Member LoginDividend CushionValue Trap |

Philip Morris International is Ready to Ride Out the Storm

publication date: Apr 29, 2020

|

author/source: Callum Turcan

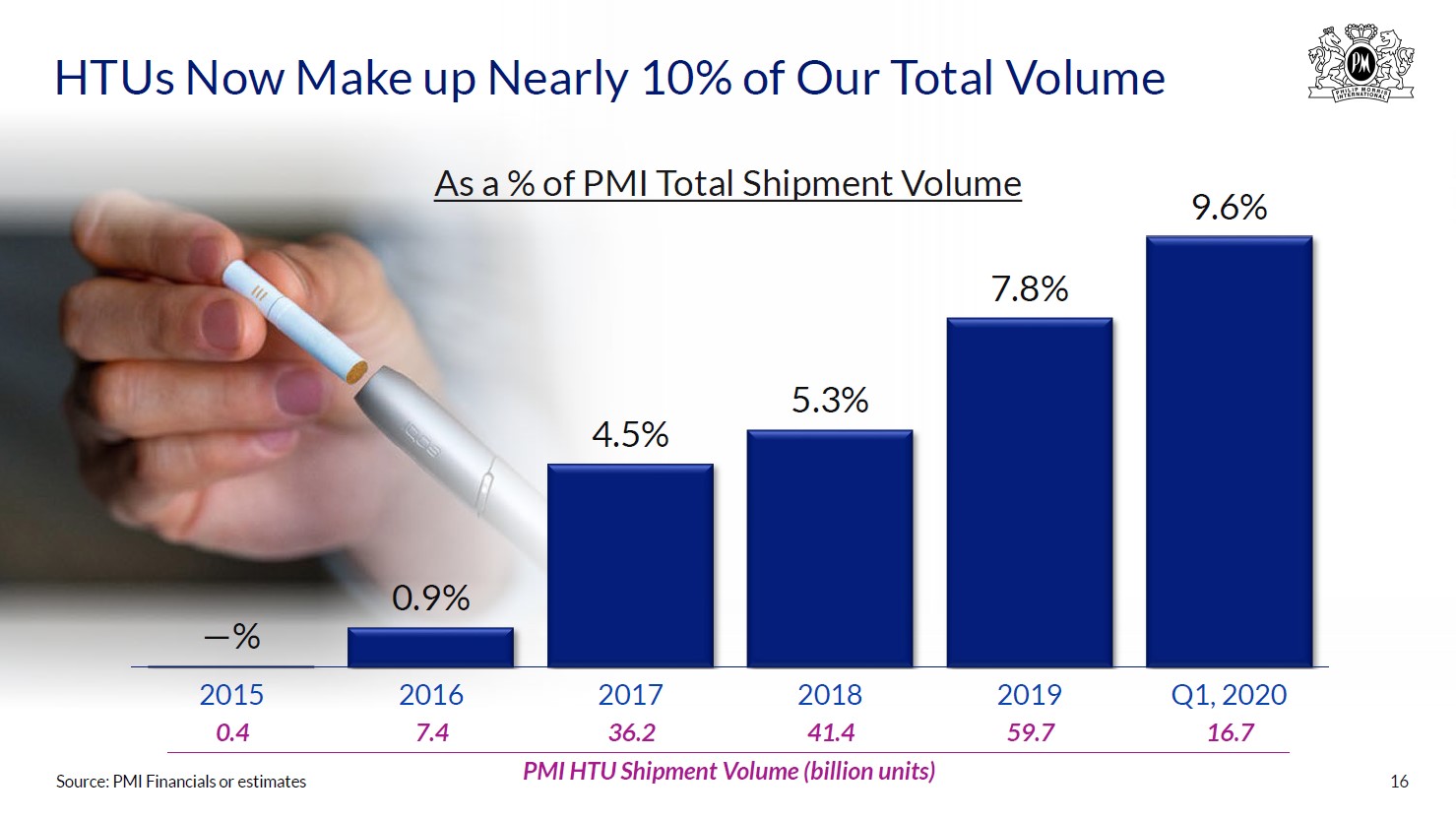

Image Source: Philip Morris International Inc – First Quarter of 2020 Earnings IR Presentation By Callum Turcan On April 21, High Yield Dividend Newsletter portfolio holding Philip Morris International Inc (PM) reported first-quarter earnings for 2020 which beat both top- and bottom-line consensus estimates. Shares of PM currently yield ~6.1% as of this writing, and we view that payout as well-covered given the resilience of Philip Morris International’s free cash flows and business model (demand for tobacco and tobacco products is inelastic), along with the firm’s ability to tap its revolving credit lines and potentially debt markets if needed. Management pulled the firm’s full-year guidance for 2020 and instead offered guidance for the second quarter, given the lack of clarity over macroeconomic conditions in light of the ongoing coronavirus (‘COVID-19’) pandemic. Quarterly Overview The pandemic will hurt Philip Morris International’s performance in the near term due to the negative impact COVID-19 and the slowdown of the global economy are having on disposable incomes. Historically, Philip Morris International has been extremely effective at raising prices on its products to offset secular demand declines for cigarettes (in particular, the negative effect lower cigarette volumes can have on the firm’s financial performance). Keeping the deconsolidation of its Canadian subsidiary Rothmans, Benson & Hedges (‘RBH’) in mind, which we covered in great detail in this note here, Philip Morris International was able to push through a 7.7% year-over-year increase in its combustible tobacco pricing last quarter with COVID-19 having just a tiny impact on its ability to do so. However, going forward that will likely change in the short-term. In the long run, Philip Morris International should retain its ability to push forward with meaningful price increases given its strong brand power and the relative inelastic demand curves of tobacco products. Last quarter, the company’s cigarette shipment volumes were down 4.4% while its heated tobacco unit (‘HTU’) shipment volumes were up 45.5% on a year-over-year basis, allowing for its total cigarette and HTU shipment volumes to slip by just 1.2% year-over-year. Heated tobacco offerings like IQOS (which does not stand for anything) are becoming increasing popular worldwide and offer a way for Philip Morris International to mitigate secular demand declines for traditional cigarettes. When removing the negative impact from the deconsolidation of RBH, Philip Morris International’s total cigarette and HTU shipment volumes moved lower by just 0.6% year-over-year last quarter. Even more importantly, HTUs now make up almost 10% of Philip Morris International’s total shipment volumes, a figure that has grown substantially since 2015 when HTUs made up less than 1% of its total shipment volumes, as you can see in the upcoming graphic down below.

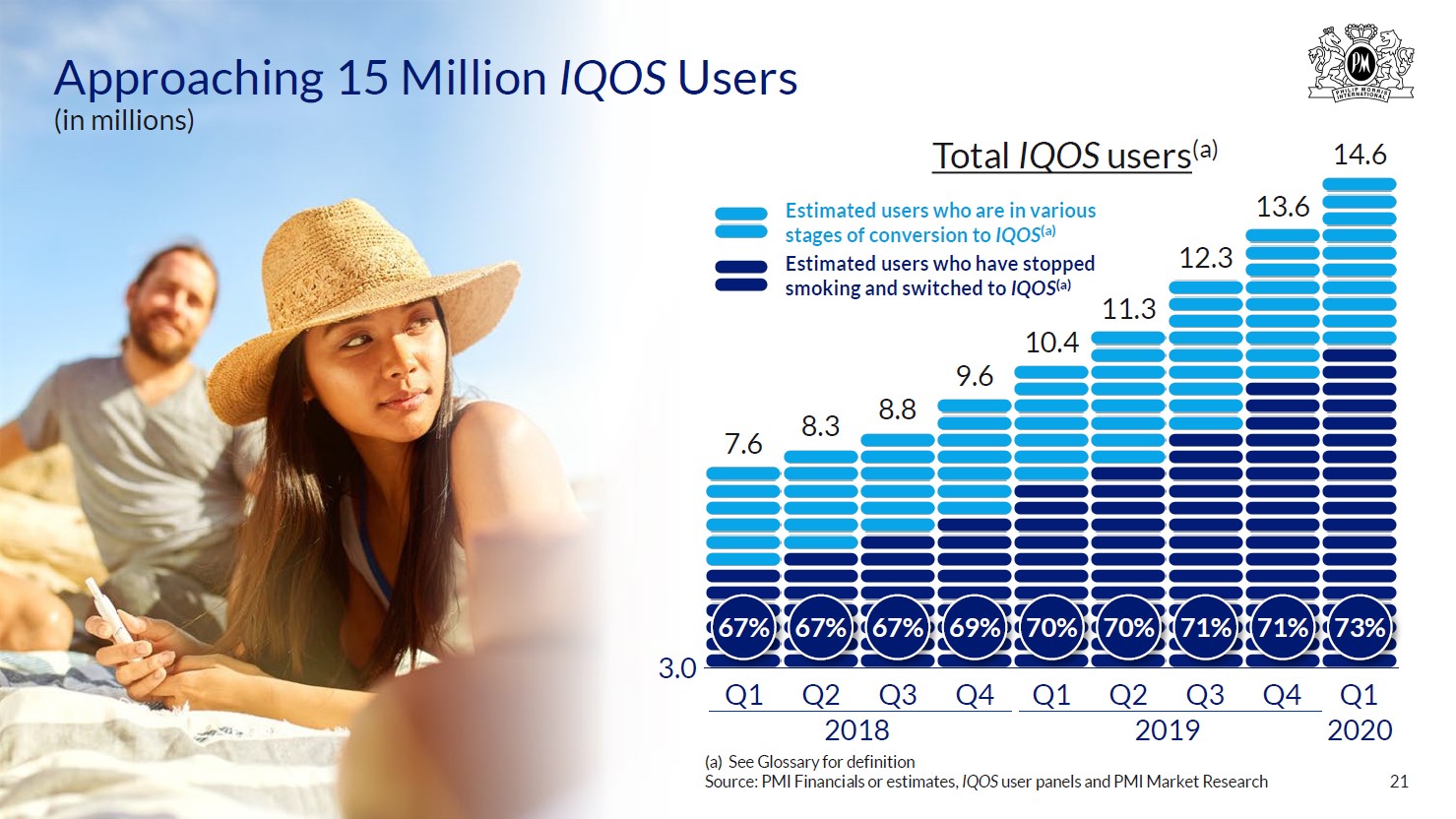

Image Shown: Philip Morris International is leaning on HTUs to offset secular demand declines for its traditional cigarette offerings. Image Source: Philip Morris International – First Quarter of 2020 Earnings IR Presentation While Philip Morris International is marketing its IQOS product in numerous markets worldwide, in the US the firm is working with Altria Group Inc (MO) to market the product, which for reference, launched in the US last year. So far, the product has had a decent amount of success, keeping in mind that COVID-19 is likely to slow those efforts in the near term in the US and elsewhere (according to management commentary within Philip Morris International’s earnings report). In the upcoming graphic down below, please note the growing popularity of Philip Morris International’s IQOS offering. Over time, products like IQOS should allow for HTUs to continue growing as a percentage of Philip Morris International’s total shipment volumes, offsetting volume declines at its traditional cigarette offerings which in turn supports the company’s cash flow outlook. Philip Morris International is now seeking regulatory approval from the US Food and Drug Administration (‘FDA’) to sell its IQOS 3 heated tobacco device in the US, having already won regulatory approval to sell other versions of its IQOS device in the country.

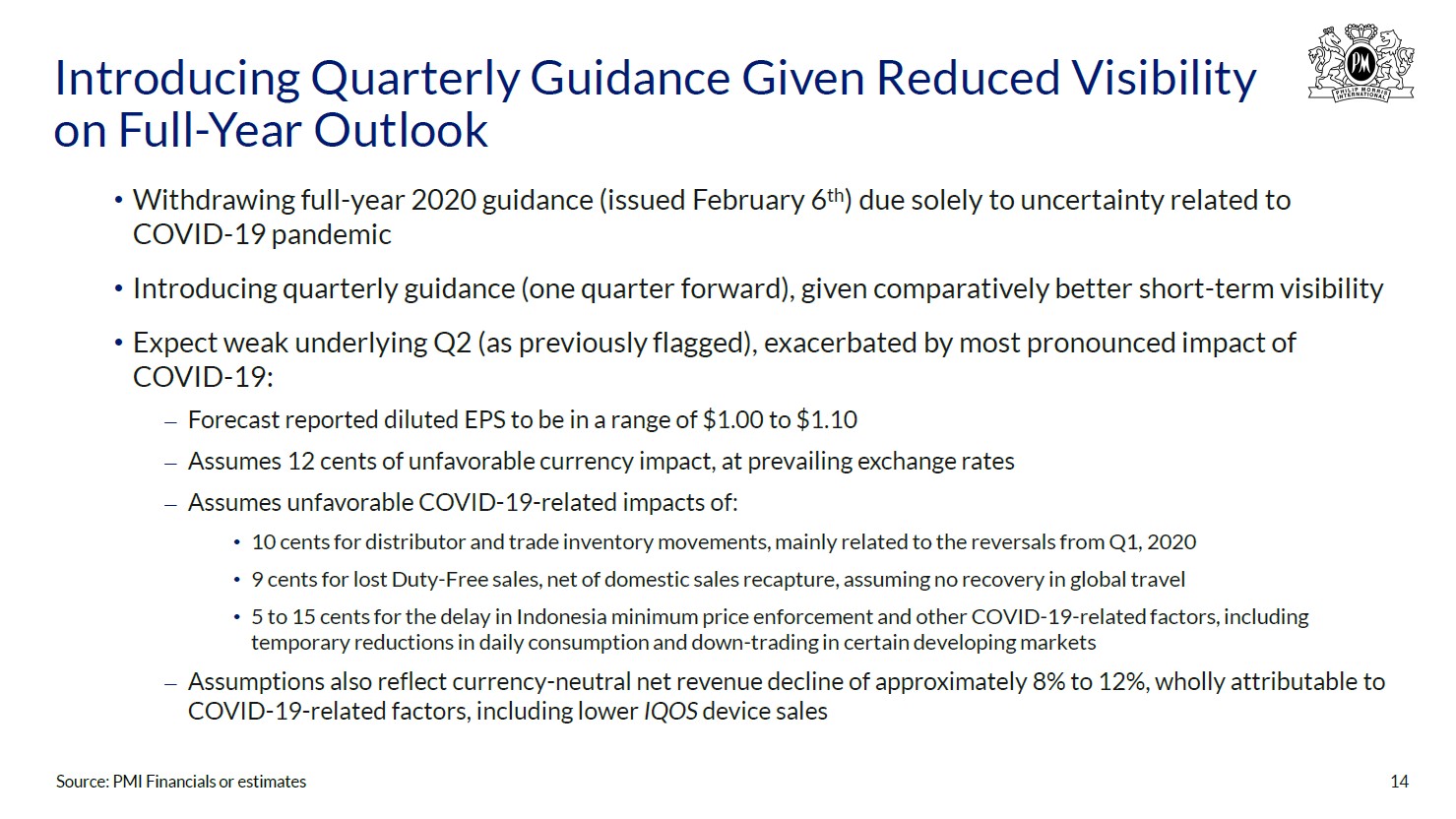

Image Shown: Philip Morris International’s IQOS product is experiencing nice adoption levels worldwide, and there’s ample room for that adoption rate to continue climbing higher now that Altria is marketing the offering in the US. Image Source: Philip Morris International – First Quarter of 2020 Earnings IR Presentation On a GAAP basis, Philip Morris International’s net revenues rose by 6% year-over-year to $7.2 billion in the first quarter of 2020 while its operating income surged 36% to $2.8 billion due in part to a meaningful reduction in the firm’s corporate overhead expenses. Its GAAP diluted EPS jumped by over 34% to $1.17 year-over-year last quarter. Please note Philip Morris International reported that it remains on track to achieve $1.0 billion in cost management efficiencies by 2021, which we appreciate as that will improve its cash flow profile. Foreign currency headwinds were present in the first quarter, and management expects those headwinds to persist through the second quarter. Going forward, management is reducing Philip Morris International’s capital expenditure expectations for 2020 from $1.0 billion previously down to $0.8 billion, which should better allow for free cash flow generation in the face of exogenous headwinds. In the upcoming graphic down below, management provides guidance for Philip Morris International’s expected second quarter performance, keeping in mind that COVID-19 is forecasted to have a big impact on its financials this year.

Image Shown: A look at Philip Morris International’s expectations for the second quarter of 2020 and the impact COVID-19 is estimated to have on the firm’s financial performance. Image Source: Philip Morris International – First Quarter of 2020 Earnings IR Presentation Cash Flow and Balance Sheet Update

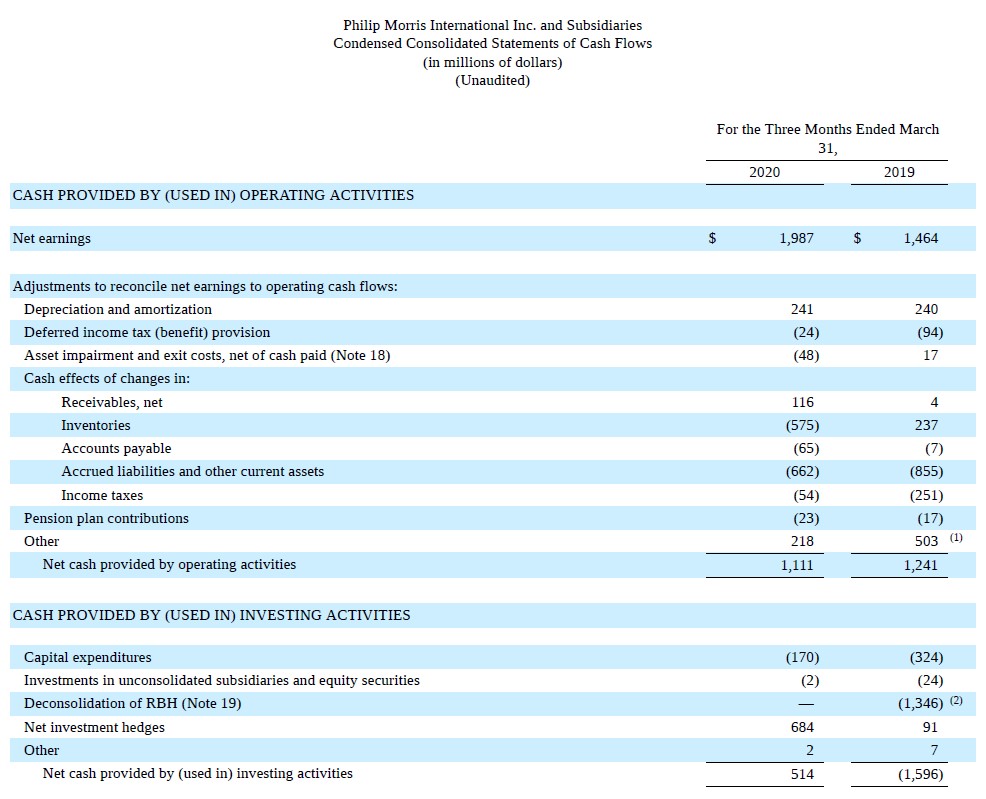

Philip Morris International continued to be a free cash flow cow during the first quarter of 2020 as one can see in the upcoming graphic down below. The firm generated over $1.1 billion in net operating cash flow and spent less than $0.2 billion on capital expenditures last quarter, allowing for over $0.9 billion in free cash flows. Please note that the firm experienced a very large working capital build last quarter which depressed its net operating cash flow by over $1.2 billion in the first quarter.

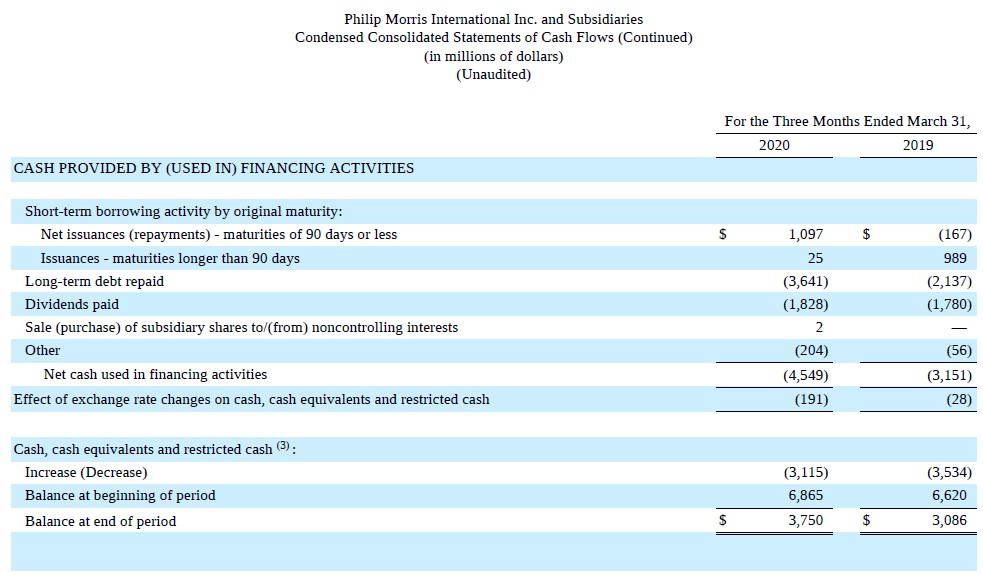

Image Shown: Philip Morris International has relatively low capital expenditure requirements, which supports its ability to generate meaningful free cash flows. Image Source: Philip Morris International – 10-Q filing for the first quarter of 2020 For reference, Philip Morris International generated $9.2 billion in free cash flow in 2019 while spending $7.2 billion on its dividend payments. The company’s ~$0.9 billion in free cash flows last quarter didn’t fully cover its ~$1.8 billion in first quarter dividend payments, as one can see in the upcoming graphic down below; however, we don’t see that as a sign of the firm’s long-term fundamentals weakening given the aforementioned working capital build.

Image Shown: Philip Morris International does not repurchase a significant amount of its stock on an ongoing basis and instead prefers to allocate its free cash flows towards meeting its dividend obligations. Image Source: Philip Morris International – 10-Q filing for the first quarter of 2020

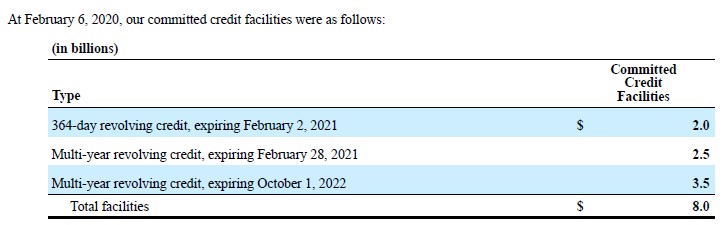

At the end of March 2020, Philip Morris International carried a nice liquidity position that is supported by its undrawn revolving credit facilities that had $7.5 billion in borrowing capacity, according to management during the firm’s latest quarterly conference call. Here’s a look at those revolving credit facilities as of February 6, 2020, according to its 2019 Annual Report (there have been some big changes to its revolving credit lines since then that we’ll cover in just a moment).

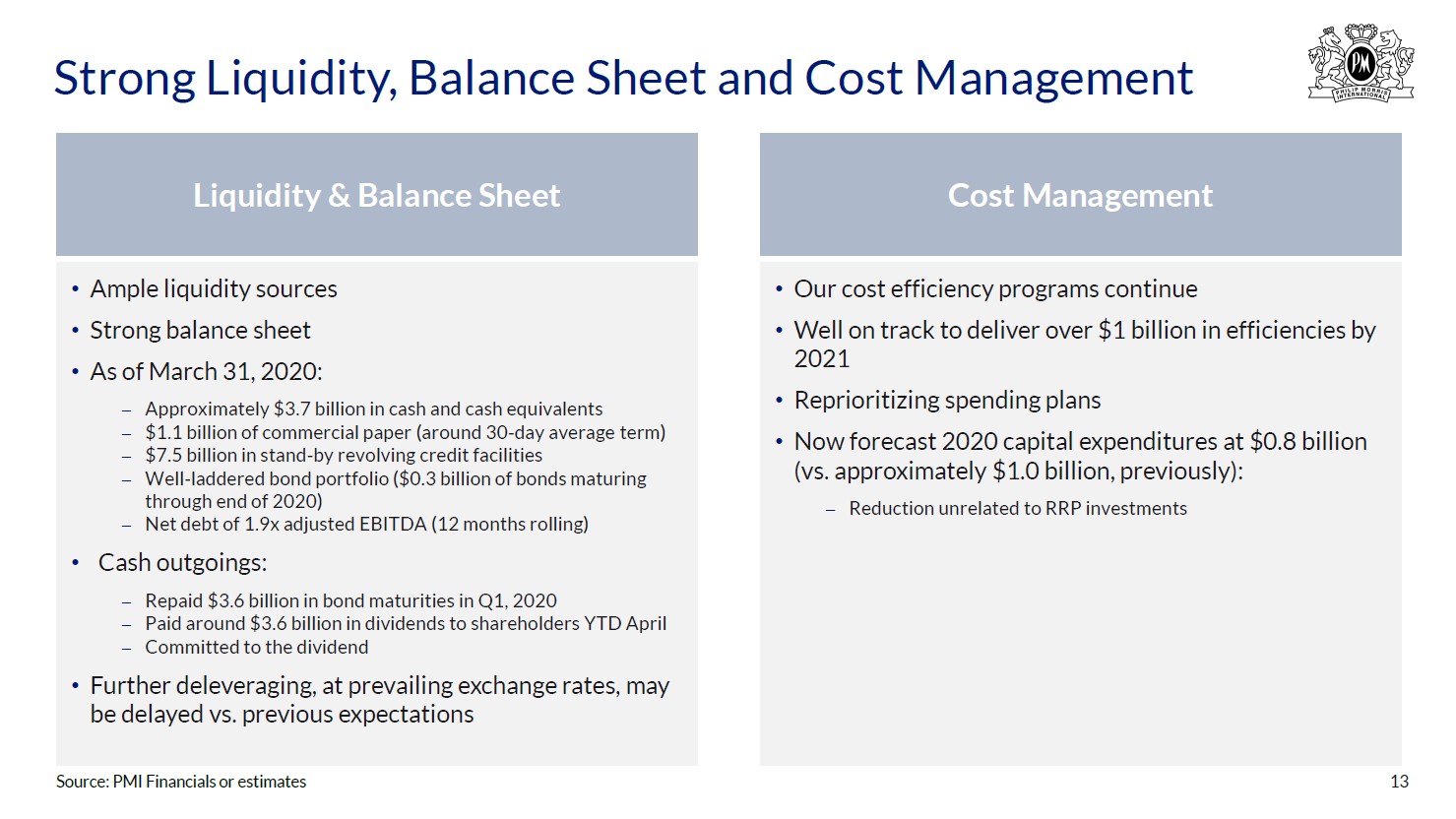

Image Shown: Philip Morris International’s revolving credit lines provide the firm with ample access to liquidity, however, one of those facilities has seen its maturity date pushed back to 2025, materially improving the company’s financial standing. Image Source: Philip Morris International – 2019 Annual Report As of February 6, 2020, those revolving credit lines matured in 2021 and 2022, however, please note this key excerpt from Philip Morris International’s 2019 Annual Report (emphasis added): All but the $2.0 billion 364-day revolving credit facility in the table above [the table that is included just above this segment] require us to maintain a ratio of consolidated earnings before interest, taxes, depreciation and amortization (“consolidated EBITDA”) to consolidated interest expense of not less than 3.5 to 1.0 on a rolling four-quarter basis. At December 31, 2019, our ratio calculated in accordance with the agreements was 11.2 to 1.0. These facilities do not include any credit rating triggers, material adverse change clauses or any provisions that could require us to post collateral. We expect to continue to meet our covenants. The terms “consolidated EBITDA” and “consolidated interest expense,” both of which include certain adjustments, are defined in the facility agreements previously filed with the U.S. Securities and Exchange Commission. We plan to replace our existing $2.5 billion multi-year revolving credit facility, expiring February 28, 2021 with a new $2.0 billion revolving credit facility expiring February 10, 2025 [please note it appears this replacement strategy went through, given that Philip Morris International’s total borrowing capacity under all of its revolving credit lines dropped from $8.0 billion as of February 6, 2020, to $7.5 billion as of the end of its first quarter of 2020]. The new credit facility, which is expected to close on February 10, 2020, will not include the consolidated EBITDA to consolidated interest expense ratio covenant discussed above. Additionally, Philip Morris International has a commercial paper program which provides the firm with additional access to liquidity as needed. Management provided an overview of the firm’s financial status in the upcoming graphic down below.

Image Shown: Philip Morris International maintains a solid financial position that can be utilized to ride out the pandemic. Image Source: Philip Morris International – First Quarter of 2020 Earnings IR Presentation

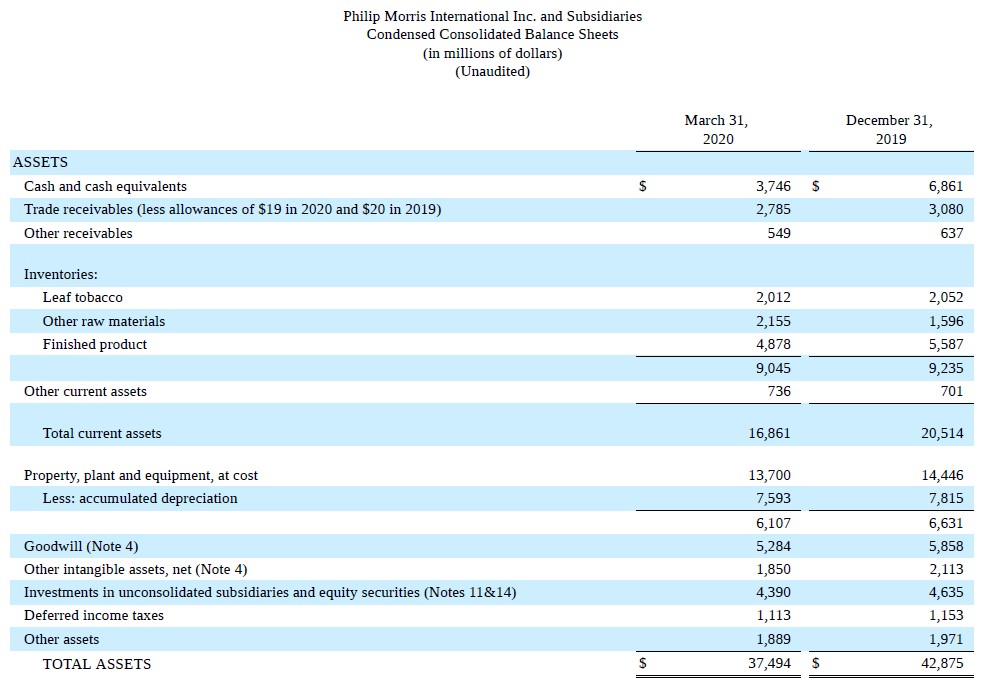

The company exited the first quarter of this year with over $3.7 billion in cash and cash equivalents on hand, which was down from levels seen at the end of 2019 as the firm paid off debt. As of February 6, 2020, Philip Morris International carried high quality investment grade credit ratings (A2/A/A) and the firm should retain access to capital markets at attractive rates. Historically, the firm has preferred to utilize debt markets to raise funds, and additionally, the company has not historically issued out or repurchased a meaningful amount of its common stock.

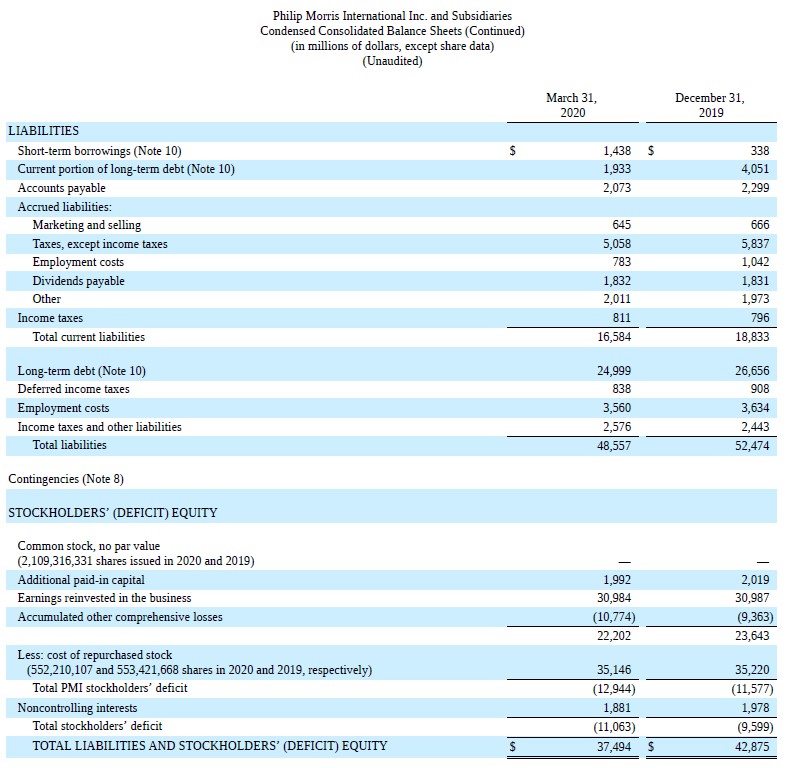

Image Shown: Philip Morris International’s liquidity position is enhanced by its revolving credit facilities, which were undrawn as of the end of its first quarter of 2020. Image Source: Philip Morris International – 10-Q filing for the first quarter of 2020 From the end of 2019 to the end of March 2020, Philip Morris International’s total debt load (inclusive of short-term debt) shrank from over $31.0 billion to under $28.4 billion as one can see in the upcoming graphic down below. However, its net debt load grew by a tad over $0.4 billion during this period as its cash balance was drawn down. The firm’s net debt to adjusted EBITDA (on a trailing twelve-month basis) ratio stood at ~1.9x at the end of the first quarter of 2020, roughly flat versus its leverage ratio at the end of 2019.

Image Shown: Philip Morris International paid down some of its debt in the first quarter of 2020, however, its net debt position still grew due in part to its working capital build depressing its net operating cash flows last quarter. Image Source: Philip Morris International – 10-Q filing for the first quarter of 2020 Operational Update Philip Morris International continues to have a favorable view on its ability to meet global tobacco demand during the pandemic, at least as of April 2020. Management noted in the earnings press release that the “large majority” of the company’s manufacturing facilities are “currently operational” around the world, and that includes all of its HTU-oriented factories which we can appreciate (given the need to maintain its growth momentum in that space). Its supply chain continues to operate relatively smoothly, as the company has “sufficient access to the inputs for its products” which is especially important given that Philip Morris International needs its key suppliers to maintain operations as well in order to keep producing new finished products. Some of the company’s cigarette production capabilities have been forced temporarily offline, and as of its earnings report, those facilities accounted for about one-fifth of Philip Morris International’s total cigarette production capacity around the globe. Due to the company’s well-disciplined inventory management system, the firm has enough finished product on hand to meet global demand for the foreseeable future as of its earnings report according to the press release (though logistical concerns in certain regions are being monitored): Based on current sales trends, there are adequate inventories of PMI finished goods, on average across all markets, of over two months for heated tobacco units, over three months for tobacco heating devices, and over one and a half months for cigarettes. While government-related restrictions have led to complexities in the company's route-to-market in select geographies, PMI does not currently anticipate out-of-stock situations in any major operating income markets and generally expects consumers to have adequate access to its products. In certain emerging markets, potential difficulties for some smaller general trade outlets could lead to temporary localized out-of-stock situations given less developed route-to-market infrastructures. Management is confident Philip Morris International will bounce back strongly once the worst of the pandemic passes (from the firm’s latest quarterly conference call): “With social isolation measures placing day-to-day life on hold for much of the world's population, this temporarily impacts our operating environment. The most direct effect is on Duty-Free sales due to reduced travel, with additional impacts from delayed IQOS user acquisition and regulatory price enforcement in Indonesia. In total this is likely to have a negative impact on our 2020 currency-neutral performance, with recent exchange rate movements a further drag… We are confident the strong momentum on IQOS user acquisition shown in recent quarters will start to resume as restrictions ease. In the meantime, our digital and commercial engine allows us to serve our existing adult consumers, maximize the conversion of adult smokers under the prevailing circumstances, and tailor our investments as required to optimize costs.” Concluding Thoughts Given the company’s ample liquidity and access to liquidity levels, along with its solid cash flow profile and high quality investment grade credit ratings, we are optimistic Philip Morris International should be able to emerge on the other side of the pandemic with its dividend intact. The successful of its HTU offerings is offsetting lower volumes at its traditional cigarette brands, aided by the company’s ability to push through meaningful price increases. Please keep in mind this dynamic is lending a tremendous amount of support to Philip Morris International’s cash flow outlook, which is assisted by management’s cost efficiency program. We continue to like the company as a holding in our High Yield Dividend Newsletter portfolio. ----- Tobacco Industry – BTI MO PM SWM VGR Related smoking: IMBBY, JAPAY, GLLA, VAPE Marijuana stocks: ACB, ACNNF, APHA, CGC, CRON, HEXO, STZ, TLRY Related ETFs: MJ, YOLO, ACT, THCX, SOIL, CNBS, TOKE, POTX ---- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment