Member LoginDividend CushionValue Trap |

Xpel Is an Intriguing Play on the Auto Industry

publication date: Feb 21, 2021

|

author/source: Callum Turcan

Image Shown: Most of Xpel Inc’s business is built around its paint protection film products for automobiles. Image Source: Xpel Inc - November 2020 IR Presentation Executive Summary: Xpel has a pristine balance sheet (nice net cash position), strong cash flow profile, ample growth opportunities, and a plan to boost its margins. The company primarily sells paint protection film products for automobiles, and its outlook appears quite promising as the firm is moving into adjacent areas while putting up rock-solid performance of late. We are highlighting Xpel given its potential for additional capital appreciation upside, though we caution shares of XPEL are up almost four-fold over the past year as of the middle of February 2021. By Callum Turcan Xpel Inc (XPEL) is an intriguing company with a promising growth outlook and stellar financial position. Ongoing efforts to diversify its revenue streams, expand its global sales footprint, and grow its high-margin services business underpins Xpel’s promising outlook. Historically speaking, around three-fifths of Xpel’s annual sales have come from North America, specifically Canada and the US. We caution that in the near term, the global shortage of semiconductor components and ongoing headwinds from the coronavirus (‘COVID-19’) pandemic represent potential downside risks. In our view, Xpel has the financial capacity to weather the storm given its net cash position and stellar free cash flow generating abilities. Overview The company’s biggest source of revenue comes from sales of its paint protection film products, which historically have represented about three-quarters of its annual sales. Sales of window film products have historically presented less than one-tenth of its annual revenues, though sales at this segment has been growing at a brisk pace of late. Xpel also has a services business that has been growing rapidly of late, indicating that its window film products and services revenues are on a trajectory to become a much larger part of its business in the coming years. The company’s service revenues are generated from various activities including software-related sales, installation services and training services for its customers. Management has noted in the past the firm was looking at acquiring installation facilities in key geographies to support its services business. Long Growth Runway Given the fragmented nature of the market, management sees room for consolidation in the industry. In January 2021, Xpel announced it had acquired Veloce Innovation, which the press release noted was “a leading provider of architectural films for use in residential, commercial, marine and industrial settings.” The deal closed on December 31, 2020 and terms of the deal were not disclosed. Moving into adjacent markets should significant extend Xpel’s growth runway, while economies of scale and other synergies from its M&A activity will help improve its cost structure around the margins. Xpel aims to bulk up its sales presence in “under-penetrated geographies” while also seeking to establish strategic partnerships to further grow its global reach. In our view, there is a long growth runway, particularly in Europe given the size of the continent’s auto market. Xpel generated 75% year-over-year sales growth at its ‘Continental Europe’ geographical segment during the first nine months of 2020, though this segment represented just ~8% of Xpel’s total revenues during this period. Furthermore, its business in China is rebounding. We stress, however, that Xpel’s revenues from China dipped materially in 2019 versus 2018 levels, though the rebound in its performance has been impressive during the first nine months of 2020 as one can see in the upcoming graphic down below.

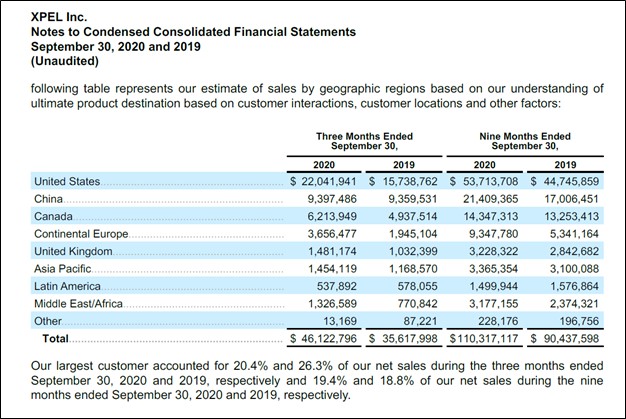

Image Shown: Xpel put up strong financial and operational performance across the board, geographically speaking, during the first nine months of 2020. Image Source: Xpel – 10-Q SEC filing covering the third quarter of 2020 Canada, China, Europe, and the US represent Xpel’s main geographical markets in terms of needle-moving growth opportunities in the medium-term. Longer term, there is ample room for Xpel to significantly grow its presence in Latin America, the Asia Pacific region, the Middle East, and Africa.

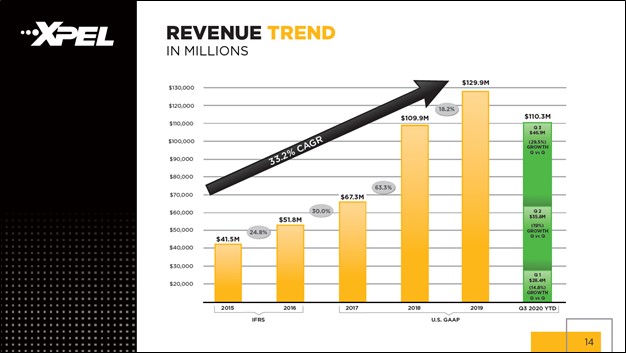

Image Shown: Xpel has significant global reach and intends to bulk up its sales force in regions with promising growth outlooks that the firm has a relatively small presence in. Image Source: Xpel - November 2020 IR Presentation Resilient Financial Performance During the first nine months of 2020, Xpel’s GAAP revenues grew by 22% year-over-year aided by a strong showing during the third quarter (when its GAAP revenues were up over 29% year-over-year). We're impressed with the resilience of Xpel’s business model. In the third quarter of 2020, Xpel noted that “Canada returned to solid growth” as the country loosened quarantine measures while Xpel also noted it reported record quarterly revenues in the US according to management commentary given during the related earnings call. Strength at its core geographical markets in North America and impressive growth in Europe and China played a big role in supporting Xpel’s financial performance during the COVID-19 pandemic. Xpel’s revenues have been moving in the right direction over the past several years, as one can see in the upcoming graphic down below--and that momentum continued during the first nine months of 2020. The company’s ability to grow its business in the face of serious exogenous headwinds such as those created by the COVID-19 pandemic and rising US-China geopolitical tensions highlights why we view Xpel’s business model as incredibly resilient.

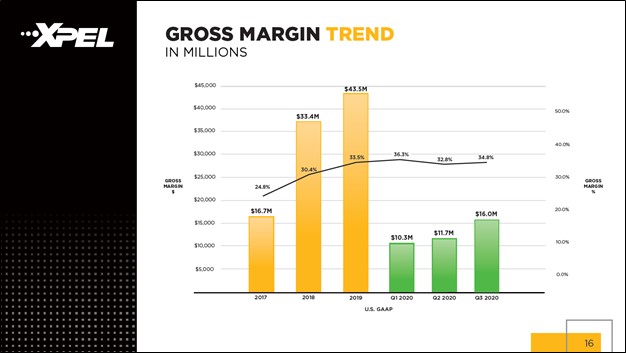

Image Shown: Xpel’s revenues have significantly grown over the past few years and the firm is on track to post annual revenue growth in 2020, based on its reported performance during the first three quarters of 2020. Image Source: Xpel – November 2020 IR Presentation Xpel’s gross margins have moved in the right direction over the past few years aided by economies of scale and its growing services business. During the first nine months of 2020, Xpel’s service business generated gross margins north of 71.6% while its product business generated gross margins just under 28.2% during this period. Sales growth (if realized) at its services business will provide an immensely powerful tailwind to its future financial performance over the coming years. We are impressed that Xpel’s GAAP gross margins continued to expand year-over-year during the first three quarters of 2020 (up almost 20 basis points). Furthermore, Xpel’s GAAP operating margins rose ~115 basis points during this period on a year-over-year basis due to a combination of gross margin expansion and economies of scale. Looking ahead, management noted during Xpel’s third-quarter 2020 earnings call that “(it) expect(s) to see gross margins in the 33% to 35% range in the near term, depending on the mix.” Management also noted that “(it) should begin to see some enhancement outside of this range as (it) move(s) through 2021 (and) execute(s) on...planned initiatives around gross margin” during the earnings call. The potential for further gross margin expansion supports the outlook for Xpel’s future operating margins and ultimately cash flow generating abilities. Xpel did not provide revenue guidance for the fourth quarter of 2020 when it reported its third quarter earnings.

Image Shown: Xpel’s gross margins have been moving in the right direction over the past few years and continued to expand on a year-over-year basis during the first nine months of 2020. This performance is particularly impressive when considering Xpel’s rising revenues during this period. Image Source: Xpel – November 2020 IR Presentation Xpel intends to moderately increase its inventory levels over the coming quarters “which will allow (it) to maximize certain cost efficiencies and sufficiently meet anticipated rising demand” according to recent management commentary. At the end of September 2020, Xpel had over $27 million in cash and cash equivalents on hand versus $7 million in total debt (inclusive of short-term debt), along with $19 million in inventory. We appreciate Xpel’s $20 million net cash position at the end of this period. Please note Xpel also had $5 million in total lease liabilities (short- and long-term combined) on the books at the end of September 2020. Through the second quarter of 2021, management intends to grow Xpel’s inventories by “by $5 million to $6 million” according to commentary given during the firm’s third quarter of 2020 earnings call. Bulking up its inventory levels is expected to help improve Xpel’s margins going forward by reducing the company’s reliance on “expensive air shipments” which management noted the firm had to turn to last year to meet stronger-than-expected customer demand. Xpel noted increased logistics costs weighed on both its gross margins and SG&A expenses in the third quarter. Reducing its reliance on air shipments would provide a tailwind to Xpel’s financial performance going forward. We view this targeted working capital build (i.e., inventory growth) as a solid strategy given the apparent strong demand for Xpel’s products and the company’s ample liquidity. During the first nine months of 2020, Xpel generated $13 million in free cash flow (up from less than $5 million in the same period a year ago). The company does not pay out a common dividend at this time and historically has not spent a significant amount buying back its stock (though the firm did spend under $1 million during the first nine months of 2020 on a ‘purchase of minority interest’). Concluding Thoughts Xpel’s outlook is promising and its financial strength is solid. Moving into adjacent markets and expanding its sales force in key geographies will go a long way in extending the company’s growth runway. Economies of scale, growth at its services business, and upside from reduced logistical costs will provide a powerful tailwind that should enable Xpel to continue growing its free cash flows going forward. Members should keep Xpel on their radar given its potential capital appreciation upside, though we caution shares of XPEL are up significantly over the past year. Xpel is expected to report its next earnings report this upcoming March. ----- Industrial Leaders Industry - MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW Tickerized for XPEL, FSR, SOLO, WPRT, CPS, VC, BWA, LKQ, RIDE, NKLA, NIO, LI, XPEV, KNDI, CAAS, SUP, VNE, LEA, MPAA, ADNT, TEN, VWAGY, NSANY, GT, CTB Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT) and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment