in 2021, a negative impact on (its) franchise momentum and a return to a more normal trading environment” within its earnings press release as holding down the firm’s financial performance at its investment banking and wealth management operations.

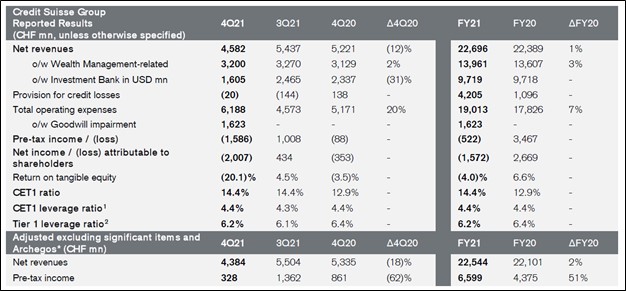

Credit Suisse also reported a sizable net loss last quarter, due in part to a large goodwill impairment charge as one can see in the upcoming graphic down below. Shares of CS sold off after its latest earnings report was made public.

Image Shown: Credit Suisse exited 2021 on a weak note as its revenues fell materially year-over-year in the fourth quarter while a large goodwill impairment charge saw the Swiss bank also posted a large net loss that quarter. Please note that the above financial metrics are in Swiss francs (‘CHF’) and were prepared to closely resemble US GAAP accounting standards. Image Source: Credit Suisse – Fourth Quarter of 2021 Earnings Press Release

In November 2021, Credit Suisse had announced several strategic initiatives to improve the company’s outlook and help put the past behind it. The company aims to grow its wealth management business by allocating additional capital to the unit and improving its operational focus, while also steadily improving its cost structure through corporate reorganization efforts.

At the start of 2022, Credit Suisse reorganized its corporate reporting structure into four divisions: Wealth Management, Investment Bank, Swiss Bank, and Asset Management. It also reorganized its geographical reporting into four regions: Switzerland, Europe, Middle East and Africa (‘EMEA’), Asia-Pacific (‘APAC’), and the Americas. Unifying its wealth management business under one reporting segment and its investment banking business under one reporting segment should sharpen Credit Suisse’s operational focus going forward, while also offering room for potential cost savings. At the end of December 2021, Credit Suisse had CHF$1.6 trillion in AUM across its operations, up 7% year-over-year.

However, it will take some time for these efforts to be fully reflected in Credit Suisse’s financial performance, particularly as it concerns its cost saving initiatives. The Swiss bank incurred meaningful restructuring expenses last year (approximately CHF$0.1 billion) and will likely continue to do so going forward as it overhauls its corporate structure. Litigation and legal expenses have also been quite material of late. Eventually, some of these expenses should fade as Credit Suisse attempts to put the past behind it and completes its major corporate overhaul (sizable legal expenses are an ordinary part of the business, though relatively speaking, elevated legal expenses should normalize over time as Credit Suisse puts past scandals behind it).

Management provided commentary regarding Credit Suisse’s outlook that underwhelmed the market during the firm’s latest earnings call in February 2022 (emphasis added):

“So let me just close then with just a few words, please, on the outlook for the current year. Clearly, as we’ve said already, 2022 will be a transitional year for Credit Suisse as the benefits of the strategic capital allocation towards our Wealth Management businesses and