Member LoginDividend CushionValue Trap |

NextEra Energy Is a Great Income Growth Idea

publication date: Oct 14, 2022

|

author/source: Callum Turcan

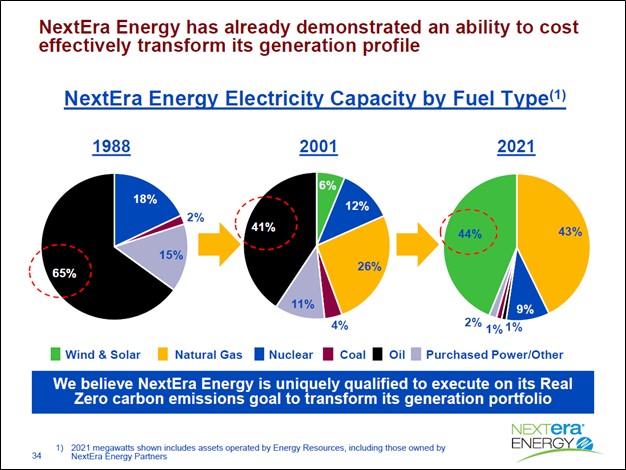

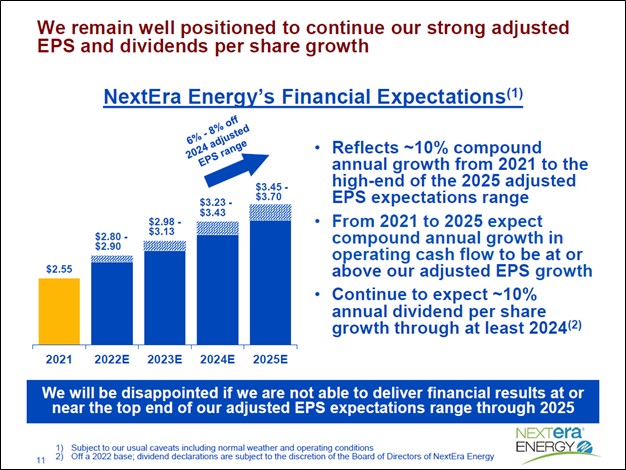

Image Shown: NextEra Energy Inc is a great income growth idea that complies with ESG investing standards as the company is investing heavily in renewable energy power generation assets and battery storage facilities. Image Source: NextEra Energy Inc – June 2022 IR Presentation By Callum Turcan The utility sector is home to companies with stable and highly visible cash flows, particularly as it concerns regulated utility operations, given the essential nature of the services these enterprises provide. Regulated utility operations refers to utilities that participate in rate cases with state-level public utilities commissions (‘PUCs’), with these rate cases largely setting the parameters of what the relevant utility can charge its customers. Generally speaking, PUCs and the rate case process allows utilities to earn a return on equity (‘ROE’) within a certain band and ensures that these companies are properly compensated for their efforts while also ensuring that customers aren’t being gouged given the natural monopolies that are inherent in this sector. As it concerns renewable energy power generation operations, while some of these assets fall into the regulated category depending on the region and operator, some of these assets fall outside of the regulated utility realm. To offset the immense volatility of the financial performance of merchant power generators, utilities will secure power purchase agreements (‘PPAs’) to ensure that new solar plants and wind farms (among other types of power plants) have a steady source of demand at a predetermined price (usually determined by a pricing formula). Utilities refer to these types of renewable energy power generation assets as contracted renewables to differentiate these assets from merchant power plants that are not protected by PPAs, which are instead at the whims of the trajectory of wholesale electricity prices and input costs (such as thermal coal and natural gas prices). NextEra Energy NextEra Energy Inc (NEE) has a vast regulated utility footprint in Florida via its Florida Power & Light Company (‘FPL’) subsidiary and a large merchant power operation via its sizable economic interest in NextEra Energy Partners LP (NEP). We are huge fans of NextEra Energy given its stable cash flow profile, rock-solid operational execution, vast growth runway, and management’s commitment to rewarding income seeking investors. In June 2022, NextEra Energy raised its non-GAAP adjusted EPS targets through 2025, which now calls for its adjusted EPS to post a CAGR of 6%-8%. That is expected to drive operating cash flow of by a similar or greater amount during this period, which in turn is expected to enable NextEra Energy to grow its per share dividend by ~10% per year through 2025. Shares of NEE yield a nice ~2.2% as of this writing with ample room for upside.

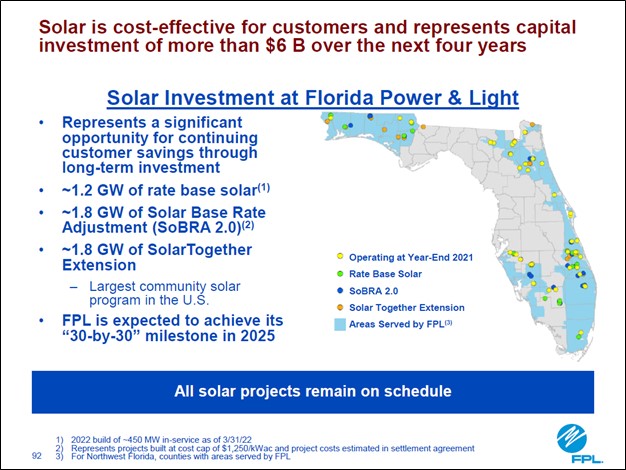

Image Shown: NextEra Energy’s adjusted EPS, operating cash flow, and per share dividend are all expected to grow robustly through 2025. Image Source: NextEra Energy – Second Quarter of 2022 IR Earnings Presentation FPL Overview The power generation base at its FPL unit is primarily represented by nuclear power plants, natural gas-fired power plants, and solar farms. FPL is investing heavily in growing the power generation capacity of its solar operations and given that these are intermittent sources of power supply, is also investing in utility-scale battery storage facilities. One such facility is the Manatee Energy Storage Center located in Parrish, Florida. The company is also investing in electric vehicle (‘EV’) charging stations as part of a new rate base agreement FPL reached with Florida’s Public Service Commission (‘PSC’) in 2021, an agreement that is favorable for both FPL and the people of Florida. As an aside, Gulf Power (another NextEra Energy subsidiary) merged with FPL at the start of 2022. Gulf Power was another electric utility in Florida that primarily operated in the northwest region of the state. Integrating these two operations together should generate meaningful synergies down the road by improving both FPL’s cost structure and its ability to meet the demand of its customers. FPL serves ~5.8 million customer accounts covering more than 12 million people in Florida. Originally, FPL aimed to install 30 million solar panels by 2030 which was forecasted to have 11.7 gigawatts (‘GWs’) of power generation capacity through its ’30-by-30’ plan. Now FPL aims to complete its 30-by-30 plan by 2025, five years earlier than expected, as its rock-solid operational execution has seen the development of new solar farms go smoothly. By 2025, FPL expects its 30-by-30 program will have saved ~$2.5 billion in fuel savings for its customers as these solar farms are very economically competitive with other forms of electricity generation in the current environment.

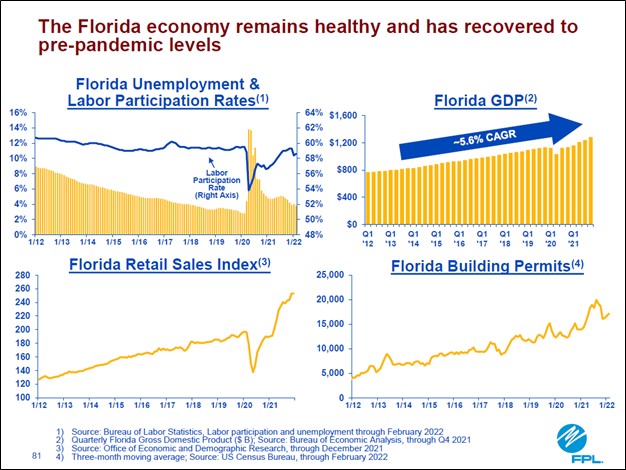

Image Shown: NextEra Energy is investing billions towards developing additional solar farms and battery storage facilities in Florida over the coming years via its FPL unit. Image Source: NextEra Energy – June 2022 IR Presentation As both Florida’s population and economic growth outlooks are bright, the outlook for electricity demand growth in the state is incredibly promising. That in turn should drive up demand for electricity, helping to ensure FPL’s existing and future power generation operations can operate at healthy utilization rates while also generating ample new growth opportunities for FPL to capitalize on. From 2022-2025, FPL expects to invest ~$32-$34 billion towards capital expenditures which should materially grow its rate base, adjusted earnings, and ultimately NextEra Energy’s operating cash flow generating abilities. As an aside, FPL is working hard to restore power to its customers in the wake of Hurricane Ian, and we are hoping everyone in the region stays safe out there during this hurricane season.

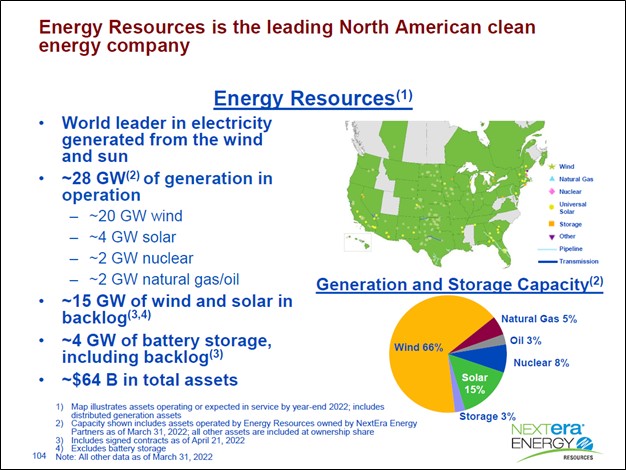

Image Shown: Florida’s population and economic growth outlooks are both incredibly bright and underpin FPL’s promising growth trajectory. Image Source: NextEra Energy – June 2022 IR Presentation NextEra Energy Resources Pivoting to NextEra Energy Resources (‘NEER’), the division of NextEra Energy that covers its economic interest in NextEra Energy Partners, the growth runway at this unit is immense. NEER had ~28 GW of operating power generation assets as of March 2022. By the end of the first quarter of 2022, NEER had a backlog of ~15 GW of solar and wind farm projects and an additional ~4 GW of battery storage developments. During the second quarter of 2022, NEER added ~0.8 GW of net new wind power developments, ~1.2 GW of net new solar power projects, and a negligible amount of net new battery storage developments to its backlog. Around 66% of NEER’s operational power generation capacity is represented by wind power, followed by nuclear power at 15% and solar at 8%. NEER also owns natural gas infrastructure, such as pipelines, and has a moderate amount of exposure to operational battery storage along with various fossil fuel assets. The unit’s footprint stretches across the continental US, up into Canada, and over to Hawaii, highlighting the vast presence in the renewable energy landscape NEER has in North America.

Image Shown: NextEra Energy’s NEER unit has an enormous amount of power generation capacity that’s heavily weighted towards wind power. Image Source: NextEra Energy – June 2022 IR Presentation From 2022-2025, NextEra Energy expects to spend ~$85-$90 billion on its capital expenditures across all its operations (including FPL and NEER). The company’s growth runway beyond 2025 is also bright, and NextEra Energy is looking for opportunities in the realm of green hydrogen, electricity transmission developments, additional renewable energy power generation capacity, battery storage assets, and water utilities (recently, NextEra Energy has been actively acquiring small water utility companies).

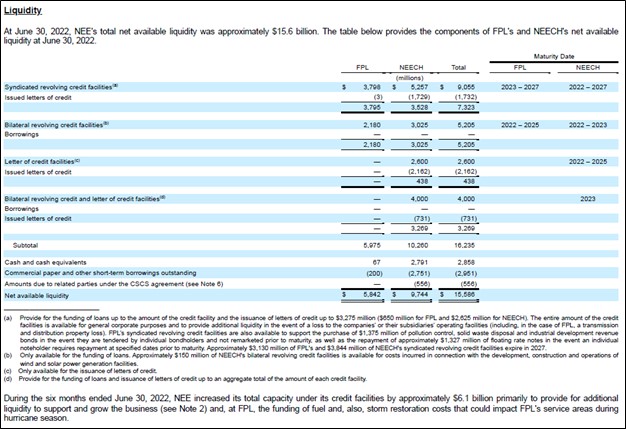

Image Shown: NextEra Energy’s capital investment pipeline is robust. Image Source: NextEra Energy – June 2022 IR Presentation Earnings Update On July 22, NextEra Energy reported second quarter 2022 earnings that missed consensus top-line estimates but beat consensus bottom-line estimates. Its non-GAAP adjusted EPS rose to $0.81 in the second quarter of 2022, up 14% year-over-year, aided by strength at both its FPL and NEER units. NextEra Energy noted that its FPL unit’s net income rose by 12% year-over-year to reach $1.0 billion while its NEER unit flipped from a net loss in the same period last year to a positive net income of $0.1 billion in the second quarter of 2022. On an adjusted basis, its NEER unit posted $0.7 billion in net income in the second quarter of 2022, up 19% year-over-year. Strength at FPL was driven in part by the unit adding more than 87,000 average customers to its operations in the second quarter of 2022 versus the same quarter last year (after adjusting for the merger of FPL and Gulf Power). Additionally, FPL’s regulatory capital employed increased by 11% year-over-year during this period due to the utility’s robust capital investment pipeline and recent capital expenditures. Pivoting to its NEER unit, strength here was driven by NEER bringing additional developments online and solid operational execution. As noted previously, its NEER unit did a solid job securing additional renewable energy power projects during the second quarter of this year. Financial Considerations NextEra Energy, due to its enormous capital expenditure requirements, large dividend obligations, a hefty net debt load, is a capital market dependent entity. The utility needs to be able to tap capital markets at reasonable rates to refinance maturing debt, make good on its dividend obligations, and fund its growth ambitions. At the end of June 2022, NextEra Energy had $2.9 billion in cash and cash equivalents on hand versus $10.2 billion in short-term debt and $53.4 billion in long-term debt. Furthermore, NextEra Energy generated negative free cash flows during the first half of 2022. However, please note that NextEra Energy is a solid cash flow generator (it posted $4.8 billion in net operating cash flows during the first half of 2022) and over time should become an impressive free cash flow generator once it finishes its major expansion plan. In September 2022, NextEra Energy raised $2.0 billion gross via an equity issuance which raised over $1.9 billion on a net basis. Here is what the firm had to say on the equity issuance: Each equity unit will be issued in a stated amount of $50. Each equity unit will consist of a contract to purchase NextEra Energy common stock in the future and a 5% undivided beneficial ownership interest in a NextEra Energy Capital Holdings, Inc. debenture due Sept. 1, 2027, to be issued in the principal amount of $1,000. The debentures will be guaranteed by NextEra Energy Capital Holdings' parent company, NextEra Energy, Inc. Total annual distributions on the equity units will be at the rate of 6.926%, consisting of interest on the debentures and payments under the stock purchase contracts. Each stock purchase contract will require the holder to purchase NextEra Energy common stock for cash, based on a per-share price range of $88.88 to $111.10. The higher end of this price range reflects a premium of 25% over the New York Stock Exchange closing price of NextEra Energy common stock on Sept. 14, 2022, which was $88.88. The holders must complete the stock purchase by no later than Sept. 1, 2025, and their purchase obligations may be satisfied with proceeds raised from remarketing the debentures that comprise part of their equity units. NextEra Energy appears to retain access to capital markets at attractive rates and should be able to continue making good on its various financial obligations going forward, in our view. The company and its subsidiaries also have various revolving credit facilities at their disposal, providing the corporate family with ample access to liquidity that can be used to meet their near term funding needs. NextEra Energy has an investment grade corporate level credit rating (Baa1/A-/A-) with stable outlooks, which should support its ability to tap debt markets going forward.

Image Shown: NextEra Energy’s corporate family has ample access to liquidity via various revolving credit facilities. Image Source: NextEra Energy – 10-Q SEC filing covering the second quarter of 2022 Concluding Thoughts NextEra Energy is an attractive dividend growth idea that also complies with ESG investing standards, given its efforts on the renewable energy front. We appreciate the company’s robust capital investment pipeline as that underpins its bright adjusted EPS, operating cash flow, and dividend per share growth outlook through 2025. The utility is best of breed. ----- Utilities (Mid/Small) Industry - AEE, ALE, CNP, CMS, DTE, ES, LNT, MGEE, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC Utilities (Large) Industry - AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, PCG, PPL, SO, XEL Related: NEP, XLU Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE. Utilities Select Sector SPDR ETF (XLU) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. NextEra Energy Inc (NEE) is included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

0 Comments Posted Leave a comment