Image Shown: Facebook Inc’s digital advertising business is a behemoth and enabled the firm to put up banner first quarter 2021 performance. We continue to be enormous fans of Facebook and include shares of FB as a top-weighted idea in our Best Ideas Newsletter portfolio. Image Source: Facebook Inc – First Quarter of 2021 IR Earnings Presentation

By Callum Turcan

We continue to view Facebook Inc (FB) as one of the most attractive capital appreciation opportunities out there as shares of FB, as of this writing, are trading at a steep discount to their intrinsic value on the basis of enterprise cash flow analysis. Our fair value estimate for Facebook sits at $413 per share with room for upside as the top end of our fair value estimate range sits at $516 per share. Facebook is included as a top-weighted idea in the Best Ideas Newsletter portfolio and more recently, shares of FB have begun to converge towards our fair value estimate. Momentum continues to shift in the right direction after Facebook published its first quarter 2021 earnings report on April 28, which saw shares of FB jump higher after the report went public as the firm easily surpassed consensus top- and bottom-line estimates.

Earnings Update

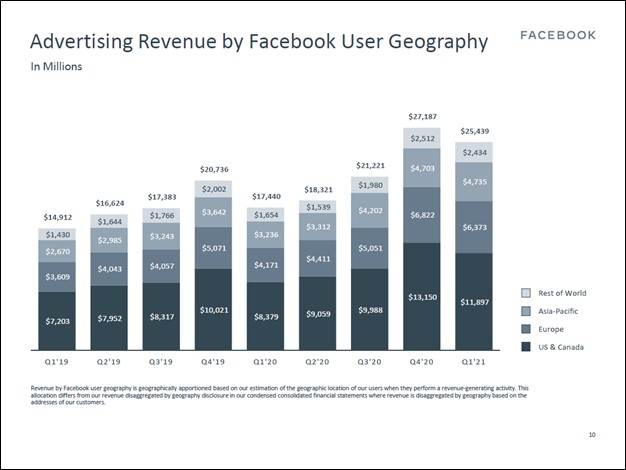

Facebook reported that its GAAP revenues and GAAP operating income surged higher by 48% and 93% year-over-year, respectively, last quarter due to simply stunning performance at its digital advertising operations. Though Facebook aims to eventually build a sizable e-commerce and payment processing business, in the here-and-now, its bread-and-butter remains digital advertising. The company’s headcount grew 26% from the end of March 2020 to the end of March 2021, though revenue growth and economics of scale more than offset rising operating expenses.

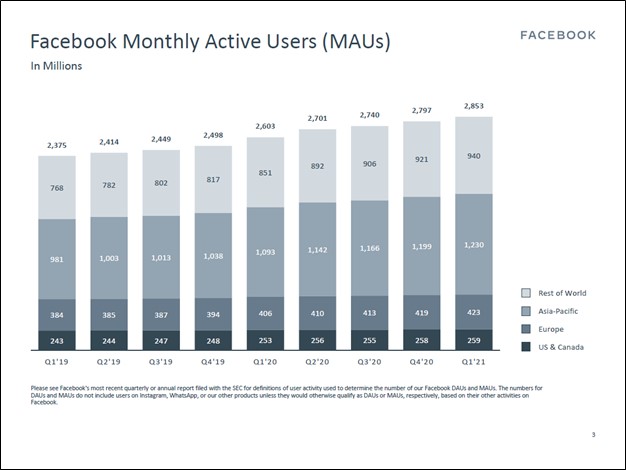

Facebook’s daily active users (‘DAUs’) were up 8% year-over-year in March 2021, hitting 1.88 billion on average, while its monthly active users (‘MAUs’) grew 10% year-over-year, hitting 2.85 billion as of the end of March 2021. User growth is primarily coming from overseas markets as its core North American operations (US and Canada) represent mature markets, limiting user growth opportunities.

Image Shown: Facebook’s active user base continues to expand, almost entirely due to its overseas growth story continuing in earnest. Image Source: Facebook – First Quarter of 2021 IR Earnings Presentation

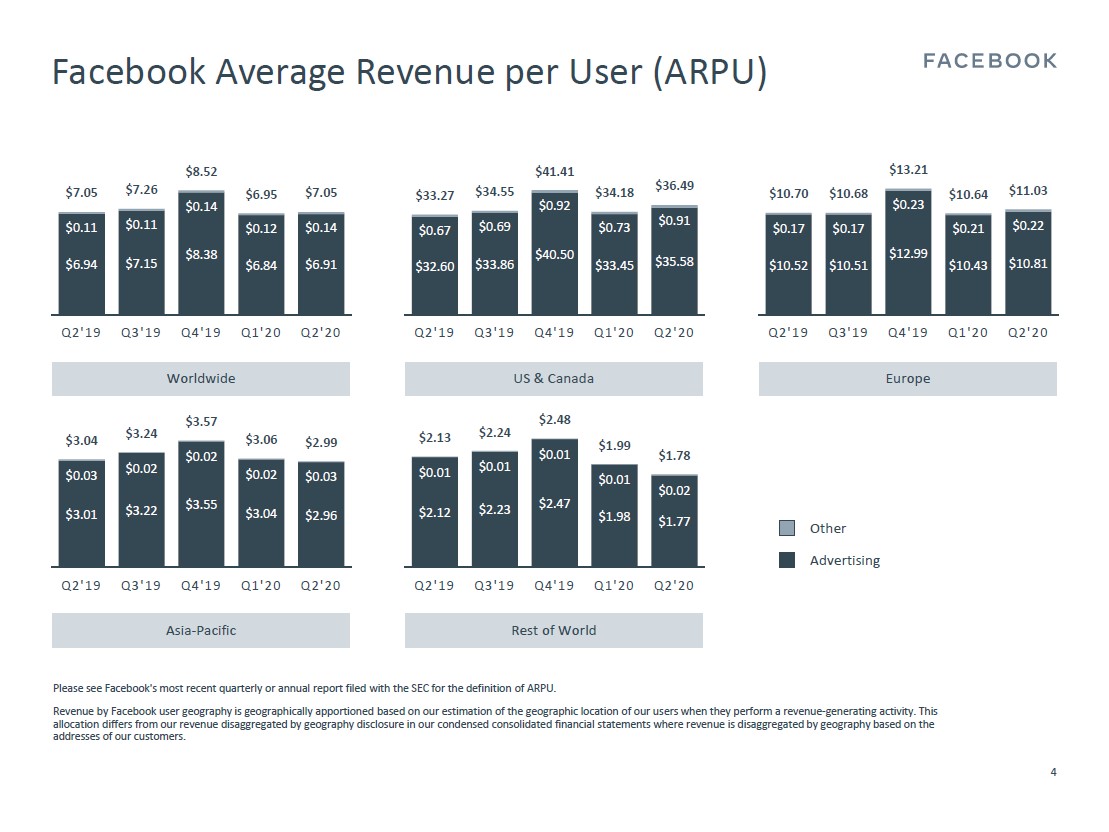

Internationally, Facebook’s growth runway is immense. A combination of active user growth and greater average revenue per user (‘ARPU’) should provide a nice tailwind to Facebook’s financial performance going forward. The company’s ‘Worldwide’ ARPU rose from $6.95 in the first quarter of 2020 to $9.27 in the first quarter of 2021 with strong growth reported across all geographical segments (up 46% in Europe, 29% in the Asia-Pacific region, and 33% in the ‘Rest of World’ region on a year-over-year basis). Its business in the US and Canada continues to outperform, with ARPU hitting $48.03 last quarter in this region, up 41% from year-ago levels.

Image Shown: Facebook’s ARPU continues to move in the right direction on a worldwide basis, providing the company with another avenue to aggressively boost its profitability levels and ultimately free cash flows going forward. Image Source: Facebook – First Quarter of 2021 IR Earnings Presentation

Facebook generated $8.0 billion in free cash flow last quarter, up from $7.4 billion in the same period last year, while spending $3.9 billion buying back its Class A common stock. We view share buybacks as a great use of capital given shares of FB are trading well below their intrinsic value. Facebook exited March 2021 with no debt on the books and $64.2 billion in cash, cash equivalents, and marketable securities on hand. Please note Facebook also had $6.3 billion in non-current equity investments on the books at the end of this period, though this figure includes strategic assets. Beyond having tremendous free cash flow generating abilities, Facebook has a fortress-like balance sheet and its growth runway is stellar, underpinning why we are big fans of the company.

Concluding Thoughts

We continue to like Facebook as a top-weighted idea in our Best Ideas Newsletter portfolio. Even after recent increases in its stock price, shares of FB still have a lot of room to run higher, in our view. It appears that investors are warming up to Facebook’s stellar capital appreciation potential, seen through its appreciating stock price of late, though concerns remain about a forced breakup of Facebook. Though we do not view that situation as likely, should US regulators force Facebook to split into separate companies, we view that as a move that would counterintuitively drive shares of FB closer to their intrinsic value (again, our fair value estimate sits at $413 per share) as investors evaluate the firm on a sum-of-the-parts basis. Facebook’s outlook remains bright.

Interested members are encouraged to check out our latest article on Alphabet Inc (GOOG) (GOOGL), another top-weighted idea in our Best Ideas Newsletter portfolio, which covers its stellar first quarter 2021 earnings report (link here).

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for FB, SNAP, TWTR, PINS, SOCL, MILN, BIDU, BABA, MTCH, FNGS

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.