Image: ASML has been one of the most successful semiconductor companies thanks in part to the firm’s advanced lithography systems that continue to meet customer demands for size and cost efficiencies. Image Source: ASML

By Brian Nelson, CFA

ASML Holding N.V. (ASML) is one of the most prolific innovators in the semiconductor industry. The firm provides chipmakers with hardware, software and services to make patterns on silicon with lithography, a vital system in the chip-manufacturing process that increases chip value while lowering costs. The resolution of ASML’s lithography systems contributes to the ever-shrinking nature of transistors and microchips needed for ongoing industry innovation.

Smaller and smaller chips save on energy, cost and time, and the wavelength of the light used by ASML’s lithography systems can print smaller and smaller features to accommodate required shrink. ASML views its “job” as helping the industry continue Moore’s Law, which states “that computing would dramatically increase in power, and decrease in relative cost, at an exponential pace. In other words, the number of transistors…on an integrated circuit will double every two to three years at the same cost (Form 10-K).”

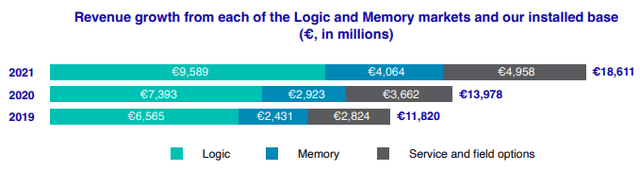

Image: A breakdown of key revenue generators for ASML. Image Source: ASML

ASML’s “goal has always been to reduce the critical dimension, the smallest structure that a lithography system can print.” The firm is in the sweet spot of the industry, in our view, because “by reducing the wavelength and increasing numerical aperture, (its) systems can print IC structures in increasingly small feature sizes.” If “its customers can print smaller structures, the chips can be smaller and the costs per transistor become cheaper, which in turns makes it more profitable for (its) customers (Form-10K).” The need for smaller and smaller technology is par for the course in the semiconductor industry.

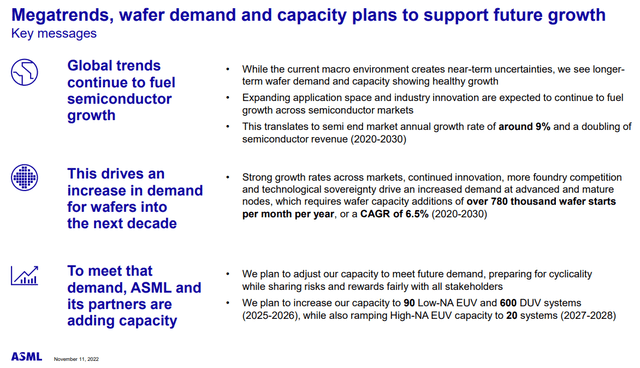

Image: It is estimated that the semiconductor market will double in the next 10 years. Image Source: ASML

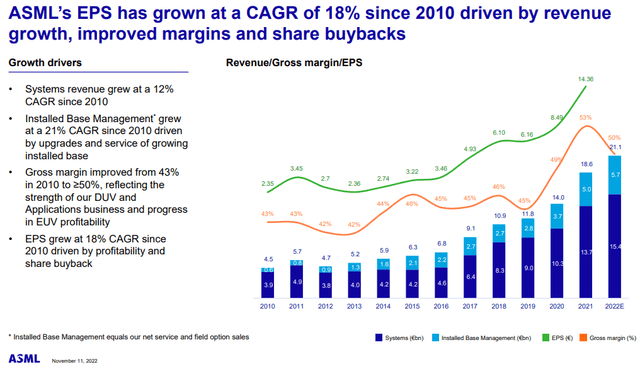

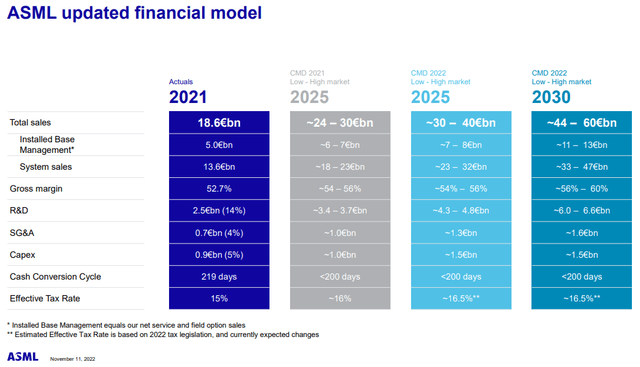

On November 11, ASML hosted its Investor Day, and the firm’s shares popped nicely during the week. ASML issued a bright outlook amid uncertainty about Sino-American relations, as well as the chip space, more generally. The key drivers of a connected world, climate change and resource scarcity, as well as social and economic shifts remain intact, and management noted that its “innovation pipeline is filled to the brim.”

The transition from fossil fuel to green energy and electric in mobility will be a huge driver for lithography systems and more wafers, in general, given the increased content in green energy generators and electric vehicles relative to fossil fuels. Right now, the semiconductor market is estimated at $600 billion per annum, but management reiterated the analyst view that it could reach as much as $1.1-$1.3 trillion by 2030, a huge growth runway for ASML. We’re excited about new technologies the industry may bring over this period.

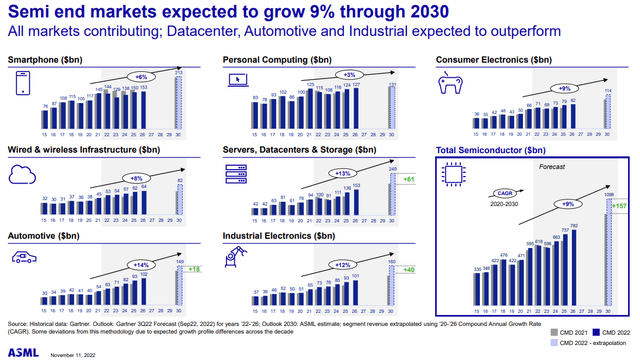

Image: Strong growth across semiconductor end markets will drive wafer demand across the segments, helping to support lithography spend on future nodes. Image Source: ASML

Looking ahead, ASML is expecting substantial opportunities as lithography intensity increases on future nodes, and in particular, the firm offered specific targets for 2025 and 2030. By 2025, ASML expects annual revenue between €30 billion and €40 billion with its gross margin coming in at 54%-56%. By 2030, management expects annual revenue between €44 billion and €60 billion with gross margin between 56%-60%. The company also expects to return a significant amount of capital to shareholders during this time in the form of dividends and repurchases via a new €12.0 billion buyback program that runs through the end of 2025.

Concluding Thoughts

Image: Though the range of outcomes for expected revenue growth in the coming decade is rather large, we love the trajectory. Image Source: ASML

We think ASML Holding is in a sweet spot in the semiconductor space as its lithography systems position the industry well along the path of Moore’s Law. Strong past investments have given it a leadership position, and we expect ASML to capture a significant amount of its addressable market from smartphones to personal computing and beyond, all the while it pays a dividend and buys back stock along the way.

A continued focus on research & development and capital spending, while maintaining a strong and flexible balance sheet should be expected. The firm’s recent Investor Day was a positive catalyst for shares and eased the worst of the concerns regarding the intermediate-term impact of Sino-American tensions on the semiconductor space. We continue to like shares of ASML Holding.

Tickerized for holdings in the SMH.

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.