Member LoginDividend CushionValue Trap |

Qualcomm’s Growth Trajectory Is Impressive and Supported by Numerous Secular Trends

publication date: Dec 28, 2020

|

author/source: Callum Turcan

Image Source: Qualcomm Inc – 2019 Analyst Day Presentation By Callum Turcan There is a lot to like about Qualcomm Inc (QCOM), especially after the company reached a truce with Apple Inc (AAPL) in 2019 and resolved a dispute with China’s Huawei in 2020. Both agreements involved Qualcomm signing long-term licensing deals with those companies. The firm has a dominant position in cellular 5G modem and radio frequency (‘RF’) technology, and we don't expect this lucrative industry position to change anytime soon. Qualcomm is a holding in Valuentum's Dividend Growth Newsletter portfolio thanks to its strong competitive advantages, healthy balance sheet, asset-light operations, considerable free cash flow generating capacity, and of course, its long-term dividend growth potential. Qualcomm's shares yield ~1.8% at the time of this writing. The Dividend Growth Newsletter portfolio is where some of our favorite dividend growth ideas can be found. Qualcomm is not yet a Dividend Aristocrat, a company that has raised its dividend for 20-25 consecutive years, but it has all the makings of eventually becoming one. See our reports on Dividend Aristocrats here >>

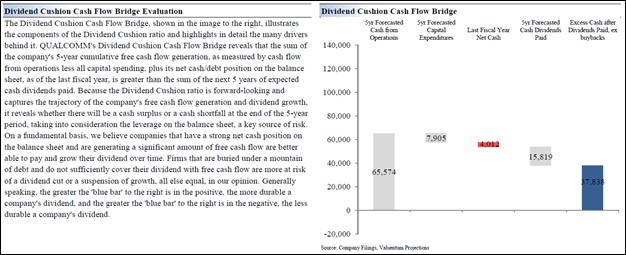

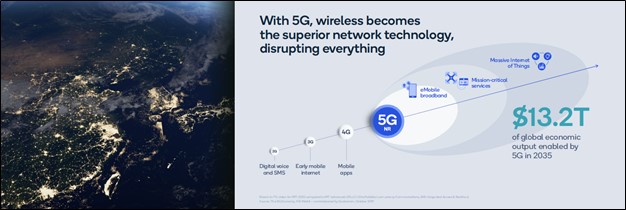

Image Shown: Qualcomm is well-positioned to capitalize on the ongoing rollout of 5G technologies and 5G wireless networks worldwide. Image Source: Qualcomm – 2019 Analyst Day Presentation Background on Recent Developments Recently, shares of Qualcomm faced headwinds after news broke a couple weeks ago that Apple is reportedly considering designing its own cellular modems in-house. Many investors grew concerned about this development, but we emphasize that Qualcomm has considerable know-how and technical capabilities that have been enhanced and refined over years that won't easily be matched by early iterations of new rivals or even ones of established entities. For some context, Qualcomm spends an enormous ~25% of its annual revenue on research & development (R&D) to stay ahead of rivals and capitalize on new industry trends. In our view, it would be hard for any company that makes smartphones (even behemoths such as Apple) to not utilize Qualcomm’s technology in order to still deliver top tier performance. Qualcomm’s recent deals with Apple and Huawei are a testament to Qualcomm’s prowess in this space. Even if major smartphone makers such as Apple start to design their own in-house chips, those companies will likely need to continue to license Qualcomm’s technology given Qualcomm's technical experience and continued strides in innovation thanks to its massive annual R&D spend. As an aside, we like both Apple and Qualcomm--not one or the other. Apple’s outlook is bright regardless of how successful its efforts are in developing in-house modems (should Apple be successful on this front, that would be entirely incremental to its fair value estimate). We recently wrote about Apple here. We like Qualcomm as well. Our fair value estimate for Qualcomm sits at $164 per share, comfortably above where QCOM's shares are trading as of this writing. Qualcomm's 16-page stock report and its Dividend report can be downloaded here and here, respectively (both are pdf downloads). For some background, we added shares of Qualcomm to the Dividend Growth Newsletter portfolio November 27 (link here) given its impressive dividend growth outlook, which is underpinned by its high-quality cash flow profile and strong balance sheet. Qualcomm earns an “EXCELLENT” Dividend Safety rating as the firm has a nice 3.4 Dividend Cushion ratio, which factors in our expectations that the company will meaningfully grow its per-share payout going forward. The upcoming graphic down below provides a visual overview of Qualcomm’s Dividend Cushion ratio. This proprietary metric is derived by adding a company's cumulative forecasted future free cash flows over the next five full fiscal years, less its net debt position (excluding short-term debt), divided by its expected cumulative cash dividend obligations during this period. We believe the Dividend Cushion ratio is much more informative than the traditional dividend payout ratio (see here).

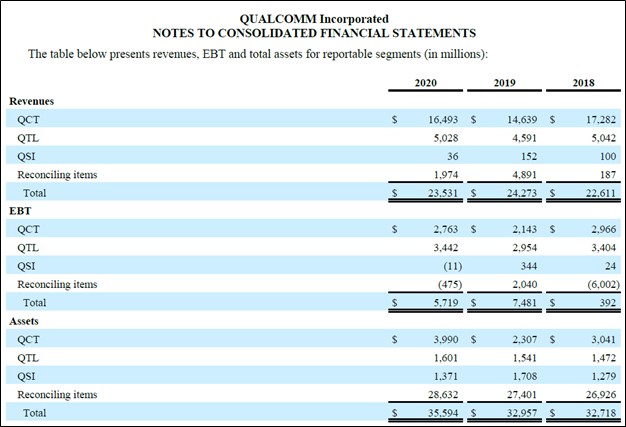

Image Shown: Qualcomm’s forward-looking dividend coverage is rock-solid and supports our forecasts that the firm will steadily grow its payout over the coming fiscal years. Covering Qualcomm’s Business Profile Qualcomm has two primary business operating segments, Qualcomm CMDA Technologies (‘QCT’) and Qualcomm Technology Licensing (‘QTL’). The former develops and supplies semiconductors for mobile devices, broadband gateway equipment, automobiles, consumer electronic devices, wireless networks, and various Internet of Things (‘IoT’) devices using 3G/4G/5G technologies and other technologies. The latter licenses out Qualcomm’s intellectual property (‘IP’) from its vast portfolio, which includes patents that are essential in supporting certain wireless operations. Combined, QCT and QTL have historically represented 80%-90% of Qualcomm’s annual revenue (they accounted for over 90% in fiscal 2020). For reference, Qualcomm’s fiscal year has historically ended in late September. Image Source: Qualcomm's fiscal 2020 10-K. The company’s 'Qualcomm Strategic Initiatives' business operating segment makes strategic investments, largely through its 'Qualcomm Ventures' unit, which focuses on early stage companies mainly in the artificial intelligence (‘AI’), automotive, digital healthcare, IoT, mobile, enterprise, networking, and other realms. Generally speaking, these are investments in non-marketable equity securities and convertible debt instruments, though occasionally these companies go public, so this segment of Qualcomm also holds (from time to time) some marketable securities as well. According to the company, Qualcomm Ventures “intend[s] to pursue various exit strategies for each of our QSI investments in the foreseeable future.” Additionally, Qualcomm Government Technologies (‘QGOV’) and Qualcomm’s cloud AI inference processing initiatives represent some of the company’s other significant operations. QGOV “provides development and other services and sells related products to U.S. government agencies and their contractors” though not much is made public concerning these operations (by design as this is a nonreportable segment of Qualcomm’s, likely for strategic/confidential purposes). Historical Financial Overview Though most of Qualcomm’s revenues have historically been generated from its QCT segment and that will likely continue to be the case going forward, the company’s QTL segment has historically been the single largest source of its operating income generation. Going forward, considering the licensing deals Qualcomm recently struck with Apple and Huawei, Qualcomm’s QTL segment should continue to put up solid results. The upcoming graphic down below highlights Qualcomm’s segment-level financial performance during the past few fiscal years.

Image Shown: Qualcomm’s licensing business is incredibly lucrative, which is why its QTL segment is the firm’s single-largest source of operating income. Image Source: Qualcomm – Fiscal 2020 Annual Report From fiscal 2018 to fiscal 2020, Qualcomm’s annual free cash flow averaged ~$4.6 billion while its annual dividend obligations stood near $2.9 billion in fiscal 2020. The firm’s modest capital-expenditure requirements, made possible through its asset-light operations, enhances its ability to continue to generate strong free cash flows. Qualcomm tends to spend a significant amount of money buying back its stock, which could weigh on the pace of its dividend growth going forward, but we're not too worried about this discretionary headwind (we expect dividend growth to be robust in coming years). Qualcomm’s dividend coverage is rock-solid on a forward-looking basis, too, given its promising outlook as it concerns the company’s future free cash flows and balance sheet health. At the end of fiscal 2020, Qualcomm had a net debt position of $4.5 billion (inclusive of current marketable securities and short-term debt). We view the firm’s net debt load as manageable given Qualcomm’s ample liquidity on hand ($11.2 billion in cash-like items on the books as of the end of fiscal 2020), strong free cash flow generating abilities and its apparent ability to tap capital markets at attractive rates (which will support its future refinancing activities). Qualcomm issued $1.2 billion in unsecured 2.15% notes due May 2030 and $0.8 billion in unsecured 3.25% notes due May 2050 this past May, indicating the firm retains access to debt markets at favorable rates. Additionally, given its strong stock price performance of late, Qualcomm has ample access to equity markets as well (if needed). The company completed various refinancing activities in August 2020 that improved Qualcomm’s maturity schedule (exchanging longer dated maturities for existing notes and repurchasing debt that was not exchanged but part of the relevant tranche), moves that which we appreciate. On a final note, Qualcomm recently entered into a ~$4.5 billion unsecured revolving credit line that matures December 2025 to meet its near-term liquidity needs. Continued Bright Growth Outlook In November 2020, Qualcomm and DISH Network Corp (DISH) announced a new partnership that involves testing Qualcomm’s new 5G radio access network (‘RAN’) platforms. The goal is to speed up the rollout of DISH Network’s “Open RAN-compliant 5G network” as DISH Network is now a meaningful player in the US telecom industry after acquiring Boost Mobile in July 2020 for $1.4 billion. DISH Networks also acquired Ting Mobile in August 2020 to further grow its wireless customer base, which stood just north of 9.4 million as of September 30, 2020. Qualcomm’s management team had this to say on the issue during the firm’s fourth quarter of fiscal 2020 earnings call (emphasis added): “Building on our modem and RF expertise, we recently announced our new 5G RAN platform offerings. These platforms will provide foundational technology for high-performance infrastructure and will accelerate the cellular ecosystem transition towards virtualized and interoperable Radio Access Networks, a trend driven by 5G. Our expanded portfolio which is scalable from macro to micro sites will include integrated support for 5G millimeter wave and sub-6 gigahertz spectrum across all key global bands. Together with our partners, we are helping to drive the vRAN transition with commercial products expected by calendar year 2023.” --- Steve Mollenkopf, CEO of Qualcomm We appreciate that Qualcomm places a great emphasis on innovation. Generally, Qualcomm spends ~25% of its annual revenue on R&D, and we view these investments as a good decision. Skimping on R&D investments simply to boost near-term results, especially in a hypercompetitive industry like the one Qualcomm operates in, can eventually lead to serious consequences (including technological irrelevancy/obsolescence). Here is another key comment from management given during Qualcomm’s fourth quarter of fiscal 2020 earnings call (emphasis added): “As you can see in our results, we have successfully commercialized our innovation leadership in our product business through a combination of higher dollar share of content combined with significant 5G design wins with leading OEMs [original equipment manufacturers] around the world. Our foundational 5G innovations unmatched patent portfolio and ecosystem collaborations enable us to drive the industry forward to facilitate the rapid global adoption of 5G. Our continued innovation drive success and stability in our licensing business. All major handset OEMs are under license and we now have over 110 5G agreements.” --- CEO of Qualcomm Qualcomm’s growth outlook is incredibly promising and fiscal 2021 could prove to be a great year for the firm as consumers begin to adopt 5G-capable smartphones. Management provided guidance for the first quarter of fiscal 2021 that calls for significant non-GAAP revenue growth and non-GAAP diluted EPS growth on a sequential basis. Farther out, Qualcomm is optimistic that 5G adoption will take off in earnest around the world due to the vast technological improvements 5G technology offers over 4G technology. The rise of the IoT trend and the emergence of technologies that were not previously viable before 5G will create new growth opportunities for Qualcomm to capitalize on over the long haul.

Image Shown: The emergence of 5G technologies and the ongoing rollout of 5G wireless networks worldwide will create new opportunities for Qualcomm to capitalize on that did not existing a decade ago. Qualcomm’s growth runway is enormous with multiple avenues for upside. Image Source: Qualcomm – 2019 Analyst Day Presentation Potential Automotive Upside The company is interested in how the emergence of 5G technologies will improve its automotive business, keeping in mind cars, trucks, and SUVs have significantly more computing power now than they did just a decade ago (made possible by these vehicles containing far more chips now than they did a decade ago). Looking ahead, automobiles will likely continue to include a greater amount of semiconductor components within them, favorably augmenting Qualcomm’s growth runway on this front. For instance, self-driving and assisted-driving passenger cars could include components (such as 5G modems) that along with the related software could allow those vehicles to “communicate” with other automobiles to build a virtual grid of the region to optimize travel routes, minimize accidents, and improve traffic (the emergence of 5G technology makes smart-cities a possibility in the future). These components could also be included within vehicles for commercial purposes, such as trucking fleets and other vehicles used in the logistics industry. Qualcomm’s offerings in the near term will allow for automobiles to provide increasing amounts of assisted-driving features, safety features, and other features that improve the driving experience. The company’s chips are also used for infotainment purposes among other things.

Image Shown: Qualcomm is excited by the various opportunities that its automotive business will be able to capitalize on going forward. Image Source: Qualcomm – 2019 Analyst Day Presentation Concluding Thoughts Qualcomm offers dividend growth investors a way to play the rollout of 5G technologies and other nascent technologies worldwide, along with technologies that do not exist yet but could be made viable by the ongoing rollout of 5G wireless networks. We like Qualcomm’s business model, and we view the company as well-positioned to capitalize on numerous secular growth tailwinds. Beyond the recent launch of several 5G-capable smartphones by various companies, its automotive business offers Qualcomm ample upside potential. Additionally, we are intrigued by the opportunities created by the IoT trend and the firm’s AI-related investments. Concerns over competitive threats to Qualcomm’s modem business are not to be viewed lightly, though the company has many technical competitive advantages (know-how) derived from years of development and remains a leader in its field. As long as Qualcomm continues to innovate, made possible through its meaningful R&D investments, its product offerings and expansive IP portfolio should continue to remain in high demand. The company’s dividend growth trajectory is supported by its stellar cash flow profile and relatively strong balance sheet. Shares of QCOM yield ~1.8% as of this writing. ----- Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT Tickerized for QCOM, AVGO, DISH, INTC, AMD, MU, AMAT, LRCX, KLAC, TSM, SWKS, CRUS, QRVO, SYNA, STM, MKSI, CREE, LITE, JBL, IDCC, KN, GLW, ON, AMBA, MDTKF, SSNLF, WDC, SOXX, SMH ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc Class C shares (GOOG), Facebook Inc (FB), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Qualcomm Inc (QCOM) and Oracle Corporation (ORCL) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment