Member LoginDividend CushionValue Trap |

Our Thoughts on Berkshire Hathaway’s Latest Annual Report

publication date: Mar 5, 2021

|

author/source: Callum Turcan

Image Shown: Shares of Berkshire Hathaway Inc Class B stock have been on an upward climb since June 2020 with room for additional capital appreciation upside. The top end of our fair value estimate range for BRK.B sits at $275 per share. By Callum Turcan We include Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares in the Best Ideas Newsletter portfolio and continue to be enormous fans of Warren Buffett. Berkshire Hathaway reported fourth quarter 2020 earnings on February 27 which saw the firm’s ‘operating earnings’ (a non-GAAP metric that better reflects Berkshire’s underlying financial performance) surge higher by 14% year-over-year aided by strength at its ‘railroad, utilities and energy’ and ‘other businesses’ operating segments. However, Berkshire’s operating earnings for all of 2020 fell 9% year-over-year due to headwinds from the ongoing coronavirus (‘COVID-19’) pandemic. Mr. Buffett provided some interesting commentary on Berkshire’s various operating segments in a letter included in the company’s 2020 Annual Report that we found interesting. Railroad and Utility Update In the aforementioned letter, Mr. Buffett had favorable things to say about railroad operator Burlington Northern Santa Fe Railway Company (‘BNSF’) which Berkshire acquired back in 2010 (specifically the stake it did not already own in the company). Since then, BNSF has invested $41.0 billion in fixed assets according to Mr. Buffett, well in excess of the company’s total depreciation expense during this period. Now BNSF owns 23,000 miles of track spread across 28 US states and carries around 15% of all non-local ton miles (one ton of freight moved one mile) of goods moved domestically (including freight moved by barge, boat, aircraft, rail, or truck). Since getting acquired by the conglomerate, BNSF has paid $41.8 billion in dividends to Berkshire. BNSF keeps a lid on its cost of debt by only paying out dividends after taking its capital expenditure needs into account, according to Mr. Buffett. Additionally, BNSF aims to always keep around $2.0 billion in cash on hand. This helps ensure that BNSF can borrow cheaply on an independent basis (before including guarantees from Berkshire) and goes a long way in maintaining the financial strength of the subsidiary. Mr. Buffett noted that (emphasis added): One further word about BNSF: Last year, Carl Ice, its CEO, and his number two, Katie Farmer, did an extraordinary job in controlling expenses while navigating a significant downturn in business. Despite a 7% decline in the volume of goods carried, the two actually increased BNSF’s profit margin by 2.9 percentage points. Carl, as long planned, retired at yearend and Katie took over as CEO. Your railroad is in good hands. While this is one asset among many in Berkshire’s portfolio, it stands out due to its size. According to Mr. Buffett’s letter, BNSF is the largest railroad operator in the US by freight volume and Berkshire owns 100% of BNSF. Mr. Buffett also had something interesting to say regarding Berkshire Hathaway Energy (‘BHE’) in the letter, the conglomerate’s massive utility and energy division (of which it owns a 91% stake). While older power plants were built near major population centers (in part to reduce the cost of building transmission systems), solar and wind farms are generally better suited for less populated areas given the need for vast amounts of land (at an affordable price). Mr. Buffett sees an immense opportunity here. BHE does not pay dividends while most other utilities do, providing BHE with ample financial firepower that has allowed it to make enormous investments that will not generate cash flow for years, in the eyes of Mr. Buffett. Since 2006, BHE has been making material investments in electric utility transmission systems stretched out across the Western US. These upgraded and expanded transmission systems are a necessity, in the eyes of Mr. Buffett, as these systems are required to connect new sources of electricity (primarily from renewable operations) that are located far away from end markets to electric utilities that operate distribution networks in major demand centers. Effectively, Mr. Buffett appears to see Berkshire as being able to benefit from the “green revolution” by connecting new renewable power plants to electric utilities that can distribute power to end users. Though this endeavor started in 2006, Mr. Buffett does not see BHE completing its electric utility transmission expansion plan in the Western US until 2030, something he stressed in his letter. In the past, we covered Berkshire’s green energy ambitions as it concerns its power generation assets that interested members can check out here. Admitting His Mistake Though Mr. Buffett was upbeat on the company’s railroad and utility operations, he was realistic as it concerned one of Berkshire’s largest acquisitions. Simply put, Berkshire’s decision to buy Precision Castparts through an all-cash deal worth $37.2 billion when including the Precision Castparts’ debt (that deal was completed in 2016) has not gone as planned. Berkshire recorded an ~$11 billion impairment charge in 2020 that was primarily due to the firm writing down the value of Precision Castparts according to Mr. Buffett. The slowdown in the aerospace industry due to the COVID-19 pandemic was part of the reason why, but there is more to the story here. Mr. Buffett had this to say (emphasis added): The final component in our GAAP figure – that ugly $11 billion write-down – is almost entirely the quantification of a mistake I made in 2016. That year, Berkshire purchased Precision Castparts (“PCC”), and I paid too much for the company. No one misled me in any way – I was simply too optimistic about PCC’s normalized profit potential. Last year, my miscalculation was laid bare by adverse developments throughout the aerospace industry, PCC’s most important source of customers. In purchasing PCC, Berkshire bought a fine company – the best in its business. Mark Donegan, PCC’s CEO, is a passionate manager who consistently pours the same energy into the business that he did before we purchased it. We are lucky to have him running things. I believe I was right in concluding that PCC would, over time, earn good returns on the net tangible assets deployed in its operations. I was wrong, however, in judging the average amount of future earnings and, consequently, wrong in my calculation of the proper price to pay for the business. PCC is far from my first error of that sort. But it’s a big one. One of the things we admire about Mr. Buffett is his ability to draw attention to his mistakes without putting down others in the process, in this case the management team of Precision Castparts. In light of the numerous headwinds facing the aerospace industry, Precision Castparts was forced to aggressively rationalize its headcount last year in order to right the ship. The grounding of Boeing Company’s (BA) 737 MAX further pressured Precision Castparts’ operations. According to Berkshire’s 2020 Annual Report, Precision Castparts’ workforce shrank by roughly 40% in 2020 versus levels seen at the end of 2019. Looking ahead, the outlook for the aerospace industry is improving, though it will likely be several years until the industry returns to its pre-pandemic levels. Share Buybacks Berkshire generated $26.8 billion in free cash flow in 2020 (up from $22.7 billion in 2019) while spending $24.7 billion buying back its stock. The company does not pay out a common dividend currently. Mr. Buffett had this interesting segment on share buybacks in the letter (emphasis added): Last year we demonstrated our enthusiasm for Berkshire’s spread of properties by repurchasing the equivalent of 80,998 “A” shares, spending $24.7 billion in the process. That action increased your ownership in all of Berkshire’s businesses by 5.2% without requiring you to so much as touch your wallet. Following criteria Charlie and I have long recommended, we made those purchases because we believed they would both enhance the intrinsic value per share for continuing shareholders and would leave Berkshire with more than ample funds for any opportunities or problems it might encounter. In no way do we think that Berkshire shares should be repurchased at simply any price. I emphasize that point because American CEOs have an embarrassing record of devoting more company funds to repurchases when prices have risen than when they have tanked. Our approach is exactly the reverse. We view Berkshire’s share repurchases in 2020 as a good use of its capital given that the company’s stock was trading well below its intrinsic value throughout this period (based on our fair value estimate). Mr. Buffett noted that “Berkshire has repurchased more shares since year-end and is likely to further reduce its share count in the future” which will likely be funded with Berkshire’s internally generated free cash flows. However, given where shares of BRK.B are trading at as of this writing, Berkshire should remove its foot from the share buyback gas pedal, in our view. Berkshire’s balance sheet remained pristine at the end of 2020, another reason why we are big fans of the company. In the upcoming two graphics down below, Berkshire provides investors a glimpse at its massive cash-like holdings and its large equity portfolio as of the end of last year. However, please note Berkshire also has substantial debt and other long-term non-cancellable financial obligations on the books to be aware of. We are intrigued by what Mr. Buffett might invest in next (we covered some of Berkshire’s recent acquisition activity in this article here).

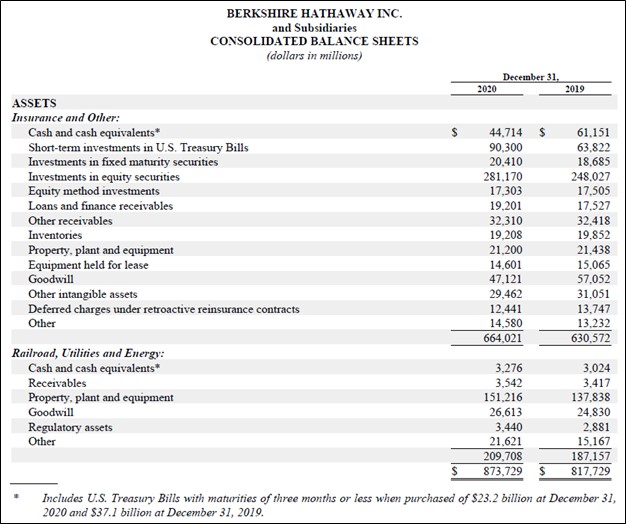

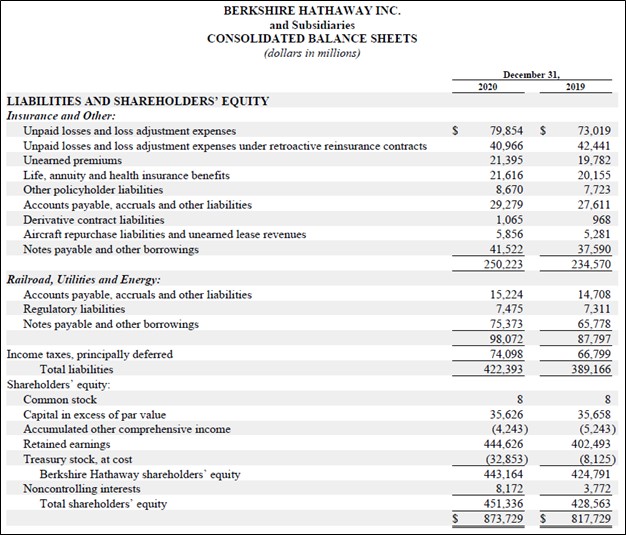

Images Shown: Berkshire had significant financial firepower on hand at the end of 2020. Images Source: Berkshire – 2020 Annual Report Concluding Thoughts We continue to like exposure to Berkshire Class B stock in our Best Ideas Newsletter portfolio. The top end of our fair value estimate range sits at $275 per share of BRK.B, indicating the company has room for additional capital appreciation upside as of this writing even after moving higher over the past several months. Just like any investor, Mr. Buffett will not always get it right, but we appreciate his candor when he gets something wrong. Bigger picture, the outlook for the US economy appears strong as public health authorities are utilizing COVID-19 vaccine distribution efforts to help bring an end to the crisis. Mr. Buffett, in his letter, was very upbeat about the US economy. We will end with this comment from the Oracle of Omaha: “Our unwavering conclusion: Never bet against America.” ----- Tickerized for BRK.A, BRK.B Railroad operators: CNI, CSX, GWR, KSU, NSC, UNP Aerospace: BA, EADSY, GE, AA, ARNC, RTX, HWM Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment