Member LoginDividend CushionValue Trap |

French Conglomerate Bolloré Is Intriguing

publication date: Mar 3, 2021

|

author/source: Callum Turcan

Image Source: Bolloré SE – 2019 Business Report We are intrigued by the extensive reach of Bolloré and the very diversified nature of its asset base. The French conglomerate’s ability to generate meaningful free cash flows during the initial stages of the COVID-19 pandemic highlights the resilience of its business model and cash flow profile. However, we caution that the Bolloré family will continue to exert an outsized level of influence on the trajectory of the conglomerate going forward. Nonetheless, this is one for the radar. By Callum Turcan The French conglomerate Bolloré SE (BOIVF) is a behemoth. It operates in ~130 countries across the world, has ~84,000 employees, and is controlled by the Bolloré family. Cyrille Bolloré is chairman and CEO of the company after he replaced his father, Vincent Bolloré, who had previously been chairman and CEO of the firm. Several Bolloré family members are currently severing on the company’s board of directors and in managerial roles at the conglomerate’s portfolio companies. Note that the firm Sofibol has a controlling stake in the parent company of Bolloré as one can see in the upcoming graphic down below, and that Sofibol is controlled by Vincent Bolloré. There are a lot of moving parts at this corporate giant.

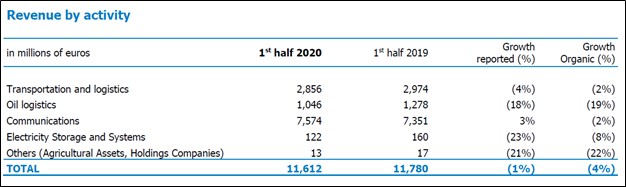

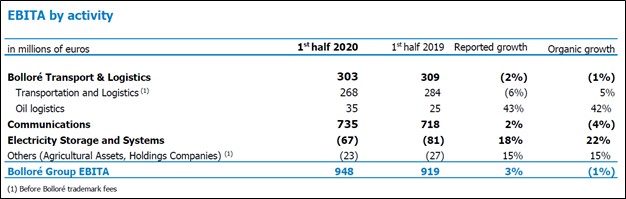

Image Shown: A look at the corporate structure of Bolloré and its portfolio companies. Image Source: Bolloré – 2019 Business Report Corporate Structure and Operations Overview Bolloré has three core business operating segments: ‘Transportation and logistics,’ ‘Communications’ and ‘Electricity storage and systems’ alongside its ‘Other assets’ business operating segment. Please note that the first two business operating segments represent the bedrock of the conglomerate’s business profile as these assets generated roughly 99% of its total revenues during the first half of 2020. Bolloré reports its financial results in euros and in accordance with IFRS practices. Its Electricity storage and systems segment includes its Blue Systems brand and what Bolloré bills as its “unique” Lithium Metal Polymer (‘LMP’) battery technology. Additionally, this segment produces ultrafine plastic film for capacitors. The conglomerate’s Other assets segment includes farming operations in the US and vineyard operations in France. While its battery technology could lead to meaningful upside in the long run, its revenue and cash flow generation from these operations has historically been quite modest. Pivoting now to its Transportation and logistics segment. In Africa, the company manages 16 container terminals (primarily in West and Central Africa) and seven roll-on/roll-off terminals along with warehouses, dry ports and three rail concessions through companies owned by Bolloré. The conglomerate has been investing in logistical infrastructure that connects ports to “hinterland cities” which in turn enhances the utility of its integrated logistics network across the continent. Furthermore, Bolloré developed state-of-the-art logistics hubs in Morocco, Senegal, Ivory Coast, Ghana, Nigeria, Cameroon, South Africa and Kenya over the past few years. Looking ahead, Bolloré is reviewing potential development opportunities in the eastern portion of the African continent. By leveraging its own logistics and transportation operations, Bolloré also offers its customers logistics aggregation solutions (utilizing a combination of third-party transportation services and its own to provide comprehensive transportation offerings). This strategy is supported by the 600+ branch offices Bolloré has across ~110 countries along with its numerous logistics hubs. Additionally, Bolloré operates an oil distribution business focused on France, Germany, and Switzerland which in recent years has pivoted towards the petroleum product storage business. Shifting to its Communications segment, this operation consists of its 27% stake in Vivendi (VIVHY), which is a media and entertainment conglomerate that has exposure to the music, pay-TV, film and television, video game, advertising and publishing industries. Since 2017, Bolloré has consolidated Vivendi’s performance with its own. Here is how Vivendi describes its business profile on its website: Creation in all its diversity and the revealing of talents are at the heart of Vivendi's strategy. All of its activities contribute to this, in particular music (Universal Music Group), audiovisual (Canal + Group), publishing (Editis) and video games (Gameloft). Its distribution platforms (Dailymotion and myCanal) and the agreements concluded with numerous telecom operators and content aggregators ensure a wide worldwide distribution of works and talents. Havas Group has unique creative expertise in the service of meaningful and differentiating communication for brands and their consumers. Vivendi is also developing complementary activities in the fields of live entertainment, the promotion of franchises and ticketing, federated under Vivendi Village. Vivendi's various entities and its 44,000 employees around the world work fully together, operating within an integrated group. This organization facilitates creative exchanges and joint projects, a source of additional value creation for the Group. In 2019, Vivendi acquired Editis which marked its “return to the publishing business” according to Bolloré. More recently, Vivendi has been preparing to spin off Universal Music Group by listing the company in Amsterdam (and distributing shares of Universal Music Group back to its own shareholders). This move still needs shareholder approval, and should it go ahead as planned, Universal Music Group’s three biggest shareholders would be Vivendi, a consortium led by Tencent Holdings (TCEHY), and Bolloré on a pro forma basis according to Reuters. Please note a consortium led by Tencent acquired a stake in Universal Music Group through two recent transactions. Financial Overview During the first half of 2020, Bolloré faced significant headwinds due to the coronavirus (‘COVID-19’) pandemic though its financial performance still held up quite well. The firm reported that its revenues fell by1% year-over-year while its EBITDA was up 10% year-over-year during this period. Its adjusted operating income climbed higher by 3% year-over-year in the first half of 2020, aided by effective cost control measures and pockets of strength at some of its businesses. Bolloré cited solid performance at its Universal Music Group as helping shore up its financials in the face of serious exogenous headwinds. Growing demand for music streaming services enabled Universal Music Group to outperform due to its lucrative arrangements with entities that provide such services, and the outlook for its business is quite bright.

Images Shown: An overview of how Bolloré performed financially during the first half of 2020 when the conglomerate faced the initial stages of the COVID-19 pandemic. Images Source: Bolloré – Half Year 2020 Financial Report Bolloré generated EUR€1.1 billion in free cash flow during the first half of 2020, up many-fold from year-ago levels, while spending EUR€0.7 billion covering its total dividend obligations and another EUR€0.8 billion on ‘acquisition of minority interests and treasury shares’ during this period. We appreciate the resilience of its cash flow profile in the face of major exogenous headwinds. At the end of June 2020, Bolloré had roughly EUR€7.7 billion in net debt (inclusive of short-term debt), and we view that burden as manageable given its ability to generate significant free cash flows in almost any environment. We caution that shares of BOIVF trade over-the-counter in the US, and additionally, that its dividend is paid out semi-annually and that its payout policy is set in euro terms. Concluding Thoughts We are intrigued by the extensive reach of Bolloré and the very diversified nature of its asset base. The French conglomerate’s ability to generate meaningful free cash flows during the initial stages of the COVID-19 pandemic highlights the resilience of its business model and cash flow profile. However, we caution that the Bolloré family will continue to exert an outsized level of influence on the trajectory of the conglomerate going forward. Nonetheless, this is one for the radar. ----- Related: BOIVF, BOLRF, TCEHY, VIVHY, FCODF, TI, UBSFY, MDIUY, HAVSF, EWQ, EZA Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment