Image Shown: Alphabet Inc Class C shares, a top-weighted idea in our Best Ideas Newsletter portfolio, are up ~65% over the past year.

By Callum Turcan

Alphabet Inc (GOOG) (GOOGL) has historically focused primarily on growing its digital advertising revenues since the company was founded under the Google name back in 1998. More recently, the technology giant has begun seriously seeking to broaden its revenue base, and we like what we see on this front. We include Alphabet Class C shares (ticker: GOOG) as an idea in the Best Ideas Newsletter portfolio given its immense capital appreciation upside potential as a net cash-rich, free cash flow generating powerhouse (topics that we have covered often in the past). Our fair value estimate sits at $3,504 per share of Alphabet Class C shares while the high end of our fair value estimate range stands at $4,205 per share of GOOG.

Google Cloud Upside

The company’s Google Cloud segment has been a bright spot as it concerns Alphabet’s diversification efforts. Here is how Alphabet describes its Google Cloud unit within its 2020 Annual Report:

Google Cloud

Google was a company built in the cloud. We continue to invest in infrastructure, security, data management, analytics and AI. We see significant opportunity in helping businesses utilize these strengths with features like data migration, modern development environments and machine learning tools to provide enterprise-ready cloud services, including Google Cloud Platform and Google Workspace (formerly known as G Suite).

Google Cloud Platform enables developers to build, test, and deploy applications on its highly scalable and reliable infrastructure. Our Google Workspace collaboration tools — which include apps like Gmail, Docs, Drive, Calendar, Meet and more — are designed with real-time collaboration and machine intelligence to help people work smarter. Because more and more of today’s great digital experiences are being built in the cloud, our Google Cloud products help businesses of all sizes take advantage of the latest technology advances to operate more efficiently.

Google Cloud generates revenues primarily from fees received for Google Cloud Platform services and Google Workspace collaboration tools.

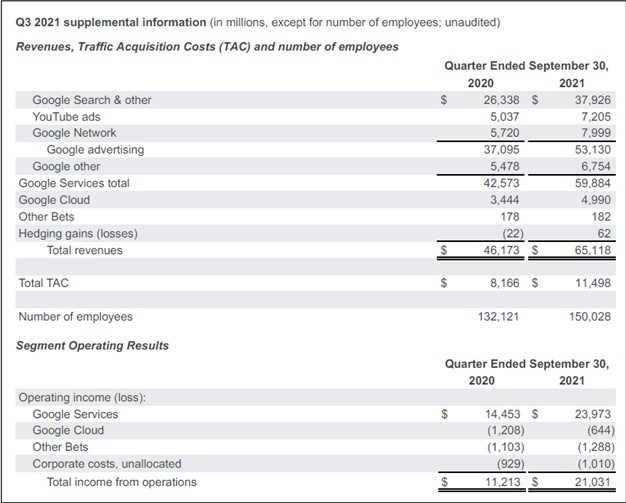

In the third quarter of 2021, Alphabet’s Google Cloud unit generated $5.0 billion in sales, which increased 45% year-over-year, indicating this segment is gaining some real traction. Furthermore, Google Cloud’s operating loss declined materially in the third quarter of 2021, coming in at $0.6 billion (down 47% year-over-year). Google Cloud has a diverse customer base ranging from fintech firms to consumer staples giants to logistical services providers to e-commerce companies to healthcare giants and much more. We appreciate the operating leverage of Google Cloud as the segment is getting closer to breaking even and eventually generating positive operating income for Alphabet.

During Alphabet’s third-quarter 2021 earnings call, management stressed that revenue growth at Google Cloud would be the main priority for the foreseeable future. Additionally, the company noted that growth at its Google Cloud Platform had exceeded the total growth rate of its Google Cloud segment in the third quarter. A large percentage of its revenue growth on this front is coming from its cloud computing operations (as compared to sales relating to its Google Workspace collaboration tools).

Recent management commentary indicates that Alphabet is willing to continue cranking up investments at its Google Cloud unit going forward as compared to moderating the segment’s operating expense growth (to better allow the unit to eventually generate positive operating income). Put another way, Alphabet is sacrificing near-term profitability for a stronger growth trajectory. Given that Alphabet’s bread-and-butter, digital advertising, continues to perform exceptionally well, the company has the financial firepower to make these kinds of investments. Alphabet’s management team noted that headcount growth at Google Cloud was expected to be “robust” during the final quarter of 2021 during Alphabet’s third quarter of 2021 earnings call.

Image Shown: Alphabet’s Google Cloud business posted solid revenue growth while reducing its operating loss in the third quarter of 2021 on a year-over-year basis. Image Source: Alphabet – Third Quarter of 2021 Earnings Press Release

Cloud Region Expansion Plans

On December 1, Alphabet provided an important update on its Google Cloud unit. The segment recently opened its first cloud region in Chile in the country’s capital city of Santiago (which is a major business hub in South America). For reference, these cloud regions represent areas where Google Cloud has a meaningful physical presence in terms of data center operations, though some of these regions have more computing power and the ability to offer a greater array of services than others.

Alphabet noted its operations in Santiago would better enable Google Cloud to meet the needs of its financial services (such as Caja Los Andes), healthcare (such as Red Salud), and airline (such a LATAM Airlines Group SA [LTMAQ]) customers in the region. Its cloud region in Chile marks Google Cloud’s second in South America after it brought its first online in Brazil’s city of Sao Paulo in 2017 (another major business hub in South America). As of early December 2021, Alphabet had 29 cloud regions up and running, with plans to continue expanding its reach on this front going forward.

Looking ahead, Alphabet intends to add cloud regions supporting its Google Cloud unit in the US cities of Columbus, Ohio, and Dallas, Texas, along with various international locations such as Madrid (Spain), Tel Aviv (Israel), Dammam (Saudi Arabia), Doha (Qatar), Paris (France), Berlin (Germany), Milan (Italy) and Turin (Italy). During Alphabet’s third-quarter 2021 earnings call, management noted that the firm intended to make sizable capital investments at its Google Cloud unit. Developing new cloud regions represents a large chunk of its planned capital expenditures towards this segment. Furthermore, please note that many of these planned cloud regions are in countries where Google Cloud does not currently have a cloud region (particularly in parts of Europe and the Middle East).

Google Cloud currently has operational cloud regions in the US, Canada, the UK, Finland, Belgium, Germany, the Netherland, Poland, Japan, Singapore, Australia, South Korea, India, Indonesia, Chile, and Brazil, according to its website. Adding cloud regions in France, Italy, Spain, Israel, Qatar, and Saudi Arabia to Google Cloud’s global footprint would likely create big growth opportunities for this segment given that Google Cloud does not yet have cloud regions in these countries, according to its website.

Concluding Thoughts

We are very bullish on the view that Alphabet’s Google Cloud unit will continue to grow at a robust pace going forward and should eventually become a major source of operating income. Alphabet is one of our favorite companies out there, and its capital appreciation upside potential remains immense, in our view. We are big fans of Alphabet’s push deeper into the cloud computing space, and we are keeping a close eye on its efforts on this front. The company’s incredibly lucrative digital advertising business is still growing at a decent clip, though we appreciate that Alphabet is now placing a greater emphasis on building up new revenue streams and creating multiple sources of long-term upside. The company remains a top weighting in the simulated Best Ideas Newsletter portfolio.

Downloads

Alphabet’s 16-Page Stock Report (pdf) >>

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.