|

|

Normalizing our Fair Value Estimates for the Money Center Banks

publication date: Nov 19, 2020

Image Source: Mike Cohen. Image Source: Mike Cohen. During the past few weeks, positive news surrounding the Pfizer/BioNTech and Moderna vaccines means that, while times will still be tough for banks as bad loans pile up, losses and defaults perhaps won’t be as bad as we had originally predicted at the onset of the outbreak of COVID-19. The unemployment rate has steadily crept lower from the 14.7% rate it hit in April 2020 (it stands at 6.9% as of October), and businesses have been battling hard through the worst of times with help from the Paycheck Protection Program, among other stimulus efforts. There have still been many business failures, however. Several banks’ net interest margins have faced pressure, too, but 30-year rates have managed to ease a bit higher from the sub-1% mark on March 9, 2020, to 1.62% at the time of this writing (November 18). The widely-watched 10-year/3-month Treasury yield spread has also advanced to 79 basis points, representing a meaningful improvement from most of February and early March when the 10-year/3-month Treasury yield spread was negative. The probability of an adverse tail-event is also substantially reduced (if not, eliminated), given the laser-focus of the Fed/Treasury to do whatever it takes to get to the other side the COVID-19 crisis. With all of this in mind, we expect to raise our fair value estimates for the money center banks upon their next update, effective November 21. That said, we’re not changing our general views on the banking and financials sector. Banks are being used more and more these days as extensions of government fiscal intervention/policy via myriad stimulus programs (which makes them more like “utilities”), while regulatory oversight has put a limit on just how much capital they can return to shareholders. This adds a degree of unnecessary complexity for dividend growth and income investors. Returns on equity remain relatively unattractive for many banks when compared to some of the strongest Economic Castles on the market that put up ROICs north of 100%, for example, some even higher. Systemic risk remains present, too, with most lending books opaque and intertwined within a global financial system that remains far from healthy due to COVID-19.

Subscribe Now to Gain Access!

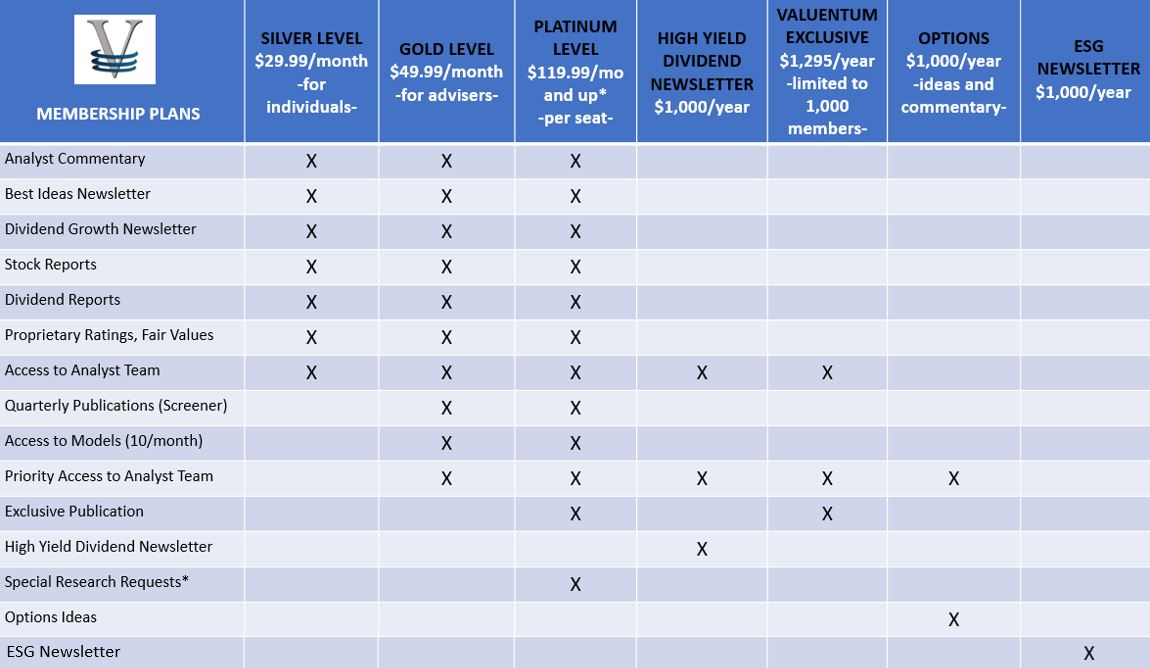

This page is available to subscribers only. To gain access to members only content (including this research piece), click here to subscribe. With a subscription, you'll have access to all of our premium commentary, equity reports, dividend reports and Best Ideas Newsletter and Dividend Growth Newsletter, as well as receive discounts on all of our modeling tools and products. Financial advisers and institutional investors have even more to choose from!

Click to Learn More about Valuentum

If you are already a subscriber, please login.

If you believe you should be able to view this area then please contact us and we will try to rectify this issue as soon as possible.

To gain access to the members only content, click here to subscribe. You will be given immediate access to premium content on the site.

|