Member LoginDividend CushionValue Trap |

Two High-Quality REITs Report Earnings: Crown Castle and Digital Realty

publication date: Feb 21, 2021

|

author/source: Callum Turcan

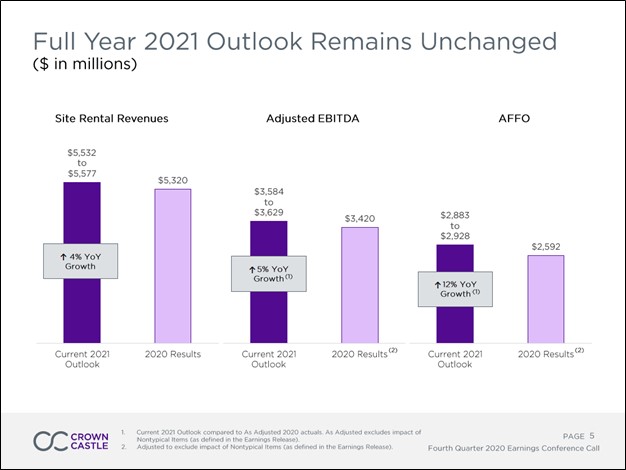

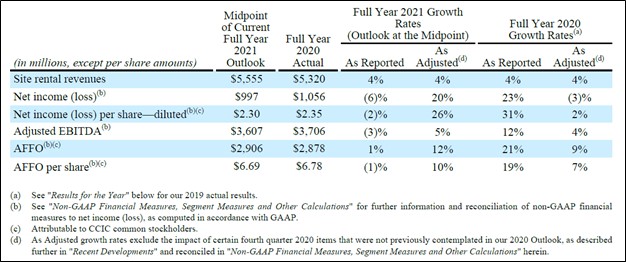

Image Shown: Crown Castle International Corp. forecasts that its core financial metrics will continue to grow in 2021. Image Source: Crown Castle International Corp. – Fourth Quarter of 2020 IR Earnings Presentation By Callum Turcan Searching for lofty yields in a low interest rate environment comes with substantial risks as high yields can sometimes be more indicative of the expected headwinds facing the company or entity in question rather than an excellent risk-reward opportunity. We published an article back in September 2020 titled High Yield Dividend Income Investing in a Time of Need (link here) that highlighted our thoughts on this issue and why we think investors in high-yielding enterprises need to keep their guards up. All yields--even of the same level--are not created equal as each company has different cash-flow characteristics and business model risks. For example, real estate investment trusts (‘REITs’) that own economic interests in malls, movie theaters, restaurants, and corporate offices were hit hard by the coronavirus (‘COVID-19’) pandemic as daily routines were upended worldwide. Shares of Simon Property Group Inc (SPG), the giant mall and shopping center REIT, are recovering but have still significantly underperformed the Vanguard Real Estate Index Fund ETF (VNQ) since the start of 2020 as of the middle of February 2021. On the other hand, shares of Crown Castle International Corp. (CCI), a cell tower REIT, and the Digital Realty Trust Inc (DLR), a data center REIT, have held up well since the start of 2020 as both firms operate in realms that are supported by secular growth tailwinds. We include CCI and DLR in the High Yield Dividend Newsletter portfolio (more on that here). These are two high-quality REITs with promising outlooks. The rollout of 5G wireless networks in the US underpins Crown Castle’s bright outlook as demand for small cells (more on that here), which are an essential part of 5G wireless networks, remains incredibly strong. Digital Realty’s outlook is supported by the transition towards cloud computing operations due to the rising need for data centers and interconnectivity services worldwide. Let's dig into their latest respective earnings reports. Crown Castle (CCI) On January 27, Crown Castle reported fourth quarter earnings for 2020 that beat consensus bottom-line estimates but missed consensus top-line estimates. On a full-year basis, the REIT’s ‘site rental revenues’ and adjusted funds from operations (‘AFFO’) per share continued to trend in the right direction last year. Economies of scale and the favorable nature of its contracts with tenants (long-term deals with escalators) underpins our expectations that Crown Castle’s operating margins will steadily improve over the coming years, supporting its cash flow growth outlook. Crown Castle grew its ‘site rental revenues’ (a non-GAAP metric) by 4% in 2020 on an annual basis. Management noted the REIT experienced very strong growth for its small cells offerings and decent growth for its towers and fiber solutions offerings last year during the firm’s latest earnings call. Additionally, Crown Castle reported that its non-GAAP AFFO per share grew by 7% year-over-year in 2020 on an “as adjusted” basis (meaning this AFFO per share metric was further adjusted to remove “nontypical items”). Management recently commented that mobile data demand in the US was up 30% last year (on what appears to be an annual basis). The REIT has been steadily securing new strategic partnerships to extend its growth runway as wireless network operators scale up to meet surging data demand. For instance, Crown Castle signed a new long-term deal with Verizon Communications Inc (VZ) on January 27 that involves Crown Castle supporting the buildout of Verizon’s 5G wireless network. The press release noted that “Verizon has committed to lease 15,000 new small cells from Crown Castle over the next four years” with each small cell lease agreement having an initial ten-year term once installed. In Crown Castle’s fourth-quarter 2020 earnings press release, the firm noted “(it) meaningfully increased (its) backlog of small cells committed or under construction to approximately 30,000” with its recent agreement with Verizon being key here. Crown Castle also signed a long-term deal with DISH Network Corporation (DISH) that was announced back in November 2020. The deal involves DISH Network leasing “space on up to 20,000 [of Crown Castle’s] communication towers” and utilizing Crown Castle’s fiber infrastructure. Please note that after DISH Network entered the US wireless space last year through its acquisition of Boost Mobile, the company is now working on building out its own 5G wireless network. These deals with Verizon and DISH Network more than offset the backlog losses that arose when T-Mobile US Inc (TMUS) ended up cancelling ~5,700 small cells that Crown Castle had contracted with Sprint, after T-Mobile acquired Sprint last year. According to recent management commentary, Crown Castle had yet to construct most of those small cells. Crown Castle was financially compensated as part of this termination which involved the REIT receiving payment for the relevant capital costs it had incurred along with the acceleration of the relevant contractually owed rent payments. Management stressed that the cancellation of these orders would not stymie Crown Castle’s small cells growth trajectory during the REIT’s latest earnings call. Crown Castle maintained its full-year guidance for 2021 during its fourth quarter of 2020 earnings report. On an annual basis, its guidance calls for modest single-digit site rental revenue growth and double-digit AFFO per share growth this year at the midpoint of its forecasts (on an “as adjusted” basis) as one can see in the upcoming graphic down below. Management stressed that Crown Castle’s recent deals with Verizon and DISH Network would largely not be reflected in the REIT’s 2021 performance. The REIT sees strong organic growth for its small cells offerings continuing into 2021 according to recent management commentary, with organic growth for its towers and fiber solutions offerings expected to come in nicely as well this year.

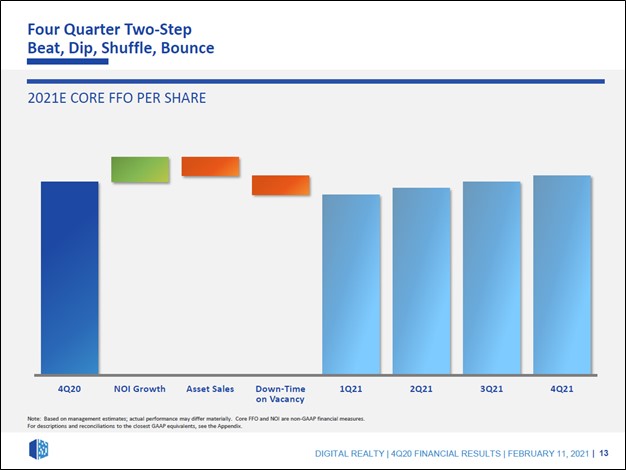

Image Shown: The ongoing rollout of 5G wireless networks in the US supports Crown Castle’s growth outlook. Image Source: Crown Castle – Fourth Quarter of 2020 Earnings Press Release On February 8, Crown Castle announced it had priced $1.0 billion in 1.050% Senior Notes due 2026, $1.0 billion in 2.100% Senior Notes due 2031, and $1.25 billion in 2.900% Senior Notes due 2041 at just below par. At the end of 2020, Crown Castle had a net debt load of ~$19.0 billion (inclusive of ‘current maturities of debt and other obligations’ and ‘debt and other long-term obligations’ but not including restricted cash on hand) and that comes on top of hefty operating lease liabilities. Though Crown Castle generated $1.4 billion in free cash flows in 2020, the number did not fully cover $2.2 billion in dividend and distribution obligations during this period (including payouts on its preferred securities). Please note that as a capital-market dependent entity, Crown Castle needs to retain constant access to debt and equity markets to refinance its debt load, fund its growth endeavors and keep making good on its payout obligations. In our view, the REIT should be able to keep tapping capital markets at attractive rates going forward, aided by its ability to generate free cash flows in almost any environment. Generally speaking, most REITs do not generate sizable (or any) free cash flows due to their hefty capital expenditure requirements (one of the reasons we are big fans of Crown Castle). Here is what Crown Castle’s management team had to say regarding the REIT’s financial position during its latest earnings call (emphasis added): “As it relates to the balance sheet, we finished the year with approximately four times debt to EBITDA on a last quarter annualized basis, which includes the net benefit from the non-typical items discussed earlier. Adjusting to include those items as onetime impacts that are not annualized, our leverage would have been approximately five times. During 2020, we improved our balance sheet flexibility by extending the weighted average maturity by nearly two years, reducing our average borrowing cost by 40 basis points and reducing our leverage to our target of approximately five times. Looking forward, our expectation for 2021 capital expenditures remains unchanged at approximately $1.5 billion. We expect we will be able to once again fund this discretionary capital with free cash flow and incremental borrowings, consistent with our investment-grade credit profile.” --- Daniel Schlanger, Executive Vice President and Chief Financial Officer of Crown Castle Please note that it appears Crown Castle’s capital expenditures are expected to decline modestly in 2021 versus 2020 levels (when the REIT spent $1.6 billion on capital expenditures) according to guidance (furthermore, the REIT’s capital expenditures were down significant in 2020 versus 2019 levels). Management maintained that Crown Castle’s long-term goal is to grow its per share payout by 7%-8% per year during the REIT’s latest earnings call. During its third quarter of 2020 earnings report, Crown Castle grew its quarterly payout by 11% sequentially (which we covered here). We continue to like exposure to Crown Castle in our High Yield Dividend Newsletter portfolio. Shares of CCI yield ~3.2% on a forward-looking basis as of this writing. Digital Realty (DLR) On February 11, Digital Realty beat both consensus top- and bottom-line estimates. The data center REIT’s (non-GAAP) core funds from operations (‘FFO’) on a per share basis slipped in 2020 versus 2019 levels in part due to headwinds from the COVID-19 pandemic and in part due to headwinds created by the expiration of legacy contracts (a dynamic we covered here). Digital Reality’s core FFO per share dropped 7% year-over-year in 2020, though its financial performance staged a strong rebound in the final quarter last year (its core FFO per share was down less than 1% year-over-year in the fourth quarter). Digital Realty issued full-year guidance for 2021 during its latest earnings report, which calls for the firm’s financial performance to rebound meaningfully going forward. The REIT forecasts its core FFO per share will reach $6.40-$6.50 in 2021, up from $6.22 in 2020. Management noted that renewal activity last quarter indicated Digital Realty was seeing signs of some pricing strength in certain areas during the REIT’s latest earnings call. As one can see in the upcoming graphic down below, Digital Realty expects its financial performance will steadily improve throughout 2021.

Image Shown: Digital Realty’s financial performance is expected to rebound in 2021. Image Source: Digital Realty – Fourth Quarter of 2020 IR Earnings Presentation At the end of 2020, Digital Realty’s debt load was substantial as its net debt to adjusted EBITDA ratio stood at 6.1x. When Digital Realty publishes its 10-K SEC filing covering 2020, we will have more to say on its financial position, though we caution that Digital Reality is also a capital-market dependent entity. In January 2021, Digital Realty announced it had priced €1.0 billion in 0.625% Guaranteed Notes due 2031 at just below par. Going forward, the REIT should be able to continue tapping capital markets at attractive rates, in our view, aided by expectations that its financial performance will rebound this year. The REIT last increased its quarterly payout in the first quarter of 2020, which marked the 15th consecutive year that Digital Realty had grown its common dividend according to the related press release. We continue to like exposure to Digital Realty in the High Yield Dividend Newsletter portfolio. Shares of DLR yield ~3.3% as of this writing. Concluding Thoughts To avoid many of the risks inherent when seeking out high-yielding income generating opportunities, we focus on locating firms with resilient business models that can churn out meaningful cash flows in almost any environment. Crown Castle and Digital Realty Trust are two high-quality REITs with nice yields and promising outlooks. We continue to like exposure to both CCI and DLR in the High Yield Dividend Newsletter portfolio. ----- Retail REIT Industry – CONE DLR FRT O REG SPG WPC Related: CCI, VNQ, AMT, SBAC, VZ, DISH, TMUS Also tickerized for PLD, EQIX, PSA, WELL Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Realty Income Corporation (O) and Digital Realty Trust Inc (DLR) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Crown Castle International Corp. (CCI), Digital Realty Trust, CyrusOne Inc (CONE), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment