Member LoginDividend CushionValue Trap |

Two Railroad Operators to Join Forces, Creating the First Fully Integrated Canada-US-Mexico Railroad Network

publication date: Mar 24, 2021

|

author/source: Callum Turcan

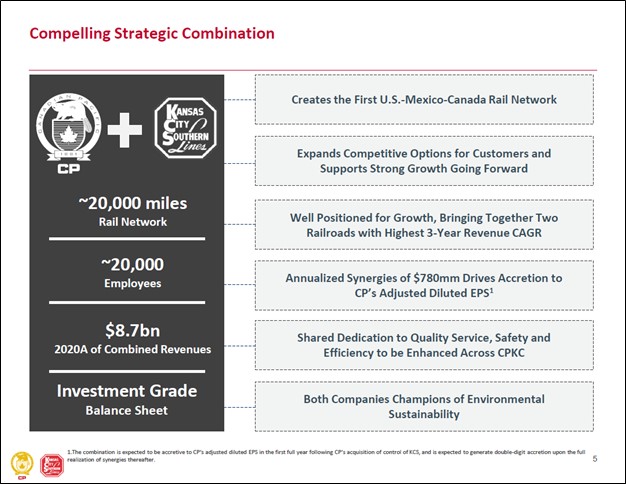

Image Source: Canadian Pacific Railway Ltd, Kansas City Southern – March 2021 Acquisition Presentation By Callum Turcan On March 21, Canadian Pacific Railway Ltd (CP) announced it was acquiring Kansas City Southern (KSU) through a cash-and-stock deal worth ~$29.0 billion by enterprise value (factoring in assumed debt). The combination will create the first fully integrated Canada-US-Mexico railroad operator with ~$780 million in annualized synergies expected within three years of the deal closing. Once this two-part transaction is complete, the new entity will have a US Class 1 railroad network that spans ~20,000 miles with ~20,000 employees supporting its operations. The pro forma company will be renamed Canadian Pacific Kansas City (‘CPKC’). According to the acquisition press release: Calgary will be the global headquarters of CPKC, and Kansas City, Mo. will be designated as the U.S. headquarters. The Mexico headquarters will remain in Mexico City and Monterrey. CP's current U.S. headquarters in Minneapolis-St. Paul will remain an important base of operations. Four KCS Directors will join CP's expanded Board at the appropriate time, bringing their experience and expertise in overseeing KCS' multinational operations. Over time, it is possible that the pro forma company’s corporate footprint will be consolidated to eliminate redundancies and to provide for a more streamlined corporate structure. However, cost synergies only represent a modest slice of the targeted annualized synergies, indicating that this acquisition is primarily about growing the pro forma company’s total addressable market (‘TAM’). We will cover this in detail later. Regulatory Concerns As it relates to whether this deal could pass regulatory scrutiny (with an eye towards anti-trust concerns), it is worth comparing the size of the pro forma firm to some of the big companies in the North American railroad operator space. Union Pacific Corporation (UNP) operates a US Class 1 railroad network that runs for ~32,300 miles across 23 US states (primarily in the Western US region). Berkshire Hathaway Inc (BRK.A) (BRK.B) owns BNSF, another US Class 1 railroad operator with ~32,500 miles of track across 28 US states and three Canadian provinces. It appears that the tie up between Canadian Pacific and Kansas City Southern has a strong chance of securing regulatory approval given that the combination will create an entity that is still significantly smaller than the biggest players in this arena. Management noted in the acquisition press release that the pro forma entity would still be “the smallest of six U.S. Class 1 railroads by revenue” in an apparent bid to highlight the chances of this deal passing regulatory muster. However, nothing is for certain on this front. As an aside, we include shares of BRK.B as an idea in the Best Ideas Newsletter portfolio and continue to like exposure to the industrial and insurance conglomerate, in part due to its stellar railroad operations. To read about our thoughts on Berkshire Hathaway, check out this article here. Deal Overview When the first part of the Canadian Pacific-Kansas City Southern deal closes, KSU shareholders will receive $90 in cash and 0.489 share of CP for each share of KSU they own (which represented a nice pre-announcement premium for KSU shareholders). Canadian Pacific will issue roughly 44.5 million new shares and approximately $8.6 billion in new debt to help fund the cost of the acquisition. The goal is for the pro forma entity to maintain an investment grade credit rating over the long haul. Canadian Pacific suspended its share buyback program in conjunction with the announcement of this acquisition to help make that possible.

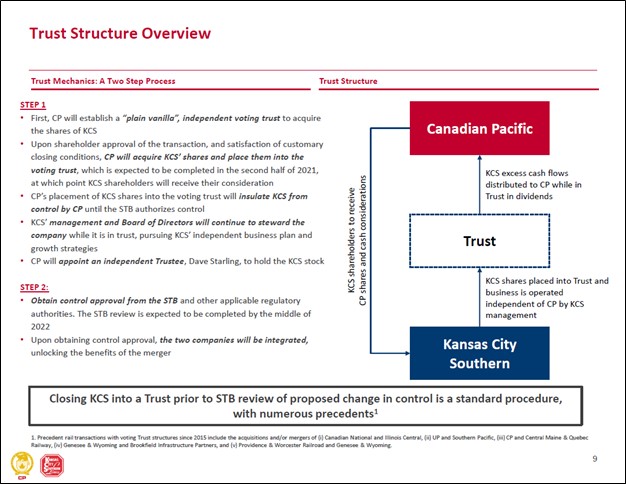

Image Shown: Canadian Pacific and Kansas City Southern are joining forces. Image Source: Canadian Pacific, Kansas City Southern – March 2021 Acquisition Presentation Canadian Pacific sees the deal being accretive on an adjusted (non-GAAP) diluted EPS basis within the first year of the deal closing, though getting regulatory approval from the federal US Surface Transportation Board (‘STB’) will be required before the transaction can go forward. Beforehand, an independent trust owned by Canadian Pacific will acquire the outstanding shares of Kansas City Southern, once receiving the necessarily shareholder approvals. The independent trust will operate Kansas City Southern as a separate entity from Canadian Pacific’s operations and will continue to pursue Kansas City Southern’s current strategic priorities. In the upcoming graphic down below, the railroad operators lay out how the two-part transaction is expected to unfold.

Image Shown: An overview of the two-part transaction that will see Canadian Pacific take over Kansas City Southern, should the deal receive the necessary shareholder and regulatory approvals. Image Source: Canadian Pacific, Kansas City Southern – March 2021 Acquisition Presentation The first half of this transaction involves Kansas City Southern shareholders receiving their cash-and-stock consideration. On a pro forma basis, Kansas City Southern shareholders will own approximately 25% of Canadian Pacific’s stock when the deal closes, and this phase of the transaction is expected to be completed in the second half of 2021. Approval from the US STB is expected to be completed by the middle of 2022 which will allow integration efforts to commence, highlighting the relatively long amount of time it will take for this deal to be finalized and longer still for meaningful operational synergies to be realized. However, the tie up makes sense, in our view, given the operational overlap and ability to capitalize on the highly integrated and growing nature of North America’s three big economies (i.e., Canada, the US, and Mexico).

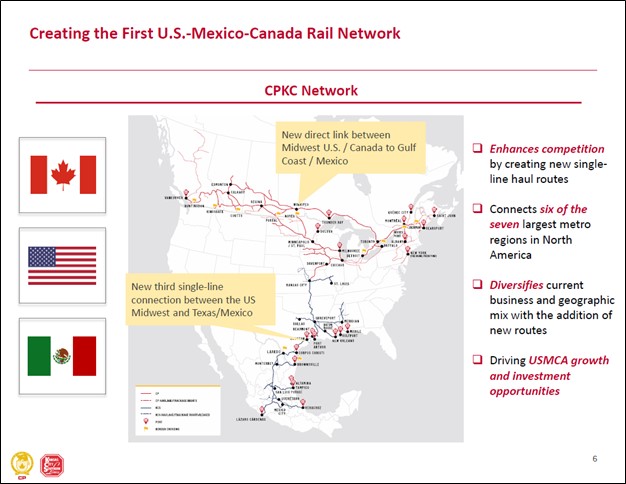

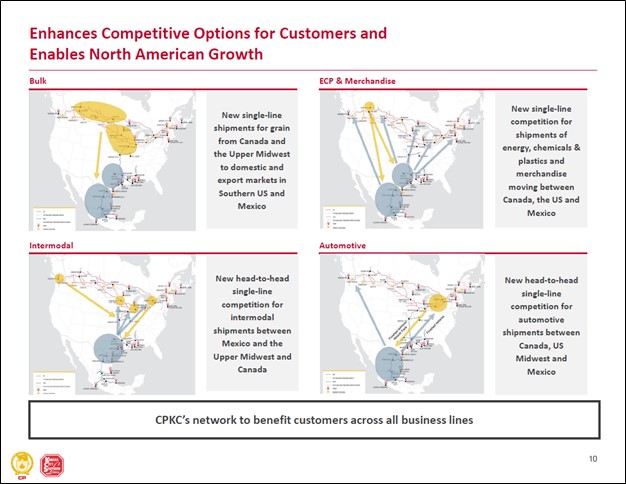

Image Shown: Should the deal go through as envisioned, the combination of Canadian Pacific and Kansas City Southern would create a fully-integrated Canada-US-Mexico railroad network, the first of its kind. In theory, this is expected to generate meaningful new market opportunities that the pro forma entity intends to swiftly capitalize on. Image Source: Canadian Pacific, Kansas City Southern – March 2021 Acquisition Presentation Keith Creel, currently President and CEO of Canadian Pacific, will take over as CPKC’s CEO when the deal is finalized. Also on March 21, Canadian Pacific announced it had amended its contract with Mr. Creel to extend his employment agreement until at least early-2026. Mr. Creel has a long history of working in the railroad industry. Sizable Synergies Roughly $180 million of the ~$780 million in targeted annualized synergies are expected to come from cost savings and efficiency gains (such as better fuel efficiency, reduced corporate overhead and IT expenses, rationalizing its facility footprint, better rates on equipment rentals, reduced licensing costs as it concerns securing right-of-way and land use rights). The remaining ~$600 million in targeted annualized synergies will come from new market opportunities the tie up between Canadian Pacific and Kansas City Southern is expected to generate. As mentioned previously, this pro forma entity will be the first to operate a fully integrated Canada-US-Mexico railroad. This is expected to create numerous new single-line railroad transportation opportunities involving various commodities and semi-finished/finished products including grains, energy products, chemicals/petrochemicals, plastics, and automotive shipments. Single-line railroad tracks involve trains moving in both direction on the same track. This strategy has its advantages as is it much easier and cheaper to maintain and build a single-track compared to a multi-track system, though there are disadvantages as well (such as the potential for significant shipment delays). In the acquisition press release, the railroad operators had this to say on the issue: The combined network's new single-line offerings will deliver dramatically expanded market reach for customers served by CP and KCS [Kansas City Southern], provide new competitive transportation service options, and support North American economic growth. The transaction is also expected to create jobs across the combined network. Additionally, efficiency and service improvements are expected to achieve meaningful environmental benefits. Here is an example of how this strategy could play out: CPKC could ship grain volumes from Canada and the Upper US Midwest down to the Southern US and Mexico along a single-line track. After unloading the grain shipment, those trains could then load up on energy, chemical, and plastics products (which are plentiful in this region in the wake of the North American energy production boom and related boom in petrochemical and plastic products production) and those products could be shipped up north. CPKC’s pro forma railroad network would also tie together North America’s major automotive and auto parts production hubs in the Great Lakes region in Canada, the US Midwest, and Mexico. We see room for the pro forma firm to significantly grow its total addressable market (TAM) via integration efforts and future capital investment programs.

Image Shown: An overview of the new market opportunities CPKC intends to capitalize on as an enlarged entity. Image Source: Canadian Pacific, Kansas City Southern – March 2021 Acquisition Presentation

Railroad operators have, generally speaking, been running longer trains and fewer trips in a bid to reduce their operating ratios (operating expenses dividend by revenues over a given period). For reference, the lower the operating ratio, the better. In the final quarter of 2020, Canadian Pacific had a record-low operating ratio of 53.9% and Kansas City Southern had an operating ratio of 62.2%, though please note that the latter faced sizable headwinds that quarter due to a service interruption stemming from a protest (according to the company). Please note that Kansas City Southern expects its operating ratio to improve going forward, hitting a forecasted ~57.5% in 2021 and 55.0%-56.0% in 2022. Financial Considerations This deal will cause the pro forma entity to have a bloated balance sheet, though Canadian Pacific is committed to utilizing its strong free cash flow generating abilities to pare down its pro forma (net) debt load over the coming years. As noted previously, the company has suspended its share buyback program to help keep a lid on its leverage ratio. Management expects the pro forma entity will have a leverage ratio of ~4.0x in 2021 which is forecasted to fall to ~2.5x by 2023. Note that Canadian Pacific’s leverage ratio is defined as its adjusted net debt to adjusted EBITDA ratio. Canadian Pacific and Kansas City Sothern pledged to not change their dividend policies in conjunction with the acquisition announcement, and please note that both railroad operators have relatively modest payout obligations. At the end of 2020, Canadian Pacific had ~$9.4 billion in net debt (inclusive of short-term debt and long-term investments) and Kansas City Southern had ~$3.5 billion in net debt (inclusive of short-term debt and long-term investments) on the books. Furthermore, both firms have substantial operating lease and pension plan liabilities. Canadian Pacific noted in the acquisition press release that it expects it would “produce approximately $7 billion of levered free cash flow (after interest and taxes) over the next three years” which will help the firm stay on top of its financial commitments. Concluding Thoughts We see this railroad operator combination as one that should benefit all parties over the long haul. Shares of CP sold off and shares of KSU rose sharply during normal trading hours Monday, March 22, the first business day after the deal was announced. However, the targeted cost savings and new market opportunities that the pro forma entity intends to capitalize on appear reasonable, in our view. The long-term economic outlook for the North American economy remains bright, and it is quite likely that integration between the big three economies (i.e., Canada, the US, and Mexico) will continue in the coming years and decades, aided by the United States-Mexico-Canada Agreement (‘USMCA’). That free trade pact officially entered into force in July 2020 after getting ratified by the three signatories. We are keeping an eye on the railroad operator space, and our favorite way to gain exposure to the industry is indirectly via Berkshire Hathaway Class B shares. ----- Railroad operators: CP, CNI, CSX, GWR, KSU, NSC, UNP Related: BRK.A, BRK.B Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment