Member LoginDividend CushionValue Trap |

News Brief: Stay at Home Stocks, REITs, Housing, Oracle, and AT&T

publication date: Oct 22, 2020

|

author/source: Brian Nelson, CFA

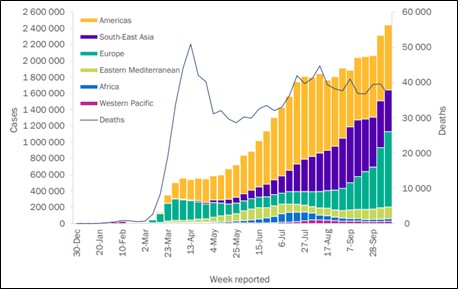

Image: Number of COVID-19 cases reported weekly by WHO Region, and global deaths, 30 December 2019 through 18 October 2020. Source: WHO. The COVID-19 pandemic continues to rage on, though the healthcare community has become more adept at reducing the incidence of death given the many treatments now available to battle the disease. We continue to stay the course with the newsletter portfolios. Many of our favorites include Apple, Microsoft, Facebook, Alphabet, and PayPal, among other moaty, net-cash-rich, free-cash-flow generating powerhouses tied to secular growth trends. Our focus remains on the long haul. The business models of many stay-at-home stocks are solid as they continue to reap the rewards of the accelerated trends of home office use and e-commerce proliferation. Housing-related names are also benefiting as consumers adjust their lifestyles to accommodate a post-COVID-19 world. Many pockets of the economy still remain ill, and the slow fading of the attractiveness of commercial / office / apartment space may rear its ugly head as this new decade continues. As was the case with the department stores, they may hang around for years (decades) with myriad fits and starts, but it will be an uphill battle for REITs operating in these areas. We see little reason to bottom fish in airlines, cruise lines, or fickle mall-based retail, for example, but there may be select opportunities in the restaurant arena with Chipotle and Domino’s. The financials and energy sectors are two areas we continue to avoid, more generally, and they have continued to underperform. By Brian Nelson, CFA Infections related to the COVID-19 pandemic are not slowing, even though the healthcare community is fighting back with effective treatments, and a vaccine seems imminent in the next few months. As of October 18, there have been over 40 million reported cases across the globe and 1.1 million deaths have been recorded. According to the CDC, there are now 8.25 million cases in the United States alone, with more than 414,000 occurring during the past week. The total number of US deaths is now 220,362, with 863 new deaths in the country since the last update. We expect the Fed and Treasury to continue to stimulate the US economy out of this crisis, and while there are still a number of very troubled areas from the airlines to cruises to mall-based retailers and restaurants, many other companies continue to thrive, largely irrespective of the economic environment and the pandemic. Though the timing of the next stimulus deal is pending, we expect Congress to continue to deliver. Our focus remains on opportunities that we expect to do well over the long haul--meaning we’d seek to “own” ideas in the newsletter portfolios regardless of the pandemic-driven economic weakness. The likes of Facebook (FB), Alphabet (GOOG), PayPal (PYPL), and many other newsletter holdings are levered to long-term secular trends that have only accelerated because of COVID-19. Their business models are not likely to be derailed by the COVID-19 crisis, but rather in many cases, they have been augmented. We continue to focus on the micro characteristics of individual holdings, running both upside and downside scenarios often in the context of each company’s fair value range. For example, it’s hard not to like Apple (AAPL) and Microsoft (MSFT)--two nicely-valued net cash rich, free cash flow generating powerhouses that may turn into the two best dividend growth stocks in the decades to come. The economic environment this year or next isn’t going to change that. One of our favorite quotes from legendary Fidelity manager Peter Lynch continues to ring true: “If you spend more than 13 minutes analyzing economic and market forecasts, you’ve wasted 10 minutes.” Too great of a focus on near-term expected economic data would have left many an investor on the sidelines for what turned out to be the best 50-100 days ever in the stock market this summer. We went confidently to fully invested in April, and we pounded the table on how optimistic we were about the markets shortly after in May, reiterating our views again mid-June, Stay Optimistic. Stay Bullish. I Am.” Despite their big share-price runs thus far, we expect work-from-home (WFM) stocks to continue to do well given inevitable secular trends. For starters, many companies are adapting as executive teams realize that productivity is not being hurt from employees working out of their home offices. Facebook, for example, is letting people work from home forever, with CEO Mark Zuckerberg estimating that “as much as 50 percent of the company’s 45,000-person workforce could be working entirely remotely in the next five to 10 years.” Microsoft is also allowing more employees to work from home permanently, and we’d expect other companies to eventually make the secular shift, allowing employees to work from home permanently, too. Many commercial / office / apartment REITs may find it much harder to convince tenants to double-down on more office space, while some of the retail and apartment REITs could see their business models face even greater pressure as e-commerce and work-from-home trends accelerate. Many “hold-outs” of online purchasing have made the leap as a result of stay-at-home orders, with their buying patterns changed forever, and COVID-19 has all but shown many workers with families that they need more living space at their residence. Valuentum’s Callum Turcan had the following to say about this dichotomy: The expected increase in the percent of the US workforce working from home will pressure some commercial/office real estate holdings. With that in mind, having several self-storage and data center REITs in the High Yield Dividend Newsletter portfolio highlights that investors can find high quality income generation opportunities in the REIT space without having to face work-from-home related headwinds. As it concerns open Exclusive income generation ideas, many REITs that have been highlighted have also held up well. The inevitable shift toward home ownership driven by the COVID-19 pandemic (and expectations that other pandemics may occur in the future) has become evident. According to RE/MAX Holdings (RMAX), September home sales leapt an incredible 21% on a year-over-year basis. Homes are selling faster, too, averaging a full week quicker than last year, while inventory levels collapsed nearly 32%, to at least a 13-year low. The median sales price increased more than 12% on a year-over-year basis, as consumers want more houses--and bigger, more expensive ones at that. Here’s an excerpt from the report: Demand is off the charts right now. Buyers of all ages are coming into the market determined to improve their quality of life through amenities, community and the unique security that comes with homeownership. They’re working through the challenges of tight inventory, high prices and competing offers to take advantage of historically low interest rates and, in many cases, the greater mobility they now enjoy through working remote. We also asked Valuentum’s Callum Turcan about his thoughts on Dividend Growth Newsletter portfolio holding Oracle (ORCL). Many have grown concerned about the competitive environment across Oracle’s product suite and the effectiveness of its cloud migration efforts, but we continue to have a more positive bent to its economic return and organic growth potential. Oracle’s shares are up an impressive ~13% year-to-date, excluding the collection of dividend payments, roughly doubling the return of the S&P 500. Here’s what Mr. Turcan had to say about this: Oracle's cloud-oriented offerings have started to put up some better growth figures recently, and management has been able to revive sales growth while keeping a lid on operating expenses. The TikTok deal, if it materializes, would be a big win for Oracle though its outlook has been improving of late regardless of how that story ultimately pans out. Some of Oracle's recent key wins in the cloud-computing arena include signing big deals with Zoom (ZM) and 8x8 (EGHT). Where Oracle will find some support going forward is the desire from companies to have multiple providers of cloud-based services, as a way to improve their negotiating ability, and from the launch of its new cloud-based offerings and improved database offerings. Shares of near-8% dividend yielder AT&T (T) popped during the trading session October 22 thanks to a better-than-feared third-quarter report. Though revenue fell on a year-over-year basis, the company beat the consensus figure, and while non-GAAP earnings came in a little light, the commentary was upbeat. We think management continues to focus on the right areas, and we continue to like this high-yield idea, even if outsize dividend growth may be hard to come by going forward, “High Yield Dividend Income Investing in a Time of Need.” Here is what AT&T’s CEO John Stankey had to say in the press release: We delivered a solid quarter with good subscriber momentum in our market focus areas of connectivity and software-based entertainment. Wireless postpaid growth was the strongest that it’s been in years with one million net additions, including 645,000 phones. We added more than 350,000 fiber broadband customers and are on track to grow our fiber base by more than 25% this year. And we continue to grow and scale HBO Max, with total domestic HBO and HBO Max subscribers topping 38 million — well ahead of our expectations for the full year. Our strong cash flow in the quarter positions us to continue investing in our growth areas and pay down debt. We now expect 2020 free cash flow of $26 billion or higher with a full-year dividend payout ratio in the high 50s%. Concluding Thoughts The COVID-19 pandemic continues to rage on, though the healthcare community has become more adept at reducing the incidence of death given the many treatments now available to battle the disease. We continue to stay the course with the newsletter portfolios. Many of our favorites include Apple, Microsoft, Facebook, Alphabet, and PayPal, among other moaty, net-cash-rich, free-cash-flow generating powerhouses tied to secular growth trends. Our focus remains on the long haul. The business models of many stay-at-home stocks are solid as they continue to reap the rewards of the accelerated trends of home office use and e-commerce proliferation. Housing-related names are also benefiting as consumers adjust their lifestyles to accommodate a post-COVID-19 world. Many pockets of the economy still remain ill, and the slow fading of the attractiveness of commercial / office / apartment space may rear its ugly head as this new decade continues. As was the case with the department stores, they may hang around for years (decades) with myriad fits and starts, but it will be an uphill battle for REITs operating in these areas. We see little reason to bottom fish in airlines, cruise lines, or fickle mall-based retail, for example, but there may be select opportunities in the restaurant arena with Chipotle (CMG) and Domino’s (DPZ). The financials and energy sectors are two areas we continue to avoid, more generally, and they have continued to underperform. --- REIT related: ARE, CUZ, DEA, GNL, KRC, BDN, EQR, IRT, ACC, CPT, MAA, AIV, UDR, VNQ Airline related: AAL, ALK, DAL, HA, JBLU, LUV, SAVE, UAL, JETS Housing related: TOL, ITB, BZH, LEN, HOV, DHI, PHM, SHW, OC, HD, LOW, LL Other: RCL, CCL, NCLH Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson owns shares in SPY, SCHG, DIA, VOT, and QQQ. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

1 Comments Posted Leave a comment