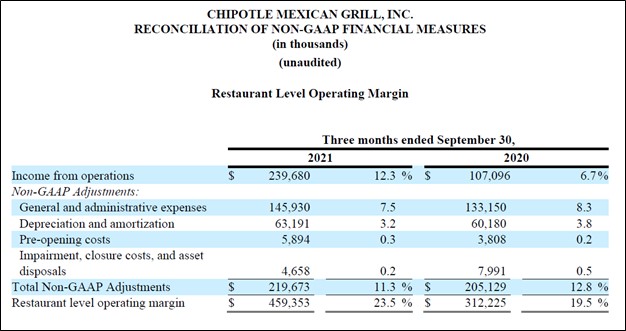

Image Shown: Chipotle Mexican Grill Inc’s restaurant level unit economics continued to improve in the third quarter of 2021, supporting the company’s growth trajectory. Image Source: Chipotle Mexican Grill Inc – Third Quarter of 2021 Non-GAAP Reconciliation Presentation

By Callum Turcan

On October 21, Chipotle Mexican Grill Inc (CMG) reported third-quarter 2021 earnings that beat both consensus top- and bottom-line estimates. Comparable restaurant sales grew 15% year-over-year last quarter as Chipotle’s e-commerce business held up well, with digital sales up 9% year-over-year (representing 43% of its total sales during this period), while customers resumed in-store dining activities in earnest. We liked what we saw in Chipotle’s latest earnings report. Shares of CMG are included as an idea in the Best Ideas Newsletter portfolio.

Earnings Update

The firm opened 41 new restaurants last quarter, including two relocations, with all but five of those locations including a “Chipotlane” according to management commentary provided during Chipotle’s latest earnings call. Chipotlanes are simply drive-through options.

In the past, Chipotle has not focused on offering drive-through fulfillment services though going forward, that is now a key priority for management. During the company’s latest earnings call, management noted the goal was for Chipotle to add around 200 new restaurants to its operations this year with 75% of those including a Chipotlane drive-through option (up from 70% previously).

Management noted that “as of September 30th, we had a total of 284 Chipotlane[s], including 12 conversions and 8 relocations” during Chipotle’s latest earnings call. For reference, Chipotle had roughly 2,890 operating restaurant locations at the end of September 2021.

What makes these Chipotlane options important is that they support the margins of Chipotle’s business. During the firm’s latest earnings call, management cited the smaller store format requirements of restaurants with Chipotlanes, the stronger sales performance the company is witnessing at restaurant locations with Chipotlanes that recently opened versus those that don’t (something management has also commented on in the past), and how restaurant locations with Chipotlanes skew towards its digital order-ahead transactions that are higher margin. All of these factors play a big role in underpinning the economics of building new restaurants with Chipotlanes.

Strong comparable store sales growth, aided by the enduring strength of its digital business and its more recent push to grow its drive-through options, enabled Chipotle to grow its GAAP revenues by 22% year-over-year in the third quarter, hitting a quarterly record of about $2.0 billion. Its relatively new quesadilla offerings, which are only available through its digital platform, have been quite popular. Chipotle’s ‘delivery service revenue’ declined modestly on a year-over-year basis in the third quarter as the firm relied on its customers showing up at physical locations to fulfill orders made digitally in the wake of delivery driver shortages. Its GAAP operating income more than doubled year-over-year last quarter, as Chipotle emerged from the worst of the coronavirus (‘COVID-19’) pandemic on a powerful upswing.

Chipotle was able to effectively implement menu pricing increases to preserve its financial strength in the wake of major inflationary pressures and recent wage increases. To keep its restaurants properly staffed as best it can in the wake of the ongoing labor shortage, Chipotle recently increased the wages of its restaurant workers to remain competitive on this front. Additionally, food expenses are on the rise as commodities pricing continues to surge higher, while rising fuel expenses combined with the labor shortage is making delivery services more expensive.

Its restaurant level operating margin improved ~400 basis points year-over-year in the third quarter, reaching 23.5%. This was made possible in part by recent menu pricing increases, efficiencies generated via its digital business and Chipotlanes, and economies of scale as customer demand for its offerings remained robust. Management is contemplating future menu pricing increases should inflationary headwinds persist.

Digital Optimization

To meet robust demand for its offerings, Chipotle has rerouted some digital orders to different stores nearby to ensure that it can optimize its available labor supply. Management recently noted that “we continue to retain about 80% of digital sales, but have now recovered nearly 80% of in-restaurant sales” which is encouraging the firm “to allocate labor as needed among the different roles, including the DML and the front line, depending on available staff to accommodate the needs of our customers and our restaurant teams. This flexibility has allowed us to keep our frontline open given our ability to divert orders on the digital lines as needed to overcome periodic staffing challenges.” We appreciate the company’s ability to quickly adapt.

Chipotle’s loyalty program now has more than 24.5 million members according to recent management commentary. The company seeks to utilize its loyalty program and digital platform to build up a frequent customer base to generate “sticker” revenues. Chipotle is investing in its data analytics capabilities to make the most of these programs and to improve its economics.

Immense Growth Runway

During the first nine months of 2021, Chipotle generated over $0.5 billion in free cash flow while spending $0.3 billion buying back its stock during this period. The company exited September 2021 with $1.2 billion in cash, cash equivalents, short-term investments, and long-term investments on hand (exclusive of restricted cash) with no debt on the books, though it does have sizable operating lease liabilities to be aware of. We are big fans of Chipotle’s impressive financial performance and pristine balance sheet.

Over the long haul, Chipotle sees room to have ~6,000 restaurant locations operating in North America (more than double current levels) with average trailing twelve month revenue sales north of $3 million. Last quarter, its average trailing twelve month restaurant sales (excluding delivery sales) stood at just under $2.6 million. Growing this metric is expected to provide a powerful tailwind to Chipotle’s restaurant level operating margin. The goal is to generate “improving returns on invested capital” while growing its unit store count according to recent management commentary.

Higher beef and freight expenses along with rising labor costs are expected to pose headwinds for Chipotle’s restaurant level operating margins in the near term. Additionally, Chipotle’s unit count growth ambitions have run into hurdles stemming from “construction inflationary pressures, subcontractor, labor shortages, critical equipment shortages, and landlord delivery delays” though the firm’s “development team is doing an excellent job opening these new restaurants.” Chipotle should be able to utilize its strong financial position to power through these headwinds.

We want to stress that Chipotle’s growth runway is enormous. The company is slowly expanding into Canada, and it opened one new restaurant in the country last quarter, with plans for additional store openings in the fourth quarter (including its first Chipotlane in the country). Chipotle has had plenty of success on this front, and management is also contemplating expanding Chipotle into Western Europe. Expanding into a new continent, particularly one with disposable incomes that are similar to those in the US and Canada, would go a long way in extending Chipotle’s growth runway.

In the near term, management is guiding for Chipotle to post comparable restaurant sales “in the low to mid double-digits” during the current quarter “which is encouraging considering there will be about 200 basis points less in pricing contribution during Q4 versus Q3 as we [pass] some of our delivery menu price increases.” Chipotle has had a lot of success launching limited time menu items, such as its smoked brisket offerings, to drum up excitement in its products without adding too much to its menu complexity. Having a large and complicated menu slows everything down, a situation that many of its peers have had to contend with in the past.

Concluding Thoughts

Chipotle is doing a stellar job navigating the current environment and its growth trajectory remains intact in the face of major exogenous shocks including labor shortages, inflationary headwinds, the COVID-19 pandemic, and other pressures. While Chipotle is investing heavily in its business, it remains a stellar generator of free cash flow, and its pristine balance sheet offers the firm ample financial firepower. The company’s push to add drive-through options to its business and ongoing improvements at its digital platform should act as powerful tailwinds for Chipotle’s performance going forward. We continue to like shares of CMG as an idea in the Best Ideas Newsletter portfolio.

Downloads

Chipotle’s 16-page Stock Report (pdf) >>

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, DNKN, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL

Tickerized for CMG, YUM, YUMC, QSR, MCD, WEN, DASH, WTRH, GRUB, APRN, TKAYF, HLFFF, NDLS, EATZ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Long put options on the SPDR S&P 500 ETF Trust (SPY) with an expiration date of December 31, 2021, and strike price of $412 are included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.