Member LoginDividend CushionValue Trap |

Our Fair Value Estimate for Cisco Remains Unchanged at $51 Per Share

publication date: Nov 13, 2020

|

author/source: Callum Turcan

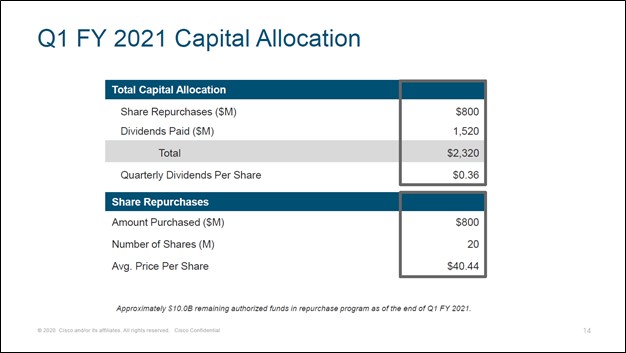

Image Shown: Cisco Systems Inc continues to focus on rewarding shareholders by deploying its sizable free cash flows towards dividend payments and share repurchases. We are big fans of the tech giant. Image Source: Cisco Systems Inc – First Quarter of Fiscal 2021 IR Earnings Presentation By Callum Turcan On November 12, Cisco Systems Inc (CSCO) reported first quarter earnings for fiscal 2021 (period ended October 24, 2020) after the market close that beat both consensus top- and bottom-line estimates. Though its GAAP revenues and GAAP net income fell by 9% and 26% year-over-year, respectively, the market was assuming the worst given the headwinds Cisco is facing due to the coronavirus (‘COVID-19’) pandemic. More importantly, Cisco’s fiscal second quarter guidance was decent, all things considered. We include shares of Cisco in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. As of this writing, shares of CSCO yield a nice ~3.7%, and our fair value estimate for Cisco still stands at $51 per share. Cisco offers a variety of products and services that support networking, security collaboration, applications, and cloud-computing needs. Increasingly, software and services are becoming a bigger part of Cisco’s business. In the first quarter fiscal 2021, ‘subscription’ revenues represented about 78% of its ‘software’ revenues. Recurring revenue streams provide for stronger cash flow profiles given the greater visibility of those sales on a forward-looking basis. Guidance Update

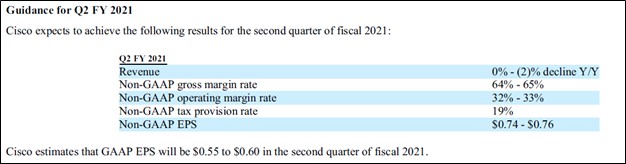

Image Shown: An overview of Cisco’s guidance covering its current fiscal quarter. The company’s near-term outlook is improving. Image Source: Cisco – First Quarter of Fiscal 2021 Earnings Press Release In the graphic just up above, Cisco highlights its expectations for the current fiscal quarter. It appears the company’s near-term revenue trajectory is improving, especially when compared to the high-single digit decline in its GAAP revenues on a year-over-year basis Cisco reported in the third and fourth quarters of fiscal 2020 (fiscal year ended in July 25, 2020) and in the first quarter of fiscal 2021. Shares of CSCO rocketed higher after posting its latest earnings report, which in our view was largely due to its improving near-term outlook and ability to continue generating sizable free cash flows in any operating environment. Financial Update During the first quarter of fiscal 2021, Cisco generated $3.9 billion in free cash flow which fully covered $1.5 billion in dividend payments and $0.8 billion in share repurchases made over this period. We support Cisco’s share repurchasing strategy as shares of CSCO have been trading well below their fair value estimate over the past several months and continue to do so as of this writing. Cisco exited the fiscal first quarter with $10.8 billion in cash and cash equivalents on hand along with $19.2 billion in short-term investments. Stacked up against $5.0 billion in short-term debt and $9.6 billion in long-term debt, Cisco had a net cash position of ~$15.4 billion at the end of its previous fiscal quarter. Cisco’s stellar cash flow profile and net cash position highlight why we are big fans of the firm. After its latest earnings report, the tech giant might finally be starting to win some attention from investors as Cisco continued to showcase why the firm’s business model is incredibly resilient. Growth Drivers One of the bright spots at Cisco last fiscal quarter was its ‘Security’ business, as the firm noted that its ’product revenue’ from these offerings was up 6% year-over-year in its earnings press release. Cisco’s management mentioned that “Webex, our security solutions and business resiliency offers, also saw strong growth as our customers are trusting us with their most critical projects” during the firm’s latest earnings call. Management also had this to say regarding Cisco’s Webex videoconferencing business during the company’s fiscal first quarter conference call (emphasis added): “Moving to our collaboration portfolio, business continuity and resiliency remain top of mind for our customers. Organizations are focused on creating flexible work environments to drive productivity, while ensuring that employees remain safe. The future of work will be a hybrid model with employees both in the office and at home, and we are leading in this area. Our collaboration portfolio is empowering organizations and teams to be more productive and secure as they adapt to new business, healthcare and learning models. We are providing seamless collaboration with anyone anywhere, while enabling consistent experiences for hybrid workplaces and continuing our leadership in security. Cisco Webex saw significant increased usage and solid adoptionas customers look to us for a flexible work solution that also enables privacy and security. Whether at home or in the office, our customers need a solution that brings together meetings, calling, file sharing and messaging with a simple and highly secure user experience. Last month alone, Webex had nearly 600 million participants, almost double the number we had in March. We recently launched new return to office solutions that provide actionable workplace analytics with Webex Room Navigator and integrated collaboration device sensors that help ensure a safe working environment. We are also accelerating our innovation with new offerings such as Webex Legislate to keep critical functions of global governments running, along with capabilities like breakout rooms, virtual huddle spaces and noise cancellation. We are reimagining every aspect of the collaboration experience with built-in AI technology, security and integrated workflow applications to create a more intelligent work environment and to improve productivity.” --- Chuck Robbins, CEO of Cisco Additionally, here is what management had to say regarding Cisco’s security business during the firm’s latest earnings call (emphasis added): “In security, we delivered another solid quarter of growth, driven by our broad cloud-native portfolio. SecureX, which offers a simplified security experience, saw strong adoption as it has been deployed across more than 4,000 organizations since it became globally available in June. As our customers' employees remain working from home, they are looking to bolster their existing security efforts with unified user and endpoint protection. We continue to benefit from the shift to cloud-based security capabilities and had robust growth in our secure remote worker offer that includes Duo, Umbrella and AnyConnect.” --- CEO of Cisco We appreciate Cisco’s exposure to the (secure) videoconferencing and cybersecurity space, as these operations represent some of its best long-term growth drivers. Concluding Thoughts We continue to be big fans of Cisco’s stellar cash flow profile and pristine balance sheet. The company’s forward-looking dividend coverage is strong as Cisco carries a Dividend Cushion ratio of 2.6 (this ratio factors in our expectations that Cisco will push through meaningful per share dividend increases over the coming fiscal years) that interested members can read more about here. On a final note, we want to congratulate R. Scott Herren, who is set to become CFO of Cisco starting December 18 as Cisco’s current CFO Kelly Kramer is retiring after working nine years at Cisco. We wish both parties the best in their future endeavors. ----- Related: ANET, EXTR, FFIV, JNPR, ACIA ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment