Member LoginDividend CushionValue Trap |

Steris Ties the Knot with Cantel Medical

publication date: Jan 15, 2021

|

author/source: Callum Turcan

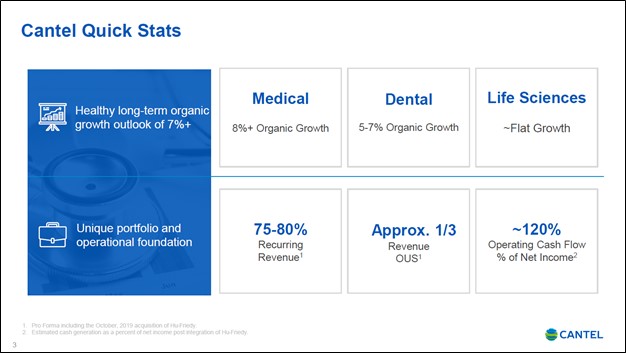

Image Shown: Cantel Medical Corp is getting bought out by Steris PLC through a cash-and-stock deal. The image up above highlights Cantel Medical’s promising long-term growth outlook, though its performance in 2020 was subdued due to headwinds created by the coronavirus (‘COVID-19’) pandemic. In our view, Steris was attracted to Cantel Medical’s improving outlook (the latter started to stage an impressive rebound in the second half of calendar year 2020) and the ability for the combined firm to generate substantial synergies. Image Source: Cantel Medical Corp – December 2020 IR Presentation By Callum Turcan On December 2, we highlighted (link here) the ongoing turnaround at Cantel Medical Corp (CMD) and noted that “we (thought) Cantel Medical is one for the radar of a risk-seeking investor” in that article. Cantel Medical focuses heavily on sterilization products that are used during medical (specifically endoscopy-related activities) and dental procedures along with providing related services. After the company reported its first quarter of fiscal 2021 (period ended October 31, 2020) earnings report on December 8, we followed up with another article (link here) that mentioned: As global health authorities work toward bringing an end to the COVID-19 pandemic, Cantel Medical’s outlook should continue to get brighter as elective surgeries slowly return to pre-pandemic levels. Though there are still meaningful short-term headwinds to consider, longer term, Cantel Medical’s cash flow growth trajectory looks quite promising. We are reiterating our prior view that Cantel Medical should continue to be on the radar of a risk-seeking investor. Deal Overview On January 12, Steris PLC (STE) announced it had reached an agreement with Cantel Medical to buy the company through a cash-and-stock deal worth ~$3.6 billion (~$4.6 billion when including the assumption of debt and convertible notes) that valued CMD at $84.66 per share based on the closing price of STE on January 11. The deal includes $16.93 in cash and 0.33787 share of STE for each share of CMD. Steris is heavily focused on sterilization products for hospitals and laboratories (it also provides related services). The company intends to fund the cash component of its deal for Cantel Medical with new debt issuance and committed bridge financing, which will also be used to refinance most of Cantel Medical’s existing debt. Shares of Cantel Medical have advanced ~38% (as of the end of normal trading hours January 13) from when we first wrote about the idea back in early December 2020. Even before the acquisition was announced, investors started to warm back up to the company due to expectations that the headwinds that held the firm back last year would start to dissipate this year. In our view, Steris’ acquisition of Cantel Medical is highly complementary. It appears Steris was optimistic that Cantel Medical’s long-term growth outlook remained bright even though the firm had a rough 2020.

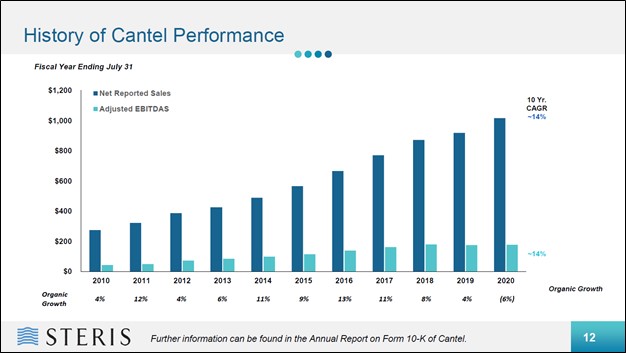

Image Shown: Cantel Medical has grown like clockwork, more or less, over the past decade. Image Source: Steris – Steris Acquiring Cantel Medical IR Presentation

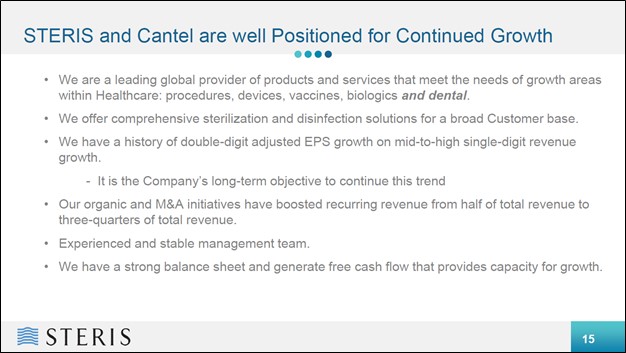

In the upcoming graphic down below, Steris highlights why the combined firm will be well-positioned to generate significant growth once the world emerges from the COVID-19 pandemic. The enlarged entity is supported by secular growth tailwinds as the market for sterilization products, disinfectant products and related services is likely to grow at a brisk pace going forward once elective surgeries resume in earnest (something that requires the COVID-19 pandemic to first be brought under control).

Image Shown: The growth outlook for Steris and Cantel Medical, as a combined entity, is bright according to Steris. Image Source: Steris – Steris Acquiring Cantel Medical IR Presentation Within the fourth year after closing, the duo expects the combined company will generate $110 million in annualized pre-tax synergies with half of those savings coming within the first two years. Savings are expected to be realized through “public company and back-office overhead [rationalized], commercial integration, product manufacturing, and service operations” and given the highly complementary nature of both companies, this strategy seems reasonable. The deal is expected to close by the end of Steris’ first quarter of fiscal 2022 (period ended June 30, 2021). Steris forecasts the deal will be accretive to its adjusted (non-GAAP) earnings in the first year after closing. For Steris, the company will be able to grow its medical portfolio by pushing into the endoscopy sterilization space while also entering a new market by adding dental sterilization operations to its corporate profile. Entering new markets enables Steris to extend and favorably augment its growth runway, while greater scale offers the firm the ability to improve its margins over the long haul. For Cantel Medical, the company’s shareholders receive a nice premium compared to where CMD was trading just a few months ago and now have the option to capitalize on the upside the combined firm could yield via the equity component of the deal, while also pocketing a decent chunk of cash. Key Considerations In November 2020, Steris completed its all-cash ~$850 million acquisition of Key Surgical (the ultimately purchase price was a tad lower when factoring in expected tax benefits). The company offered “sterile processing department, operating room and endoscopy” products. Steris is a serial acquirer as the firm aims to bulk up in a space full of significantly larger competitors. Cantel Medical completed its acquisition of Hu-Friedy, a “manufacturer of instruments and instrument reprocessing workflow systems serving the dental industry,” in October 2019. Industry consolidation is heating up in the sterilization product market for both medical and dental needs. Cantel Medical’s financial performance was hit hard by the COVID-19 pandemic, though the firm started to stage an impressive rebound during the second half of calendar year 2020. It raised its sales guidance a number of times last year, which is one of the reasons why we highlighted the firm back in December. [Please note equities are valued on their expected future performance, not their historical financial results; see video here.] To reiterate, stocks are not valued on a bad quarter or tough year, but on what kind of normalized financial performance they will be able to put up once the COVID-19 pandemic comes to an end. With vaccine distribution activities well underway in countries across the world, it appears global health authorities will be able to put an end to the COVID-19 pandemic sooner than expected. This will allow for medical and dental procedures, particularly elective procedures, to resume in earnest, which in turn supports the outlook for Cantel Medical’s future financial performance. Steris saw the potential in Cantel Medical’s improving outlook and the ample synergies the deal should be able to create given the highly complementary nature of their operations and decided to make a move. Concluding Thoughts Though our favorite ideas are included in the Best Ideas Newsletter (link here) and Dividend Growth Newsletter (link here) portfolios (please note we recently tweaked our Best Ideas Newsletter portfolio and those changes can be viewed here)--as well as the High Yield Dividend Newsletter portfolio and the Exclusive publication--we also highlight interesting names on our website via our articles. You can also use the Symbol search box in our website header to find what you are looking for. A number of months ago, we identified key reasons why shares of CMD were subdued and why the firm’s outlook was stronger that its trading performance at the time suggested. For those interested, our favorite healthcare plays include CRISPR Therapeutics AG (CRSP), Johnson & Johnson (JNJ), UnitedHealth Group Inc (UNH), Vertex Pharmaceuticals Inc (VRTX) and Health Care Select Sector SPDR Fund (XLV). Downloads CRISPR Therapeutics' 16-page Stock Report (pdf) >> Vertex Pharmaceuticals' 16-page Stock Report (pdf) >> UnitedHealth Group's 16-page Stock Report (pdf) >> UnitedHealth Group's Dividend Report (pdf) >> Johnson & Johnson's 16-page Stock Report (pdf) >> Johnson & Johnson's Dividend Report (pdf) >> ----- Health Care Bellwethers Industry - JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH Disruptive Innovation Industry – W, ZM, SPCE, ROKU, WORK, MNST, SAM, SPLK, PENN, VRSK, ICE, LULU, ETSY, DOCU, UBER, BYND, SFIX, CVNA, TER, GPN, PANW, VRSN, MELI, PRLB, FSLR, JD, CRSP Related (vaccine/treatment): MRNA, INO, NVAX, BNTX, APDN, VXRT, TNXP, EBS, PFE, JNJ, DVAX, IMV, IBIO, REGN, SNY, GSK, ABBV, TAK, HTBX, SNGX, PDSB, SRNE, SFOSF, CTLT Also Tickerized for OCPNF, OCPNY, BSX, FTV, ECL, GNGBF, GNGBY, BAX, FMS, XRAY, AMCR, DVA, HSIC, PDCO, CRSP, XLV ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment