Member LoginDividend CushionValue Trap |

Facebook Is Roaring Higher!

publication date: May 11, 2020

|

author/source: Callum Turcan

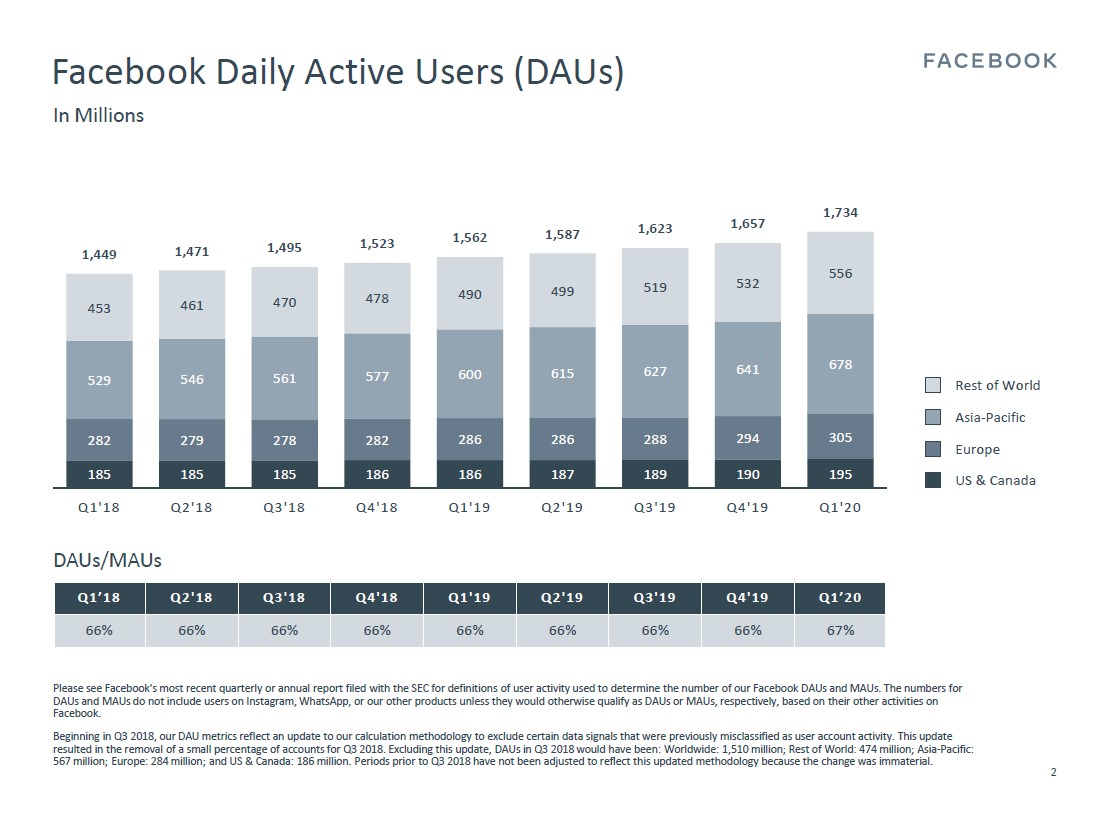

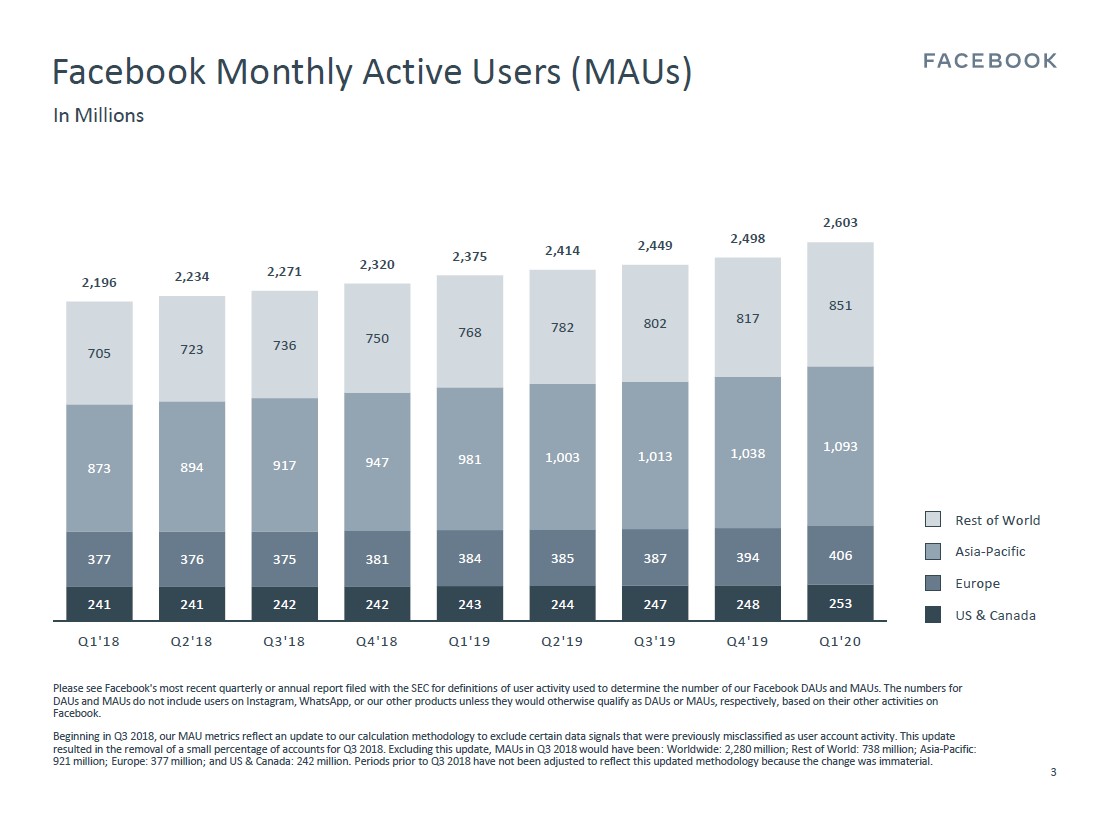

Image Shown: Shares of Facebook Inc have roared higher since reaching their March 2020 lows, far outpacing the rebound in the S&P 500 (SPY). We continue to like shares of FB as a top-weighted holding in our Best Ideas Newsletter portfolio. By Callum Turcan Top-weighted Best Ideas Newsletter portfolio holding Facebook Inc (FB) posted first quarter 2020 earnings on April 29 that saw its GAAP revenues jump 18% year-over-year to $17.3 billion while its GAAP diluted EPS grew by 101% year-over-year, hitting $1.71. Please note that Facebook’s bottom-line comparison was made easier due to the firm recording a $3.0 billion legal settlement with the US Federal Trade Commission (‘FTC’) during the first quarter of 2019. While digital advertising spending levels are expected to get crushed in 2020 due to the ongoing coronavirus (‘COVID-19’) pandemic, Facebook communicated to investors that its long-term growth trajectory remained very promising during the firm’s latest quarterly conference call. In our view, digital advertising spending levels will quickly bounce back once economies around the world start to reopen in earnest, though we caution that efforts to reopen the economy and resume “normal” daily activities need to keep in mind the risk another wave of infections imposes. Operational Update In the two upcoming graphics down below, note that stay-at-home orders and other containment measures led to both Facebook’s Daily Active Users (‘DAUs’) and Monthly Active Users (‘MAUs’) posting very strong sequential and year-over-year growth last quarter. That’s one of the reasons why Facebook’s share price has performed well of late, in our view, as strong user growth should better allow for Facebook to rebound when the global economy starts to reopen. Facebook experienced MAUs and DAUs growth in every major geographical region last quarter. Please note that Facebook’s ‘US & Canada’ geographical segment remains its most lucrative as the digital advertising market in this region is very mature and connects businesses with households that have relatively high levels of disposable incomes.

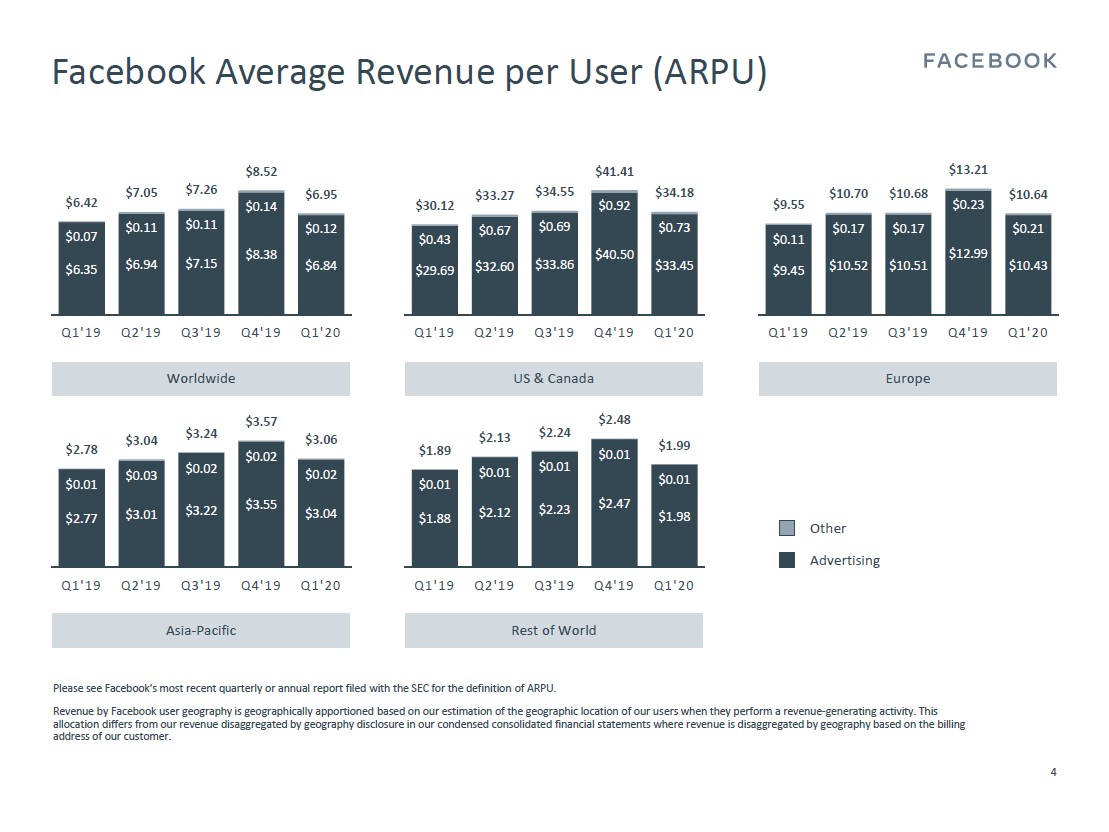

Images Shown: Facebook’s user base growth rate jumped up last quarter, with growth experienced in every geographical region. Images Source: Facebook – First Quarter of 2020 Earnings IR Presentation Facebook’s ‘Worldwide’ Average Revenue Per User (‘ARPU’) grew year-over-year in the first quarter but was down sequentially. That’s largely to be expected given that digital advertising spending levels tend to be strongest in the fourth quarter due to seasonal shopping trends (i.e. Christmas shopping) in key Western markets. In the upcoming graphic down below, Facebook provides a visual breakdown of the trajectory of its ARPU over the past several quarters.

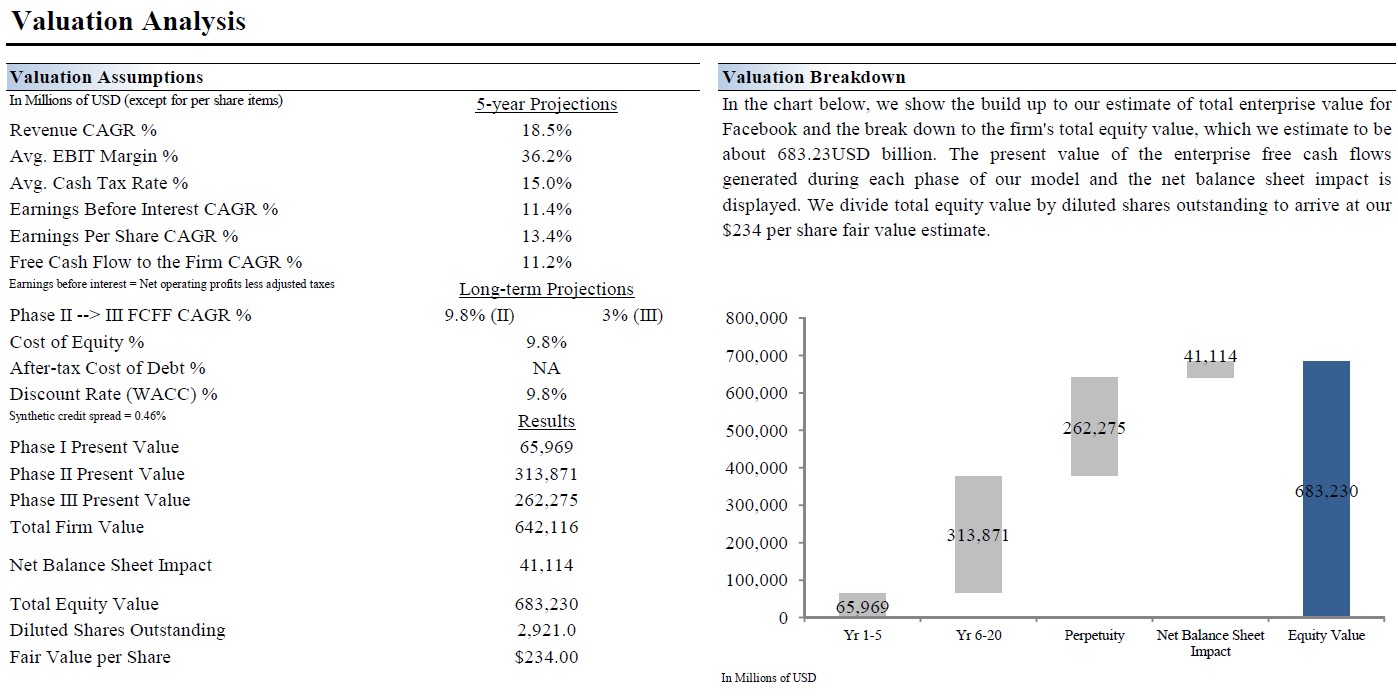

Image Shown: Facebook’s ARPU continued to grow year-over-year last quarter, though that metric will likely shift lower over the coming quarters due to the pandemic, before rebounding later on. Image Source: Facebook – First Quarter of 2020 Earnings IR Presentation In the short-term, Facebook’s ARPU will likely drop due to the negative dynamic impact the ongoing pandemic is having on consumer spending levels and digital advertising budgets worldwide. However, the giant in this space Alphabet Inc (GOOG) (GOOGL) sees digital advertising spending levels rebounding quickly when the global economy begins to reopen due to the high return on investment this method of advertising offers clients (which we covered in this article here). As an aside, Alphabet Class C shares (ticker: GOOG) are included as a top-weighted holding in our Best Ideas Newsletter portfolio. Balance Sheet Strength and Indian Growth Ambitions Facebook exited the first quarter with $60.3 billion in cash & cash equivalents and marketable securities combined and continued to carry no debt on the books. Last quarter, Facebook generated ~$7.65 billion in free cash flow and spent ~$1.25 billion on share repurchases (Facebook does not have a common dividend program at this time). We strongly appreciate Facebook’s pristine balance sheet, high quality cash flow profile, and large net cash position as that allows for the company to capitalize on prime opportunities when they arise. For instance, as we covered in a prior note (link here), Facebook is buying a ~10% equity stake in Jio Platforms for USD$5.7 billion (Jio Platforms is a subsidiary of Reliance Industries, a massive conglomerate run by India’s richest individual, Mukesh Ambani). Here’s what Facebook had to say about the deal during its latest quarterly conference call: “One aspect of online commerce I want to mention is the partnership we just announced with Jio Platforms in India. The largest Facebook and WhatsApp communities in the world are in India, and we think there's an especially important opportunity to serve small businesses and enable commerce there over the long term. By bringing together JioMart, which is Jio's small business initiative to connect millions of shops across India, with WhatsApp, we think that we’re going to be able to create a much better shopping experience. There's a lot more we can do here and I'm looking forward to making progress with the team at Jio.” --- Mark Zuckerberg, CEO of Facebook Facebook is excited about the opportunities India’s emerging digital landscape will create, and that includes plenty of e-commerce opportunities. Market research group Forrester forecasts strong double-digit growth in India’s annual e-commerce sales over the coming years, assisted by the large telecommunications investments Jio Platform has made over the past decade (Jio Platform built out India’s 4G telecommunications infrastructure and caters to over 370 million subscribers in the country). Mobile e-commerce sales are expected to represent a large driver of this growth trajectory. WhatsApp and Jio Platforms combined are expected to allow the partnership to better capitalize on that upside. The goal is to leverage WhatsApp to connect India’s ~1.35 billion strong populace with the millions of small businesses (including many mom-and-pop grocery stores) out there, most of which are unlikely to have a meaningful (or any) online presence. WhatsApp has been investing in product catalog infrastructure (a necessary part of any e-commerce marketplace) and Facebook has been allocating resources to develop payment processing technology. Jio Platform’s owns JioMart, an online grocery shopping service, and tying JioMart in with WhatsApp could drive meaningful sales growth at the marketplace. Ultimately, the goal is to create a large comprehensive platform where Indian consumers can go online (using Jio Platform’s telecommunication infrastructure), locate stores within logistical range (in terms of shipping/transportation options) on JioMart, connect and communicate with those stores via WhatsApp, and buy groceries from the millions of small businesses out there all on one integrated platform (with WhatsApp handling the payment processing side of things). We like the strategy and please note Facebook’s Indian growth ambitions represent a key reason why our models include very strong mid-cycle growth expectations as it relates to Facebook’s future forecasted free cash flows as you can see below (our 16-page Stock Report covering Facebook can be downloaded by clicking this link here).

Image Shown: Under our base case scenario, our discounted free cash flow models give shares of FB a fair value estimate of $234 per share. Additionally, please note that recently, Vista Equity Partners announced it would invest USD$1.5 billion in Jio Platforms and Silver Lake Investments announced it would invest USD$0.75 billion in Jio Platforms. There’s a lot of apparent interest in Facebook’s and Jio Platform’s vision that aims to fundamentally reshape India’s digital landscape. Walmart Inc (WMT) purchased a 77% equity stake in India’s e-commerce giant Flipkart for approximately USD$16.0 billion back in 2018 and Amazon Inc (AMZN) pledged to invest roughly USD$1.0 billion in India with an eye towards digitizing the operations of small- and medium-sized businesses at the start of 2020 (on top of the investment commitments Amazon has already made). Facebook is now pushing its way into the space, aided by Jio Platform’s largess and existing telecommunications/digital infrastructure. Concluding Thoughts We continue to like both Alphabet and Facebook as top-weighted holdings in our Best Ideas Newsletter portfolio and in our view, the digital advertising market will rebound strongly once the pandemic is contained. The discovery of a COVID-19 vaccine (or an effective therapeutic for treating the virus after infection occurs) combined with unprecedented fiscal and monetary stimulus measures seen around the world would go a long way in supporting both Alphabet’s and Facebook’s growth trajectory. As the world waits for a potential vaccine/treatment to get discovered (with clinical trials currently underway), Facebook continues to witness extremely strong user base growth and the firm is making major investments in emerging digital markets (like India) to further extend its already impressive growth trajectory. ----- Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TECHY TWTR Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP Related: SOCL, SPY, WMT ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment