Member LoginDividend CushionValue Trap |

Free Cash Flow Machine Visa Remains One of Our Best Ideas

publication date: Feb 9, 2021

|

author/source: Callum Turcan

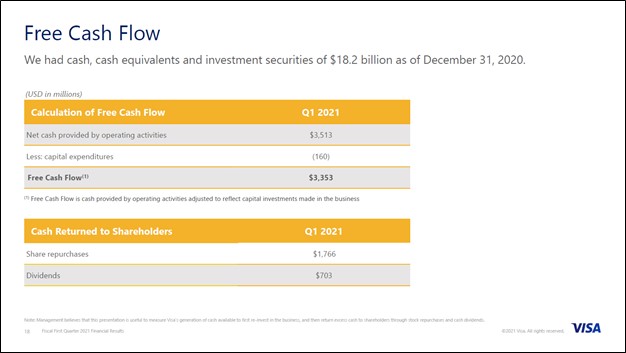

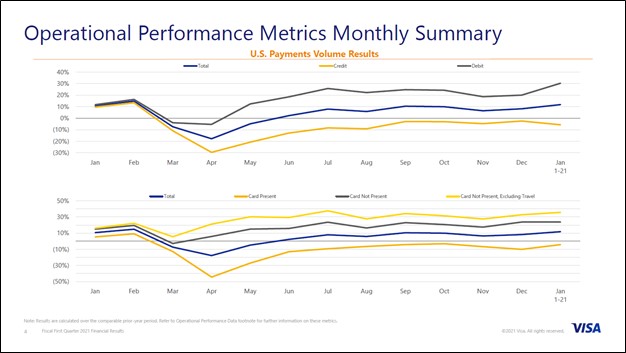

Image Shown: Visa’s ability to generate sizable free cash flows continues to impress. We are big fans of the payment processing giant. Image Source: Visa Inc – First Quarter of Fiscal 2021 IR Earnings Presentation By Callum Turcan We're huge fans of Visa Inc’s (V) business model. The credit card network’s free cash flow generating abilities are impressive, aided by its low capital expenditure requirements. We view Visa’s long-term outlook quite favorably and include the company in the Best Ideas Newsletter portfolio as a top-weighted idea. The top end of our fair value estimate sits at $263 per share of Visa, materially above where V is trading at as of this writing. Overview Visa benefits from the network effect, which in our view is one of the strongest competitive advantages out there. As a greater number of consumers use credit and debit cards (particularly Visa-branded cards), a greater number of merchants accept those payment options, creating a virtuous cycle. In the US, there has been a steady shift away from cash to card during the past couple of decades, a trend that is occurring in international markets as well. Visa’s payment network, an integral part of the “plumbing” of the financial services sector, is key to enabling a “cashless” global society. The company’s growth runway is immense. The coronavirus (‘COVID-19’) pandemic weighed negatively on Visa’s financial and operational performance during the past year due primarily to sharp reductions in travel-related spending activity and cross-border transactions, a part of Visa’s business that is incredibly lucrative. However, headwinds facing Visa’s ‘card present’ transaction volumes have more recently been largely offset by its surging ‘card not present’ transaction volumes as demand for e-commerce offerings has been quite strong of late. Arguably, the COVID-19 pandemic accelerated the proliferation of e-commerce offerings as households worldwide sought to socially distance, and in our view, this trend may be more permanent than many believe (households have fundamentally adjusted their purchasing habits due to the pandemic, and going forward, that will include a greater utilization of e-commerce offerings). Earnings Update When Visa reported its first quarter earnings for fiscal 2021 (period ended December 31, 2020) on January 28, the firm beat both consensus top- and bottom-line estimates. During the firm’s related earnings call, management noted that in the US Visa’s “card not present [transaction] volume excluding travel continued to grow over 30% in the quarter, primarily driven by retail spending” with an eye towards its operations that deal with debit and e-commerce transactions. However, Visa’s domestic card present transaction volumes continued to face headwinds due to quarantine measures imposed by various government entities last fiscal quarter (and into the current fiscal quarter, which we will cover in just a moment). The company’s payment volumes and processed transactions were up 5% and 4% year-over-year, respectively, on a constant currency last fiscal quarter. However, Visa’s GAAP revenues and GAAP net income were down 6% and 4% year-over-year, respectively, last fiscal quarter due to a reduction in lucrative cross-border transactions. In the upcoming graphic down below, Visa provides an overview of its US payment volume performance on a weekly basis during the past year. Please note the strong performance Visa put up during the first few weeks of January 2021 as a sharp increase in debit payment volumes more than offset a downturn in credit payment volumes with growth at Visa’s "card not present ex-travel business" approaching 40% year-over-year on a weekly basis last month. Ongoing strength at its e-commerce business combined with the eventual resumption of travel activities supports Visa’s medium-term outlook. It appears Visa’s US operations entered calendar year 2021 with substantial upward momentum.

Image Shown: Growth in payment volumes at Visa’s US debit business has helped offset headwinds facing its credit business, with “card not present” transactions leading the way due to elevated e-commerce demand. Image Source: Visa – First Quarter of Fiscal 2021 IR Earnings Presentation During the first quarter of fiscal 2021, Visa generated $3.4 billion in free cash flow and spent $0.7 billion covering its dividend obligations along with another $1.8 billion buying back shares of its Class A common stock. Both activities were fully covered by its free cash flows. Given that shares of V have been trading at a discount to their intrinsic value for some time, we view Visa’s historical share buyback programs as a good use of capital. Going forward, share repurchases remain a good use of capital as of this writing as shares of V are currently trading below our estimate of their intrinsic value. At the end of calendar year 2020, Visa had $18.2 billion in cash, cash equivalents, short-term investment securities and long-term investment securities on hand (which are all cash-like assets). That was stacked up against no short-term debt on the books and $21.1 billion in long-term debt at the end of December 2020. We view Visa’s $2.9 billion net debt position at the end of the fiscal first quarter as manageable given its stellar cash flow profile and ample liquidity on hand. We want to highlight that Visa’s ~$5.3 billion acquisition of fintech company Plaid is now off after the US Department of Justice (‘DOJ’) sued to stop the deal in November 2020, with Visa publicly announcing the deal was over in January 2021. Visa’s reasoning largely had to deal with the firm not wanting to engage in a protracted legal fight with the US federal government. It is unfortunate the deal did not go through, though Visa’s outlook remains stellar with or without Plaid. Here is what management had to say in response to a question on the conference call regarding how Visa viewed its ability to pursue future M&A activities (lightly edited, emphasis added): “[There] was a single lawsuit brought by a single regulator about one specific M&A transaction. So I don't believe that this portends anything about the future and our ability to continue to try to acquire companies. As we said a couple weeks ago, we ended up making the decision that this was just going to go on for too long. And we all know that the payments marketplace is moving with great speed on so many fronts. And the idea that we would tie ourselves up on this transaction, and frankly, the plan would tie themselves up through a long-term litigation that could go all the way through and appeal in and of itself which is not appealing to us, in terms of all the other things that we thought, we could be investing in and spending management time on and spending our dollars on. We're continuing to forge down a path of making sure that we are a real player in this space of open banking, and believe that we have a lot of the assets already. What Plaid was going to do was going to get us into specifically into the data extraction type of business, which would have added to our network of networks, but it doesn't in and of itself prevent us from doing more going forward. We also still have the ability in that space to partner with Plaid, we have the ability to partner with other players around the world. In many cases, that might give us the ability to partner with players that understand the nuances of specific markets in which they do work… …[W]e're positioned well to make sure that we can provide payments capabilities for the various FinTechs that we are doing business with today. And we have the ability to continue to sell value added services to all those players. So I think that ultimately, as we have in the past, we will invest to grow internally, we will look to partner and we will look to buy.” --- Al Kelly, Chairman and CEO of Visa Visa will likely continue to be a serial acquirer going forward, though most of its acquisitions are relatively modest in size for a firm of Visa’s size. International Upside Management noted that Visa was not in a position to provide full-year guidance for fiscal 2021 given the inability to accurately forecast its performance when dealing with the COVID-19 pandemic. However, Visa did have plenty of positive operational updates to provide during its latest earnings report and related earnings call concerning its international growth ambitions. In India, Amazon Inc (AMZN) teamed up with ICICI Bank to offer Visa-branded credit card that are marketed as Amazon Pay ICICI Bank Credit Cards. Visa’s management noted that this offering “has set a country record by issuing over a million cards in just 20 months” during Visa’s latest earnings call and followed up on that by noting “India now has 6.5 million acceptance points including over 1 million QR points, up almost 20 percentage points from a year ago and 65% of all terminals are tap to pay enabled.” Furthermore, Visa announced that it had partnered up with SBI Payments and HDFC Bank (HDB) to bulk up its operational capabilities and presence in India. While securing major deals is vital, Visa is also cognizant of the need to help India improve its payment processing infrastructure to stimulate the shift from cash to card. Visa announced that it contributed “to India's Payment Infrastructure Development Fund to encourage growth of physical and digital acceptance in underpenetrated geographies” during its latest earnings call; note the fund is expected to help add “1 million points of sale and 2 million QR points per year over the next three years.” For reference, India’s government in 2016 made a huge push to reduce the role cash plays in the country’s domestic economy (in part to boost tax receipts by ensuring all transactions are properly recorded in a digital manner). This was part of a broader economic restructuring drive that India’s current Prime Minister, Narendra Modi, has aggressively pursued over the past few years (including a major tax overhaul that saw a standardized goods and services tax imposed in India to create a more uniform tax structure). We are impressed with Visa’s growth efforts in India as the company is setting the stage for a multi-decade growth story in the country, one that is underpinned by powerful secular tailwinds that are actively supported by the national government. Pivoting here, Visa’s management team touted how a new agreement with Goldman Sachs Group Inc (GS) that involves leveraging Visa B2B Connect operations (allows firms to transfer money from bank-to-bank) to enable Goldman Sachs to offer its “corporate clients the ability to transact in over 80 markets globally.” These are some of the many deals Visa recently signed, with management also talking up a new deal with European-focused bank Banco Santander SA (SAN) covering credit and commercial customers in seven continental European countries during Visa’s latest earnings call. On a final note, Visa announced during its latest earnings call that the firm had renewed its long-standing deal with Wells Fargo & Company (WFC) this past January across consumer debit, credit, small business and commercial operations, which extends the arrangement for another six years. The payment processing giant continues to secure the necessary partnerships to support its impressive long-term growth runway. Concluding Thoughts Visa’s growth outlook is bright, its financial position is stellar, and we continue to like exposure to the company in the Best Ideas Newsletter portfolio as a top-weighted idea. Shares of V are trading well below the top end of our fair value estimate range as of this writing, and we view Visa’s capital appreciation upside quite favorably. Additionally, Visa offers incremental dividend growth upside as well, though historically, the company has prioritized investing in growth opportunities, acquisitions and share buybacks over its dividend payout. As of this writing, shares of V yield a modest ~0.6% though its payout has grown at a brisk pace over the past several years (adjusted for its 4:1 stock split in 2015), albeit off of a very low base. As it concerns the financial services sector at-large, in our view, the outlook for the banking space has improved significantly during the past few months (particularly as it concerns net interest margins and credit write-offs). Ongoing COVID-19 vaccine distribution activities will eventually enable the economy to return to some type of “normal” and we see global health authorities bringing the pandemic under control sooner than expected. We added Financial Select Sector SPDR Fund (XLF) to the Best Ideas Newsletter portfolio on January 12 (link here) to gain broad exposure to the space. ----- Related: AMZN, GS, HDB, SAN, V, WFC, XLF Other Related: MA, DFS, AXP, IGC, INDA, IFN, EPI, PIN, IIF, SMIN, INR, NFTY, FLIN Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Visa Inc (V) and Financial Select Sector SPDR Fund (XLF) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment