Member LoginDividend CushionValue Trap |

Macy’s Builds Liquidity and Cuts Costs to Stay Afloat

publication date: Jul 1, 2020

|

author/source: Callum Turcan

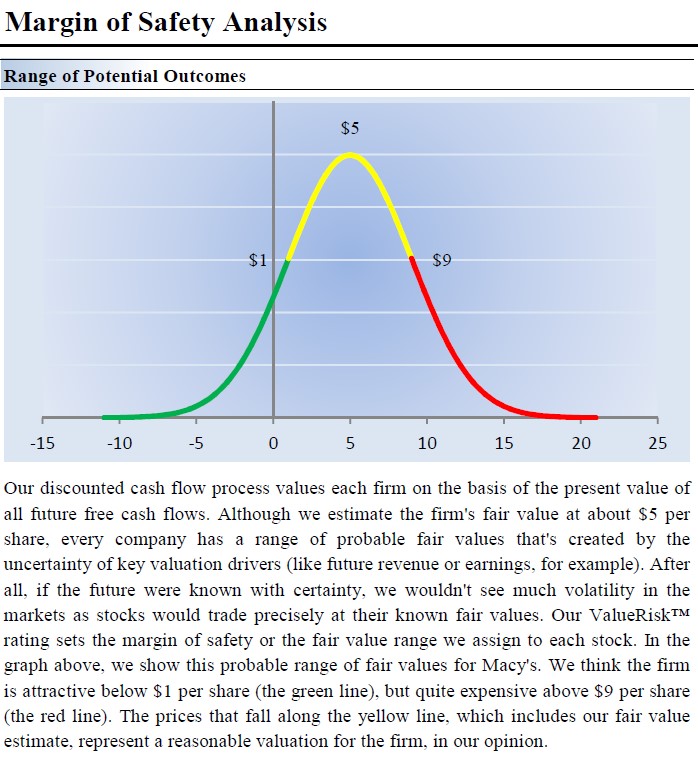

Image Shown: Our fair value estimate range for shares of Macy’s Inc is quite wide at $1-$9 per share, relatively speaking, as the retailer’s outlook remains troubled due to its large net debt load and the ongoing pandemic. In the event Macy’s can reopen its physical stores in the near-term while maintaining recent gains seen at its digital operations, its revenues might rebound convincingly. Should Macy’s be forced to close its physical stores again for a prolonged period of time to contain the ongoing pandemic, that would likely drain its recently enhanced liquidity position and put a tremendous amount of stress of its financials going forward. Thus Macy’s has a relatively wide range of fair value outcomes, and represents the type of firm we generally prefer to stay away from. By Callum Turcan On July 1, Macy’s Inc (M) reported first quarter fiscal 2020 earnings (period ended May 2, 2020) that missed consensus top-line estimates but beat consensus bottom-line estimates. The retailer’s GAAP net sales plummeted by 45% year-over-year last fiscal quarter due to various US state and local government mandates that forced non-essential businesses to close. Quarantine efforts to contain the coronavirus (‘COVID-19’) pandemic in the US, rising unemployment rates, and a large net debt load represent three big hurdles Macy’s will need to find a way to deal with. Please note that most of the retailer’s physical stores are in the US and that Macy’s suspended its common dividend payouts earlier this calendar year. A large impairment charge combined with sharply lower revenues saw Macy’s post a large GAAP net loss of $3.6 billion in the fiscal first quarter. Liquidity and Cost Savings Update At the end of its latest fiscal quarter in early-May, the retailer’s cash and cash equivalents balance stood at $1.5 billion versus a short-term debt load of $0.7 billion and a long-term debt load of $4.9 billion. However, Macy’s engaged in some serious financing activities in late-May and early-June that materially improved its liquidity position, which we covered in a past article (link here): On May 27, Macy’s announced the pricing of an upsized (from $1.1 billion previously) bond issuance of $1.3 billion in 8.375% senior secured notes due June 2025 (that is a hefty coupon, highlighting the wariness of creditors as it concerns lending to distressed retailers). On June 8, Macy’s announced it had closed on that deal. Please note that (from the press release concerning the aforementioned senior secured notes due June 2025): The notes were issued by Macy’s, Inc. and are secured on a first-priority basis by (i) a first mortgage/deed of trust in certain real property of subsidiaries of Macy’s that were transferred to subsidiaries of Macy’s Propco Holdings, LLC, a newly created direct, wholly-owned subsidiary of Macy’s (“Propco”) and (ii) a pledge by Propco of the equity interests in its subsidiaries that own such transferred real property. Macy’s also announced on June 8 that it had closed on a new $3.15 billion asset-based credit agreement. With those proceeds “the company has amended and substantially reduced the credit commitments of its existing $1.5 billion unsecured credit agreement. The company intends to use the proceeds of the notes offering, along with cash on hand, to repay the outstanding borrowings under the existing $1.5 billion unsecured credit agreement.” Furthermore (emphasis added), “with the closing of these financings, the company expects to have sufficient liquidity to address the needs of the business, including funding operations and the purchase of new inventory for upcoming merchandising seasons, resolving its accrued payables obligations, and repaying upcoming debt maturities in fiscal 2020 and fiscal 2021.” During the company’s latest quarterly conference call, management expressed confidence that these measures combined with programs to cut down on Macy’s operating expenses provides the firm with at least a couple more years of liquidity (if not more). Macy’s announced it will reduce its corporate workforce headcount by an additional 3,900 according to a June 25 press release, and that is expected to save the firm $630 million on an annualized basis (including $365 million in fiscal 2020). These cost savings are on top of previous pledges to realize $1.5 billion in annualized cost savings by the end of fiscal 2022, which were made in February (these cost savings are expected to be generated via headcount reductions and store closures). The company expects to realize $180 million in restricting charges in fiscal 2020 as part of these cost savings programs. Looking Ahead Macy’s withdrew its fiscal 2020 guidance back in March 2020 given the uncertainties created by the COVID-19 pandemic. The retailer’s CEO Jeff Gennette noted “we do not anticipate another full shutdown, but we are staying flexible and are prepared to address increases in cases on a regional level” in the firm’s latest earnings press release. Please note that numerous US states are reimposing pandemic containment measures in response to rising confirmed cases of COVID-19 and unfortunately, rising hospitalizations and deaths relating to the pandemic. Macy’s expects that most of its furloughed workforce will return to work starting early-July, though nothing is for certain during a pandemic. Here’s what the retailer’s CEO had to say during the firm’s latest quarterly conference call (emphasis added): “So we cut our weekly cash burn rate, significantly reducing payroll during the furlough process. We refinance for liquidity [as] that gives us the flexibility we need to navigate through the next several years. And last week [week ended Sunday June 28], we took the painful, but necessary action to align our cost base with anticipated sales. This included reducing our corporate and support headcount by approximately 4,000 colleagues, as well as reductions in staffing levels across the stores, customer service and supply chain network… Beginning next week [week ending Sunday July 12], we welcome back most of our remaining furloughed colleagues. It’s been a tough few months for our organization, but I’m glad that we have a culture of resiliency, and I know that our colleagues will come back together to support the business recovery… …as we are now well into the second [fiscal] quarter, I want to give you a sense of how business is looking. Nearly all of our stores reopened, in fact, only six Macy’s brand stores remain closed… [Macy’s] initial sales trend as stores reopened were stronger than we modeled with a few encouraging signs. In most stores, we saw steady, modest improvement in sales on a weekly basis. Digital sales remain strong in each market as our stores reopen, and our customers were very happy to be back in our stores.” Things appear to be improving at Macy’s though the firm is not out of the woods yet. We wrote a note back in April 2020 (link here) covering why in our view, Macy’s would find it tough to unlock the fair value of its real estate assets (given the pressures facing most parts of the consumer discretionary retail industry). While the retailer’s real estate holdings (and inventory, which was recently used as collateral for a new revolving credit facility) make it easier to raise funds, Macy’s carries a very high cost of debt. Macy’s was struggling long before the pandemic arrived, and recent cost control measures can only do so much to offset major sales declines. The retailer’s interim CFO, Felicia Williams, had this to say during the firm’s latest quarterly conference call (emphasis added): “In the [fiscal] second quarter, we expect roughly 6 to 7 percentage points of comp improvement over the first quarter, with stores exiting the second quarter at approximately 35% down… Taking into account strong digital growth, we expect comps to culminate in the third and fourth quarter, with the total company down in the low to mid-20 range… We expect our digital business to continue to outperform. In the [fiscal] first quarter of this year, we saw digital sales penetration of approximately 43%. And we currently expect that our annual digital penetration will average in the mid-40s. While we saw a low single-digit reduction in year-over-year digital sales in the first quarter, we expect a high-teens increase in the fall season, as customers continue to shift to online shopping as the pandemic continues. As such, we are projecting a low to mid-teens increase in full-year digital sales. The associated delivery cost from the mix shift towards digital are expected to further add to a slow recovery in gross margin, despite expectations for merchandise margin to improve quarter-over-quarter. Our outlook on merchandise margin has improved… we now expect gross margins to improve in the second quarter from first quarter levels, with improvement in each quarter thereafter.” Macy’s is offering up promising guidance, but that will depend heavily on the strength of the US consumer along with the retailer’s ability to reopen its physical stores. As of February 1, 2020, Macy’s had 775 store properties located in 43 US states, Washington DC, Guam, and Puerto Rico, though that number is expected to shrink going forward. Concluding Thoughts Macy’s has the liquidity to ride out the storm but just as importantly, the retailer needs to find ways to either revive revenue growth and/or meaningful shrinking its operating costs. Store closures represent a key part of that strategy as Macy’s shuts down underperforming locations and rationalizes its headcount. However, cost reduction measures can only do so much. If Macy’s continues to experience declining sales over the medium- to long-term, the retailer will have few options given its large net debt load. ---------- Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR PSMT Specialty Retailers Industry – AAN BBBY BBY GME HD LOW LL ODP SHW TSCO WSM Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT Related: AMZN, FDS, SPY, VDC ---------- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG) is included in Valuentum’s simulated Best Ideas Newsletter portfolio.The Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment