Member LoginDividend CushionValue Trap |

The Resilience of the US Digital Advertising Market and Alphabet

publication date: Oct 9, 2020

|

author/source: Callum Turcan

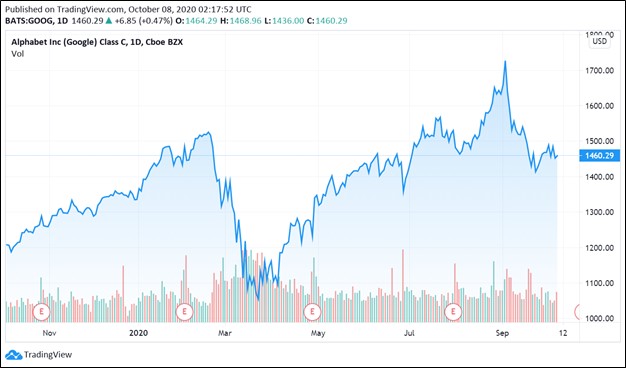

Image Shown: Shares of Alphabet Inc Class C shares, a top-weighted holding in our Best Ideas Newsletter portfolio, have performed very well over the past year. Going forward, we see room for significant capital appreciation upside as the digital advertising market has proven to be very resilient of late. By Callum Turcan To ride out the ongoing coronavirus (‘COVID-19’) pandemic, we continue to prefer large-cap tech companies with pristine balance sheets, strong cash flow profiles, and promising long-term growth outlooks. Ideally, we are searching for companies with outlooks that are supported by secular growth tailwinds, allowing for several winners in their respective end markets. Digital advertising is a prime example of a resilient high-quality market that is supported by secular growth tailwinds. Alphabet Inc (GOOG) (GOOGL) perfectly bits the bill given its ~$117.1 billion net cash position at the end of June 2020 (not including ~$13.0 billion in non-current non-marketable securities, and with no short-term debt on the books), and considering it generated over $14.0 billion in free cash flow during the first half of 2020 alone. We include Alphabet Class C shares as a top-weighted holding in our Best Ideas Newsletter portfolio, and the top end of our fair value estimate range sits at $1,795 per share of GOOG. Resilient Digital Advertising Market Outperforms Broader Space While Alphabet has various business segments, and we are very intrigued by the numerous long-term opportunities its self-driving Waymo subsidiary could yield, the company is still first and foremost a behemoth in the digital advertising business. The COVID-19 pandemic has weighed negatively on advertising budgets across all mediums worldwide, including in the US. GroupM, the media agency division of the international advertising firm WPP Plc (WPP), published a report this past June which forecasted that the US advertising market was expected to contract by 13% this year, though that does not include political spending (including political spending, the forecasted decline in the US advertising market shrinks to 8%). For reference, GroupM noted the US advertising market declined by 16% in 2009 during the Great Financial Crisis (‘GFC’). However, GroupM also noted that US digital advertising spend was holding up surprisingly well and the firm expected the US digital ad market would decline by only 3% in 2020 when not including political spend, or flat when including forecasted political spend. Here, we would like to stress that the brunt of the pressures facing the advertising market are being borne by traditional media and advertising companies (such as those in the print and traditional television businesses). Looking ahead, digital advertising spend should snap back sharply as economic activities slowly return to pre-pandemic levels and given that digital ad campaigns are one of the best advertising methods around (if not the best) due to their targeted nature. Surging e-commerce retail sales this year further supports the outlook for digital advertising demand. GroupM expects US digital advertising will grow by double-digits on an underlying basis next year, or high single-digits when including the impact of political ad spending. Numerous large consumer staples firms have touted their plans to improve their digital advertising campaigns going forward, which will likely include digital ad budget increases in the near- to medium-term. Campbell Soup Company (CPB) indicated during its fourth quarter fiscal 2020 (period ended August 2, 2020) earnings call in early-September that the company was stepping up its digital advertising programs to reach younger demographics to support demand at its ‘Meals & Beverage’ business unit. Cocoa-Cola Company (KO) mentioned during its second quarter of fiscal 2020 earnings call (period ended June 26, 2020) back in July that the firm intended to keep placing a great focus on its digital strategy going forward. Alphabet’s management team had this to say during the firm’s second quarter 2020 earnings call (emphasis added): “Let me end with our outlook. As I said earlier, ads revenue gradually improved during the [second] quarter across Search, YouTube and network. However, we believe it is premature to gauge the durability of recent trends, given the obvious uncertainty of the global macro environment. As we discussed on last quarter's earnings call, global macroeconomic performance has tended to be correlated with ad spend and is a key signal to monitor. Over the long term, we remain optimistic about the underlying strength of our business.” --- Ruth Porat, CFO of Alphabet Concluding Thoughts We expect Alphabet will return to its promising long-term growth trajectory once global health authorities get the COVID-19 pandemic under control. We remain optimistic that one of the many COVID-19 vaccine candidates currently undergoing clinical trials will cross the goal line. Beyond digital advertising, Alphabet’s cloud computing business, Google Cloud, has performed very well of late. The company’s growing backlog at this unit lends support to both its near- and long-term outlooks, which we covered in this article here. Alphabet remains one of our favorite companies out there and we see room for significant capital appreciation upside. ----- Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP Related: AAPL, CPB, CL, KO, SOCL, MILN, SNAP, PINS, XLC, VOX, FCOM, IXP, FNGS, VDC, WPP, EBAY ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Microsoft Corporation (MSFT), and Oracle Corporation (ORCL) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Apple, Facebook Inc (FB), and Microsoft are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment