Member LoginDividend CushionValue Trap |

Expect Huge Equity Returns This Decade, Much More Volatility However

publication date: Jun 21, 2023

|

author/source: Brian Nelson, CFA

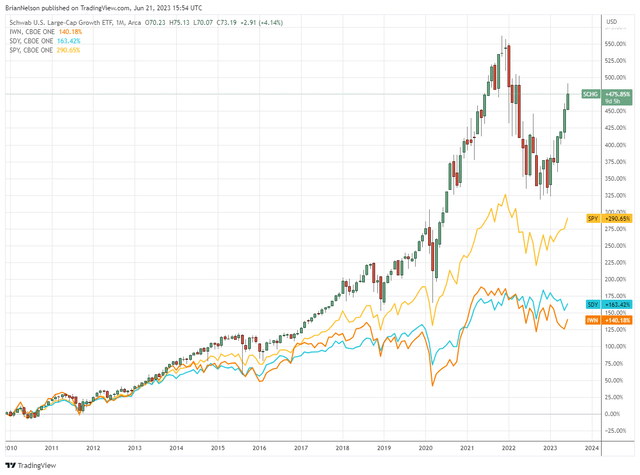

Image: Without question, the stylistic area of large cap growth has been the place to be for almost 15 years now. We think it remains the place to be. Brian Nelson, CFA The game has changed folks. The flooding of the markets with liquidity during the Great Financial Crisis [GFC] and the bailout of the banks in 2007-2009 marked the beginning of a new “regime” that we now live in. It wasn’t until the collapse of the markets during COVID-19, however, that the belief these markets would continue to move ever higher was reinforced. Where is the risk? What does “Lehman” even mean anymore? “Lehman” was not risk – “Lehman” was a generational buying opportunity. What was the worst global pandemic in a hundred years? COVID-19 wasn’t “risk” to the markets. Like “Lehman,” COVID-19 was a generational buying opportunity. These markets are no longer built for price discovery. They have become “socialized” retirement accounts. Every two weeks or every month, workers pump money into the markets via their retirement accounts, and government agencies backed by appointed or elected officials need to make sure that these accounts continue to grow. Has it really become that simple for equity investors? A regional banking crisis? Nope. The FDIC is there, and then of course, an “implicit” guarantee that all deposits over FDIC insurance would be safe came so fast our heads are still spinning. Is there any reason to ever sell stocks anymore? Seriously – where are the risks to this market? 2022 was a surprising year in how the markets reacted to inflationary pressures, but markets merely retraced to late 2020 levels last year (on some pretty high levels of inflation). Is the risk to the downside in these markets really just a couple years’ worth of returns? That’s not “risk.” How could that be risk? “Risk” to me is another Great Depression but still -- every historic calamity from the Crash of 1929 to that October day in 1987 to the depths of the GFC has been met with eventual buying and the markets setting new highs again and again. With dollar cost averaging, investors made money during the worst of times. What then are the risks to equities anymore? Maybe the one true risk for diversified equity investors--with an emphasis on diversified--is perhaps one of their own device--panic selling. Selling in March 2020 at the bottom. Selling in October 2022 right before a huge bull market. That seems about it. Falling into the trap of thinking that these markets (i.e. retirement accounts) won’t be propped up by everything the U.S. government can do (eventually when needed) and then panic selling. Maybe that's the only risk these days?

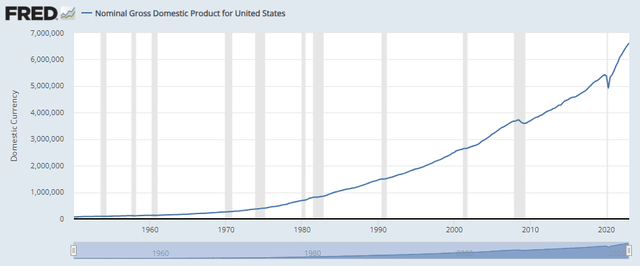

Image: Nominal Gross Domestic Product for United States. Source: St. Louis Fed That’s neither here nor there, however. The U.S. economy is surging on a nominal basis. Stocks are not priced at “real” levels; they are priced at nominal levels, and when it comes to equities, nominal gross domestic product has been booming. Everybody is worried about the economy, but again – call me unconcerned. Look at nominal GDP. The trade for the next decade, just like the last decade, remains big cap tech and large cap growth, in my view. Higher levels of volatility will shake out the weak holders as it did during June-October 2022 last year, but we’re staring down a $2+ trillion market in artificial intelligence in the next 5-7 years, as nominal GDP continues to surge.

We expect huge equity returns this decade, but much more volatility--the kind of volatility that will make holding stocks painful at times (and shake out some investors at the worst possible time), but it is what it is, as it has always been. We’re as bullish today as we’ve ever been. Cheers! NOW READ -- ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Tickerized for MSFT, NVDA, AMZN, AAPL, ORCL, GOOG, GOOGL, META, MDB, SNOW, AI, PLTR, CRM, SCHG, IWN, SDY, SPY Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

0 Comments Posted Leave a comment