Member LoginDividend CushionValue Trap |

Surveying the Clean Energy Landscape for Ideas

publication date: Jan 13, 2021

|

author/source: Callum Turcan

Image Source: American Electric Power Company Inc (AEP) – January 2021 IR Presentation By Callum Turcan There’s a lot of interest in clean energy these days! Though our favorite ideas within a portfolio context are always the ideas within the Best Ideas Newsletter portfolio, the Dividend Growth Newsletter portfolio, the High Yield Dividend Newsletter portfolio, and the Exclusive publication, we also highlight interesting ideas via our articles that we publish on our website. [For instance, we recently published work that covered the electric vehicle (‘EV’) industry; members can check out that article here.] In this article, let’s dig deep into the clean energy space. We’ll talk more about: 1) Ameresco (AMRC), one of the green energy ideas we highlighted in the past that has performed incredibly well, 2) NextEra (NEE), a large utility “family” to keep an eye on (a utility firm and a merchant power spinoff), 3) First Solar (FSLR), a US-based manufacturer of solar panels, and 4) various alternative fuel and power storage companies, including Clean Energy Fuels Corp (CLNE) and Gevo Inc (GEVO). The recently-passed omnibus spending package in the US included significant funds to support various alternative and renewable energy activities. For example, the production tax credit for wind farms was extended for one year while the investment tax credit for solar plants was extended by two years. This is a major benefit for both manufacturers of solar modules and wind turbines along with the utility firms (XLU) that would own/operate such assets. Looking ahead, we expect that the US federal government will be very accommodative toward the green energy space as President-elect Biden and the incoming US Congress (which will be controlled by the Democratic Party) will likely step up federal investments in the space (such as subsidies, low or no interest loans, favorable procurement contracts, and other considerations). The share prices of various solar companies are on the rise as witnessed through the performance of funds such as Invesco Solar ETF (TAN) surging higher of late, while the impressive price performance of iShares Global Clean Energy ETF (ICLN) showcases the widespread nature of investor excitement toward almost all green energy oriented firms. Other securities in this realm include ALPS Clean Energy ETF (ACES) and SPDR S&P Kensho Clean Power ETF (CNRG). Ameresco We covered green energy-oriented Ameresco Inc (AMRC) back on August 7 through our Ameresco Targets Green Growth by Offering Customers Cost Savings note (link here). In that piece we wrote: Ameresco offers a slate of comprehensive energy services that primarily involve designing, engineering, and installing projects at its client's operations. That includes upgrading the heating, cooling, ventilation, and lighting systems of its client's major facilities to improve efficiency (with an eye towards reducing energy consumption). By adding smart metering technology, upgrading lighting with light-emitting diode (‘LED’) systems, developing intelligent microgrids, building water reclamation infrastructure, and adding battery storage operations to these facilities, the goal is to cut down on its client’s operating and maintenance (‘O&M’) expenses over the long-term… Furthermore, the company also develops small-scale renewable energy plants for its clients, particularly at or close to a client’s existing operations, with most of those plants being either solar photovoltaic (‘PV’) or landfill gas (‘LFG’) facilities. Ameresco notes its largest project in this space was a renewable energy facility powered by biomass. Please note that Ameresco sometimes retains ownership and operatorship of these facilities. The electricity, thermal energy, and “processed renewable gas fuel” that are generated by these facilities are generally sold under long-term contracts with the customer… Ameresco operates in the US, Canada, the UK, and Greece. Historically speaking, “federal, state, provincial or local government entities” represent about ~75% of its annual revenues. Ameresco’s largest customer is the US federal government, which represented ~33% of its revenues in 2019… Ameresco is an interesting company that is capitalizing on some powerful secular growth tailwinds. We appreciate the company’s focus on recurring revenue streams, keeping in mind those represent just a modest portion of its business as things stand today. On November 5, we followed up to that note with another article (link here) which among other things highlighted that Ameresco had recently updated its full-year guidance and continued to report solid operational and financial results. We noted in the article that: Ameresco appears uniquely well-positioned to capitalize on rising demand from enterprises, government agencies, and other entities to appear “green” without breaking the bank. Given that the company’s core offerings involve reducing its customers' long-term operating costs (particularly O&M expenses) and improving its clients' cost structure, it appears Ameresco’s offerings should be quite appealing to a large range of customers. We will continue keeping an eye on Ameresco going forward. Since then, Ameresco has continued to post solid operational performance. On January 12, Ameresco announced it had mechanically completed a landfill gas to renewable natural-gas development in Houston, Texas. The company broke ground on the project in the second quarter of 2020 and was able to finish the development in a timely manner. Note that this project occurred at Republic Services Inc’s (RSG) McCarty Road Landfill. We are big fans of Republic Services and continue to include shares of RSG in our Dividend Growth Newsletter portfolio. By early-2021, Ameresco expects that the landfill gas to renewable natural gas project will achieve commercial operations. From August 7 to the end of normal trading hours on January 12, shares of Ameresco have roughly doubled. We continue to view Ameresco as an interesting green energy play and encourage our members that have not done so already to view our previous two articles covering the company.

Image Shown: Shares of Ameresco have surged higher over the past year. NextEra Energy NextEra Energy Inc (NEE) is a giant in the green energy space and owns two utility companies in the US along with a massive merchant power generation business (this segment is responsible for most of its green energy exposure). That includes Florida Power & Light Company, a rate-regulated electric utility firm with more than five million customer accounts in Florida and Gulf Power Company, which provides services to about 470,000 customers in eight counties in northwest Florida. NextEra Energy completed its acquisition of Gulf Power from Southern Company (SO) at the start of 2019 as part of a broader deal worth $6.475 billion when including the assumption of debt. As an aside, NextEra Energy recently completed a four-for-one stock split.

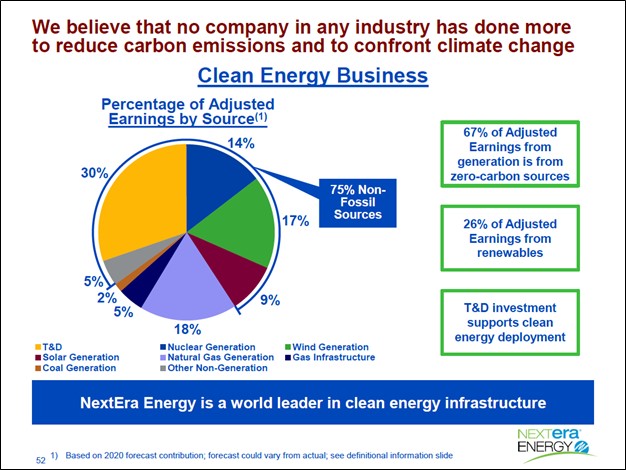

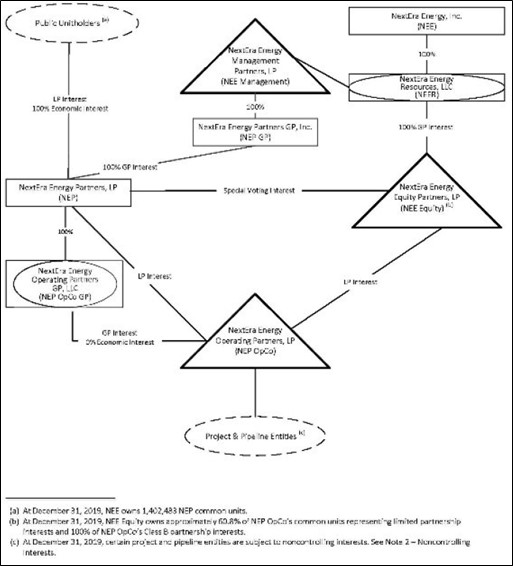

Image Shown: NextEra Energy generates most of its adjusted earnings through transmission, distribution, nuclear power, and renewable energy operations. Please note that assumes its electric transmission and distribution systems are “green” assets. Image Source: NextEra Energy – November 2020 IR Presentation Pivoting now to NextEra Energy’s massive merchant power spinoff NextEra Energy Partners LP (NEP), we caution that the organizational structure is somewhat complex. NextEra Energy, through its wholly-owned NextEra Energy Resources (‘NEER’) subsidiary, owns a large economic stake in NextEra Energy Operating Partners LP (‘NEP OpCo’) which is the entity that owns an economic interest in numerous renewable energy developments such as solar plants and wind farms across the US and Canada. NextEra Energy Partners owned a 39.2% limited partner interest in NEP OpCo at the end of 2019 and NextEra Energy owned the remaining 60.8% limited partner interest at the end of this period. Alongside its limited partner interest, NextEra Energy Partners owns the non-economic general partner interest in NEP OpCo. NextEra Energy owns the general partner of NextEra Energy Partners via its wholly owned subsidiaries depicted in the upcoming graphic down below, and James Robo is the CEO of both NextEra Energy and NextEra Energy Partners.

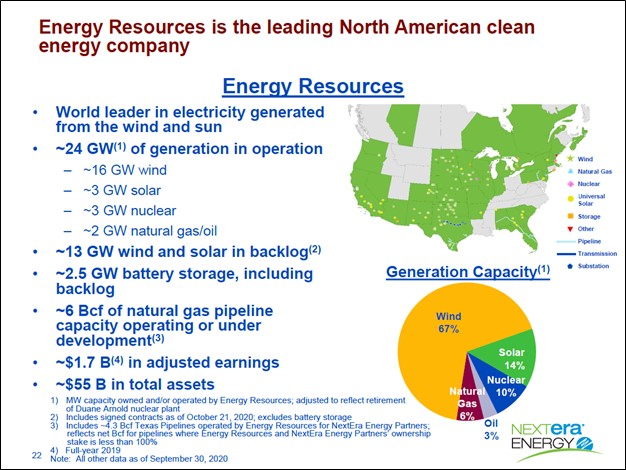

Image Shown: An overview of the complex organization structure covering NextEra Energy and NextEra Energy Partners along with their various subsidiaries and limited partner economic interests. Image Source: NextEra Energy Partners – 2019 Annual Report The entire NextEra Energy family is closely aligned and effectively run by similar management teams, though past organization changes means NextEra Energy now accounts for its stake in NextEra Energy Partners in the equity method of accounting. Unitholders of NextEra Energy Partners could start appointing their own board of directors back in 2018 via past organization changes that among other things established a board of directors for NextEra Energy Partners. During the past several years, the NextEra Energy family has built up a large portfolio of solar plants and wind farms. These are considered “intermittent” power plants, meaning that the assets cannot always supply significant amounts of electricity to the grid (if the sun is not shining and the wind is not blowing, etc.). Battery storage investments are expected to change that dynamic over the coming years, aided by expected reductions in costs. Until then, these operations are supported by natural gas-fired power plants and nuclear power plants (these types of power plants are “baseload” generators that can operate continuously at a certain capacity, keeping maintenance concerns in mind). Additionally, NextEra Energy also has a modest amount of oil-fired power generation capacity (these are “peaker” plants used when electricity demand is elevated and wholesale rates are relatively high), though these assets are getting phased out for more economical power sources. About two thirds of NEER’s generation capacity is represented by wind (~16 GW) followed by solar (~3 GW), nuclear (~3 GW), and natural gas/oil (~2 GW) with operations in the US and Canada. This does not include power generation capacity at NextEra Energy’s two Florida-focused utilities. Looking ahead, NEER has a backlog of ~13 GW of wind and solar projects along with a sizable backlog of battery storage projects as you can see in the upcoming graphic down below.

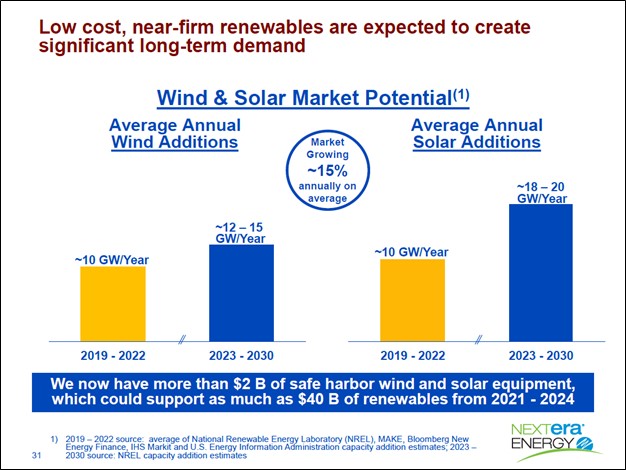

Image Shown: An overview of NEER’s operations as of the end of September 2020. Image Source: NextEra Energy – November 2020 IR Presentation As it concerns Florida Light and Power, NextEra Energy intends to grow its solar power generation mix at the electric utility from 2% in 2019 to 16% by 2029 according to the company’s forecasts. This will be made possible through large capital investments as NextEra Energy intends to have the utility spend $23-$25 billion on capital investments during for the 2019-2022 period alone. Additionally, nuclear power is expected to remain a large part of Florida Light and Power’s operations, generating 22% of its power mix in 2019 which is forecasted to fall modestly to 20% by 2029. Natural gas is expected to remain the single largest source of power generation at the utility by 2029, as it was in 2019. Pivoting to Gulf Power, NextEra Energy intends to have the utility invest significant sums towards developing solar power plants over the coming years as well (including ~$0.3 billion during the 2020-2021 period). During the past several years, NextEra Energy has been shutting some of its coal-fired power plants and converting others to run on natural gas, particularly in Florida. Due to the “fracking” boom in America, domestic natural gas (UNG) prices are quite low, which makes modern natural gas-fired combined cycle power plants more economical than older coal-fired power plants By 2022, NextEra Energy intends to combine its two Florida utilities into a single electric utility system. This should help the company better realize economies of scale, allowing it to drive down certain operating expenses. In the view of NextEra Energy, the company sees the North American renewable energy market growing at a brisk pace in the coming years as one can see in the upcoming graphic down below. Given the firm’s expansive asset base, ample access to capital, and operational prowess, we view NextEra Energy as incredibly well-positioned to capitalize on this upside.

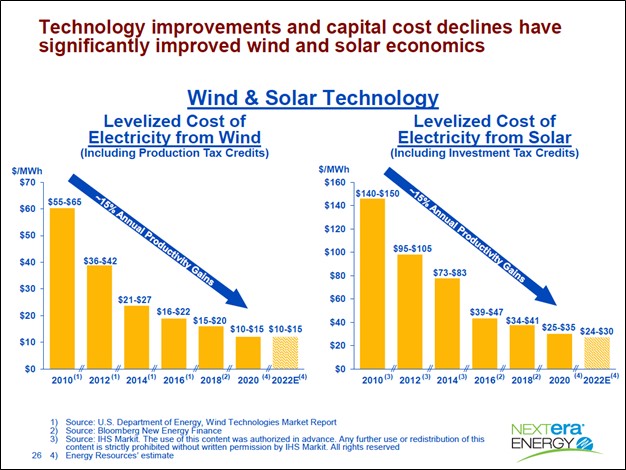

Image Shown: Demand for renewable energy in North America is expected to grow at a brisk pace going forward. Image Source: NextEra Energy – November 2020 IR Presentation Beyond companies, government, utilities, and other enterprises seeking to appear “green” by making renewable energy investments, sharp reductions in the levelized cost of electricity (‘LCOE’) during the past decade have made these power generation projects significantly more viable. Subsidies, particularly on the federal level, along with long-term power purchase agreements (‘PPAs’) with favorable pricing terms have further enhanced the economics of these projects. There is room for further LCOE reductions going forward, and if realized, those reductions would continue to shift the economics of renewable energy projects in the right direction.

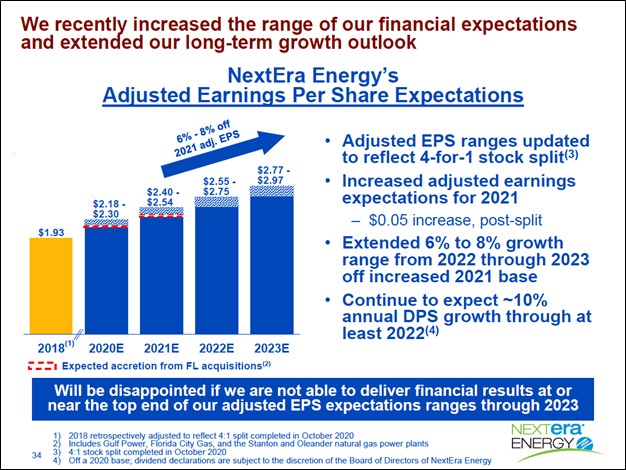

Image Shown: Solar plants and wind farms have become far more economical over the past decade with room for additional upside. Image Source: NextEra Energy – November 2020 IR Presentation Putting this all together, NextEra Energy views its expansive growth runway driving its adjusted (non-GAAP) EPS significantly higher over the coming years. The firm recently increased and extended its EPS growth guidance, and these forecasts are underpinned by the major capital investment programs the NextEra Energy family has planned over the coming years. NextEra Energy expects to deploy ~$60 billion in capital during the 2019-2022 period across its various entities after investing ~$90 billion in capital during the 2010–2019 period.

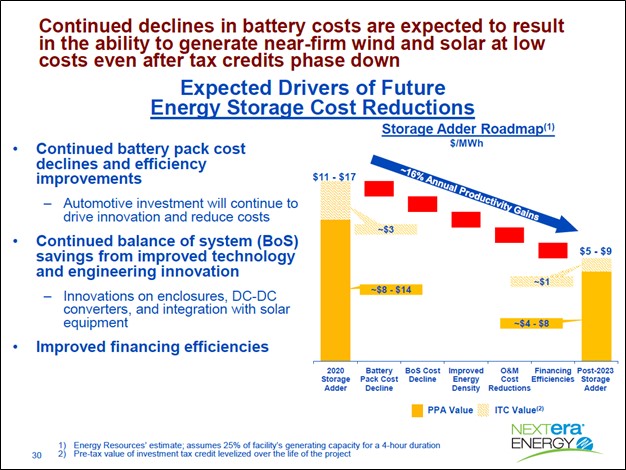

Image Shown: NextEra Energy expects its adjusted (non-GAAP) EPS will grow meaningfully on an annual basis over the coming years. Image Source: NextEra Energy – November 2020 IR Presentation NextEra Energy is optimistic that battery storage operations will continue to become more economical in the medium-term. Being able to economically store power from intermittent supplies of renewable energy would be a game changer for the green energy space.

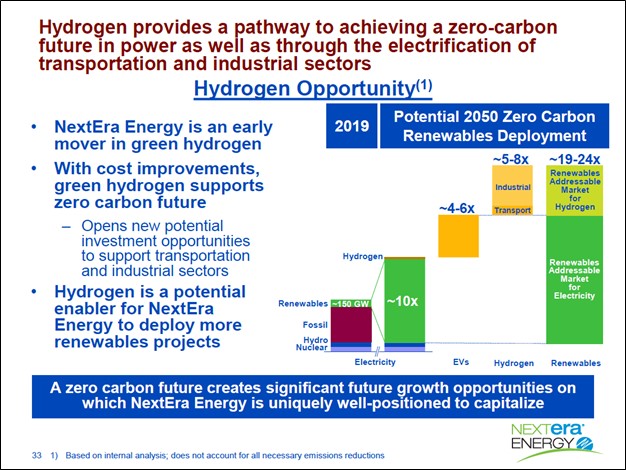

Image Shown: NextEra Energy lays out why it sees battery storage costs moving lower going forward by highlighting where the savings and efficiencies will come from. Image Source: NextEra Energy – November 2020 IR Presentation The company is also intrigued by its hydrogen upside, which is more of a long-term story, though we appreciate that NextEra Energy’s management team is viewing its growth runway in terms of decades, not months or years. Upside on this front will come from electric utility-related needs, EVs, the industrial sector, and the transportation space as you can see in the upcoming graphic down below.

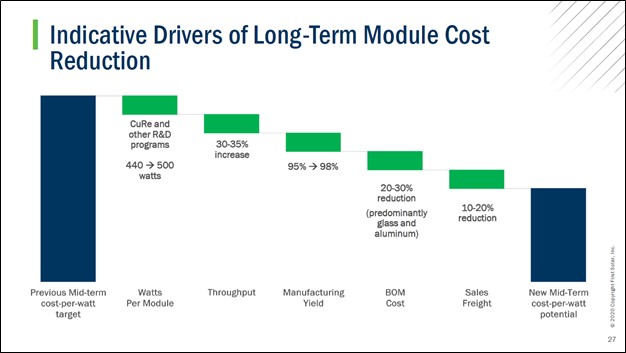

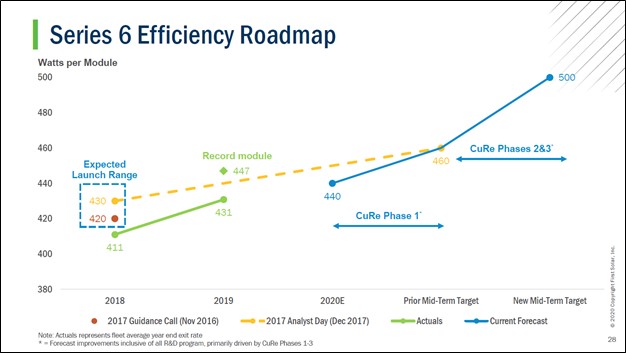

Image Shown: NextEra Energy views its long-term hydrogen growth upside as enormous. Image Source: NextEra Energy – November 2020 IR Presentation First Solar We assign First Solar Inc (FSLR) a fair value estimate of $106 per share, roughly where FSLR is trading at as of this writing. The firm designs, manufactures and sells photovoltaic (‘PV’) solar modules along with PV solar power systems that primarily utilize the models First Solar manufacturers. First Solar has a manufacturing footprint in the US, Malaysia, and Vietnam along with recycling operations at its former manufacturing plant in Germany (in the recent past the firm has attempted to sell some/all of these operations). First Solar offers operations and maintenance (‘O&M’) services to owners of its systems, providing it with the opportunity to generate recurring revenue streams. We are big fans of recurring revenue streams given the greater visibility regarding future cash flow performance. Looking ahead, First Solar is excited by the potential its CdTe modules, built on its Series 6 module technology, could create as these offerings are expected to help drive module costs lower relatively speaking. First Solar’s Copper Replacement (‘CuRe’) program with further assist in driving down module costs.

Image Shown: Various initiatives will help drive down module costs over the long haul. Image Source: First Solar – October 2020 IR Presentation

Image Shown: First Solar is optimistic that technological improvements at its Series 6 module production operations, supported by its CuRe program, will help enhance the economics of its offerings going forward. Image Source: First Solar – October 2020 IR Presentation After pulling its full-year guidance back in May 2020, First Solar later reinstated its guidance and now the firm expects to generate $2.6-$2.9 billion in net sales and $310-$380 million in operating income in 2020. We are big fans of First Solar’s growth runway and its pristine balance sheet given that the company had a net cash position of ~$1.0 billion at the end of September 2020 (inclusive of short-term debt). At the high end of our fair value estimate range, First Solar carries a fair value estimate of $138 per share. To read First Solar’s 16-page Stock Report (pdf), check out this link here. Alternative Fuels When the US Congress passed the recent omnibus spending package, that legislation included extensions for various green energy tax credits. The Alternative Fuels Tax Credit has been extended through 2021, a move that Clean Energy Fuels Corp (CLNE) noted in a December 2020 press release would be a big benefit for the renewable natural gas (‘RNG’) space. This subsidy provides a $0.50 per gallon tax credit for the use of qualified alternative fuels. Additionally, the omnibus spending legislation also extended the Alternative Fuel Vehicle Refueling Property Credit which is an investment tax credit for alternative vehicle refueling property. Clean Energy Fuels provides RNG to the transportation space under its Redeem brand. The company produces RNG by capturing biogenic methane that is created by organic waste sources and supplies its RNG via a network of ~540 fueling stations in the US and Canada. Shares of CLNE have surged higher since November 2020 due to expectations that the US federal government will provide more generous aid to its industry going forward, in our view. While Clean Energy Fuels has historically generated sizable GAAP operating losses, the firm generated ~$43 million in positive free cash flow during the first nine months of 2020. Gevo Inc (GEVO), which bills itself as an advanced biofuel and renewables chemicals company, has also seen its stock price surge higher during the past few months as the omnibus spending bill included provisions beneficial to the biofuel space (including a one-year extension for the tax credit covering the production of qualified second-generation biofuels). The firm makes products such as renewable gasoline, renewable diesel, sustainable aviation fuel, isobutanol and isobutylene, largely by converting existing facilities. Its goal is to provide the transportation industry with low-carbon fuels and the petrochemical space with inputs that can be used to make plastics products in a more sustainable way. Up in Luverne, Minnesota, Gevo has a facility that produces isobutanol using corn mash as a feedstock. Down in Silsbee, Texas, Gevo has a biorefinery that produces sustainable aviation fuel and isooctane from isobutanol. The company is also working on a wind farm near its Luverne facility through a partnership with Juhl Energy (JUHL) to reduce and eventually eliminate its need to utilize electricity generated by coal-fired power plants. Gevo notes that a direct transmission system will connect the wind farm to the facilities in Luverne. We caution that Gevo historically has generated sizable GAAP operating losses and negative free cash flows, prompting the firm to utilize large equity issuances to raise funds. Other firms that should benefit from expectations that the US federal government will continue to support the alternative fuel and power storage space include Plug Power Inc (PLUG) [involved in the production of hydrogen fuel cell systems], Bloom Energy Corp (BE) [involved in the production of solid oxide fuel cells that produce electricity on-site], FuelCell Energy Inc (FCEL) [focuses on providing enterprise-scale fuel cells for utility companies and other entities] and Ballard Power Systems Inc (BLDP) [focuses on providing fuel cells for vehicles, forklifts, trains, busses, marine vessels and backup power purposes]. Concluding Thoughts The green energy space is home to significant upside with opportunities across the board. Ameresco is focused on providing offerings in the realm of energy efficiency and green energy projects (usually smaller-scale endeavors). NextEra Energy and NextEra Energy Partners are focused on building out an enormous portfolio of utility-scale renewable energy power generation assets, namely solar plants and wind farms, while maintaining its nuclear power operations and investing in battery storage assets. This strategy is primarily supported by its various natural gas-fired power plants that along with its nuclear power plants acts as NextEra Energy’s core baseload operations. First Solar aims to become a major player in the PV solar modules and PV solar power systems space and offering O&M services provides it with another avenue for upside. Various alternative fuel companies, including Clean Energy Fuels and Gevo, aim to disrupt the transportation fuel space (Gevo also aims to disrupt the petrochemical space as well), assisted by recent favorable changes in the federal US tax code. We are keeping a close eye on the green energy and sustainable operations space. ----- Disruptive Innovation Industry – W, ZM, SPCE, ROKU, WORK, MNST, SAM, SPLK, PENN, VRSK, ICE, LULU, ETSY, DOCU, UBER, BYND, SFIX, CVNA, TER, GPN, PANW, VRSN, MELI, PRLB, FSLR, JD, CRSP Utilities (Large) Industry - AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, OKE, PCG, PPL, SO, XEL Utilities (Mid/Small) Industry - AEE, ALE, BIP, CNP, CMS, DTE, ES, LNT, MGEE, NFG, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC Related: AMRC, NEP, CLNE, GEVO, JUHL, PLUG, BE, FCEL, BLDP, TAN, ICLN, ACES, CNRG, XLU, RSG, UNG, AEP, REGI ----- Callum Turcan does not own shares in any of the securities mentioned above. Crispr Therapeutics AG (CRSP) and Vertex Pharmaceuticals Inc (VRTX) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Republic Services Inc (RSG) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Utilities Select Sector SPDR Fund (XLU) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

1 Comments Posted Leave a comment