Image: How the VBI rating system has ranked equities so far this year.

By Brian Nelson, CFA

At Valuentum, we use the Valuentum Buying Index (VBI) to source ideas into diversified simulated newsletter portfolios, and the VBI may be most applicable to the simulated Best Ideas Newsletter portfolio, where we generally like to include ideas when they register a high VBI rating and remove them when they register a low VBI rating.

We always use the VBI in a portfolio setting and never by itself.

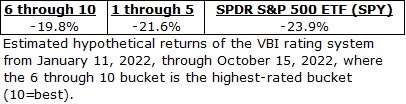

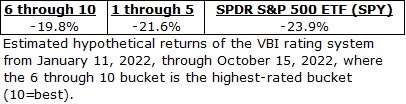

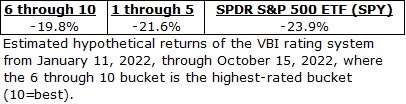

But what about the Valuentum Buying Index ratings, themselves? How did they “perform” during 2022 in one of the worst years for stock market investors in history? Well, not as spectacular as we would have liked – there was only a small separation in estimated return from the high-rated bucket (6 through 10; 10=best) from the low-rated bucket (1 through 5), as measured from the Stock Screener, released January 15, 2022, through the one released October 15, 2022.

Remember, we would never consider loading up on one or two highly-rated ideas on the VBI because there are tremendous diversification benefits of having at least 15-25 securities in a portfolio. I wrote this in April 2021, warning about the 60/40 stock/bond portfolio (yes, you guessed it -- the year before the 60/40 stock/bond portfolio’s worst yearly performance in history), but again – my warning “is not a ding against the concept of diversification.”

Here's what I wrote in Value Trap a few years ago now:

At the very least, I think the equity portion of someone’s entire portfolio should consist of no less than 15-25 securities. If you’re holding less than 15-25 securities that span sectors of the economy, I don’t think you’re adequately diversified. The work of Surz and Price, The Truth About Diversification by the Numbers, talked about how the common view that 90% of diversification is achieved with a 16-stock portfolio and 95% with a 32-stock portfolio may be somewhat imprecise, but they are still good rules of thumb. Surz and Price used r-squared and tracking error, instead of standard deviation, and still found that a 30-stock portfolio achieves approximately 86% of possible diversification.

Adding more companies than 30-60+ in the equity portion of one’s portfolio may lead to something that is commonly described as “diworsification.” For example, even a rather large investment team probably can’t know the sixty-first best idea in the portfolio as well as the very best idea, and the potential cost of allocating capital to the sixty-first best idea instead of overweighting the top ten ideas may only hurt expected return in the long run, while doing very little to improve overall diversification. An equity portfolio of 30-60+ stocks is probably heavily diversified, or at least sufficiently diversified. If you’re only holding a few stocks in an equity portfolio, however, you’re taking on a tremendous amount of risk, and that almost always doesn’t end well.

For example, we were huge fans of Meta Platforms (META) for a long time and through August of this year (ugh and ugh), and we were very excited about the company when it registered a 10 on the Valuentum Buying Index, but even with all that excitement, META never was greater than 8%-10% of the simulated Best Ideas Newsletter portfolio.

We maintain our independence as a financial information publisher – meaning we do not know what our readers are doing with their own portfolios -- but we get the sense that a lot of investors, not just Valuentum readers, were loading up on META. As you all should know, loading up on one or two stocks is not investing, in our view, but gambling.

Again, here is what we wrote in that April 2021 work:

The 60/40 stock bond portfolio may have cost investors a bundle during the past 30 years relative to active stock managers charging 2% per annum, but that doesn’t mean you shouldn’t diversify appropriately within the equity component of your asset mix.

Use common sense, and don’t get too aggressive on your favorite ideas either. We generally like to limit new ideas to 8%-10% of the newsletter portfolios at “cost” and generally don’t like them to run higher than 15% of the newsletter portfolio after appreciation.

From my perspective, only ultra-sophisticated investors should ever consider shorting, and please don’t gamble too aggressively on options. Know the unlimited loss potential of selling options contracts. Options is not a fun game to lose.

Investing is a long game--and know the difference between diversification across your favorite ideas and “diworsification” by buying overpriced assets just because they "seem" uncorrelated. Adding pipeline MLPs to your portfolio in mid-2015, for example, may have smoothed your returns the past five years, but only by hurting them.

Leave gambling on multiples such as the P/S ratio to the quants. See through the illusion of “factor” investing. Be smart, and don’t get stuck thinking “inside the box.” Markets are inefficient, unless of course, you think GameStop was appropriately priced at both $180 and $350 on the same day (March 10, 2021) on no news.

As I’ve said before, we feel terrible about Meta Platforms, but it’s one stock out of hundreds we follow, and hundreds of ideas that we’ve highlighted across the simulated newsletter portfolios and Exclusive publication. In June 27, 2021, for example, we added Exxon Mobil (XOM) and Chevron (CVX), which are up ~70% and ~49% so far this year. Collectively, the “weightings” for these two ideas were roughly in-line with Meta’s in the simulated Best Ideas Newsletter portfolio. We haven’t heard much of anything about these ideas from members.

From our note June 27, 2021: In the Dividend Growth Newsletter portfolio, we’re adding a 5-7% weight in ExxonMobil and a 3-4% weighting in Chevron). In the Best Ideas Newsletter portfolio, we’re adding a 4-6% weighting in ExxonMobil and a 3-5% weighting in Chevron. We like their respective dividend yields, and the strengthening energy markets have only made their future free cash flow prospects better.

We’ve explained why we missed big on Meta Platforms - post-mortem here, full removal here -- PayPal and AT&T this year on several occasions. Don’t get me wrong: I feel really bad about these ideas, but they are three of hundreds of ideas we’ve highlighted across our publications, and we have to continue to cover a lot of ground. It’s important readers know this year has been terrible for almost everybody, too.

In our work, we continue to try to give members context – we do not operate in a vacuum; our ideas are impacted by market conditions. In 2022, for example, the 60/40 stock/bond portfolio is down over 30% on an annualized basis, according to Bank of America, the ARKK Innovation ETF (ARKK) is down over 60% this year, Bitcoin is down nearly 60% year-to-date, and dozens of stocks are down huge.

2022 has been a terrible year for almost all asset classes, but there are going to be years like this. I get the sense that some readers may think we don’t have skin in the game, but I can assure you, we definitely do. With all of these areas of the market facing considerable pressure this year, it doesn’t matter how well our ideas do across the newsletter portfolios. Many have lost interest in investing and are walking away; our work doesn’t stop during bear markets, however.

With that said, we continue to use the Valuentum Buying Index as a source of ideas for the simulated Best Ideas Newsletter portfolio. The rating system hasn’t done as well as we would have liked this year, but it still carved out a modest separation between high-rated VBI stocks (6 through 10) and low-rated VBI stocks (1 through 5), based on our estimates. On deck is a breakdown of how the VBI ratings have performed during 2021. Please stay tuned!

P.S.: We’re very sorry about META -- CEO Mark Zuckerburg has really destroyed everything we liked about the company when it registered a 10 on the VBI many moons ago! Darn META! We feel the same way.

How Some Members Use Our Services >>

Image: How the VBI rating system has ranked equities so far this year.

Valuentum has provided the following table to promote transparency within its process. Our best efforts have been made with respect to calculations and to adjust data for stock splits occuring in 2022. If you have any questions, please contact us at info@valuentum.com.

Turn mobile device horizontally to better view table.

| Company Name |

Symbol |

VBI, as of 1/11/2022 |

Price -- 1/11/2022 |

Price - 10/15/2022 |

Est. Return % |

| PPL |

PPL |

9 |

29.95 |

24.50 |

-18.20% |

| Global Payments |

GPN |

8 |

149.1 |

110.06 |

-26.18% |

| FedEx |

FDX |

8 |

255.54 |

156.96 |

-38.58% |

| Dick's Sporting |

DKS |

7 |

116.06 |

109.96 |

-5.26% |

| Dollar General |

DG |

7 |

228.65 |

236.60 |

3.48% |

| Home Depot |

HD |

7 |

386.67 |

276.43 |

-28.51% |

| Leggett & Platt |

LEG |

7 |

41.76 |

31.91 |

-23.59% |

| McDonald's |

MCD |

7 |

262.12 |

243.16 |

-7.23% |

| First Solar |

FSLR |

7 |

84.45 |

123.36 |

46.07% |

| IntercontinentalExchange |

ICE |

7 |

131.95 |

90.15 |

-31.68% |

| JD.com |

JD |

7 |

76.76 |

42.33 |

-44.85% |

| Monster Beverage |

MNST |

7 |

94.58 |

87.40 |

-7.59% |

| NASDAQ |

NDAQ |

7 |

64.19 |

54.75 |

-14.70% |

| Copart |

CPRT |

7 |

138.02 |

107.84 |

-21.87% |

| Becton, Dickinson |

BDX |

7 |

261.74 |

224.70 |

-14.15% |

| Biogen |

BIIB |

7 |

241.52 |

264.63 |

9.57% |

| Pfizer |

PFE |

7 |

56.69 |

42.86 |

-24.40% |

| Canadian National |

CNI |

7 |

122.28 |

107.03 |

-12.47% |

| General Dynamics |

GD |

7 |

211.58 |

221.17 |

4.53% |

| Union Pacific |

UNP |

7 |

246.42 |

193.79 |

-21.36% |

| BHP Billiton |

BHP |

7 |

64.49 |

48.31 |

-25.09% |

| Carlisle Companies |

CSL |

7 |

239.74 |

281.62 |

17.47% |

| Enbridge |

ENB |

7 |

41.34 |

35.98 |

-12.97% |

| Enterprise Product Partners |

EPD |

7 |

23.92 |

24.99 |

4.47% |

| Fresh Del Monte |

FDP |

7 |

28.42 |

25.10 |

-11.68% |

| Mondelez Intl |

MDLZ |

7 |

67.26 |

56.94 |

-15.34% |

| PepsiCo |

PEP |

7 |

174.09 |

170.19 |

-2.24% |

| Regency |

REG |

7 |

76.39 |

53.40 |

-30.10% |

| Simon Property |

SPG |

7 |

161.83 |

95.86 |

-40.77% |

| Analog Devices |

ADI |

7 |

173.63 |

136.73 |

-21.25% |

| Applied Materials |

AMAT |

7 |

152.45 |

74.82 |

-50.92% |

| Cisco |

CSCO |

7 |

62.37 |

40.20 |

-35.55% |

| eBay |

EBAY |

7 |

66.43 |

37.08 |

-44.18% |

| F5 Networks |

FFIV |

7 |

242.66 |

140.44 |

-42.12% |

| KLA-Tencor |

KLAC |

7 |

425.61 |

263.70 |

-38.04% |

| Lam Research |

LRCX |

7 |

673.21 |

314.95 |

-53.22% |

| Micron Technology |

MU |

7 |

94.2 |

52.72 |

-44.03% |

| QUALCOMM |

QCOM |

7 |

185.4 |

109.95 |

-40.70% |

| Taiwan Semiconductor |

TSM |

7 |

129.17 |

63.92 |

-50.51% |

| AT&T |

T |

7 |

26.34 |

14.99 |

-43.09% |

| Comcast |

CMCSA |

7 |

51.14 |

30.05 |

-41.24% |

| Verizon |

VZ |

7 |

53.59 |

36.38 |

-32.11% |

| Centerpoint |

CNP |

7 |

27.4 |

25.88 |

-5.55% |

| DTE Energy |

DTE |

7 |

118.78 |

104.50 |

-12.02% |

| Entergy |

ETR |

7 |

108.74 |

100.01 |

-8.03% |

| Exelon |

EXC |

7 |

55.62 |

36.59 |

-34.21% |

| First Energy |

FE |

7 |

41.36 |

36.17 |

-12.55% |

| National Grid |

NGG |

7 |

71.63 |

48.65 |

-32.08% |

| NextEra |

NEE |

7 |

84.79 |

71.77 |

-15.36% |

| Public Service |

PEG |

7 |

65.85 |

53.81 |

-18.28% |

| South Jersey |

SJI |

7 |

25.62 |

33.72 |

31.62% |

| Spire |

SR |

7 |

65.9 |

63.20 |

-4.10% |

| Activision |

ATVI |

6 |

65.85 |

72.13 |

9.54% |

| Best Buy |

BBY |

6 |

104.09 |

63.35 |

-39.14% |

| Domino's Pizza |

DPZ |

6 |

486.42 |

317.34 |

-34.76% |

| Ford |

F |

6 |

24.35 |

11.67 |

-52.07% |

| Lowe's |

LOW |

6 |

249.5 |

188.96 |

-24.26% |

| Nike |

NKE |

6 |

150.3 |

87.55 |

-41.75% |

| Ralph Lauren |

RL |

6 |

117.28 |

92.54 |

-21.09% |

| Ross Stores |

ROST |

6 |

106.93 |

81.45 |

-23.83% |

| Starbucks |

SBUX |

6 |

104.04 |

86.37 |

-16.98% |

| TJX Cos |

TJX |

6 |

74.21 |

63.55 |

-14.36% |

| Ulta Salon |

ULTA |

6 |

384.44 |

394.24 |

2.55% |

| VF Corp |

VFC |

6 |

71.85 |

28.95 |

-59.71% |

| Whirlpool |

WHR |

6 |

227.3 |

139.21 |

-38.75% |

| Williams-Sonoma |

WSM |

6 |

153.44 |

117.29 |

-23.56% |

| Crocs |

CROX |

6 |

126.27 |

77.51 |

-38.62% |

| DocuSign |

DOCU |

6 |

142.13 |

44.00 |

-69.04% |

| ETSY |

ETSY |

6 |

182.81 |

92.45 |

-49.43% |

| Lululemon |

LULU |

6 |

346.75 |

288.78 |

-16.72% |

| Mercadolibre |

MELI |

6 |

1166.07 |

756.88 |

-35.09% |

| Penn National |

PENN |

6 |

48.01 |

28.07 |

-41.53% |

| Zoom Video |

ZM |

6 |

175.97 |

72.29 |

-58.92% |

| Abbott |

ABT |

6 |

135.7 |

100.91 |

-25.64% |

| AbbVie |

ABBV |

6 |

136.97 |

142.94 |

4.36% |

| Boston Scientific |

BSX |

6 |

43.4 |

39.98 |

-7.88% |

| Bristol-Myers Squibb |

BMY |

6 |

65.48 |

70.62 |

7.85% |

| CVS Health |

CVS |

6 |

106.04 |

89.30 |

-15.79% |

| Gilead Sciences |

GILD |

6 |

72.37 |

66.17 |

-8.57% |

| Medtronic |

MDT |

6 |

107.89 |

81.61 |

-24.36% |

| Merck |

MRK |

6 |

81.67 |

92.18 |

12.87% |

| Mettler-Toledo |

MTD |

6 |

1571.43 |

1117.03 |

-28.92% |

| Stryker |

SYK |

6 |

268.17 |

209.13 |

-22.02% |

| UnitedHealth Group |

UNH |

6 |

469 |

513.13 |

9.41% |

| Vertex Pharma |

VRTX |

6 |

226.15 |

293.21 |

29.65% |

| Amphenol Corp |

APH |

6 |

82.61 |

67.05 |

-18.84% |

| Boeing |

BA |

6 |

216.02 |

133.15 |

-38.36% |

| CSX Corp |

CSX |

6 |

36.3 |

27.31 |

-24.77% |

| General Electric |

GE |

6 |

101.79 |

67.57 |

-33.62% |

| Northrop Grumman |

NOC |

6 |

400.6 |

464.19 |

15.87% |

| Raytheon Tech |

RTX |

6 |

90.72 |

82.59 |

-8.96% |

| Republic Services |

RSG |

6 |

132.1 |

127.45 |

-3.52% |

| Waste Management |

WM |

6 |

159.46 |

154.73 |

-2.97% |

| Albemarle |

ALB |

6 |

240.17 |

237.47 |

-1.12% |

| Alcoa |

AA |

6 |

62.2 |

38.35 |

-38.34% |

| Compass Minerals |

CMP |

6 |

53.84 |

52.10 |

-3.23% |

| Ecolab |

ECL |

6 |

226.62 |

139.53 |

-38.43% |

| Graco |

GGG |

6 |

76.23 |

60.08 |

-21.19% |

| Martin Marietta |

MLM |

6 |

419.33 |

298.83 |

-28.74% |

| Nucor |

NUE |

6 |

110.84 |

118.71 |

7.10% |

| Rio Tinto |

RIO |

6 |

74.42 |

53.71 |

-27.83% |

| Sherwin-Williams |

SHW |

6 |

324.5 |

201.70 |

-37.84% |

| Vulcan Materials |

VMC |

6 |

200.44 |

148.44 |

-25.94% |

| Wheaton Precious Metals |

WPM |

6 |

39.79 |

30.70 |

-22.84% |

| Baker Hughes |

BKR |

6 |

26.96 |

22.91 |

-15.02% |

| Chevron |

CVX |

6 |

127.97 |

160.14 |

25.14% |

| ConocoPhillips |

COP |

6 |

83.59 |

117.96 |

41.12% |

| Energy Transfer |

ET |

6 |

9.33 |

11.47 |

22.94% |

| EOG Resources |

EOG |

6 |

102.2 |

120.57 |

17.97% |

| Halliburton |

HAL |

6 |

27.24 |

29.41 |

7.97% |

| Kinder Morgan |

KMI |

6 |

17.61 |

17.19 |

-2.39% |

| Occidental Petroleum |

OXY |

6 |

34.7 |

66.68 |

92.16% |

| Phillips 66 |

PSX |

6 |

86.15 |

94.10 |

9.23% |

| Schlumberger |

SLB |

6 |

36.48 |

42.16 |

15.57% |

| Anheuser-Busch InBev |

BUD |

6 |

64.8 |

45.57 |

-29.68% |

| Costco |

COST |

6 |

522.03 |

454.65 |

-12.91% |

| Kroger |

KR |

6 |

47.71 |

43.16 |

-9.54% |

| Lancaster Colony |

LANC |

6 |

168.46 |

165.00 |

-2.05% |

| Target |

TGT |

6 |

227.55 |

145.69 |

-35.97% |

| CubeSmart |

CUBE |

6 |

52.74 |

37.24 |

-29.39% |

| Digital Realty Trust |

DLR |

6 |

159.03 |

90.84 |

-42.88% |

| Extra Space Storage |

EXR |

6 |

210.06 |

160.81 |

-23.45% |

| Federal Realty |

FRT |

6 |

134.1 |

89.17 |

-33.50% |

| Iron Mountain |

IRM |

6 |

46.38 |

44.14 |

-4.83% |

| Public Storage |

PSA |

6 |

362.85 |

281.79 |

-22.34% |

| Universal Health Realty |

UHT |

6 |

58.77 |

43.22 |

-26.46% |

| WP Carey |

WPC |

6 |

79.18 |

68.46 |

-13.54% |

| Adobe Systems |

ADBE |

6 |

529.89 |

287.94 |

-45.66% |

| Advanced Micro Devices |

AMD |

6 |

137.31 |

55.94 |

-59.26% |

| Alibaba |

BABA |

6 |

132.19 |

73.02 |

-44.76% |

| Amazon.com |

AMZN |

6 |

165.362 |

106.90 |

-35.35% |

| Apple |

AAPL |

6 |

175.08 |

138.38 |

-20.96% |

| Automatic Data Processing |

ADP |

6 |

235.28 |

225.91 |

-3.98% |

| Baidu |

BIDU |

6 |

156.7 |

100.29 |

-36.00% |

| Broadcom |

AVGO |

6 |

622.05 |

427.10 |

-31.34% |

| Facebook |

FB |

6 |

334.37 |

126.76 |

-62.09% |

| Mastercard |

MA |

6 |

366.29 |

288.69 |

-21.19% |

| Microsoft |

MSFT |

6 |

314.98 |

228.56 |

-27.44% |

| Nvidia |

NVDA |

6 |

278.17 |

112.27 |

-59.64% |

| Oracle |

ORCL |

6 |

88.48 |

64.31 |

-27.32% |

| Paychex |

PAYX |

6 |

128.77 |

109.19 |

-15.21% |

| Salesforce.com |

CRM |

6 |

234.84 |

142.22 |

-39.44% |

| Visa |

V |

6 |

214.38 |

182.62 |

-14.81% |

| Dish Network |

DISH |

6 |

35.38 |

12.96 |

-63.37% |

| Lumen Tech |

LUMN |

6 |

13.34 |

6.72 |

-49.63% |

| ViacomCBS |

VIAC |

6 |

34.96 |

18.77 |

-46.31% |

| Allete |

ALE |

6 |

66.35 |

48.94 |

-26.24% |

| Alliant Energy Corp |

LNT |

6 |

59.8 |

48.93 |

-18.18% |

| Ameren |

AEE |

6 |

86.97 |

76.25 |

-12.33% |

| CMS Energy |

CMS |

6 |

63.87 |

54.07 |

-15.34% |

| Duke Energy |

DUK |

6 |

103.23 |

86.82 |

-15.90% |

| MGE Energy |

MGEE |

6 |

78.04 |

64.07 |

-17.90% |

| Southern Co |

SO |

6 |

67.65 |

63.51 |

-6.12% |

| Xcel Energy |

XEL |

6 |

68.6 |

58.86 |

-14.20% |

| American Express |

AXP |

5 |

175.38 |

136.81 |

-21.99% |

| Bank of America |

BAC |

5 |

49.21 |

31.70 |

-35.58% |

| Bank of NY Mellon |

BK |

5 |

63.07 |

38.41 |

-39.10% |

| Citigroup |

C |

5 |

67.11 |

43.23 |

-35.58% |

| Discover Financial |

DFS |

5 |

128.58 |

91.20 |

-29.07% |

| Fifth Third |

FITB |

5 |

49.05 |

33.96 |

-30.76% |

| Goldman Sachs |

GS |

5 |

403.05 |

299.99 |

-25.57% |

| Huntington Bancshares |

HBAN |

5 |

17.01 |

13.67 |

-19.64% |

| HSBC |

HSBC |

5 |

33.73 |

25.82 |

-23.45% |

| JP Morgan |

JPM |

5 |

167.49 |

111.19 |

-33.61% |

| KeyCorp |

KEY |

5 |

26.43 |

16.48 |

-37.65% |

| Morgan Stanley |

MS |

5 |

105.92 |

75.30 |

-28.91% |

| M&T Bank |

MTB |

5 |

178.2 |

185.56 |

4.13% |

| Northern Trust |

NTRS |

5 |

131.61 |

84.06 |

-36.13% |

| PNC Financial |

PNC |

5 |

223.84 |

149.70 |

-33.12% |

| Regions Financial |

RF |

5 |

24.66 |

20.68 |

-16.14% |

| Truist Financial |

TFC |

5 |

65.66 |

43.00 |

-34.51% |

| US Bancorp |

USB |

5 |

62.12 |

42.76 |

-31.17% |

| Wells Fargo |

WFC |

5 |

56.06 |

43.17 |

-22.99% |

| AutoZone |

AZO |

5 |

2000.98 |

2255.17 |

12.70% |

| Disney |

DIS |

5 |

157.89 |

94.45 |

-40.18% |

| Boston Beer |

SAM |

5 |

504.58 |

350.68 |

-30.50% |

| Palo Alto |

PANW |

5 |

175.35 |

154.83 |

-11.70% |

| ServiceNow |

NOW |

5 |

578.44 |

341.76 |

-40.92% |

| Verisk |

VRSK |

5 |

208.68 |

166.84 |

-20.05% |

| Regeneron |

REGN |

5 |

626.09 |

736.06 |

17.56% |

| Zoetis |

ZTS |

5 |

212.8 |

145.40 |

-31.67% |

| Stanley Black & Decker |

SWK |

5 |

189.53 |

76.53 |

-59.62% |

| Berkshire Hathaway |

BRK.B |

5 |

319.8 |

272.67 |

-14.74% |

| Magellan Midstream |

MMP |

5 |

48.44 |

49.45 |

2.09% |

| Philip Morris |

PM |

5 |

100.99 |

85.26 |

-15.58% |

| Omega Healthcare |

OHI |

5 |

31.28 |

30.27 |

-3.23% |

| PayPal |

PYPL |

5 |

191.52 |

80.47 |

-57.98% |

| American Electric |

AEP |

5 |

89.77 |

83.52 |

-6.96% |

| Consolidated Edison |

ED |

5 |

83.07 |

81.91 |

-1.40% |

| Edison Intl |

EIX |

5 |

64.36 |

55.03 |

-14.50% |

| Eversource Energy |

ES |

5 |

86.63 |

72.56 |

-16.24% |

| NiSource |

NI |

5 |

27.81 |

24.49 |

-11.94% |

| Pinnacle West |

PNW |

5 |

70.29 |

61.79 |

-12.09% |

| Sempra Energy |

SRE |

5 |

135.84 |

141.50 |

4.17% |

| WEC Energy |

WEC |

5 |

95.32 |

84.30 |

-11.56% |

| CarMax |

KMX |

4 |

119.15 |

60.20 |

-49.48% |

| Cintas Corp |

CTAS |

4 |

405.1 |

381.36 |

-5.86% |

| Dollar Tree |

DLTR |

4 |

137.11 |

136.08 |

-0.75% |

| Estee Lauder |

EL |

4 |

340.57 |

209.31 |

-38.54% |

| Yum! Brands |

YUM |

4 |

130.66 |

106.77 |

-18.28% |

| Proto Labs |

PRLB |

4 |

53.37 |

35.63 |

-33.24% |

| Teradyne |

TER |

4 |

160.54 |

71.37 |

-55.54% |

| VeriSign |

VRSN |

4 |

236.24 |

174.08 |

-26.31% |

| Fiserv |

FISV |

4 |

109.47 |

94.14 |

-14.00% |

| Walgreens Boots Alliance |

WBA |

4 |

54.33 |

33.24 |

-38.82% |

| Caterpillar |

CAT |

4 |

219.95 |

178.19 |

-18.99% |

| Deere |

DE |

4 |

380.55 |

357.14 |

-6.15% |

| Dover |

DOV |

4 |

180.73 |

119.58 |

-33.84% |

| Expeditors Intl |

EXPD |

4 |

124.94 |

89.97 |

-27.99% |

| Lockheed Martin |

LMT |

4 |

364.14 |

389.41 |

6.94% |

| Eastman Chemical |

EMN |

4 |

121.4 |

139.53 |

14.93% |

| Freeport McMoRan |

FCX |

4 |

42.99 |

60.08 |

39.75% |

| Kaiser Aluminum |

KALU |

4 |

100.19 |

65.42 |

-34.70% |

| LyondellBasell |

LYB |

4 |

99.33 |

77.80 |

-21.68% |

| PPG Industries |

PPG |

4 |

168.81 |

110.33 |

-34.64% |

| BP |

BP |

4 |

30.54 |

30.33 |

-0.69% |

| Cabot |

COG |

4 |

21.25 |

28.42 |

33.74% |

| Archer-Daniels-Midland |

ADM |

4 |

70.48 |

83.38 |

18.30% |

| Casey's General |

CASY |

4 |

196.58 |

202.38 |

2.95% |

| Coca-Cola |

KO |

4 |

60.45 |

54.98 |

-9.05% |

| Kellogg |

K |

4 |

66.58 |

71.98 |

8.11% |

| Keurig Dr Pepper |

KDP |

4 |

37.83 |

37.33 |

-1.32% |

| Procter & Gamble |

PG |

4 |

158.66 |

125.08 |

-21.16% |

| Wal-Mart |

WMT |

4 |

144.2 |

130.43 |

-9.55% |

| Healthcare Realty Trust |

HR |

4 |

31.35 |

19.06 |

-39.20% |

| Healthpeak |

PEAK |

4 |

35.92 |

22.27 |

-38.00% |

| Ventas |

VTR |

4 |

52.14 |

36.04 |

-30.88% |

| Alphabet |

GOOG |

4 |

140.0175 |

97.18 |

-30.59% |

| IBM |

IBM |

4 |

132.87 |

120.04 |

-9.66% |

| Korn/Ferry |

KFY |

4 |

73.38 |

51.27 |

-30.13% |

| Texas Instruments |

TXN |

4 |

184.64 |

148.34 |

-19.66% |

| Silicon Motion Technology |

SIMO |

4 |

91.14 |

59.36 |

-34.87% |

| PG&E |

PCG |

4 |

12.17 |

13.83 |

13.64% |

| Chipotle |

CMG |

3 |

1581.61 |

1508.41 |

-4.63% |

| Cracker Barrel |

CBRL |

3 |

133.39 |

97.04 |

-27.25% |

| General Motors |

GM |

3 |

61.46 |

32.89 |

-46.49% |

| Hasbro |

HAS |

3 |

101.25 |

66.60 |

-34.22% |

| Netflix |

NFLX |

3 |

540.84 |

230.00 |

-57.47% |

| Tesla |

TSLA |

3 |

354.8 |

204.99 |

-42.22% |

| Beyond Meat |

BYND |

3 |

69.38 |

13.35 |

-80.77% |

| Carvana Co. |

CVNA |

3 |

186.2 |

17.14 |

-90.79% |

| CRISPR Therapeutics |

CRSP |

3 |

72.71 |

54.07 |

-25.64% |

| Fiverr International |

FVRR |

3 |

97.23 |

26.46 |

-72.79% |

| Pinterest |

PINS |

3 |

34 |

21.35 |

-37.21% |

| Roku |

ROKU |

3 |

185.7 |

49.28 |

-73.46% |

| Snap |

SNAP |

3 |

43.31 |

9.99 |

-76.93% |

| Splunk |

SPLK |

3 |

122.11 |

70.23 |

-42.49% |

| Stitch Fix |

SFIX |

3 |

19.2 |

3.49 |

-81.82% |

| Uber |

UBER |

3 |

43.62 |

24.71 |

-43.35% |

| Virgin Galactic |

SPCE |

3 |

12.39 |

4.59 |

-62.95% |

| Wayfair |

W |

3 |

181.81 |

28.35 |

-84.41% |

| Amgen |

AMGN |

3 |

232.38 |

251.34 |

8.16% |

| Baxter Intl |

BAX |

3 |

86.36 |

54.50 |

-36.89% |

| Intuitive Surgical |

ISRG |

3 |

328.02 |

183.06 |

-44.19% |

| Johnson & Johnson |

JNJ |

3 |

171.25 |

164.46 |

-3.96% |

| Zimmer Biomet |

ZBH |

3 |

128.38 |

106.91 |

-16.72% |

| 3M |

MMM |

3 |

178.98 |

113.63 |

-36.51% |

| AO Smith Corp |

AOS |

3 |

83.7 |

49.04 |

-41.41% |

| CNH Industrial |

CNHI |

3 |

16.26 |

12.03 |

-26.01% |

| Corning |

GLW |

3 |

38.04 |

30.20 |

-20.61% |

| Danaher |

DHR |

3 |

305.33 |

253.71 |

-16.91% |

| Eaton |

ETN |

3 |

167.76 |

134.31 |

-19.94% |

| Emerson Electric |

EMR |

3 |

96.38 |

78.22 |

-18.84% |

| Fastenal |

FAST |

3 |

60.29 |

43.87 |

-27.24% |

| Honeywell |

HON |

3 |

216.31 |

174.16 |

-19.49% |

| Illinois Tool Works |

ITW |

3 |

244.13 |

186.10 |

-23.77% |

| Parker-Hannifin |

PH |

3 |

321.37 |

254.24 |

-20.89% |

| Pentair |

PNR |

3 |

69.98 |

40.84 |

-41.64% |

| Roper Technologies |

ROP |

3 |

460.28 |

363.18 |

-21.10% |

| United Parcel Service |

UPS |

3 |

211.27 |

161.68 |

-23.47% |

| W.W. Grainger |

GWW |

3 |

505.98 |

501.17 |

-0.95% |

| Air Products & Chemicals |

APD |

3 |

297.54 |

232.53 |

-21.85% |

| DuPont |

DD |

3 |

83.03 |

72.25 |

-12.98% |

| H.B. Fuller |

FUL |

3 |

77.16 |

64.21 |

-16.78% |

| Newmont Mining |

NEM |

3 |

60.91 |

40.74 |

-33.11% |

| Sonoco |

SON |

3 |

58.42 |

60.23 |

1.76% |

| Vale |

VALE |

3 |

15.24 |

13.07 |

-14.24% |

| Exxon Mobil |

XOM |

3 |

71.35 |

99.19 |

39.02% |

| Pioneer Natural Resources |

PXD |

3 |

204 |

239.89 |

17.59% |

| Royal Dutch Shell |

RDS |

3 |

48.51 |

50.53 |

4.16% |

| Total |

TOT |

3 |

54.71 |

51.00 |

-6.78% |

| Altria Group |

MO |

3 |

49.48 |

45.23 |

-8.59% |

| Campbell Soup |

CPB |

3 |

45.07 |

50.37 |

11.76% |

| Church & Dwight |

CHD |

3 |

101.82 |

72.50 |

-28.80% |

| Clorox |

CLX |

3 |

179.57 |

131.29 |

-26.89% |

| General Mills |

GIS |

3 |

68.53 |

77.71 |

13.40% |

| Hormel Foods |

HRL |

3 |

49.69 |

44.89 |

-9.66% |

| Kimberly-Clark |

KMB |

3 |

143.14 |

113.21 |

-20.91% |

| Kraft Heinz |

KHC |

3 |

37.59 |

35.73 |

-4.95% |

| McCormick |

MKC |

3 |

95.21 |

73.54 |

-22.76% |

| Molson Coors |

TAP |

3 |

49.25 |

48.80 |

-0.91% |

| Smucker |

SJM |

3 |

142.11 |

141.03 |

-0.76% |

| Sysco |

SYY |

3 |

78.43 |

73.74 |

-5.98% |

| Tyson Foods |

TSN |

3 |

90.99 |

64.84 |

-28.74% |

| Equinix |

EQIX |

3 |

766.88 |

505.39 |

-34.10% |

| LTC Properties |

LTC |

3 |

35.44 |

36.74 |

3.67% |

| Realty Income Corp |

O |

3 |

71.29 |

55.54 |

-22.09% |

| Welltower |

WELL |

3 |

86.33 |

57.84 |

-33.00% |

| Booking Holdings |

BKNG |

3 |

2469.42 |

1670.49 |

-32.35% |

| Intel |

INTC |

3 |

55.91 |

25.91 |

-53.66% |

| Manpower |

MAN |

3 |

103.72 |

71.09 |

-31.46% |

| Twitter |

TWTR |

3 |

40.66 |

50.45 |

24.08% |

| American Tower |

AMT |

3 |

260.49 |

185.78 |

-28.68% |

| Crown Castle |

CCI |

3 |

187.59 |

127.65 |

-31.95% |

| SBA Comm |

SBAC |

3 |

341.69 |

242.10 |

-29.15% |

| T-Mobile |

TMUS |

3 |

110.97 |

131.52 |

18.52% |

| Genuine Parts |

GPC |

2 |

137.41 |

154.49 |

12.43% |

| Eli Lilly |

LLY |

2 |

262.32 |

331.39 |

26.33% |

| Dominion Energy |

D |

2 |

79.13 |

64.31 |

-18.73% |

| GameStop |

GME |

1 |

32.575 |

24.63 |

-24.39% |

| TE Connectivity |

TEL |

1 |

160.26 |

107.52 |

-32.91% |

| Colgate-Palmolive |

CL |

1 |

83.17 |

71.33 |

-14.24% |

---------------------------------------------

About Our Name

But how, you will ask, does one decide what [stocks are] "attractive"? Most analysts feel they must choose between two approaches customarily thought to be in opposition: "value" and "growth,"...We view that as fuzzy thinking...Growth is always a component of value [and] the very term "value investing" is redundant.

-- Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett's thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn't be more representative of what our analysts do here; hence, we're called Valuentum.

---------------------------------------------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

1 Comments Posted Leave a comment