Member LoginDividend CushionValue Trap |

Johnson & Johnson Beats Estimates and Raises Guidance

publication date: Jul 21, 2020

|

author/source: Callum Turcan

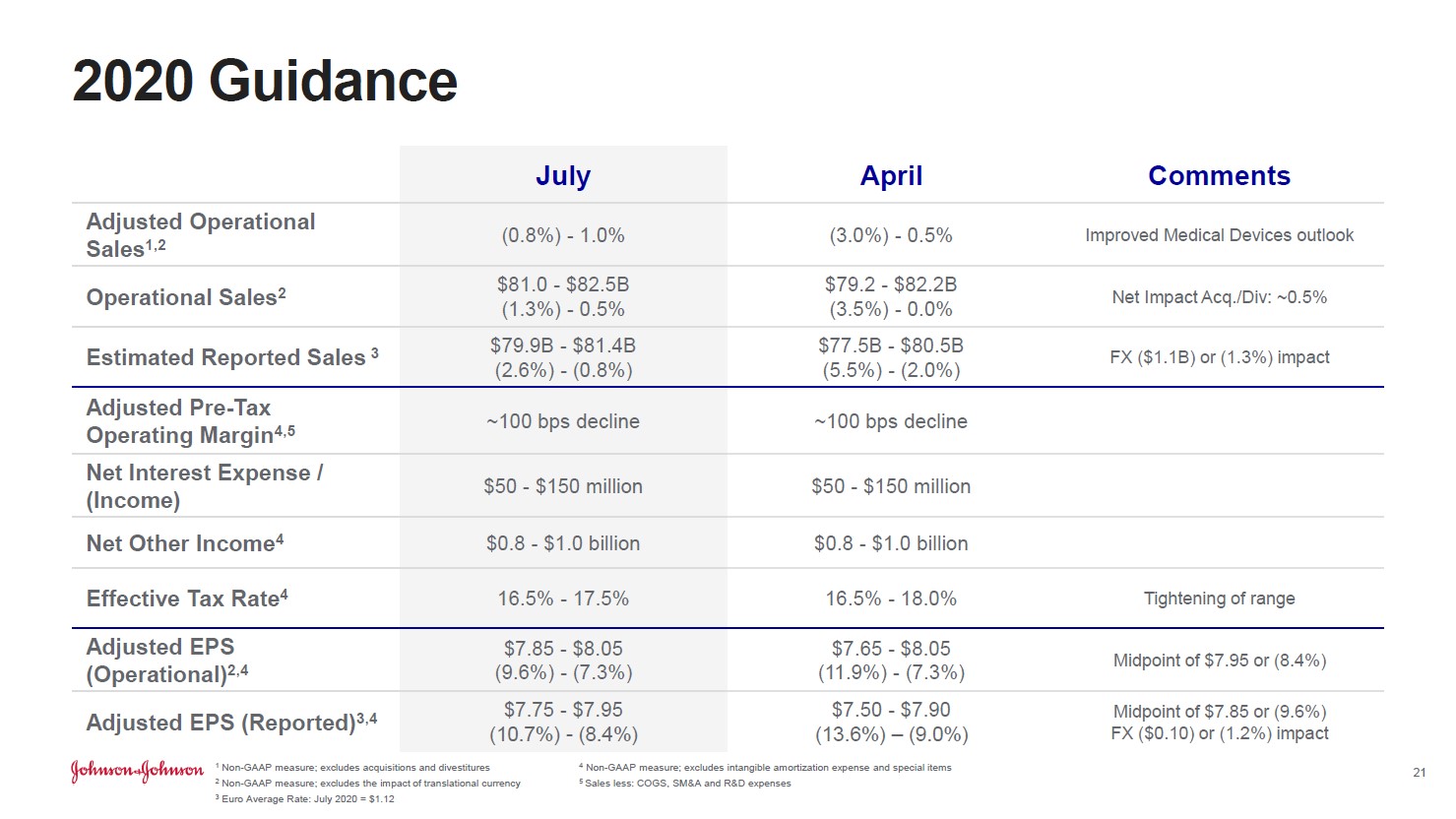

Image Source: Johnson & Johnson – Second Quarter of 2020 IR Earnings Presentation By Callum Turcan On July 16, Johnson & Johnson (JNJ) reported second quarter 2020 earnings that beat both consensus top- and bottom-line estimates. Most importantly, Johnson & Johnson increased its full-year guidance for 2020 as the firm is well-prepared to ride out the ongoing coronavirus (‘COVID-19’) pandemic, in our view. We continue to like shares of JNJ in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. As of this writing, shares of JNJ yield ~2.7%. Guidance Boost In the upcoming graphic down below, Johnson & Johnson provides a side-by-side comparison of the firm’s previous full-year guidance for 2020 as of April 2020 versus its current full-year guidance as of July 2020. This positive revision is entirely driven by Johnson & Johnson’s ‘Medical Devices’ segment performing better than previously expected, albeit off a low base given how the pandemic has curtailed elective medical procedures. Johnson & Johnson left its 2020 forecasts for its ‘Pharmaceuticals’ and ‘Consumer Health’ segments unchanged during its second quarter earnings report.

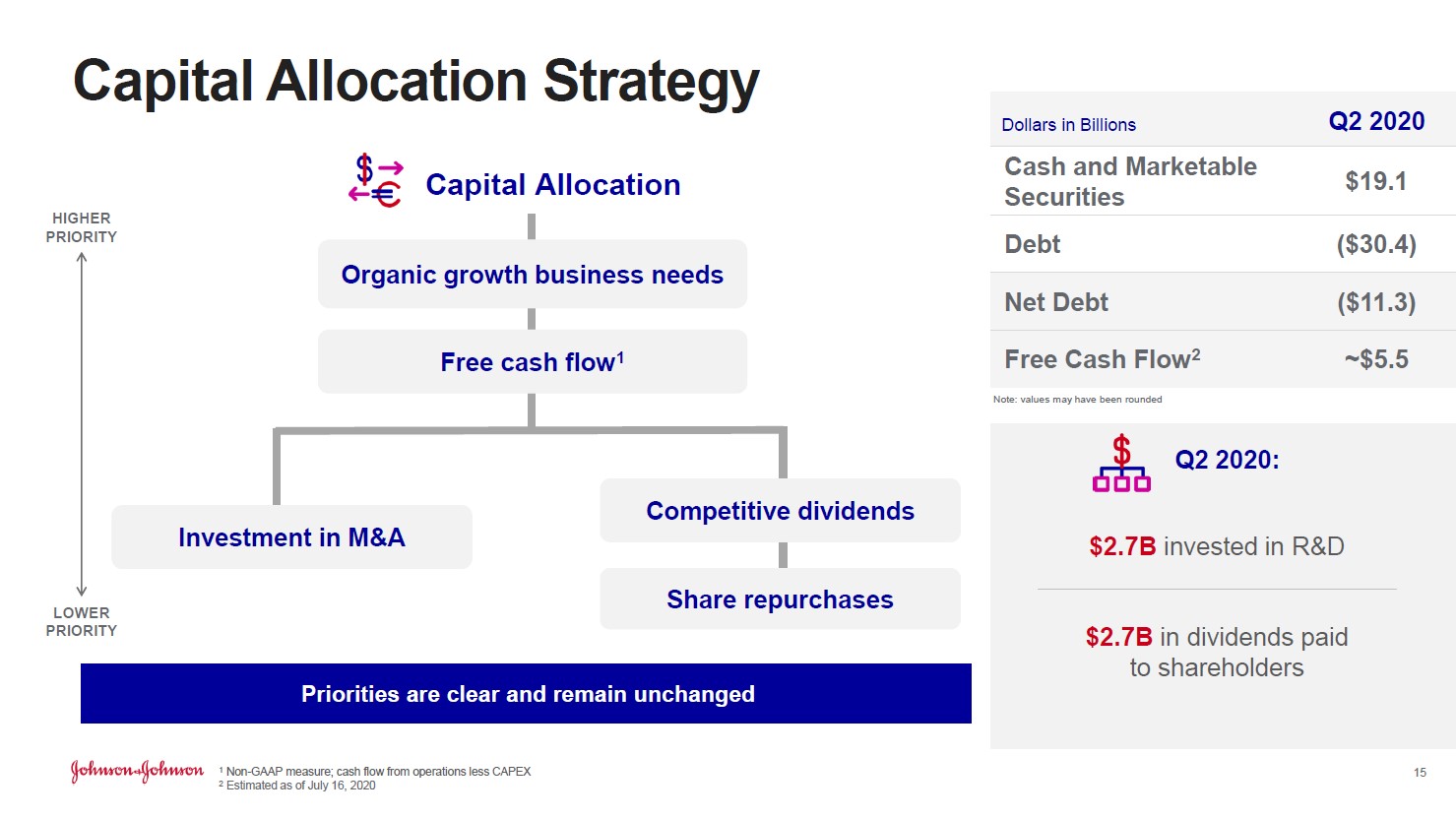

Image Shown: Johnson & Johnson expects its full-year adjusted operating sales, a non-GAAP figure, will be better than feared according to its July 2020 forecasts which were more optimistic than the guidance given out back in April 2020. Image Source: Johnson & Johnson – Second Quarter of 2020 IR Earnings Presentation One of the reasons why Johnson & Johnson improved the outlook for its Medical Devices segment was due to the firm changing its forecasting methodology from one that relies on “buckets” (e.g. South Korea, China, and Japan are viewed as one block market) to a “detailed procedural model [that] allows us to forecast at a granular level within each country” according to management commentary. Johnson & Johnson is no longer “relying on the previous regionally based buckets” and can now offer more detailed guidance, as the economic trajectories (and trajectories of healthcare activities) in South Korea, China, and Japan (for example) have differed materially from each other. Management noted that “we estimate a negative operational sales impact of approximately $3.8 billion to approximately $5.3 billion to the Medical Devices forecast below our original January [2020] guidance” due primarily if not entirely to the pandemic. Please note the company expects demand for this segment’s offerings will steadily improve over the coming quarters due to pent-up demand and the relaxing of restrictions on elective surgeries. Whether elective surgeries can continue in earnest will be largely dependent on whether COVID-19 hospitalizations in the region in question are contained, as the pandemic has put an enormous amount of stress on global healthcare systems. Financial Update Johnson & Johnson’s GAAP revenues declined by ~11% year-over-year in the second quarter and its GAAP gross margin contracted by over 210 basis points as the pandemic created headwinds for its Consumer Health and Medical Devices segments, though its Pharmaceuticals segment performed well. Strong sales of its STELARA (treats immune-mediated inflammatory diseases such as plaque psoriasis and psoriatic arthritis), DARZALEX (treats multiple myeloma), IMBRUVICA (treats certain B-cell malignancies), and other therapeutic offerings helped Johnson & Johnson’s Pharmaceutical segment grow its adjusted (non-GAAP) operational sales by almost 4% year-over-year last quarter. Johnson & Johnson’s Consumer Health segment saw sales of beauty and skin care products fall materially last quarter versus year-ago levels, though part of that might have been due to consumers stockpiling products in the first quarter of 2020 according to management. The company was still able to generate $3.6 billion in GAAP net income in the second quarter of 2020, highlighting Johnson & Johnson’s resilient financial performance. Furthermore, management noted (we will have more to say on this subject when Johnson & Johnson publishes its 10-Q SEC filing covering the second quarter of 2020) that the firm generated ~$5.5 billion in free cash flow last quarter as shown in the image below.

Image Shown: Johnson & Johnson reports that it was comfortably free cash flow positive last quarter, though we will have more to say on the issue once its 10-Q SEC filing is published. Image Source: Johnson & Johnson – Second Quarter of 2020 IR Earnings Presentation At the end of the second quarter, Johnson & Johnson had ample cash and cash equivalents on hand to fund upcoming debt maturities and manage its working capital needs. Though we would like Johnson & Johnson to build up enough cash on hand to flip its net debt position to a net cash position, we view its net debt load as quite manageable given its high quality cash flow profile and investment grade credit rating. Moody’s Corporation (MCO) rated Johnson & Johnson’s credit rating at Aaa (negative outlook) as of April 2020, the highest credit rating Moody’s offers (the negative outlook is namely due to expected legal obstacles, though we see Johnson & Johnson as well-prepared to cover those liabilities given its relatively strong financial position). COVID-19 Vaccine Update Johnson & Johnson is racing towards developing a COVID-19 vaccine, a development that we have stayed on top of for some time (I, II, III), and we are excited with what the firm had to say during its latest report. The company is speeding up its clinical trial timeline and continues to make good progress towards its goal to produce 1 billion doses of a potential COVID-19 vaccine in 2021, should its current candidate (or backup candidates if it comes to that) prove both effective and safe. Here is what Johnson & Johnson had to say on regarding its COVID-19 vaccine efforts during its latest earnings call (emphasis added): “We have seen strong preclinical data so far, which were published in the Journal of Science in May. These data validated the preclinical vaccine challenge model and showed that prototype DNA vaccines were able to create strong immunity. Based on these data and interactions with regulatory authorities, we were able to accelerate the clinical development program of our COVID-19 vaccine candidate. Since then, we have initiated a study of a final Ad26 vaccine candidate in nonhuman primate challenge model. These results will be published in a major scientific journal in the coming weeks. Based on this total package of results, we are very comfortable moving forward with Phase I/IIa studies later this month. This represents an acceleration of our timeline from our original date of September to the end of July. These studies will establish both the safety and immunogenicity of our vaccine candidate as well as evaluate the single dose and the booster dose regimen. The trials will be conducted in more than 1,000 healthy adults aged 18 to 55 years as well as adult aged 65 years and older. Our study sites are located in the U.S. and Belgium. We are also planning for a Phase II study in the Netherlands, Spain and Germany and plan to conduct a Phase I study in Japan. We anticipate the initiation of the trial on July 22 in Belgium and the following week in the U.S. We are also in discussions with the National Institute of Health with the objective to start a Phase III clinical trial ahead of its original schedule, potentially in late September, to evaluate the effectiveness of our vaccine. We are using epidemiology data to predict and plan where our study should take place. We also announced that, in parallel with the clinical development, we are working to expand our global manufacturing capacity to be able to deliver more than 1 billion doses of our COVID-19 vaccine by the end of 2021. We have made excellent progress on this front as well.” There are over 100 vaccine COVID-19 candidates currently under development, though some are far farther along than others. We remain optimistic that one of the “shots on goal” as it relates to discovering a viable COVID-19 vaccine will end up proving safe and effective. Johnson & Johnson is near the front of the pack as it relates to human clinical trials, though Moderna Inc (MRNA) and Oxford/AstraZeneca plc (AZN) are farther along. Moderna expects to soon start Phase III clinical trials on its COVID-19 vaccine, while the Oxford/AstraZeneca partnership has already launched “late stage Phase II/Phase III [clinical] trials” in the UK, Brazil, and South Africa and will soon launch such clinical trials in the US. For Johnson & Johnson, finding a viable COVID-19 vaccine won’t necessarily be needle-moving in terms of revenue generation, though it would likely materially improve its brand image in the eyes of consumers and governments worldwide. Concluding Thoughts Johnson & Johnson's shares have been resilient thus far in 2020, and its business model and cash flow profile have lent ample support to its share price during these challenging times. As the world starts to return to "normal," Johnson & Johnson’s growth outlook should improve materially, especially as its Medical Devices segment starts to recover. We continue to like shares of Johnson & Johnson in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. ----- Medical Devices Industry – EW ISRG MDT VAR WAT ZBH Health Care Services Industry – DVA EHC HCA UNH UHS Pharmaceuticals (Big) Industry – ABT ABBV AMGN AZN BMY LLY GSK MRK NVS NVO PFE SNY Pharmaceuticals (Biotech/Generic) Industry – ALXN AGN BHC BIIB BMRN GILD MYL REGN TEVA VRTX ZTS Household Products Industry – CHD CLX CL ENR HELE JNJ KMB PG Related: SPY, XLV, STT, MNK, ENDP, CAH, MCK, ABC, WMT, RAD, CVS, IBB, MCO Related (vaccine/treatment): MRNA, INO, NVAX, BNTX, APDN, VXRT, TNXP, EBS, PFE, JNJ, DVAX, IMV, IBIO, REGN, SNY, GSK, ABBV, TAK, HTBX, SNGX, PDSB, SRNE ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. The Health Care Select Sector SPDR ETF (XLV) and Johnson & Johnson (JNJ) are both included in Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment