Member LoginDividend CushionValue Trap |

Public Storage Continues to Shine

publication date: Nov 10, 2020

|

author/source: Callum Turcan

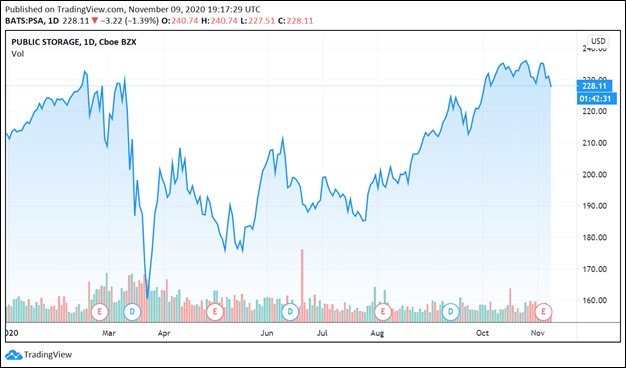

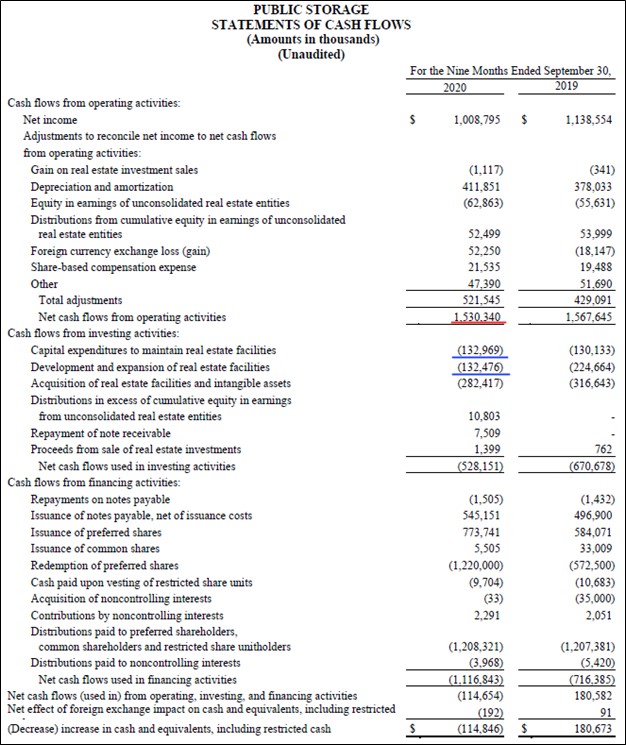

Image Shown: Shares of Public Storage have recovered from the depths of the COVID-19 pandemic and have been on an upward climb over the past few months. By Callum Turcan On November 4, Public Storage (PSA) reported earnings for the third quarter of 2020. As expected, headwinds created by the coronavirus (‘COVID-19’) pandemic weighed on its financial performance during this period; however, that did not stop the self-storage real estate investment trust (‘REIT’) from being very free cash flow positive. The long-term outlook for the self-storage industry in metropolitan areas in the US and elsewhere remains quite promising given the desire for households to maximize living space within their housing unit at a given budget. We include shares of Public Storage in our High Yield Dividend Newsletter portfolio and shares of PSA yield 3.5% as of this writing. Financial Update During the first nine months of 2020, Public Storage generated almost $1.3 billion in free cash flow (defining capital expenditures here as ‘capital expenditures to maintain real estate facilities’ and ‘development and expansion of real estate facilities’) while spending a little over $1.2 billion covering its payout obligations (including $1.2 billion in ‘distributions paid to preferred shareholders, common shareholders and restricted share unitholders’ and a negligible amount of ‘distributions paid to noncontrolling interests’). Unlike most REITs, REITs operating in the self-storage space can generate sizable free cash flows due to the relatively capital-light nature of self-storage properties. The upcoming graphic down below highlights Public Storage’s high quality cash flow profile.

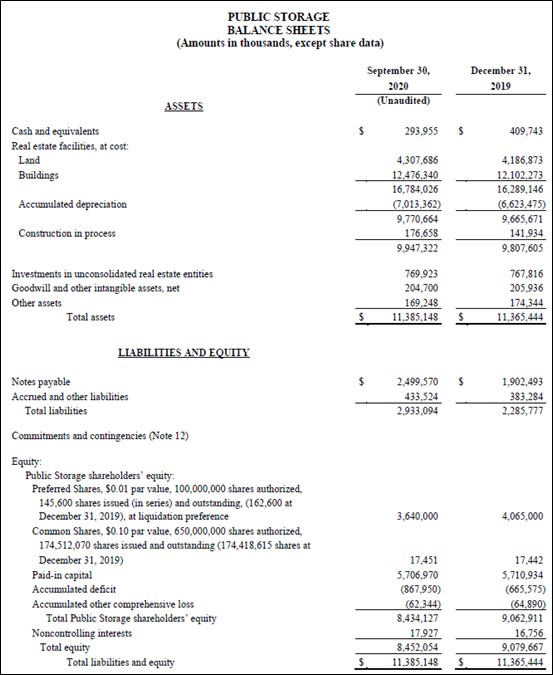

Image Shown: Public Storage’s net operating cash flows are underlined in red and its capital expenditure line-items are underlined in blue in the graphic up above. Image Source: Public Storage – 10-Q SEC filing covering the third quarter of 2020 with additions from the author Pivoting to Public Storage’s balance sheet, the REIT has historically retained a nice amount of cash and cash equivalents on hand to meet its liquidity needs (Public Storage’s cash and cash equivalents balance stood at $0.3 billion at the end of September 2020). Additionally, Public Storage has a $0.5 billion revolving credit facility that matures in April 2024, which provides it with additional access to liquidity. Like almost all REITs, Public Storage still has a sizable net debt load, which stood at $2.2 billion (inclusive of short-term debt) at the end of September 2020. Here we would like to stress that Public Storage must retain access to capital markets at all times in order to refinance its debt load, fund acquisitions, and continue to make good on its payout obligations. In October 2020, Public Storage issued out roughly $0.3 billion in preferred equity (11.3 million depositary shares that each represented 0.001 share of its 3.875% Series N Preferred Shares) after the third quarter ended. Also, please note that after the third quarter ended, Public Storage acquired 54 self-storage facilities with 4.9 million net rentable square feet for approximately $0.7 billion. Given that Public Storage generates meaningful free cash flows and has ample liquidity on hand, we view the REIT retaining quality access to capital markets at attractive rates going forward. Public Storage retains a top-notch ‘A-rated’ investment grade credit rating (A/A2).

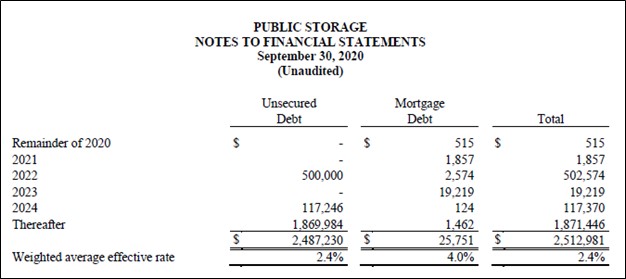

Image Shown: Public Storage has a meaningful net debt position, though its cash and cash equivalents on hand helps the REIT manage its near-term liquidity needs. Image Source: Public Storage – 10-Q SEC filing covering the third quarter of 2020 In the upcoming graphic down below, Public Storage provides an overview of its debt maturity schedule, specifically for its ‘notes payable’ balance. The REIT does not have a significant amount of debt coming due until 2022 at the earliest, putting Public Storage in a prime position to ride out the storm caused by the COVID-19 pandemic.

Image Shown: We are big fans of Public Storage’s staggered debt maturity schedule. Image Source: Public Storage – 10-Q SEC filing covering the third quarter of 2020 Operational Update In the third quarter of 2020, Public Storage’s core funds from operations (‘FFO’) came in at $2.28 per diluted common share, down from $2.76 per diluted common share in the same period in 2019. This was partially due to the REIT’s same store facilities (properties that have been in Public Storage’s portfolio long enough to provide meaningful comparison data) reporting a ~4% year-over-year decline in net operating income (‘NOI’) as the pandemic led to an increase in operating costs and a decrease in revenues, though we see these headwinds as transitory. Going forward, the resumption of normal business activities, including rental rate increases and normal delinquency processes, should result in a significant improvement in Public Storage’s financial performance. Public Storage’s square foot occupancy rate (for what appears to be at its same store facilities) stood at 95.5% in the third quarter of 2020, up from 94.2% in the same quarter last year. That may partially be due to the inability to go through the normal delinquency process in some jurisdictions, but to be clear, this also highlights the strength of Public Storage’s business model. Households in relatively expensive metropolitan areas need additional space to maximize the living area their housing unit provides (whether that be an apparent, townhouse, condo, multi-family unit, or standalone home), and self-storage options are (generally speaking) the cheapest way to maximize that space. Concluding Thoughts We continue to be big fans of self-storage REITs and include our favorite names in the space in our High Yield Dividend Newsletter portfolio. Public Storage’s high quality cash flow profile and promising long-term growth runway underpins our favorable view on the name, and looking ahead, we see room for significant dividend increases. In our view, Public Storage should be able to maintain its payout obligations going forward. To read why we are big fans of CubeSmart (CUBE), another self-storage REIT, please check out this article here. On a final note, recent news from Pfizer Inc (PFE) and BioNTech SE (BNTX) regarding favorable interim data from the Phase 3 clinical trial testing out their COVID-19 vaccine candidate could mean a safe and effective COVID-19 vaccine can get rolled out worldwide starting in late-2020 or early-2021. That in turn would help get the global economy back on track while saving millions of lives in the process. We are closely monitoring these events as the venture gets closer to seeking regulatory approval for their COVID-19 vaccine candidate. ----- Related: UHAL, CAR, PSA, R, URI, CUBE, EXR, JCAP, VNQ, PSTG, SPY, PFE, BNTX ---- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares of any of the securities mentioned above. CubeSmart (CUBE), Public Storage (PSA), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment