Member LoginDividend CushionValue Trap |

Our $140 Fair Value Estimate of Apple Remains Unchanged

publication date: Oct 30, 2020

|

author/source: Callum Turcan

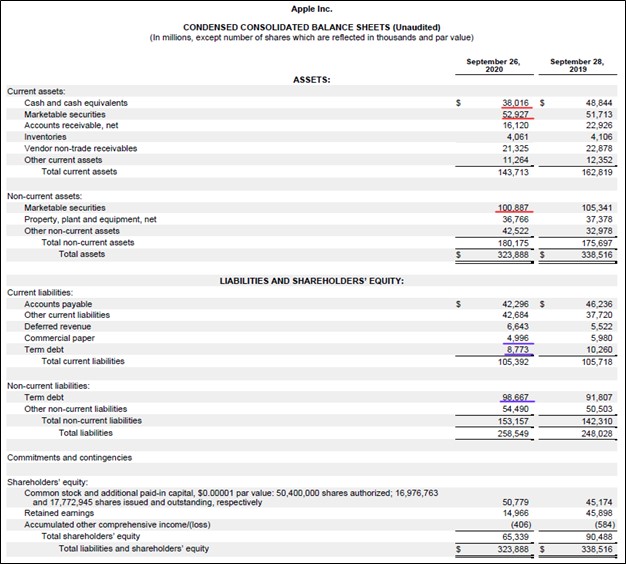

Image Shown: Apple Inc maintained its enormous net cash position at the end of fiscal 2020. In the graphic up above, Apple’s cash-like items are underlined in red and its debt-like items are underlined in blue. Image Source: Apple Inc – 8-K SEC filing covering the fourth quarter of fiscal 2020 with additions from the author. By Callum Turcan On October 29, Apple Inc (AAPL) reported fourth quarter and full-year earnings for fiscal 2020 (period ended September 26, 2020). Its fiscal 2020 GAAP revenues and GAAP operating income were up 6% and 4% year-over-year, respectively. Growth was driven by its Mac, iPad, ‘Wearables, Home and Accessories,’ and ‘Services’ offerings while its iPhone revenues dropped somewhat. Longer term, we are optimistic that Apple’s high-margin Services businesses will eventually become a significantly larger part of its overall financial performance (its Services segment represented ~20% of Apple’s sales and ~34% of its gross profit in fiscal 2020). We continue to be huge fans of Apple and include shares of AAPL as a holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Earnings Update Apple’s GAAP revenues in the fiscal fourth quarter grew modestly year-over-year while its GAAP operating income declined moderately year-over-year. Its iPhone revenues held down Apple’s financial performance last fiscal quarter though its other four offering categories performed quite well, especially its Mac, iPad, and Services offerings (the stay-at-home and work-from-home trend likely continued to support sales of Apple’s Macs and iPads, while new offerings are supporting growth at its Services segment). The company recently launched its first-ever 5G-capable iPhone, which we covered in this article here, and the success of that product will have an enormous influence on its near-term financials going forward. Management indicated that Apple’s iPhone segment was negatively impacted last fiscal quarter by the upcoming launch of its iPhone 12 lineup given that consumers delayed their smartphone purchases. Here is what management had to say on that issue and Apple’s strong Services performance during the company’s latest earnings call (emphasis added): “Our results for this quarter [fourth quarter of fiscal 2020] were ahead of our expectations, driven by stronger-than-expected iPhone and Services performance. As we anticipated, we launched new iPhone models in October, a few weeks later than last year’s mid-September launch. Up to that mid-September point, customer demand for iPhone was very strong, and grew double-digits. On Services, we saw stronger-than-expected performance across the board.Geographically, we set September quarter records in the Americas, Europe and Rest of Asia Pacific. We also set a September quarter record in India, thanks in part to a very strong reception to this quarter’s launch of our online store in the country. Greater China is the region that was most heavily impacted by the absence of the new iPhones during the September quarter, still we beat our internal expectations in the region, growing non-iPhone revenue strong double digits and iPhone customer demand grew mid-September.” --- Tim Cook, CEO of Apple In fiscal 2020, Apple generated $80.7 billion in net operating cash flow and spent $7.3 billion on its capital expenditures, allowing for $73.4 billion in free cash flows. Apple spent $14.1 billion covering its dividend obligations and $72.4 billion buying back its stock. Our fair value estimate for Apple sits at $140 per share (under our “base case” scenario), indicating share buybacks are a good use of capital. Additionally, we continue to have a favorable outlook as it concerns Apple’s dividend growth trajectory. The company increased its quarterly payout by 6% sequentially in April 2020 (the dividend was paid out in May). The company had $191.8 billion in cash-like holdings on hand as of the end of fiscal 2020 (cash, cash equivalents, short-term marketable securities, and long-term marketable securities) versus $112.4 billion in total debt (short- and long-term debt). Apple’s immense net cash position is being utilized to aggressively buy back its stock while supporting its dividend growth trajectory. During Apple’s fiscal third quarter conference call, management noted the goal was to reach a “a net cash neutral position over time.” That goal was reiterated by management during Apple’s fiscal fourth quarter conference call. Operations Update Apple intends to launch its Apple One subscription bundle service on Friday October 30 according to CNBC and recent management commentary. The bundle will include its Apple TV+ (video streaming service), Apple Arcade (video game service), Apple Music (music streaming service), Apple News+ (news aggregator), Apple Fitness+ (health and workout service), and a significant amount of iCloud storage capacity, though what the consumer gets (not all services are included in the cheaper bundles) depends on the package tier the consumer chooses (which also impacts the amount of iCloud storage the consumer gets). We like this strategy because it offers Apple a way to increase demand/usage of its lesser used services and effectively upsell its numerous services to its existing and future installed user base. There is a good chance that over time, Apple One will become quite popular with Apple’s installed user base given the firm’s ability to aggressively market the bundle to a highly targeted audience. Pivoting to Apple’s new iPhone launch, here is what management had to say on the issue during the firm’s latest earnings call (emphasis added): “Given the continued uncertainty around the world in the near term, we will not be issuing revenue guidance for the coming quarter. However, we are providing some insights on our expectations for the December quarter for our product categories. These directional comments, assume that COVID related impacts to our business in November and December are similar to what we’re seeing in October. We just started shipping iPhone 12 and 12 Pro, and we’re off to a great start. We are also excited to start preorders on iPhone 12 Mini and 12 Pro Max next Friday. Given the tremendously positive response, we expect iPhone revenue to grow during the December quarter, despite shipping iPhone 12 and 12 Pro four weeks into the quarter, and iPhone 12 Mini and 12 Pro Max seven weeks into the quarter. We expect all other products in aggregate to grow double digits, and we also expect services to continue to grow double digits.” --- Luca Maestri, CFO of Apple Apple’s management team noted that the firm’s paid subscription base grew by 35 million sequentially last fiscal quarter and that the company remained on track to grow its paid subscriber base to 600 million by the end of calendar year 2020 (up from 585 million as of the firm’s latest conference call). The company’s Services segment posted record revenue last fiscal quarter. In the fiscal fourth quarter and in fiscal 2020, Apple’s Services sales grew by 16% year-over-year in both periods. We are impressed with the performance of Apple’s Services segment of late, and the launch of Apple One bundles should help keep the momentum going on this front. Concluding Thoughts Shares of AAPL yield just ~0.7% as of this writing, though we expect significant dividend increases to be pushed through over the coming fiscal years. As it concerns Apple’s capital appreciation upside, shares are still trading well below their fair value estimate of $140 per share as of this writing. We expect the company will continue to aggressively buy back its stock given management’s stated aim to reduce Apple’s enormous net cash position to a “neutral” net cash position over time (which given the company’s impressive free cash flows, could take a long while). Apple offers investors a nice combination of capital appreciation and dividend growth upside, which is why we include the firm as a holding in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. ----- Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN Computer Hardware Industry – AAPL BB HPQ IBM TDC Communication Equipment Industry – CIEN SATS LHX PLT QCOM VSAT Communications Equipment Space – CSCO JNPR KN NOK SMCI Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM Telecom Services Industry - CMCSA CTL DISH T TMUS VZ Related: AMZN, DIS, SPY, QQQ, XLK Key Apple suppliers: CRUS, SWKS, QRVO, IDCC, LITE, JBL, KN, QCOM ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Alphabet Inc (GOOG) Class C shares, Cisco Systems Inc (CSCO), Facebook Inc (FB), The Walt Disney Company (DIS) and Microsoft Corporation (MSFT) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Apple, Cisco Systems, Microsoft, and Oracle Corporation (ORCL) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. AT&T Inc (T) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment