Member LoginDividend CushionValue Trap |

Our Thoughts on the Potential Acquisition of Concho Resources by ConocoPhillips

publication date: Oct 15, 2020

|

author/source: Callum Turcan

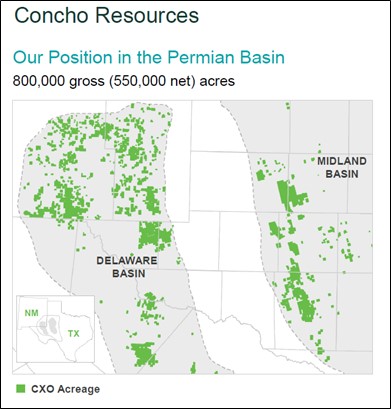

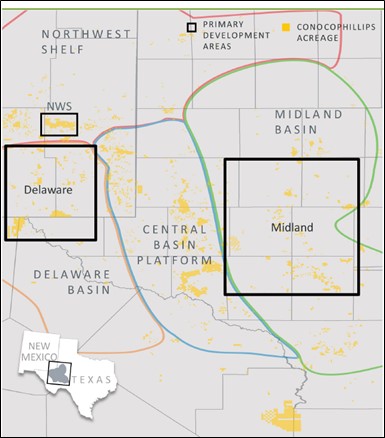

Image Source: ConocoPhillips – November 2019 Annual & Investor Meeting Presentation By Callum Turcan According to Bloomberg, the super-independent ConocoPhillips (COP) is currently talking with Concho Resources Inc (CXO) about acquiring the company. We do not expect that such a deal will come with a significant premium, and furthermore, and we expect that such a deal will likely be funded with equity. Our reasoning is underpinned by recent M&A activity in the oil patch, such as the all-stock acquisition of Noble Energy by Chevron Corporation (CVX) through a ~$5 billion deal that was completed in early-October. That deal involved Chevron paying a ~12% premium (based on ten-day average closing stock prices) at the time of the announcement, though please note shares of Noble Energy had cratered beforehand indicating that Chevron did not have to pay up for the company. Noble Energy, like Concho Resources, also had a significant position in the Permian Basin (though its Mediterranean assets were Chevron’s main target, in our view). We covered that deal in great detail here. As it concerns our view that ConocoPhillips would likely use equity instead of cash to acquire Concho Resources (should such a deal materialize), that is largely due to ConocoPhillips’ sizable net debt load at the end of June 2020 and its inability to generate meaningful free cash flows in the current pricing environment for raw energy resources. Additionally, Concho Resources had a net debt load at the end of June 2020 and is also unable to generate meaningful free cash flows in the current environment. The oil patch is contending with serious financial constraints and all-stock acquisitions/mergers with minimal premiums are likely going to continue being the norm for some time. Background ConocoPhillips spun-off its downstream (refining, petrochemicals) and most of its midstream (pipelines, storage facilities) operations back in 2012 and is currently focused solely on the extraction of raw energy resources (known as the upstream part of the oil & gas world). Given its size, ConocoPhillips is often referred to as a super-independent given that the firm is not an integrated energy company anymore. Concho Resources is an upstream player focused on the Permian Basin which stretches across Southeastern New Mexico and West Texas, and ConocoPhillips also has a modest (for a company of its size) footprint in the region. Given that Concho Resources uses fracking, a combination of horizontal drilling and hydraulic fracturing, to extract raw energy resources in the Permian Basin, the firm is sometimes referred to as an unconventional upstream firm (though that is now less common given the prevalence of fracking operations in modern times). Wells in the Permian Basin (particularly “fracked” wells) produce oil, NGLs, and natural gas with the production mix determined in large part on where the upstream operator is drilling and what formation is being targeted. If the crude oil output mix is relatively low and the natural gas output mix is relatively high, that well is unlikely to be economical given that domestic natural gas prices are quite low and have been subdued over the past decade (click here to read why we expect natural gas prices to stay low going forward). Crude oil underpins the economics of wells in the Permian and represents the core focus for upstream operators. Here we will stress that any upstream company not targeting the oil-rich corridors in the Delaware Basin and Midland Basin (both are within the larger Permian Basin) are unlikely to drill economic wells (acreage outside of those areas are not home to attractive upstream opportunities, generally speaking). The price of oil heavily influences the price of natural gas liquids (‘NGLs’) such as ethane, propane, and butane. Given that oil prices remain low (click here to read why we expect crude oil prices to stay subdued going forward), NGLs prices will likely remain subdued going forward as well. In the US, there are a lot of NGLs fractionators (processing facilities that separate out each type of NGLs product as a standalone product) and petrochemical plants along the Gulf Coast region which is where most of the NGLs produced in the Permian Basin end up. Before then, produced NGLs is separated from the natural gas (also referred to as “dry” gas) by a cryogenic processing plant. Natural gas produced in the Permian Basin is sold domestically via pipeline, exported to Mexico (usually) via pipeline, or sold overseas as liquefied natural gas (‘LNG’), though prices are lackluster on all fronts of late. ConocoPhillips needs to bulk up its “liquids-rich” well location inventory to create a significant needle-moving development growth runway in the Permian Basin. Concho Resources has a large undeveloped position in the oil-rich Delaware and Midland basins, and that is the only significant operation Concho Resources has (meaning ConocoPhillips would not be taking on “dead weight” in terms of unwanted assets). If ConocoPhillips does take over Concho Resources, the primarily goal will be to unlock synergies in the Permian Basin by integrating their development schemes (reducing rig and completion crew downtime, implementing better well spacing strategies), centralizing midstream operations (removing the need to build redundant infrastructure), and cutting G&A spending (rationalizing corporate headcount). Reducing costs has its limit, as the price of oil has an outsize impact on the upstream economics of the Permian Basin as mentioned previously. No realistic amount of cost cuts and efficiency gains can make unconventional upstream activities economical in a low raw energy resources pricing environment. The “shale treadmill” forces those companies to spend all of their cash flow on drilling and completing new wells given the high production declines experienced at “fracked” wells. Demand destruction caused by the ongoing coronavirus (‘COVID-19’) pandemic has kept a lid on raw energy resources prices and we expect that will continue being the case for some time. ConocoPhillips’ bet on Concho Resources, if it does materialize, is longer term in nature. Overlapping Acreage In the upcoming two graphics down below, we highlight the acreage position of Concho Resources and ConocoPhillips in the Permian Basin. Please note unconventional activities are primarily conducted in the Midland and Delaware basins, and that the other basins within the Permian are home to conventional upstream operations (often legacy vertical wells) with limited new development opportunities (most new development opportunities have been exhausted over the past 100 years). Fracking activities have not proved economical or successful at scale outside of the Delaware and Midland basins as it concerns the Permian region.

Image Shown: An overview of Concho Resources’ acreage position in the Permian Basin as of the end of 2019. Image Source: Concho Resources – September 2020 IR Presentation

Image Shown: An overview of ConocoPhillips’ Permian acreage position. Image Source: ConocoPhillips – November 2019 Annual & Investor Meeting Presentation Concho Resources had approximately 550,000 net acres in the Permian Basin as of the end of 2019 as you can see in the relevant graphic up above. According to ConocoPhillips’ March 2020 Lower 48 Factbook, though it owned roughly 800,000 net acres in the Permian Basin as of late-2019/early-2020 (no explicit date was given), only 88,000 net acres were located in the Delaware Basin an additional 58,000 net acres in the Midland Basin. This is particularly important to keep in mind, as ConocoPhillips’ Tier 1 unconventional acreage position in the Permian is incredibly small for a firm of its size. Though Concho Resources has developed a sizable portion of its well inventory over the years, there remains plenty of opportunities in its portfolio. We can understand ConocoPhillips interest in Concho Resources, at the right price of course. Concluding Thoughts Acquiring Concho Resources would clearly give ConocoPhillips meaningful scale in the Permian Basin and could add a nice growth lever to its portfolio when raw energy resources pricing starts to improve. However, any such deal would need to take into consideration that neither company is on strong financial footing. We will be keeping a lookout for news on this front going forward. ----- Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD Industrial Minerals - ARLP, CCJ, CNX, HCR, NRP Refining Industry – HES HFC MPC PSX VLO Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP Energy Equipment & Services (Large) Industry – BKR HAL NBR NOV SLB FTI SI Related: CXO, XLE, XOP, BNO, USO, UNG ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment