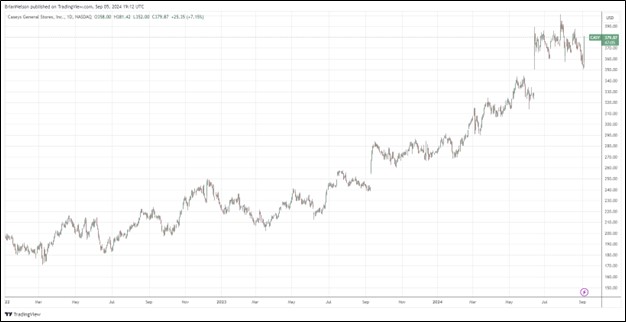

Image: Shares of Casey’s General Stores have done quite well since the beginning of 2022.

By Brian Nelson, CFA

Casey’s General Stores (CASY) reported decent fiscal first quarter results on September 4. Total revenue advanced 5.9% as inside same-store sales increased 2.3% from the prior year, resulting in 7.9% growth on a two-year stacked basis. Its inside margin was 41.7%, while total inside gross profit increased 10.4% from the same period a year ago. Same-store fuel gallons were up 0.7% with the company generating a fuel margin of 40.7 cents per gallon. Total fuel gross profit increased 5.9%.

Management was upbeat in the press release:

Casey’s started the fiscal year off on the right foot and delivered another solid quarter highlighted by strong inside gross profit growth. Inside same-store sales were driven by prepared food and dispensed beverage, with hot sandwiches and bakery performing exceptionally well. Our fuel team continues to balance volume and margin as they delivered positive same-store fuel gallons while also achieving over 40 cents per gallon fuel margin. The operations team continues to find efficiencies as we reduced same-store labor hours for the ninth consecutive quarter. Finally, we continue to work on closing the highly strategic Fikes acquisition, and look forward to welcoming their team to the Casey’s family.

For the fiscal first quarter, EBITDA was up 9% from the same period last year, while net income advanced 6%, and diluted earnings per share increased 7%. Casey’s ended the quarter with $1.2 billion in available liquidity, consisting of $305 million in cash and $900 million available under existing lines of credit. For the three months ended July 31, cash flow from operations increased to $281.4 million versus $229.1 million in the year-ago period. Free cash flow was $180.8 million in the quarter.

Looking to fiscal 2025, Casey’s continues to expect EBITDA to advance at least 8%, with inside same-store sales to increase 3%-5% and inside gross margin comparable to fiscal 2024. Same-store fuel gallons sold are expected to be between negative 1% and positive 1%. We liked Casey’s fiscal first quarter results, and while the name doesn’t make the cut for any newsletter portfolio, it’s one that we are watching closely.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.