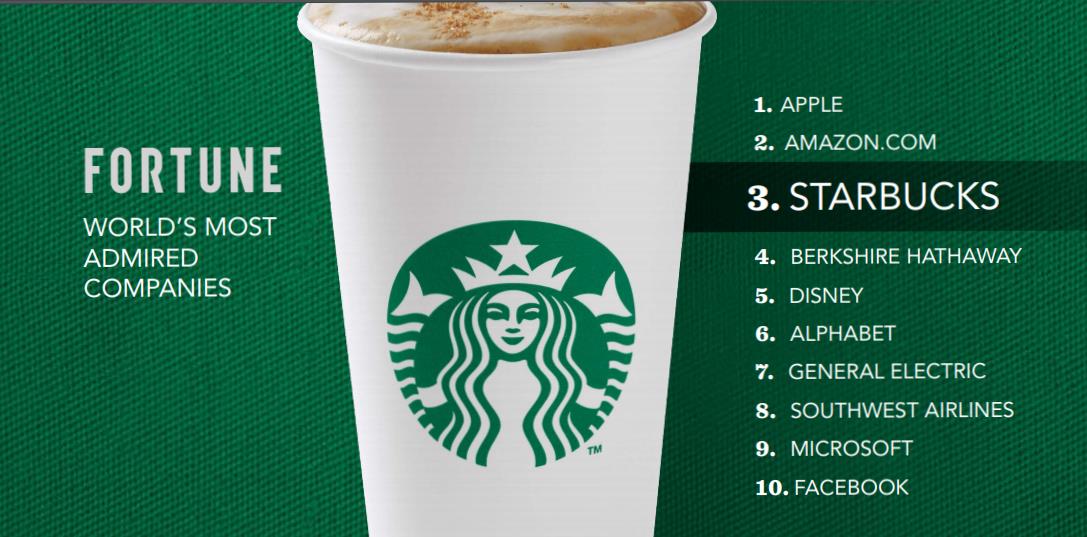

Image Source: Starbuck’s 2017 annual Shareholder Meeting

Most income-minded investors would love to find the next Dividend Aristocrat before it earns such a title, but many continue to focus on the stars of the past instead of working to identify up and coming dividend track records, which often carry higher dividend growth rates than the most established Dividend Aristocrats.

By Alexander J. Poulos

McDonald’s Is Pretty Good…

Starbucks (SBUX) has a number of qualities that we look for in identifying companies that can sustain a growing dividend over time, one that has the potential to develop into a Dividend Aristocrat. The company’s dividend track record is still a young one as the payout was initiated in 2010, but forward-looking analysis will always be the most important analysis. Starbucks’ business is relatively well-understood and well-covered, owning to its well-known brand that engenders customer loyalty (and consistent repeat business), but its dividend potential may not be as widely regarded. Let’s compare and contrast Starbucks’ dividend with that of McDonald’s (MCD), a far from a perfect comparison but still a reasonably close peer in the global restaurant space.

McDonald’s dividend track record is hard to overlook due in large part to its run of 40+ consecutive annual increases as of 2017, but as all investors know, past performance does not guarantee future results (look at General Electric, for example). McDonald’s impressive dividend growth history comes alongside impressive overall expansion for the company, too, as it now has more than 36,000 restaurants around the globe (over 31,000 are franchised). The relentless global development has enabled the company to boost its dividend in the 1970s to its current rate of $1.01 per quarter for a current annualized dividend yield of ~2.3% at the time of this writing. The company we know today is a vastly different entity than the upstart restaurant that went public in 1965, however, and while McDonald’s still has decent growth opportunities, the biggest part of McDonald’s growth phase is likely behind it.

After all, nearly 75% of the population in the US, France (EWQ), the UK, Germany (EWG) and Canada (EWC) lives within three miles of a McDonald’s. “The company is already one of the largest providers of delivered food in the world, with annual systemwide delivery sales of nearly $1 billion across various markets including China, South Korea and Singapore…no other food company in the world has this reach…” McDonald’s is still opening up a tremendous number of restaurants, with the company targeting about 900 new restaurants during 2017, a number that includes about 500 restaurants that do not require capital spending (development licensee markets), but it’s already huge, and it’s tougher for a big company to get bigger.

That said, we’ve been most impressed with McDonald’s all-day-breakfast initiatives, as we had been led to believe that such efforts would be a disaster given some of the talk of inefficiencies by franchisees. This turned out to be far from the case and set us up wrong on our original thesis for the restaurant chain in most recent years. We’re not afraid to admit it that McDonald’s proved us wrong. The company is also doing a great job with menu innovation and simplification initiatives, and it may very well have side-stepped, or at least pushed the threat of minimum-wage legislation to its operators, given McDonald’s refranchising strategy. Almost by definition because of its success, however, growth at the burger-and-fries giant will become more and more difficult to achieve. That’s really all that we’re trying to say.

Management has been working to capitalize on today’s ultra-accommodative interest rates to leverage up the balance sheet and return cash to shareholders in the form of dividends and share repurchases. Shareholders have been well-rewarded, too, and frankly, we like the company’s long-term financial targets. Systemwide sales growth of 3%-5%, operating margin in the mid-40% range, earnings per share growth in the high-single-digits and return on new invested capital in the mid-20% range, implying economic value creation. As McDonald’s refranchising efforts have gained steam, it’s worth emphasizing that capital spending as a portion of revenue has declined while operating margins have increased. We’re less concerned about revenue growth, provided that operating income and free cash flow continue to move in the right direction.

Though McDonald’s dividend metrics aren’t as strong as they could be, we are not at all worried about the health of McDonald’s payout at the moment, even as we calculate a Dividend Cushio ratio of 0.5 at last update. McDonald’s recently raised its payout more than 7% in September, and the market loved it. Furthermore, its free cash flow per share easily covers dividends per share, but we note that the Dividend Cushion considers this relationship on a forward-looking basis, including growth in the payout, as well as the balance sheet impact, something that a free cash flow coverage metric alone might miss. For example, total debt at McDonald’s has exploded to nearly $26 billion at year-end 2016 from half of that in 2011. In times of tight credit, McDonald’s will have to turn a bit more conservative when it comes to dividend growth, in our view.

…But Is Starbucks Better?

Starbucks remains firmly entrenched in its growth phase as it continues to open new locations that help drive sales growth. Starbucks in its most recent 10-K highlighted the expectation of an increase in 2,300 new restaurants for fiscal 2018. We feel the flexibility of Starbucks’ product offering remains a key differentiator between it and McDonald’s. Its emphasis on beverages compared to McDonald’s menu of predominantly food offerings allows for optimization of the store sizes. Starbucks can tailor offerings to the unique sales floor of the client such as upscale hotel lobbies by limiting selection, something McDonald’s is more limited in. Starbucks has consistently grown sales over the past five years while expanding operating margins as economies of scale are realized.

Starbucks initiated its dividend in March 2010 with a quarterly payout of $0.05, and it has hiked the annual payout each year since then as the business grows and continues to generate an impressive free cash flow stream (free cash flow averaged more than $2.7 billion in fiscal 2015-2017, easily covering annual dividend obligations of $1.45 billion over the same time period). The company’s balance sheet holds a net debt position of ~$1.2 billion as of the end of fiscal 2017, before considering long-term investments of more than $540 million, and its cash balance of nearly $2.7 billion provides nice ‘optionality’ value. Compared to McDonald’s significant net debt load north of $20 billion, Starbucks’ balance sheet health could be viewed as relatively healthier in this respect (the less net debt, the better). Though Starbucks’ payout is more than 30 years younger, shares of Starbucks yield only ~0.3 percentage points less than McDonald’s.

Our inclusion of McDonald’s in this note is to illustrate the forward path Starbucks may embark upon once–or if–its tremendous growth prospects begin to wane in coming decades. We feel the ramp for continued store growth of the core Starbucks brand is robust–that’s not to say if the Princi bakery concept won’t take off, and we’re viewing this as a source of upside, too. In any case, we wanted to put Starbucks on your radar as the share price of Starbucks remains range bound during the past few years—missing out on the impressive bull run! Is it a pressure cooker, ready to take off? In our opinion, the enthusiasm for Starbucks in late 2014 galvanized a near 50% plus run in 2015 led to the share price overshooting its fair value with the equity struggling to grow into its valuation over the past few years. Our interest in highlighting Starbucks besides the dividend is the potential for shares to undergo a similar run as investors may become enthused by the equity once again.

Though we’re not calling for this to happen, if the pace of store growth expansion at Starbucks begins to taper significantly sometime in the middle of the next decade, the coffee giant may become more aggressive in the refranchising front–a hidden source of potential upside (just like it was for McDonald’s!). Management currently lists further global expansion as a top priority, and enhancing the guest experience via an increase in technology spend will remain a key initiative. Starbucks’ utilization of its technological prowess to offer individually-tailored offers has enhanced the frequency of customer visits, thus helping to build endearing loyalty. We expect future tech rollouts such as the order-ahead feature to aid in guest visit frequency as well, ultimately translating to higher overall sales.

Concluding Thoughts

The dividend growth potential of Starbucks coupled with the resilience of the business model supported by a fantastic brand name makes for an interesting consideration for income-minded investors. Unlike the traditional dividend stalwarts, Starbucks’ dividend growth trajectory remains unimpeded by a lofty hurdle to clear in terms of inflated annual dividend obligations that may result from decades of dividend growth, as in the case of McDonald’s, for example. The dividend growth potential, coupled with strong free cash flow generation and a reasonable balance sheet, lay the foundation for what could be many years of sustained income growth for Starbucks.

That said, Starbucks is trading near the upper bound of our fair value estimate range for shares, and the market is still pretty excited about the company, even if it didn’t quite keep up with bull-market moves recently, “Euphoria Running Rampant: Investigating Some of the Hottest Names Around.” So while we love Starbucks, the company, love its dividend growth prospects, and think the stock still has potential should this aging bull market hold up, its valuation is not as inexpensive as we would like it to be. We assign Starbucks an Economic Castle rating of Very Attractive, a quality that becomes even more attractive considering the stage of growth Starbucks is currently in–when capital investment may be greatest due to store unit expansion. Starbucks’ Dividend Cushion ratio is currently 1.9, and shares yield ~2% as of this writing.

Independent Contributor Alexander J Poulos is long Starbucks.

Related: ARCO, BITE