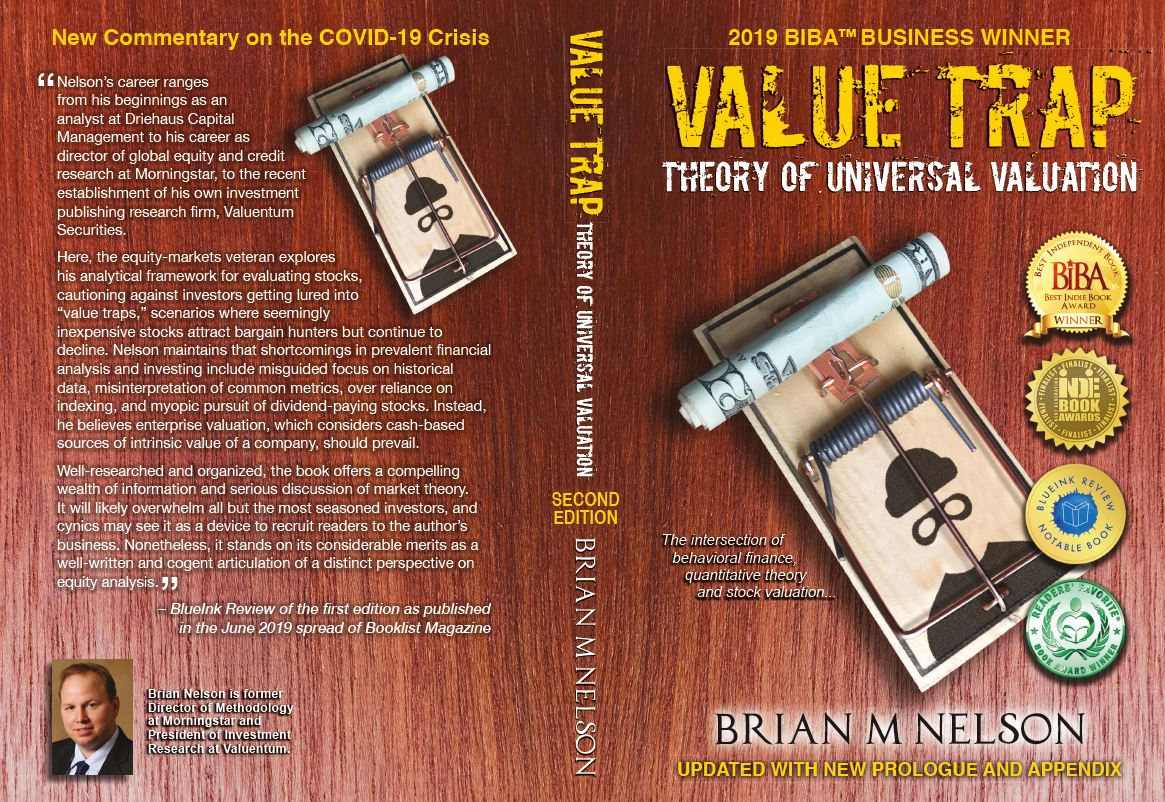

The second edition of President of Investment Research Brian Nelson's book 'Value Trap' will be released in the coming weeks. Here is a short excerpt to whet your appetite:

---

...

---

Enterprise valuation, or the discounted cash-flow framework, remains at the center of finance, in my view, and the core of what we do at Valuentum. The process and its key cash-based components helped deliver a suite of outperforming equity considerations at a time when modern portfolio theory (MPT) and diversification benefits were breaking down. Both stocks and bonds, for example, dropped aggressively in unison during the COVID-19 crisis, and the popular U.S. 60-40 stock/bond portfolio "suffered one of its worst performances since the 1960s" during the first quarter of 2020, as bonds failed to alleviate the stock collapse.

---

Figure N: Diversification Benefits Continue to Break Down During Crises

In the shaded area, from March 6, 2020 through April 9, 2020, the correlation coefficient of the daily returns on the S&P 500 (SPY) and a proxy for U.S. investment-grade bonds, the iShares Core U.S. Aggregate Bond ETF (AGG), was 0.23 (positive 0.23), revealing a modest positive correlation during the height of the COVID-19 crisis. For context, this daily return correlation was -0.21 (negative 0.21) for the prior five years ending 2019 and -0.39 (negative 0.39) year-to-date through March 5, 2020. Both stocks and bonds collapsed together during the COVID-19 crisis, bringing into question major tenets of modern portfolio theory at the very time investors needed them the most. Image: TradingView.

---

Correlations across most asset classes increased aggressively as the COVID-19 crisis unfolded, just like they have done in prior crises. Peter L. Bernstein wrote in Against the Gods of the technical problems of Nobel laureate Harry Markowitz's mean-variance framework and the origins of MPT that the "sensitivity of the process to small differences in estimates of the inputs makes the results even more tentative." During the apex of the COVID-19 market crisis, simultaneously collapsing stock, bond and other asset prices weren't factored into most models, revealing that the monumental cost of practicing modern portfolio theory for diversification benefits (i.e. vast underperformance relative to U.S. equities during the massive bull market of the 2010s) was simply not worth it for most retirees and pension funds.

---

Figure O: Asset Prices Tend to Collapse in Unison During Most Crises

As shown in Figure O, year-to-date through March 18, 2020, the prices of most asset classes from U.S. stocks and foreign stocks to gold and hedge fund strategies weakened considerably in unison, with the prices of MLPs, crude oil, and Bitcoin even collapsing during the measurement period. Every sector in the S&P 500 also fell materially during the COVID-19 market crisis.

---

A 60%/40% stock/bond portfolio, as measured by the Vanguard Balanced Index Fund Investor Shares (VBINX), for example, fell 17.6% year-to-date through March 18, 2020, and it only "saved" investors from a mere 8 percentage points of underperformance during the worst of the COVID-19 swoon relative to the S&P 500 during that time. However, the relative cost to an investor that held the VBINX for its diversification benefits during the 10-year period ending June 30, 2020--arguably to protect against the exact adverse market outcome as that driven by the COVID-19 crisis--was over 90 percentage points of cumulative underperformance compared to the S&P 500, or roughly $9,240 on an initial $10,000 investment. For long-term investors and entities with indefinite lives, perhaps they should be concerned that MPT does, in fact, sound a lot like "empty."

---

When diversification is needed most during crises, there are few major asset classes that show that they are truly uncorrelated, and the search for uncorrelated data sets to broaden the diversification of a portfolio may be largely a fool's errand, as past correlations can often differ greatly from future correlations. As shown in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, however, the inverse correlation of equity put options within equity portfolios could possibly be the best diversifier and portfolio risk management tool, provided such put options aren't layered on too heavily or too frequently (and at cost-prohibitive prices) so as to weigh down overall long-run portfolio returns.

---

Will the COVID-19 crisis then serve as a wake-up call for indexers that buy anything at any price (often no matter what), and moral hazard advisors such as modern portfolio theorists that depend in part on the efficient markets hypothesis and on past correlations to hold into future periods--tenets that simply do not pass muster in the real world? No, quite the opposite. I believe the implicit Fed and Treasury backing of the stock markets during the COVID-19 crisis will only embolden those that use these moral hazard strategies going forward, strategies that will only lead to even higher levels of volatility, exacerbated in turn by more momentum and volatility funds.

---

Quite simply, if it were not for the bold Fed and Treasury actions taken during both the Great Financial Crisis and COVID-19 crisis, indexing, modern portfolio theory and the efficient markets hypothesis would simply be a part of the past. Many capital-market-dependent assets held in index funds would have gone to $0 due to credit unavailability, correlations would have been even more nonsensical (approaching 1 across asset classes), and active investors would have outperformed tremendously as passive investors were caught like a deer in headlights. Never again would fiduciaries be able to use the efficient markets hypothesis as an excuse to not evaluate business fundamentals and calculate intrinsic values--considerations that efficient markets theorists seem to take pride in not doing.

---

...

---

We hope you enjoyed this excerpt. The second edition of 'Value Trap' will be released very soon!

2 Comments Posted Leave a comment