Member LoginDividend CushionValue Trap |

Fastenal Shares Shifting Higher

publication date: Jun 12, 2020

|

author/source: Callum Turcan

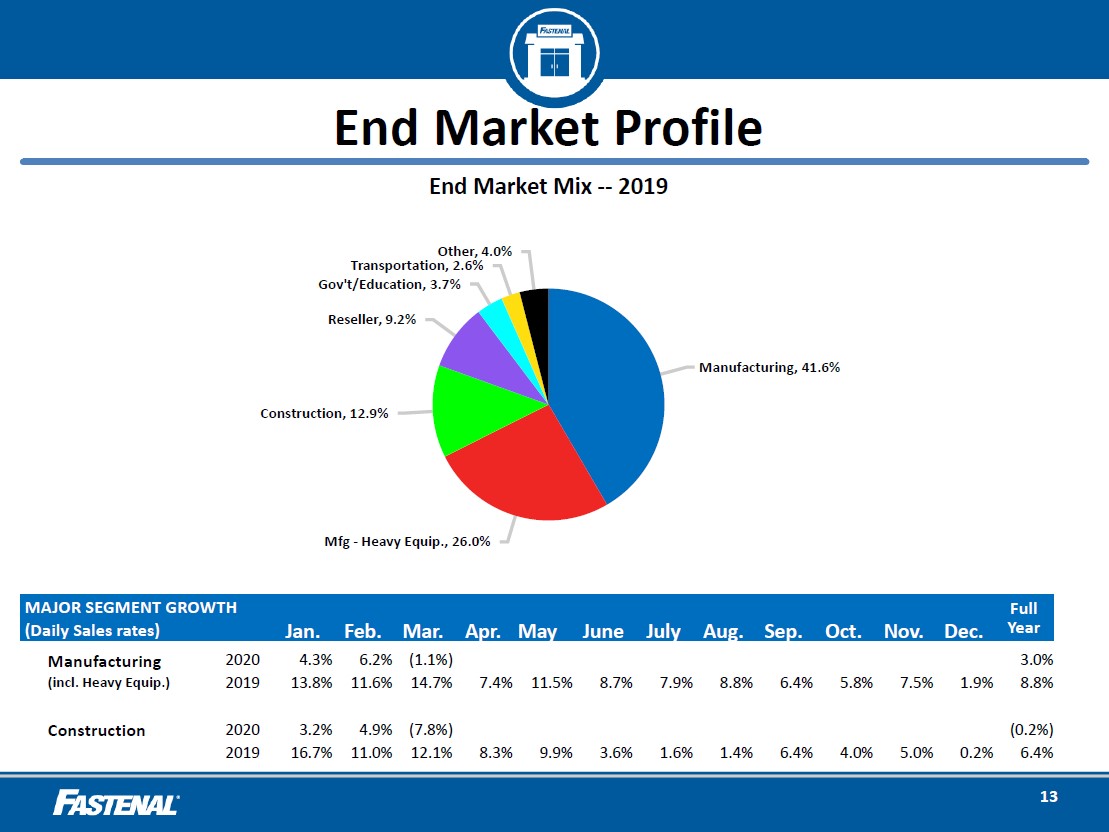

Fastenal is an interesting company and we like the firm’s business model and high quality cash flow profile. The firm’s acquisition of the Apex assets should put Fastenal in a better position to meet the needs of its industrial and construction customer base. Though its near-term operational and financial performance will likely be volatile due to the ongoing pandemic, recent operational improvements and its growing safety supplies business lends some support, as does its strong financials. Fastenal appears well-positioned to ride out the storm with its financials, operations, and dividend intact. By Callum Turcan Fastenal (FAST) is primarily a distributor of industrial and construction products that seeks to provide its customers with a one-stop shopping experience in a vast and decentralized market. To better differentiate its business model from other distributors, Fastenal also provides consultancy services (made possible in part by training its employees at the Fastenal School of Business, a multi-platform corporate university), technology products and services (including inventory management offerings), and manufacturing services (such as customized parts). Shares of FAST yield ~2.4% and are up 16% year-to-date as of this writing, vastly outperforming the S&P 500 (SPY). Background In the upcoming graphic down below, Fastenal provides an overview of its end market customer base which is predominantly in North America. None of Fastenal’s customers represented more than 5% of its net sales from 2017 to 2019. Please note Fastenal does plenty of work with governmental agencies and entities.

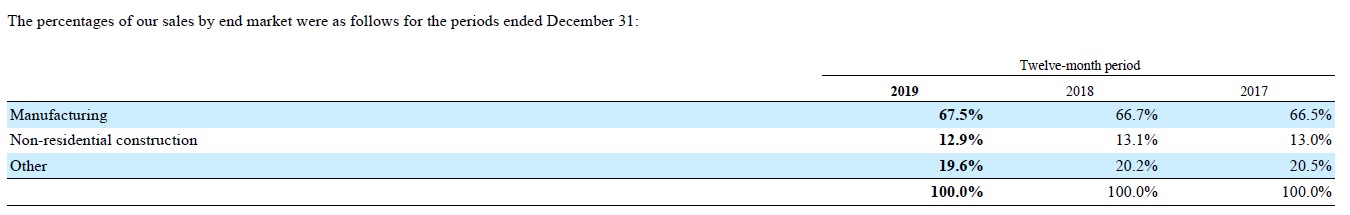

Image Shown: Manufacturing, heavy equipment manufacturers, and the construction industries are the three biggest end markets for Fastenal. Image Source: Fastenal – First Quarter 2020 Earnings IR Presentation In the upcoming image down below, Fastenal highlights that historically speaking, roughly four-fifths of its sales comes from customers in the ‘manufacturing’ and ‘non-residential construction’ end markets.

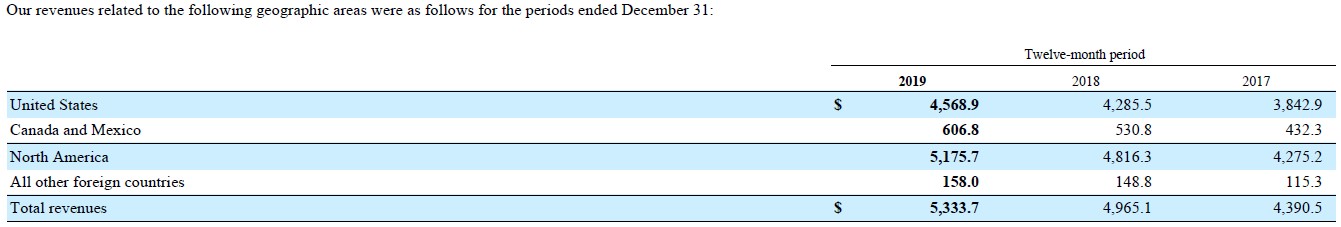

Image Shown: Fastenal is highly levered to the state of the manufacturing economy. Image Source: Fastenal – 2019 Annual Report As most of Fastenal’s revenues come from North America, as you can see in the upcoming graphic down below, the firm’s financial and operational performance is heavily influenced on the state of the continent’s manufacturing outlook and economy. Considering the United States–Mexico–Canada Agreement (‘USMCA), often referred to as “NAFTA 2.0” as the USMCA was built off of the framework created through the North American Free Trade Agreement (‘NAFTA’), was officially ratified by all three parties in March 2020, that speaks well to Fastenal’s longer term outlook.

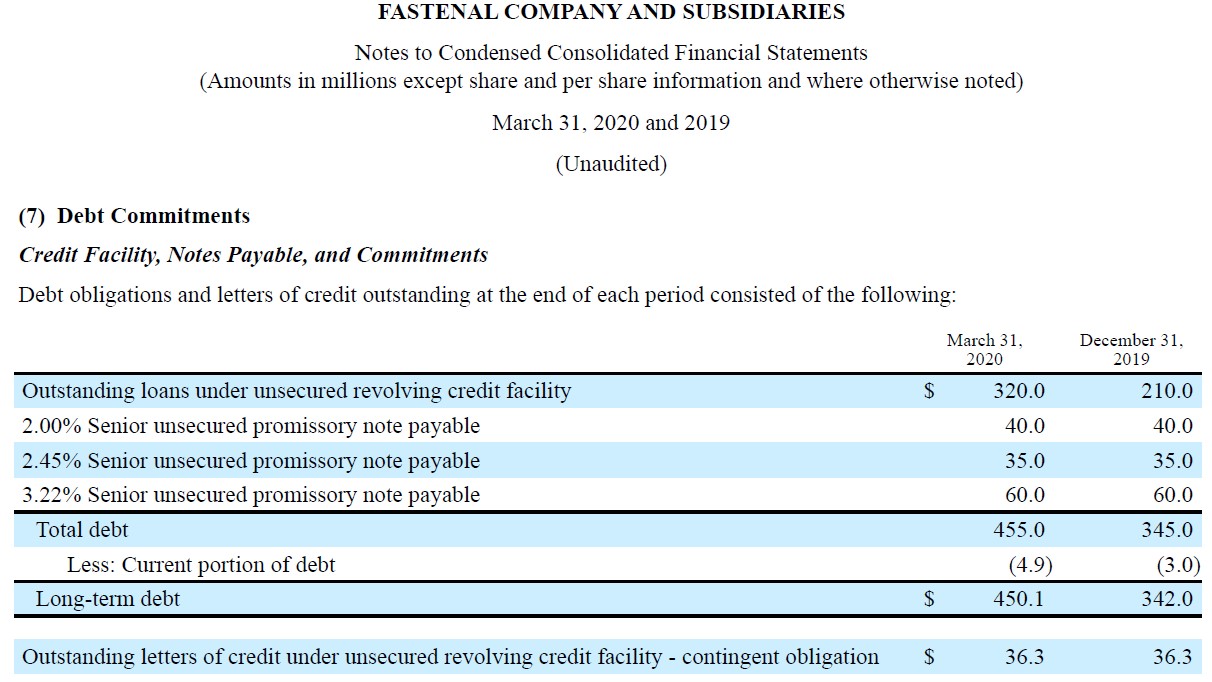

Image Shown: Fastenal generates the vast majority of its sales in North America, particularly in the US. Image Source: Fastenal – 2019 Annual Report Financial Overview At of the of the first quarter of 2020, Fastenal had $161 million in cash and cash equivalents on hand versus $5 million in short-term debt and $450 million in long-term debt. Fastenal had a current ratio of ~4.25x at the end of March 2020 due to its meaningful inventory on hand and large accounts receivable balance, relatively speaking. Though Fastenal has a net debt position and we have mentioned many times in the past we have a preference for net cash positions as cash is king (especially in this environment), the firm’s net debt load is manageable given its high quality cash flow profile. The firm had ample cash and cash equivalents on hand at the end of March 2020 ($161 million as mentioned previously), and its liquidity position is further supported by its $700 million revolving credit line due November 2023 that was partially drawn at the end of the first quarter of 2020 as you can see in the upcoming graphic down below. Please note the revolving credit line “includes a committed letter of credit subfacility of $55 [million]” according to its latest 10-Q filing.

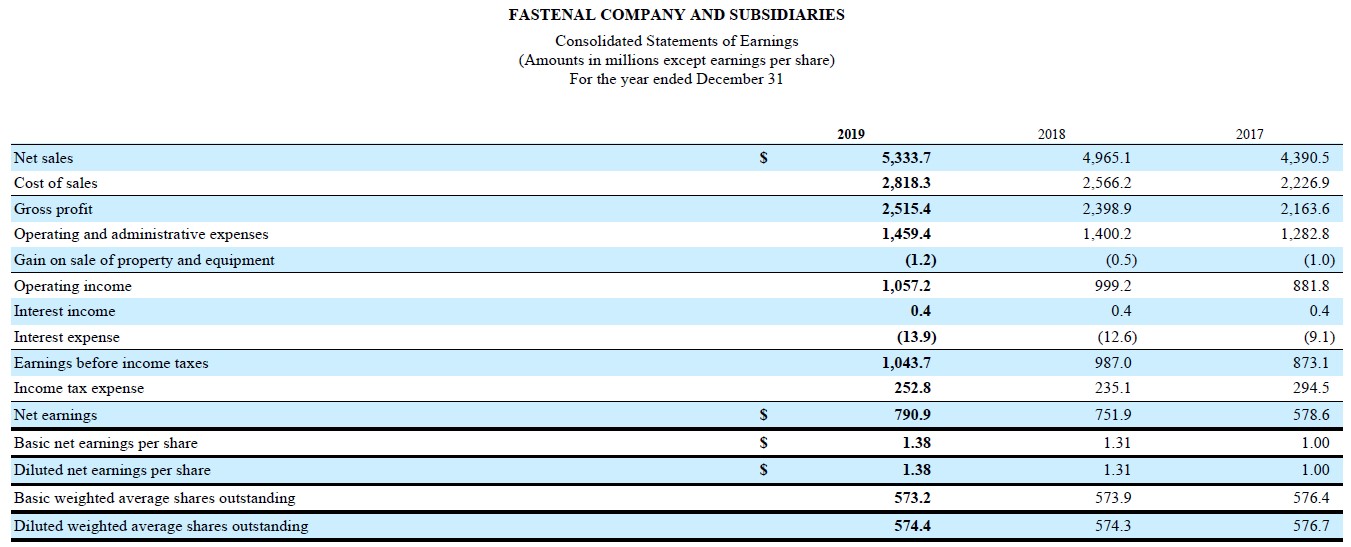

Image Shown: Fastenal’s net debt load and debt maturity schedule are manageable, in our view. Image Source: Fastenal – 10-Q SEC filing covering the first quarter of 2020 In the first quarter of 2020, Fastenal generated $192 million in free cash flow and spent $144 million covering its dividend on top of $52 million in share repurchases. For all of 2019, Fastenal generated $596 million in free cash flow and spent $499 million on its dividend obligations and the firm did not repurchase a meaningful amount of its stock last year. Though a tiny portion of Fastenal’s share repurchases were funded by the balance sheet last quarter, the company has solid dividend coverage and historically has only spent modest amounts on share buybacks (including $83 million and $103 million in 2017 and 2018, respectively). Our Dividend Coverage ratio sits at 1.4, earning Fastenal a “GOOD” Dividend Safety rating. We also like Fastenal’s payout growth trajectory and the firm’s Dividend Growth rating sits at “GOOD” as well. Please note our Dividend Coverage ratio and Dividend Safety rating factors in mid-to-high single-digit growth in Fastenal’s per share dividend over the coming years. Fastenal’s GAAP revenues grew by over 4% year-over-year in the first quarter of 2020, aided by an extra business day in the period (as it relates to its client’s business days, not Fastenal’s financial reporting period) versus the same period last year while its daily sales were up as well according to Fastenal. Please keep in mind that by the end of this period the coronavirus (‘COVID-19’) pandemic had spread throughout most of the world, and that going forward, Fastenal’s near-term performance will likely face serious but manageable pressures. The company’s GAAP gross margin fell by over 110 basis points year-over-year in the first quarter which pressured its GAAP operating income (down by over 10 basis points year-over-year), though economies of scale and flat-ish operating expenses offset most of that margin pressure. Fastenal’s ‘absolute’ headcount dropped marginally year-over-year last quarter, though its ‘full-time equivalent’ headcount rose marginally during the same period. From 2017 to 2019, Fastenal’s GAAP revenues rose by over 21%, its GAAP net income jumped higher by just below 37% and its diluted average share count drifted moderately lower during this period. The firm’s GAAP diluted EPS grew by 38% from 2017 to 2019, hitting $1.38 last year. Rising GAAP operating income which rose by roughly 20% in 2019 versus 2017 levels (its margins faced a modest amount of pressure due to rising ‘operating and administrative expenses’) and a reduced corporate income tax expense were key to driving Fastenal’s bottom-line higher.

Image Shown: Fastenal’s financial performance has been steadily improving overall in recent years. Image Source: Fastenal – 2019 Annual Report Operational Overview As you can see in the upcoming graphic down below, Fastenal has been steadily growing its ‘total in-market locations’ to support the company’s growth trajectory and to enhance its competitive advantages over its peers. Please note most of these locations are in the US and Canada.

Image Shown: Fastenal’s financial performance has been steadily improving overall in recent years. Image Source: Fastenal – 2019 Annual Report Operational Overview As you can see in the upcoming graphic down below, Fastenal has been steadily growing its ‘total in-market locations’ to support the company’s growth trajectory and to enhance its competitive advantages over its peers. Please note most of these locations are in the US and Canada.

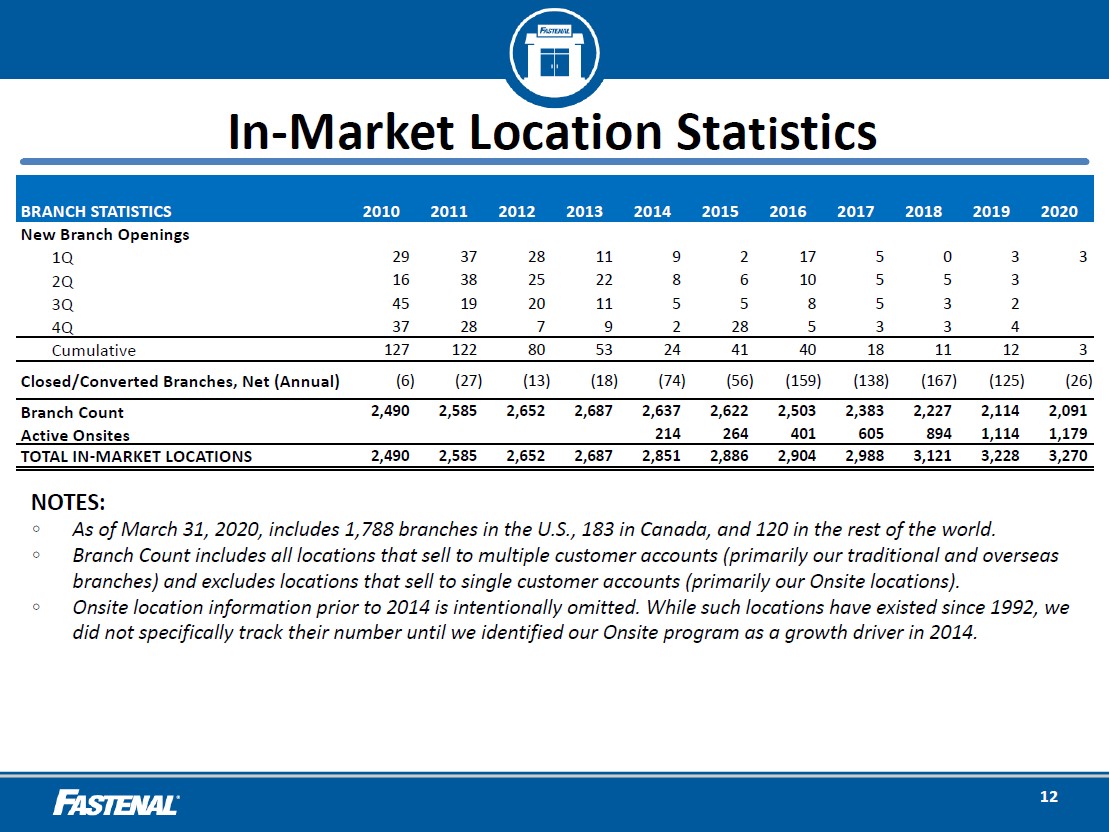

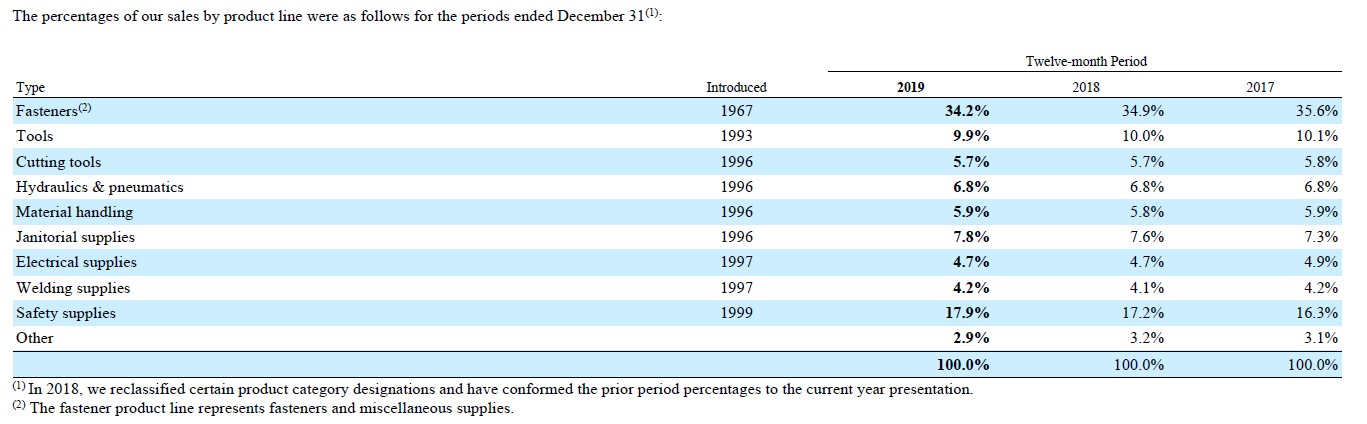

Image Shown: Fastenal has been steadily growing its operational presence over the past several years. Image Source: Fastenal – First Quarter 2020 Earnings IR Presentation In the upcoming image down below, Fastenal highlights that its sales by product line on a percentage basis of total sales have been fairly consistent from 2017 to 2019, save for a few categories. Please note that the firm’s ‘safety supplies’ product lines have seen their sales as a percent of Fastenal’s total sales rise moderately in recent years, better positioning Fastenal to handle its client’s safety needs during these harrowing times. Management mentioned during Fastenal’s latest quarterly conference call that demand for safety and sanitation products surged in March 2020, and that likely continued into the second quarter of this year.

Image Shown: Safety supplies have been steadily becoming a bigger part of Fastenal’s business in recent years. Image Source: Fastenal – First Quarter 2020 Earnings IR Presentation On March 30, 2020, Fastenal completed its purchase of certain assets from Apex Industrial Technologies LLC for $125 million in cash. Please note these are almost entirely intangible assets. Fastenal described the purchase as covering assets “that have contributed to the development, design, and scalability of the vending delivery platform utilized since 2008 within our industrial vending business to dispense product and lease devices to our customers. In connection with this transaction, we purchased a perpetual and unfettered use of key patents, designs, software and licenses, as well as direct access to the vending equipment supply chain.” Fastenal acquired the Apex assets largely to solidify its vending offering and technology presence as a whole, on top of allowing for Fastenal to have greater control over the development of the platform. In the upcoming excerpt down below, management highlights why Fastenal acquired the assets in response to an analyst’s question during Fastenal’s latest quarterly conference call: “…Today that vending platform represents roughly 20% of our revenue goes through that vending platform. And then we have another 10% of our revenue that goes to what we call our bin stock platform. So about 30% of our business goes through some type of distribution mechanism that goes right into the customer's facility and is a repetitive order cycle. And we see that piece over time expanding dramatically as we become more supply chain linked with our customer and would as a percentage of our business, I wouldn't be surprised to see that 30%, we have today more than double when we doubled in size and double as a percentage of our business. And so from that standpoint, the Apex transaction was very much about bringing the technology closer to us so that the technology development of the platform is more aligned with where we want to take it. Because our partner, great partner for the last 12 years they are as much interested about expanding outside of industrial distribution as they are within industrial distribution. And sometimes that means what's prioritized from a technology development doesn't always harmonize with what we're thinking. And so it provided us the ability to do that.” --- Daniel Florness, CEO and President of Fastenal As it relates to the ongoing pandemic, that has made forecasting Fastenal’s operational performance in 2020 a difficult task. However, the firm appears confident that its flexible business model and supply chains are up to the challenge. Fastenal increased its employee benefits, including offering additional paid time off, to better allow its workforce to cope with COVID-19 according to management commentary during the firm’s latest quarterly conference call. Concluding Thoughts Fastenal is an interesting company and we like the firm’s business model and high quality cash flow profile. The firm’s acquisition of the Apex assets should put Fastenal in a better position to meet the needs of its industrial and construction customer base. Though its near-term operational and financial performance will likely be volatile due to the ongoing pandemic, recent operational improvements and its growing safety supplies business lends some support, as does its strong financials. Fastenal appears well-positioned to ride out the storm with its financials, operations, and dividend intact. ----- Distributors Industry – AXE AIT FAST MSM GWW WCC Related: FIDU, IFRA, IYJ, SPY, VIS ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the companies mentioned above. Both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment