Image Shown: Best idea Alphabet Inc continued to grow its revenues by a nice double-digit clip last quarter. Image Source: Alphabet Inc – First Quarter of 2022 Earnings Press Release

By Callum Turcan

On April 26, Alphabet Inc (GOOG) (GOOGL) reported first quarter 2022 earnings that missed top-line estimates but beat bottom-line estimates. The company remains a free cash flow powerhouse with a fortress-like balance sheet and an incredibly promising growth outlook. Its core digital advertising business, its high-growth Google Cloud unit, and its longer term bets such as the self-driving company Waymo underpin our expectations that Alphabet will continue to grow its revenues at a nice premium to global GDP growth over the decades to come. We include shares of Alphabet Class A (ticker: GOOG) in the Best Ideas Newsletter portfolio and remain big fans of the name.

Earnings Update

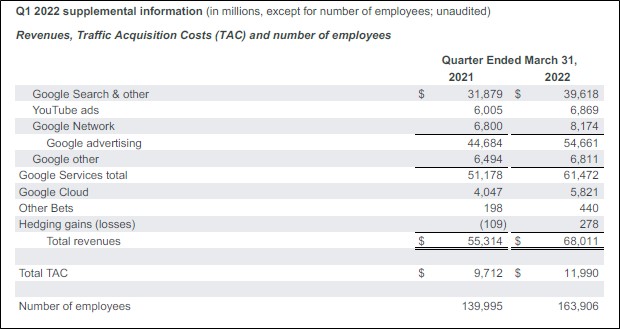

Sales at its Google advertising segment (includes Google Search & other, YouTube, and Google Network revenues) rose 23% year-over-year and sales at its Google Cloud segment rose 44% year-over-year last quarter. Revenue from its other segments including Google other (includes YouTube Premium and YouTube TV subscriptions) and Other Bets (investments in emerging technologies that may not generate sizable sales for some time, such as Waymo) also climbed higher last quarter. Alphabet’s GAAP revenues rose 23% year-over-year in the first quarter as its core digital advertising business is performing well while its Google Cloud business, one of its major longer term growth drivers, is growing at a robust pace.

In March 2022, Google suspended advertising activities in Russia in the wake of the Russian invasion of Ukraine. During Alphabet’s latest earnings call, management noted that the firm’s “second quarter results will continue to reflect that we suspended the vast majority of our commercial activities in Russia” and we appreciate Alphabet stepping up on this front.

Alphabet’s total headcount grew 17% year-over-year in the first quarter of 2022 as it continues to invest heavily in the business. Significant growth in its operating expenses (R&D, sales and marketing, and G&A) were largely offset by revenue growth as Alphabet’s GAAP operating income rose by 22% year-over-year last quarter, with its GAAP operating margin standing just above 29.5% (down by ~15 basis points year-over-year).

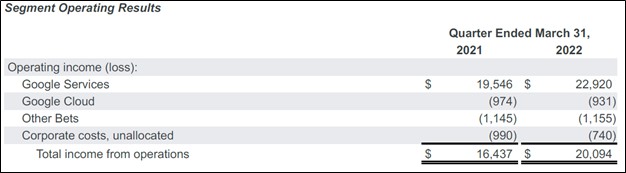

Its operating income is entirely derived from its Google Services segment which includes its digital advertising operations and revenues from its YouTube subscriptions. On a segment-level basis, Alphabet generated $22.9 billion in positive operating income from its Google Services segment last quarter, up 17% year-over-year.

The operating loss at its Google Cloud segment shrank modestly year-over-year in the first quarter, though the goal in this area is to build up a sizable revenue base first before Alphabet tries to make the segment profitable. Alphabet is spending heavily on bulking up its Google Cloud workforce and data center operations to become a serious competitor in the space. The operating loss of its Other Bets segment grew marginally, and its unallocated corporate-level costs declined materially last quarter on a year-over-year basis.

Image Shown: Alphabet’s core business is much profitable than it first appears as the firm is utilizing those profits to fund investments in its longer term growth drivers, particularly at its Google Cloud and various Other Bets operations. Image Source: Alphabet – First Quarter of 2022 Earnings Press Release

During Alphabet’s latest earnings call, management had this to say on its Google Cloud growth ambitions:

“Turning to Google Cloud. Cloud’s performance in the first quarter reflects growing deal volume and strength across multiple industries and regions. Customers are increasingly choosing Google Cloud to help them digitally transform their businesses using our global infrastructure offerings, our data analytics and AI capabilities and the collaboration benefits of Workspace. We continue to invest aggressively in Cloud given the sizable market opportunity we see.” — Ruth Porat, CFO of Alphabet

Alphabet’s GAAP net income and diluted EPS declined last quarter on a year-over-year basis due to its ‘other income (expense), net’ line-item flipping from a sizable gain to a moderate loss. The company’s underlying business is doing well, and we want to stress that Alphabet’s core digital advertising operations are much more profitable than a first glance would suggest given that these operations are effectively funding its longer term bets.

Rock-Solid Financials Underpin Massive Share Buyback Plans

The company generated $15.3 billion in free cash flow in the first quarter, up from $13.3 billion in the same period the prior year. Growth in Alphabet’s net operating cash flows offset a significant rise in its capital expenditures to fund its data center, corporate office, and other developments.

Management noted during Alphabet’s latest earnings call that it was forecasting “a meaningful increase” in its capital expenditures this year versus 2021 levels. Developments concerning office facilities in New York, London, and Poland are one reason why Alphabet’s capital expenditures are going up this year according to recent management commentary. Additionally, “the increase will be particularly reflected in investments in technical infrastructure globally with servers as the largest component,” and we view these investments as the best way to support its Google Cloud growth runway.

Last quarter, Alphabet repurchased $13.3 billion of its stock through its share buyback program. These repurchases should continue in earnest going forward as the firm approved an additional $70.0 billion in share buyback authority in April 2022 (covering both Class A and Class C common stock). At the end of March 2022, Alphabet had $119.2 billion in net cash on hand with no short-term debt on the books, and please note that does not include $30.5 billion in noncurrent marketable securities on the books at the end of this period.

We are huge fans of Alphabet’s fortress-like balance sheet and stellar free cash flow generating abilities, and view its share repurchases quite favorably. Our fair value estimate for Alphabet Class A (ticker: GOOG) common stock is ~$3,370 per share, well above where GOOG is trading at as of this writing. For that reason, we view its share repurchases as a solid use of shareholder capital.

Image Shown: Alphabet’s fortress-like balance sheet provides it with the financial firepower to continue repurchasing “gobs” of its stock going forward. Image Source: Alphabet – First Quarter of 2022 Earnings Press Release

Concluding Thoughts

Shares of Alphabet sold off modestly on April 27 in the wake of its latest earnings report as the company’s growth trajectory is slowing down a bit from the breakneck pace seen in 2020 and 2021, a period that was augmented by stay-at-home behavior from the coronavirus (‘COVID-19’) pandemic. This dynamic is already reflected in our enterprise cash flow model covering Alphabet, however, and the sell-off witnessed in shares of GOOG and the broader US equity market in recent months is overdone, in our view. We continue to be huge fans of Alphabet and its immense capital appreciation upside potential.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Tickerized for various social media names.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.