Member LoginDividend CushionValue Trap |

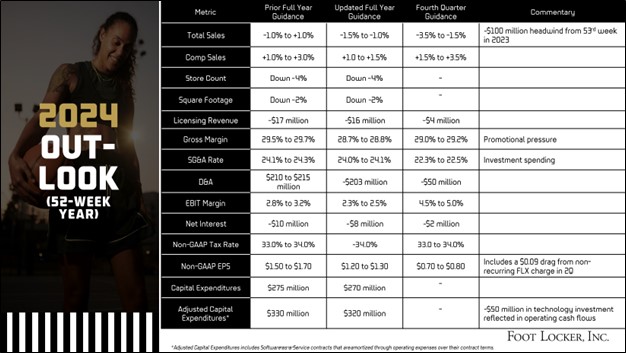

Foot Locker Talks of a More Promotional Environment, Softening Consumer Spending

To gain access to the members only content, click here to subscribe. You will be given immediate access to premium content on the site.

|