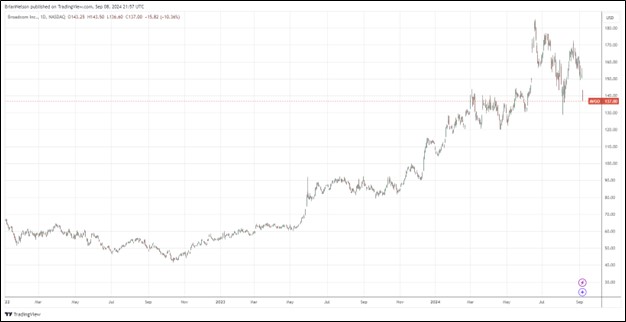

Image: Broadcom’s shares fell after the company issued fiscal fourth quarter guidance that came up short with respect to the consensus estimate.

By Brian Nelson, CFA

On September 5, Broadcom Inc. (AVGO) reported better than expected fiscal third quarter results with revenue and non-GAAP earnings per share exceeding the consensus forecast. Revenue was up 47% from the same quarter a year ago, while non-GAAP diluted earnings per share was $1.24 for the period. Adjusted EBITDA came in at 63% of revenue, while traditional free cash flow, as measured by cash flow from operations less all capital spending, of $4.89 billion amounted to 37% of revenue.

Management was upbeat with its comments in the press release:

Broadcom’s third quarter results reflect continued strength in our AI semiconductor solutions and VMware. We expect revenue from AI to be $12 billion for fiscal year 2024 driven by Ethernet networking and custom accelerators for AI data centers. The transformation of VMware continues to progress very well. The integration of VMware is driving adjusted EBITDA margin to 64% of revenue as we exit fiscal year 2024.

Consolidated revenue grew 47% year-over-year to $13.1 billion, including the contribution from VMware, and was up 4% year-over-year, excluding VMware. Adjusted EBITDA increased 42% year-over-year to $8.2 billion. Free cash flow, excluding restructuring and integration in the quarter, was $5.3 billion, up 14% year-over-year.

Looking to the fourth quarter of fiscal 2024, Broadcom expects revenue of approximately $14 billion, and fourth-quarter adjusted EBITDA of approximately 64% of projected revenue, or $8.96 billion. Though the firm’s revenue guidance for the fourth quarter wasn’t poor, it did come in lower than the $14.13 billion that the Street was expecting, and shares were punished as a result. We’re not reading much into one quarterly report, however, and we maintain that trends in artificial intelligence are prolific.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.