Member LoginDividend CushionValue Trap |

Wayfair’s Sales Rise as US Households Stay In

publication date: Apr 6, 2020

|

author/source: Callum Turcan

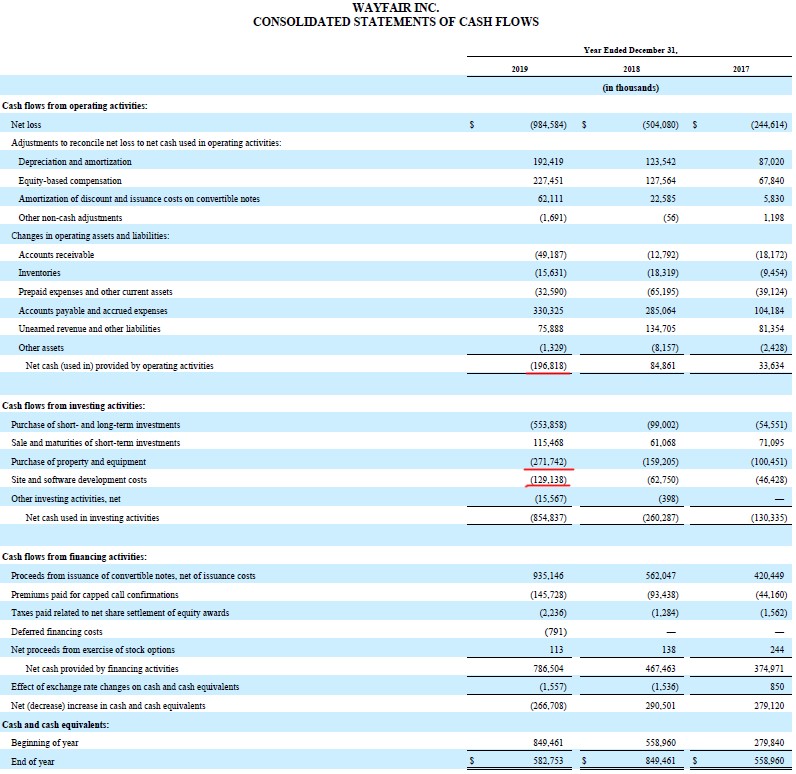

Image Shown: Shares of Wayfair Inc shot up on April 6 after publishing a very favorable business update. By Callum Turcan E-commerce firm Wayfair Inc (W) sells furniture and home décor online and operates several websites including Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold. Shares of W surged upwards on April 6 after the e-commerce company put out a very promising business update that stated Wayfair’s sales were skyrocketing upwards. Here’s a key excerpt (emphasis added): For its first quarter of 2020, Wayfair expects to meet or exceed its previously issued guidance of 15% to 17% consolidated net revenue growth year-over-year and consolidated Non-GAAP Adjusted EBITDA Margin in a negative 7.3% to 7.8% range. Wayfair continues to see strong demand across most home goods categories in both its US and International segments. After entering the month of March with gross revenue growing at slightly below 20% year-over-year, consistent with January and February growth rates, Wayfair saw this rate of growth more than double towards the end of March. This run-rate has continued into early April. Simultaneously, the company is accelerating its efforts to drive towards Non-GAAP Adjusted EBITDA profitability and materially improve its cash flow profile in 2020. Wayfair is making solid early progress against these initiatives, which are focused on driving leverage across all dimensions of its income statement including gross margin, advertising as a percent of sales, and the company’s operating expenses. When Wayfair reports first-quarter results May 5, the company intends to provide greater detail on its strong performance of late. This news ties into what we’ve been reading in other reports across the retail space as consumers and households are “cocooning” in their homes to wait out the coronavirus (‘COVID-19’) pandemic and to comply with state-issued stay-at-home orders, which in turn is bolstering e-commerce demand. Wayfair is now apparently seeing its annual sales growth rate clock in at around 40%, possibly even higher than that, due to this dynamic. Here some background information. Wayfair generated 85% of its net revenues in the US in 2019 and the firm noted in its 2019 Annual Report that the annual market for home goods in the US is worth ~$296 billion with ~14% of that sold online. Additionally, Wayfair operates in Canada and Western Europe in a bid to extend its total addressable market (‘TAM’) and ultimately growth runway. Financials At the end of 2019, Wayfair was sitting on $0.6 billion in cash and cash equivalents and $0.4 billion in short-term investments versus $1.5 billion in long-term debt. However, Wayfair was not free cash flow positive during the 2017-2019 period as the company has been aggressively investing in its business to support its growth story. Wayfair’s annual GAAP revenues almost doubled from 2017-2019, as did its GAAP gross profit, but rising operating expenses (namely surging ‘selling, operations, technology, general and administrative’ and ‘advertising’ expenses) consumed all of that incremental gross profit and then some. Wayfair’s GAAP operating loss grew almost four-gold during this period. In 2019, Wayfair posted a GAAP net operating loss of $0.9 billion and a GAAP net loss of $1.0 billion. Given its growing losses, investor confidence in the name seemed to wane during the second half of 2019, and Wayfair’s stock simply tanked through the first quarter of 2020. After publishing this very favorable business update, Wayfair seems to be winning back investor confidence given its improving growth outlook. In conjunction with Wayfair’s positive business update, the company also used this time to bolster its liquidity position by issuing convertible senior notes (from the press release): Wayfair is also taking steps to further strengthen its balance sheet and optimize its liquidity position to allow it to continue to serve customers from a position of operational and financial strength. Today [April 6, 2020], Wayfair announced a private placement of convertible senior notes (the “notes”) in an aggregate principal amount of $535 million. Great Hill Partners and Charlesbank Capital Partners, two leading investment firms, led the transaction. One of Wayfair’s largest public shareholders, The Spruce House Partnership, also participated. The notes will bear interest, to be paid in kind, at an annual rate of 2.5% and feature a $72.50 conversion price, representing a 46% premium to the average closing price of Wayfair’s Class A common stock over the last 30 days. The notes will mature in five years, unless earlier redeemed, repurchased, or converted in accordance to their terms. We can appreciate management being opportunistic during these harrowing times and having additional cash on hand will help fund the investments Wayfair needs to make, now that its revenue growth is clocking in at a very strong double-digit rate. Please note Wayfair exited 2019 with a current ratio below 1.0x, highlighting the firm’s need for more working capital. Wayfair’s CEO and co-founder, Niraj Shah, had this to say in the press release (emphasis added): “We are closely monitoring the current market as we all respond to the threat of COVID-19. Wayfair’s e-commerce model is uniquely suited to serving customers’ very real needs at this challenging time, and we are committed to doing so while taking all necessary steps and precautions to ensure the safety of our customers, employees, and communities. We are incredibly proud of our team of over 16,000 people and the way they have mobilized to both take care of our customers and to help our local communities… We are encouraged by our increasing sales momentum, yet remain highly focused on our plan to rapidly reach profitability and positive free cash flow. The additional capital we are raising, though not strictly necessary, should only enhance our ability to successfully navigate through any market backdrop.” The e-commerce company isn’t out of the woods yet. Wayfair is a long way off from posting positive free cash flow as you can see in the upcoming graphic down below. Wayfair generated negative net operating cash flow in 2019 and negative free cash flow of ~$0.6 billion.

Image Shown: Wayfair is not free cash flow positive and generated negative net operating cash flow in 2019. In the picture up above, Wayfair’s net operating cash flow and capital expenditure line-items are underlined in red. Image Source: Wayfair – 2019 Annual Report with additions from the author Concluding Thoughts While most of the US economy (and others) is shutting down to contain and ride out the pandemic, Wayfair’s business model appears more resilient than the market was previously giving it credit for. That being said, the company remains very free cash flow negative and carries a net debt position. Its recent convertible debt issuance will provide Wayfair with much needed liquidity, but it remains to be seen if the company’s success of late will translate into positive free cash flows in the medium-term. The idea is that by achieving economies of scale, Wayfair’s operating expenses as a percent of revenues will shrink materially and thus allow for positive net income and free cash flow, but in order for this to eventually become the case, Wayfair needs to better contain its expense growth. Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR PSMT Specialty Retailers Industry – AAN BBBY BBY GME HD LOW LL ODP SHW TSCO WSM Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT Related: RH, AMZN, EBAY, BABA, OSTK, SHOP, JD ---------- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Cracker Barrel Old Country Store Inc (CBRL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Dollar General Corporation (DG) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment