Member LoginDividend CushionValue Trap |

ICYMI: Never Been More Bullish Even as Buffett Dumps Airlines

publication date: May 8, 2020

|

author/source: Brian Nelson, CFA

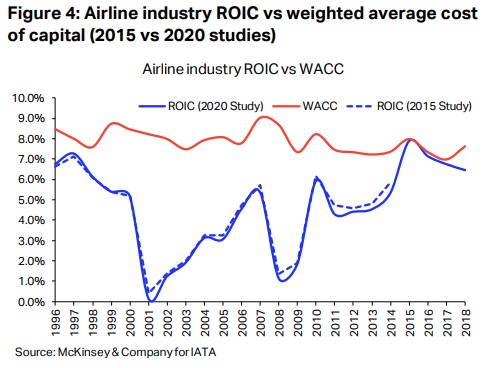

Image Source: IATA. Data Source: McKinsey & Company (IATA). Airlines haven’t been able to earn their estimated cost of capital for as long as we can remember. There have been hundreds of airline bankruptcies since deregulation in 1978. By Brian Nelson, CFA On Saturday, May 2, Berkshire Hathaway (BRK.A, BRK.B) reported expectedly weak first-quarter results. We won’t be ditching Berkshire Hathaway’s stock in the Best Ideas Newsletter portfolio so long as Uncle Warren is at the helm, but there were a couple takeaways from the report that we want you to be aware of (we’ll have another more extensive note focusing more exclusively on Berkshire coming out soon). The first big piece of news, something that should not be surprising to any reader of our work, is that Buffett sold his stakes in the airlines. We’ve already talked extensively about how the Oracle made a mistake in owning the airlines in the first place in Value Trap and in the following article, “Buffett Makes Another ‘Unforced Error’ in Airlines,” and we’re not reading anything at all (not on the economy, not on the equity markets) into his decision to unload shares. Despite their oligopolistic structure, airlines do not have “moats” and arguably have decrepit economic castles. A company is generally considered a “moaty” enterprise if its ROIC, or return on invested capital, consistently exceeds its WACC (ROIC-WACC = economic profit) and is expected to continue to do so, as a result of a benign industry structure and impenetrable competitive advantages. Consistent economic profits have never happened for airlines. Airlines have always been terrible long-term investments. According to the IATA, for example, industry-wide ROIC averaged a mere 6.7% during the 5-year period 2014-2018, well below the group’s estimated cost of capital (see image at top of this article), a period that coincides with one of the most prosperous economic environments ever witnessed across the globe. There have been hundreds of airline bankruptcies since deregulation in 1978, too, and there hasn’t been one instance where the airline industry’s ROIC has exceeded its WAAC in more than 20 years (even when oil prices collapsed in 2015/2016, ROIC still came up short).

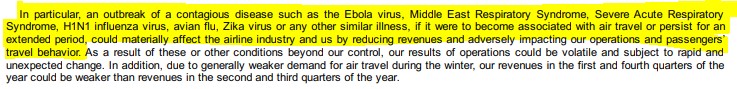

Image Source: American Airlines’ 10-K, released February 2019. A flu pandemic is a documented risk factor in airline regulatory filings. Though COVID-19 was an unexpected catalyst, so was SARS, 9/11, oil price shocks and the Iraq war. While COVID-19 may look like it came out of left field, when it comes to the airline business, these types of shocks are part of their operations (a flu pandemic is even a documented risk factor in their regulatory filings, see image above, as illustrative), and therefore not extraordinary or even anywhere close to being considered a black swan. Massive buybacks by airlines in recent years are simply unforgiveable, as many executives even used the bankruptcy process to optimize their operations during the past few decades. They knew they were rolling the dice in a bad business. “Let them fail,” we said more recently, and here’s what we said about what to expect from airlines in Value Trap, released December 2018: Buffett said once that he had an 800 number that he would call anytime that he wanted to buy an airline stock again. Maybe that number has been disconnected after all these years, as Berkshire Hathaway is once again an owner of airline equities. Though the structural characteristics of an industry can and do change over time, I’m very skeptical the airline business has changed permanently for the better. Today’s airline business may be more oligopolistic in nature and much more profitable thanks to consolidation and the right-sizing of capacity, but it retains a notoriously cyclical passenger-demand profile, ties to the level and volatility of energy resource prices, considerable operating leverage, all the while barriers to entry remain low, exit barriers remain high, and fare pressure endures. The next downturn may not see as many bankruptcies as prior economic cycles due to lower unit-cost profiles, but it may turn out to only be modestly “less bad” for equity holders. Warren Buffett ditched airlines because he knows they are terrible investments and just made a mistake, while prudently reducing exposure to the aerospace/airline industry because Berkshire also owns metal-bender Precision Castparts, one of our favorite companies that makes metal castings for jet engines. Boeing’s (BA) massive debt raise has been a material positive for the aerospace supply chain, including Precision Castparts, but the ill-health of Boeing’s airline customer base will mean commercial aerospace demand will also remain subdued for some time. We told you to stay away from Boeing a long time ago, “Boeing’s Fall from Grace.”

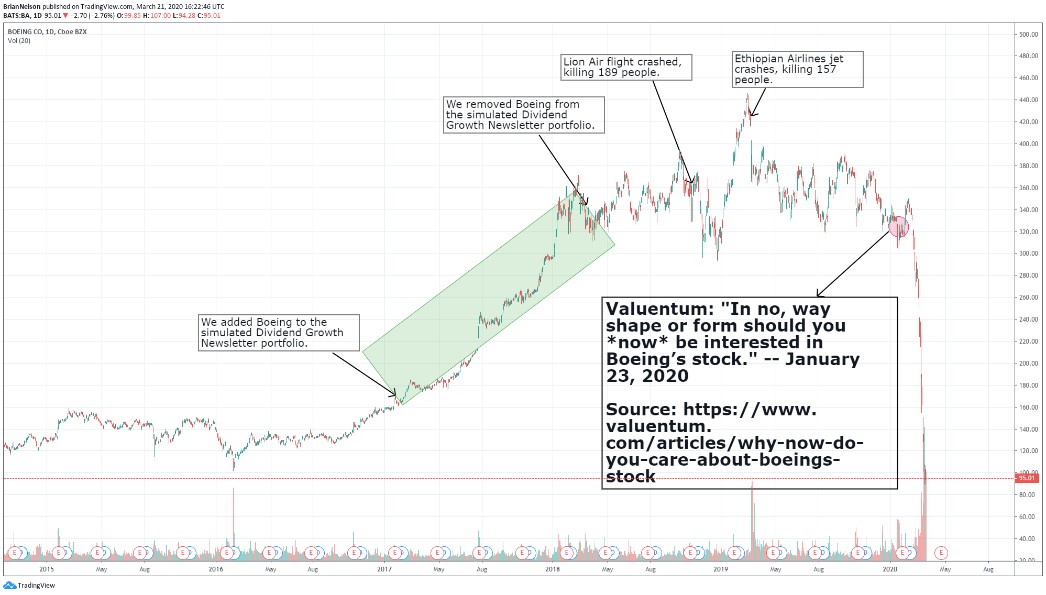

Image (March 21, 2020): Boeing was added to the Dividend Growth Newsletter portfolio January 27, 2017, and removed March 16, 2018, prior to the unfortunate accidents that have claimed the lives of hundreds of people. We warned readers to stay far away of Boeing's stock days before its huge collapse. Today, we remain unequivocally bullish on equities for the long run. This is somewhat of a change during the past week or so. As with Professor Siegel, we do not expect markets to come anywhere close to retesting the March 23 lows. While it is now much more difficult to call near-term direction than at the top in February and in dollar-cost averaging near the bottom on March 23, we’ve never been more bullish on the long term, “Staying Focused on the Long Term,” as we fully expect moral hazard advice (indexing) to not only continue to be supported via bailouts and stimulus, but actually be rewarded, a key lesson following any financial crisis.

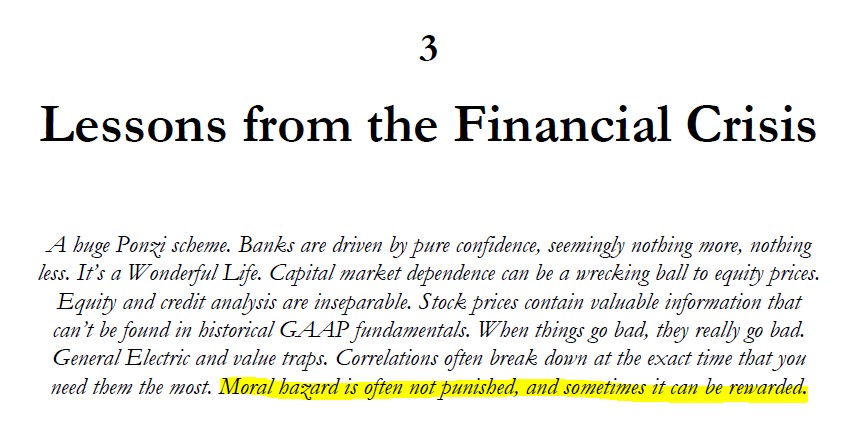

Image Source: The final lesson to learn from financial crises. Value Trap: Theory of Universal Valuation. The Treasury is expected to borrow ~$3 trillion during the current quarter, a tally that is nearly 6 times as much as the nearest record quarter of July-September 2008 during the depths of the Great Financial Crisis. The Fed plans to start buying ETFs this month, and Apple (AAPL) is borrowing 10-year debt at incredibly low rates of just 1.65%. Enter 1.65% as the discount rate in a DCF model. The bias is to the upside! The world also now has several ‘shots on goal’ for a new coronavirus vaccine with drug companies scaling up production even as any possible vaccine remains in early trials. Concluding Thoughts Warren Buffett wrote his now-famous op-ed to the New York Times on October 16, 2008, and this is what you need to know: Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497. The news may be scary in coming months, and market volatility may elevate again, but we’ve never been more bullish on the longer run. The biggest advantage of an individual investor is something called time horizon arbitrage. As many professionals continue to fear a break below the March 23 lows in the near term, we’re focused on how this market absorbs the tremendous and unprecedented stimulus in the coming months and what that means for nominal equity prices in the longer run. It may not happen this month or this year, but we expect lift off as investors race to preserve purchasing power! Our favorite ideas for a portfolio setting remain in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, and High Yield Dividend Newsletter portfolio. Our favorite brand new ideas, released each month, are included in the Exclusive publication. Facebook (FB), PayPal (PYPL), Visa (V), and Alphabet (GOOG) remain among our favorites, in particular. ----- Aerospace & Defense - Prime: BA, FLIR, GD, LMT, NOC, RTX Aerospace Suppliers: ATRO, HEI, HXL, SPR, TDY, TXT Pharmaceuticals - Big: ABBV, ABT, AMGN, AZN, BMY, GSK, LLY, MRK, NVO, NVS, PFE, SNY

Pharmaceuticals - Biotech/Generic: ALXN, AGN, BIIB, BMRN, GILD, MYL, REGN, TEVA, VRX, VRTX, ZTS Airline Related: AAL, ALK, DAL, HA, JBLU, LUV, SAVE, UAL Biotech Related (vaccine/treatment): MRNA, INO, NVAX, BNTX, APDN, VXRT, TNXP, EBS, PFE, JNJ, DVAX, IMV, IBIO, REGN, SNY, GSK, ABBV, TAK, HTBX, SNGX, PDSB, SRNE Treasury Related: TLT, TBT, IEF, SHY, IEI, EDV, TMV, TMF, VGLT, SHV, BIL, VGSH Other: XAR, IBB, JETS, SPY, DIA, QQQ --- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson owns shares in SPY and SCHG. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

3 Comments Posted Leave a comment