Member LoginDividend CushionValue Trap |

REITs Will Likely Continue To Underperform

publication date: Nov 17, 2023

|

author/source: Brian Nelson, CFA

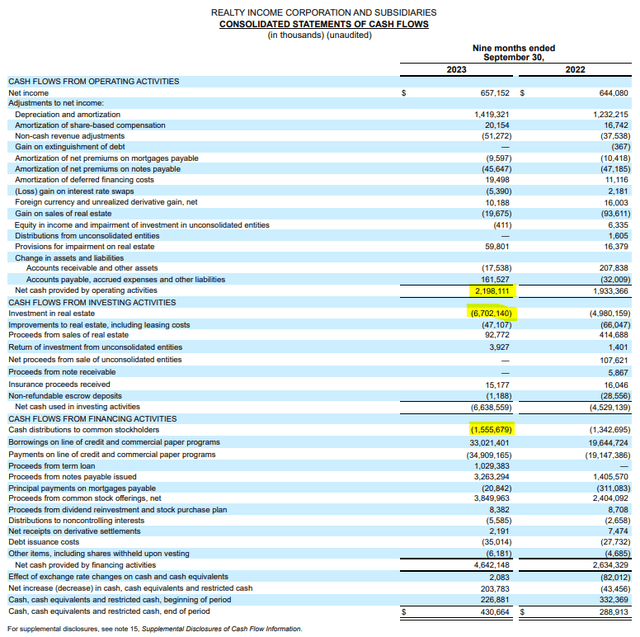

By Brian Nelson, CFA Stock prices and returns are in part a function of the cash-based sources of intrinsic value: net cash on the balance sheet and future expectations of free cash flow. Though there are many ways to slice and dice a company with respect to equity analysis, to arrive at an intrinsic value estimate of a firm, it generally comes down to these two important cash-based dynamics. Due to the nature of their business models, most REITs have lofty net debt positions, and many are investing in real estate at a pace that is faster than that which they are generating operating cash flow. One good example of the trouble brewing on many a REIT's cash flow statement is Realty Income (O). The company is investing at a pace that is multiple times its cash flow generation, while it continues to shell out growing dividends to shareholders. Though many REIT investors remain laser-focused on REIT-specific metrics, we think GAAP financials are more telling of an entity's financial position. Realty Income is spending three times as much on investments to real estate as it generates in operating cash flow, while it continues to shell out increasing dividends to shareholders. (Realty Income) With this dynamic clearly noted, the REIT sector, more generally, hasn't been a great source of reliable income either. According to S&P Global Market Intelligence, a handful of REITs cut their dividends in 2019: Medalist Diversified REIT Inc. (MDRR), Ashford Hospitality Trust, Inc. (AHT), Diversified Healthcare Trust (DHC), Uniti Group Inc. (UNIT), and Lexington Realty Trust (LXP). A half dozen more REITs slashed their payouts in 2018: New Senior Investment Group, Farmland Partners Inc. (FPI), LaSalle Hotel Properties, Franklin Street Properties Corp. (FSP), and Colony Capital, Inc. Another handful of REITs reduced their dividends in 2017: Bluerock Residential Growth REIT Inc., CBL Properties (CBL), CIM Commercial Trust (CMCT), Liberty Property Trust, and Columbia Property Trust Inc. Five additional REITs slashed their dividends in 2014 and 2015. Medical Properties Trust is a high profile REIT that recently cut its payout. (TradingView) The COVID-19 pandemic was quite telling of the fragility of REITs' business models, too. When the pandemic became widespread in 2020, dozens of REITs cut their dividends, and according to some estimates, more than 60 equity REITs and more than 30 mortgage REITs cut their dividends by the second quarter of that year. Even more REITs slashed their payouts toward the end of 2020, too, and Industrial Logistics Properties (ILPT) was another REIT that cut its payout in 2021. There were as many as six more REITs that cut their dividends during 2022, and how can readers forget the recent Medical Properties Trust (MPW) debacle. Investors seem to be asking for trouble with REITs, and they seemingly keep coming back for more and more pain, despite the sector's underwhelming dividend track records and considerable total return underperformance versus more attractive areas.

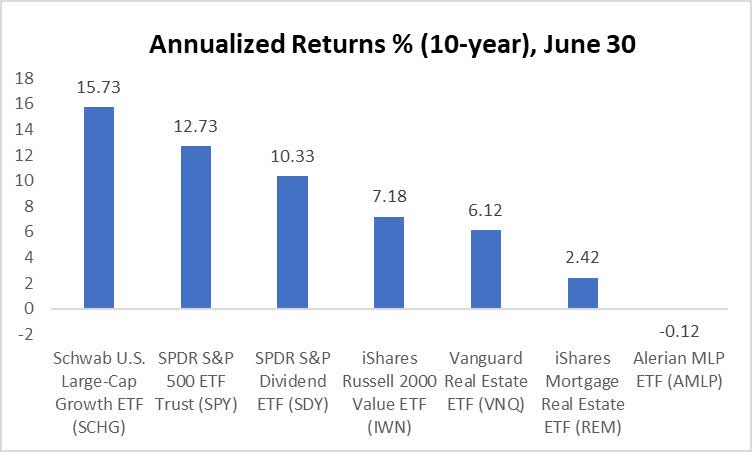

Investors focused only on the dividend have suffered underperformance the past 10 years. ((The respective ETF sponsors. Image generated by Valuentum.)) So why are the dividends of REITs so risky? Well, here’s what we write in every REIT Dividend Report that we publish: REITs pay out 90% of annual taxable income and therefore are unable to meaningfully reinvest internally-generated funds, resulting in external capital-market dependence. The weak internal cash-flow retention of most REITs translates into poor financial health, which could become severe during the depths of the real estate cycle. Even though a REIT's operating cash flow may be robust, the lack of cash accumulation on the balance sheet and the massive debt needed to purchase/develop new properties can become restrictive. To really hit these points home, here are a few important takeaways from Realty Income's latest Form 10-K that reiterates the risks of its dependence on the capital markets, both as it relates to future growth but also as it relates to the health of its payout, per its latest filing:

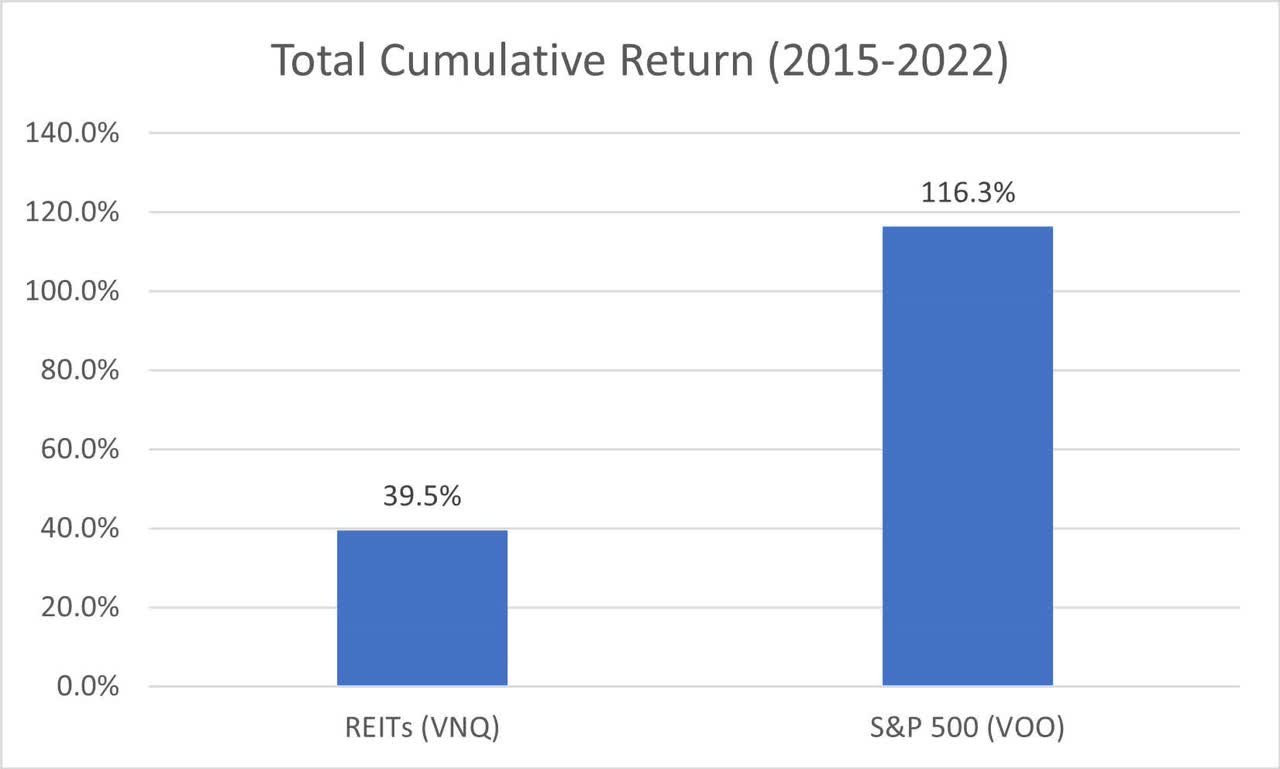

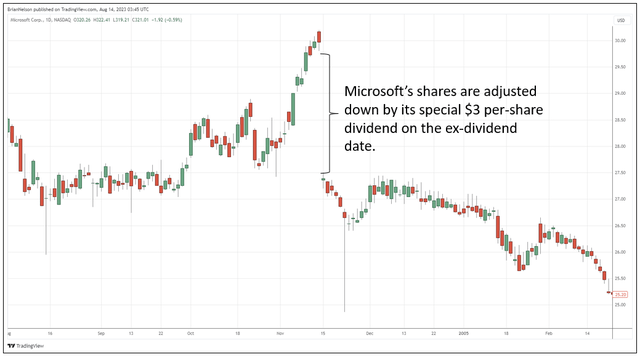

From a structural standpoint, REITs are significantly more at risk of cutting their payouts than corporate entities, which have the all-important choice of retaining significant net cash on their balance sheets. Prudent corporate entities are able to manage their payouts such that traditional free cash flow, as measured by cash flow from operations less all capital spending, can comfortably cover the dividend year in and year out, too. REITs are hindered in this regard, no matter if a REIT uses triple net leases or is benefiting from favorable secular growth trends. We love dividend-paying entities with strong net cash positions and that generate traditional free cash flow in excess of cash dividends paid. As many investors can attest that have experienced a dividend cut from one or several REITs in their portfolios, assessing the health and sustainability of a REIT's dividend is much more complicated than that of a corporate. From our standpoint, the health of a REIT relies most heavily on an assessment of external capital market conditions through the course of the economic cycle and the REIT's credit quality--the willingness for the capital markets to keep funding the REIT's initiatives. Likely in part because of these reasons and more, REITs just haven't been good to investors for a long time, and we don't expect that to change anytime soon. Quite simply, REITs are hindered by structural dynamics that may make them less attractive than other areas of the economy. REITs have not performed as well as some may have thought. (The respective ETF sponsors (Image provided by Valuentum)) With the understanding of the unique risks of REIT dividends, we think it's also important that REIT investors understand what a dividend is and what a dividend isn't. The dividend itself should be viewed as capital appreciation that otherwise would have been achieved had the dividend not been paid. In the total return calculation, this is why it is vital to add back dividends to capital appreciation. As outlined in what is called the free dividends fallacy, if you have a $10 stock, and it pays $1 in dividends, you don't have a $10 stock and a $1 in dividends, you have a $9 stock and a $1 in dividends. Dividends are not additive like bond coupons, but rather the stock price is adjusted downward by the amount of the dividend on the ex-dividend date. When a company announces a dividend, its share price is reduced by the amount of the dividend on the ex-dividend date. (TradingView) This article clearly explains that REIT dividends are risky and showcases that REIT investors have missed out on a lot of total return during the past decade or so. One has to go back a long time to see any real return from REITs, and changing working and shopping habits will likely continue to punish the broader REIT sector. We view REITs as a game of financial leverage tied to the vicissitudes of the commercial real estate cycle, all for a dividend yield that approximates that of risk-free assets these days. REITs seem to have a large following these days and many will come to the defense of REITs in their own way, but from a bird's eye view of this market, we remain puzzled by the love affair some have for them. We can only posit that some have a myopic focus on REIT-specific metrics, are not getting the best information when it comes to capital-market dependence risk, and perhaps don't truly understand the structural dynamics of the dividend payment with respect to the free dividends fallacy (i.e. that a REIT's share price is adjusted downward by the amount of the dividend on the ex-dividend date).

In our view, the structural dynamics that have hurt REITs for the past decade won't be going away anytime soon, and for investors looking to maximize their returns and the longevity of their retirement savings, there are much better options than REITs. ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Tickerized for various REITs. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and range. |

0 Comments Posted Leave a comment