Member LoginDividend CushionValue Trap |

The Stock Market Is Nearing Technical Support Levels

publication date: Jun 18, 2022

|

author/source: Brian Nelson, CFA

By Brian Nelson, CFA It's been difficult to watch the stock market give up much of the gains reaped over the past year or so during the selling barrage that has occurred thus far in 2022. Many of our members have reached out to us with various concerns about the global economy, Fed balance sheet, interest rates, inflation and other considerations that have merit. I should add that many of our members have been spot on in calling the sell-off during 2022, too, and we appreciate the dialogue with you very much. To a very large degree, many of you have been right. Based on data from Seeking Alpha, the S&P 500 has fallen roughly 23% on a price-only basis thus far in 2022, and while the simulated newsletter portfolios are doing well, even "outperforming" the broad market benchmark based on our latest tally, I understand that sometimes relative "outperformance" doesn't change the fact that the hypothetical returns of the simulated newsletter portfolios are down so far this year. Had I known that we'd see a broad-based 20%+ sell-off in the markets, we may have positioned better with a larger cash "balance" and a few long put option contracts on the broader markets to cushion the blow in the simulated newsletter portfolios. That said, I still feel that what the markets have experienced thus far in 2022 is a normal part of the stock market cycle, and that investors shouldn't panic during this bear market. Of course, my optimistic view doesn't change that we could have done better. We can always do better. At the start of 2022, I talked about how I thought "inflation is good," as it relates to strong companies that can drive prices higher in excess of increased input costs to keep their earnings and share prices moving in the right direction. This is still true for many of the strongest companies out there, in my opinion, but the market clearly disagrees with this assessment and may instead believe demand destruction may be too difficult to overcome with price-driven earnings growth. The 10-year Treasury was at a mere ~1.5% in late 2021 at the time of our Valuentum Exclusive conference call, and now the benchmark rate that is widely-used for bond and equity valuation stands at ~3.2% at the time of this writing, levels last seen in late 2018. The buy-the-dip mentality that drove the stock market ever-higher during 2020 and 2021 has been replaced with a vicious sell-the-rip bear market, and many seasoned investors and members fear that stocks may go sideways for some time. It's hard to tell how long the markets might base once they reach a bottom, but I'm still a believer in stocks for the long run. Still, the near term may offer rough sledding until the S&P 500 reaches technical support levels in the 3,200-3,500 range. That's perhaps another 5-10% swoon. Global geopolitical and economic concerns from the war in Ukraine to the pace of growth in China and emerging markets are valid, but more pointedly as it relates to the causes of this sell-off so far in 2022, I believe it is the massive deleveraging in the cryptocurrency markets, myopic concerns over Fed activity, and the relative attractiveness of Series I Savings bonds that is likely mostly responsible for the indiscriminate equity selling across almost all categories. According to Treasury Direct, "the initial interest rate on new Series I savings bonds is 9.62%," and frankly this interest rate is quite attractive. Without a doubt, Series I savings bonds have been attracting investor capital that otherwise would have been deployed in the price-setting mechanism of the markets. Many investors have bailed on some of their stocks or reallocated away from them, but this, too, may be self-correcting, as expected returns increase with every leg down in the markets. In my view, the stock market is starting to reach oversold levels as it approaches technical support territory in the 3,200-3,500 range, and we recently pointed to three of our favorite ideas in the following note, "Three Growth Stocks That Offer Tremendous Value!" As it is often said, "hindsight is 20/20," and while we can't go back to raise our cash "position" in the simulated newsletter portfolios or "add" portfolio protection via long put options, that doesn't mean the market hasn't unfairly and irrationally beaten up some of our favorite names. We've long held the view that price is vastly different than value, and right now stock prices are depressed, not values. With that said, the markets might experience more selling until they reach those technical support bands on the S&P 500 of 3,200-3,500, and while that implies another 5-10% downside on the broader market indices, it also suggests to us that the market may be nearing a bottom. Some of the largest companies on the market such as Meta Platforms (META) and Alphabet (GOOG) (GOOGL) are trading at an attractive forward earnings multiple (META is trading at less than 12x forward earnings, for example) as they throw off tons of free cash flow and hold tens of billions in net cash on the books--tangible cash-based sources of intrinsic value. The stocks on some of the strongest companies are out of favor, and we think this spells opportunity on many of the newsletter portfolio ideas.

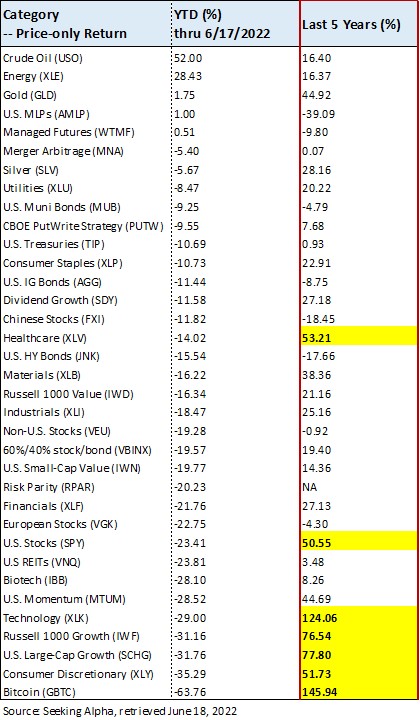

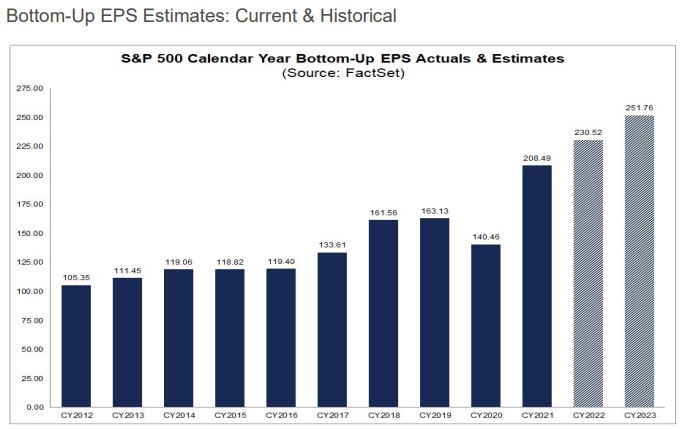

Returns right now year-to-date are flipped on their head relative to 5-year performance numbers. Some of the strongest areas during the past 5 years are the weakest performers so far in 2022, while some of the worst-performing areas have experienced what I would describe as a relief rally. I still believe the areas of big cap tech and large cap growth, which have set the tone during the prior bull market, will be the ones to come roaring back once economic uncertainty subsides. The inherent difficulty in predicting the trajectory of energy resource prices didn't stop us from "adding" the likes of Exxon Mobil (XOM) and Chevron (CVX) to the simulated newsletter portfolios last year when the market started to stall, but investors should be aware of this key risk on cyclical commodity-driven names. On the other hand, we believe in the long-term secular growth trends found in big cap tech and large cap growth. The Schwab U.S. Large-Cap Growth ETF (SCHG), for example, includes Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet, Tesla (TSLA), United Health (UNH), Nvidia Corp (NVDA), Meta Platforms, and Visa (V) as its top 10 holdings (56% of the ETF's assets) -- a stellar grouping of moaty, net-cash-rich, secular growth powerhouses with phenomenal balance sheets and tremendous free cash flow generating capacity. We think these will be the names that lead us out of the current bear market. It's difficult to watch the stock market experience a rough year as it has thus far in 2022, but as prices come in, opportunities present themselves. If we think back to the middle of last decade (2014-2016) when S&P 500 calendar bottom-up earnings per share levels stagnated at ~$120, hardly anyone could have imagined that we'd hit over $200 in S&P 500 earnings in calendar year 2021, with expectations for ~20% growth by 2023 at this time. It's my belief that we tend to overestimate earnings in the near term, but far underestimate the long-term earnings capacity of S&P 500 companies over the long haul. It's part of the reason for my optimism. Traders are trying to guess earnings for next quarter or this year, while I'm thinking about what earnings might be in 2025 or 2030.

What might be a fair value for the S&P 500 today? Well, throwing the 10-year S&P 500 average multiple of 16.9x on 2023 expected earnings numbers of 251.76 gets to a 4,255 mark on the S&P 500, which is above the last closing level of 3,674.84 for the index. Benchmark Treasury rates remain low relative to history, and balance sheets of many S&P 500 companies are overflowing with net cash, supporting such a multiple, too. All told, investors might expect the stock market to hit technical support levels on the S&P 500 of 3,200-3,500 in the near term, but from where we stand, stocks remain an attractive proposition at the moment and a very attractive consideration over the long haul. We're available for any questions. ---------- Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

1 Comments Posted Leave a comment